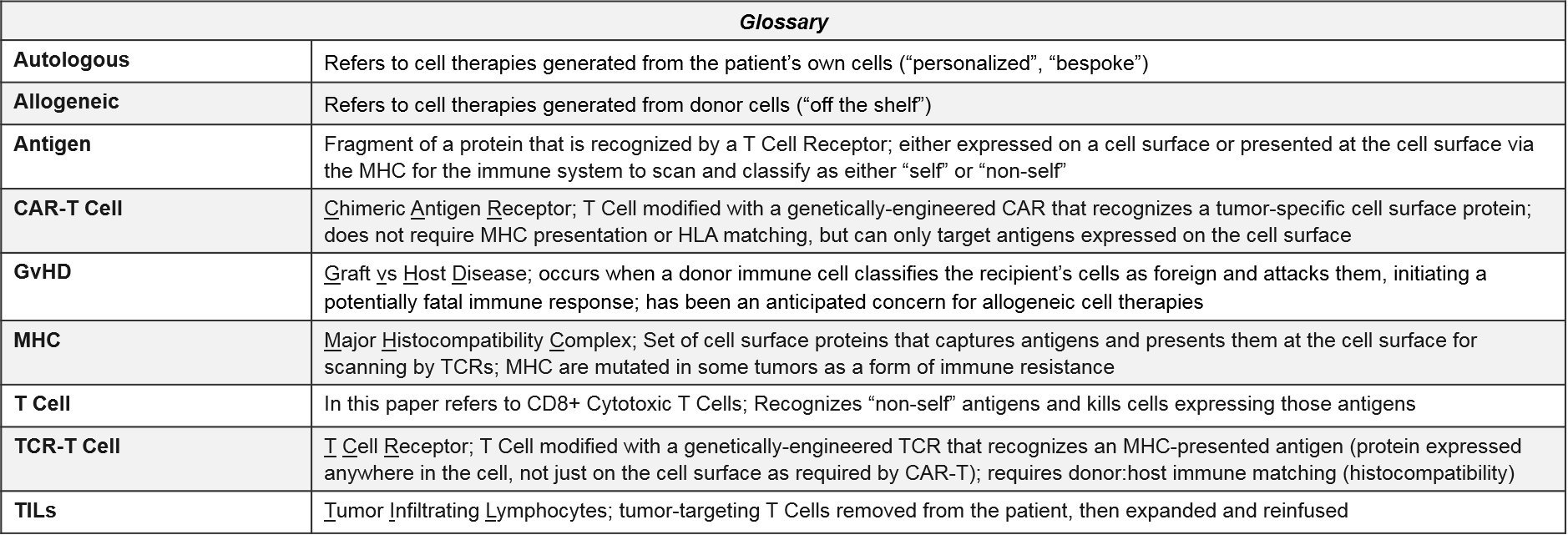

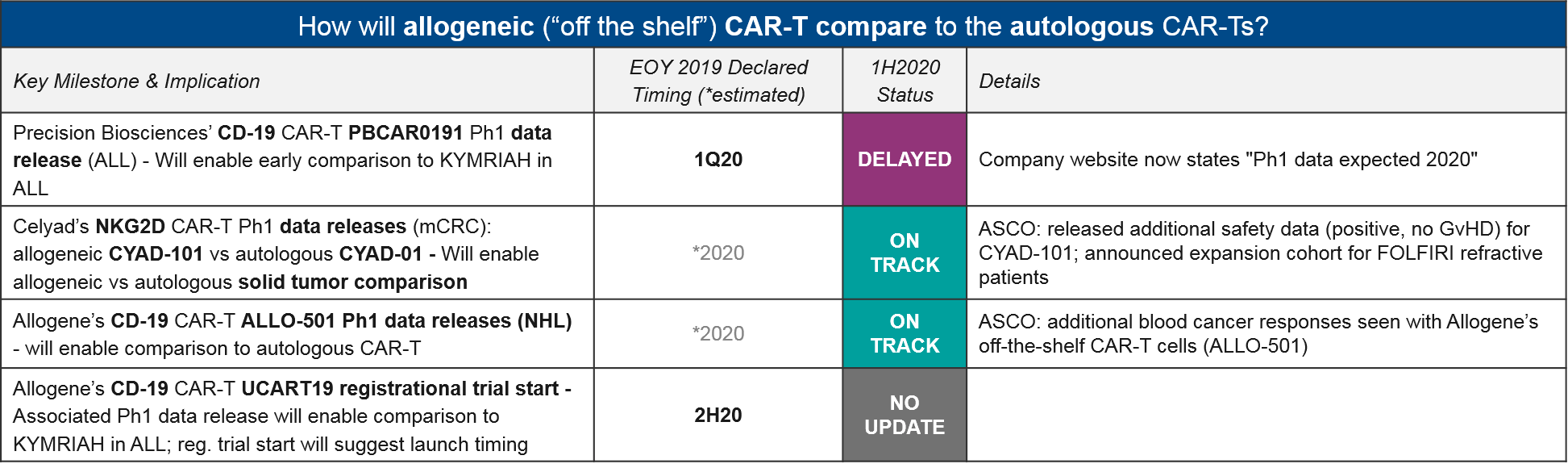

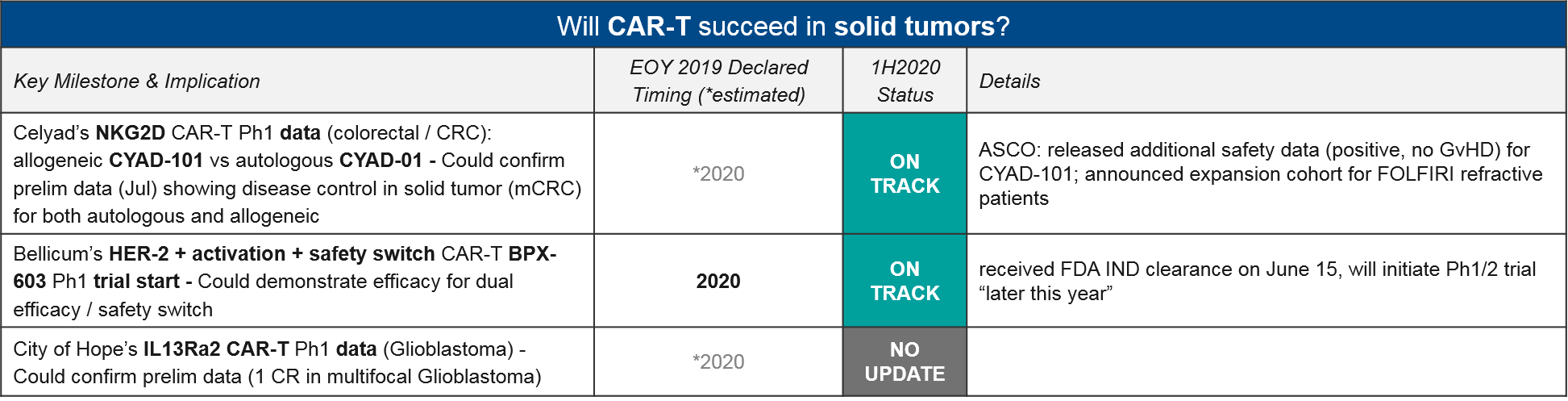

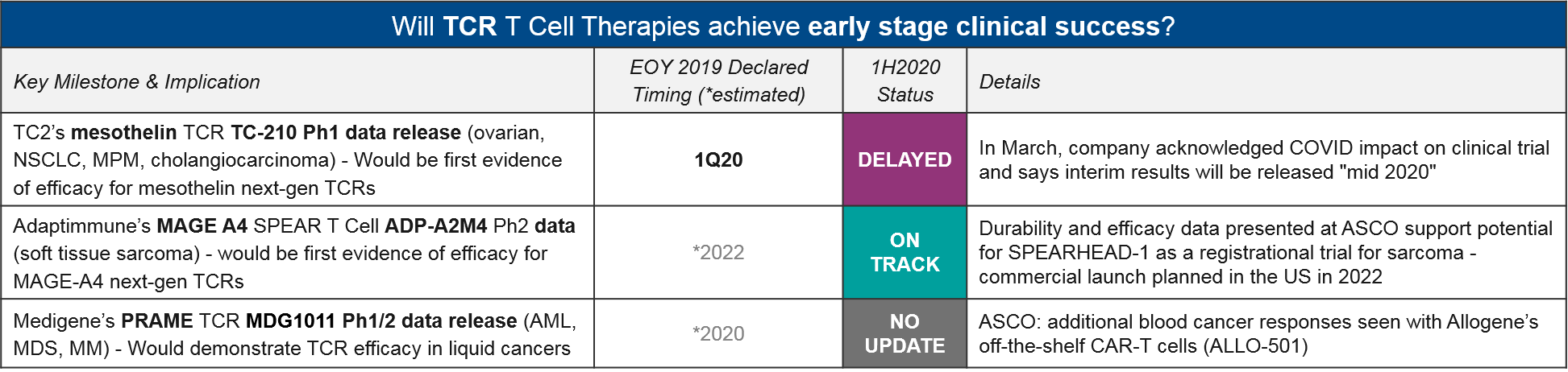

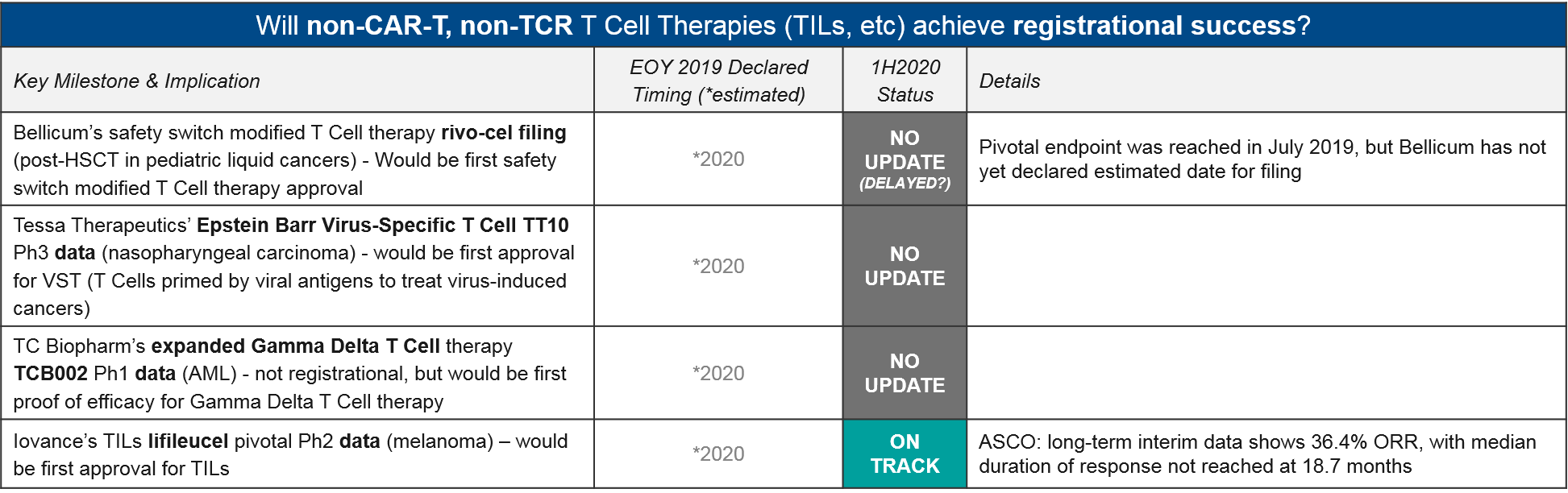

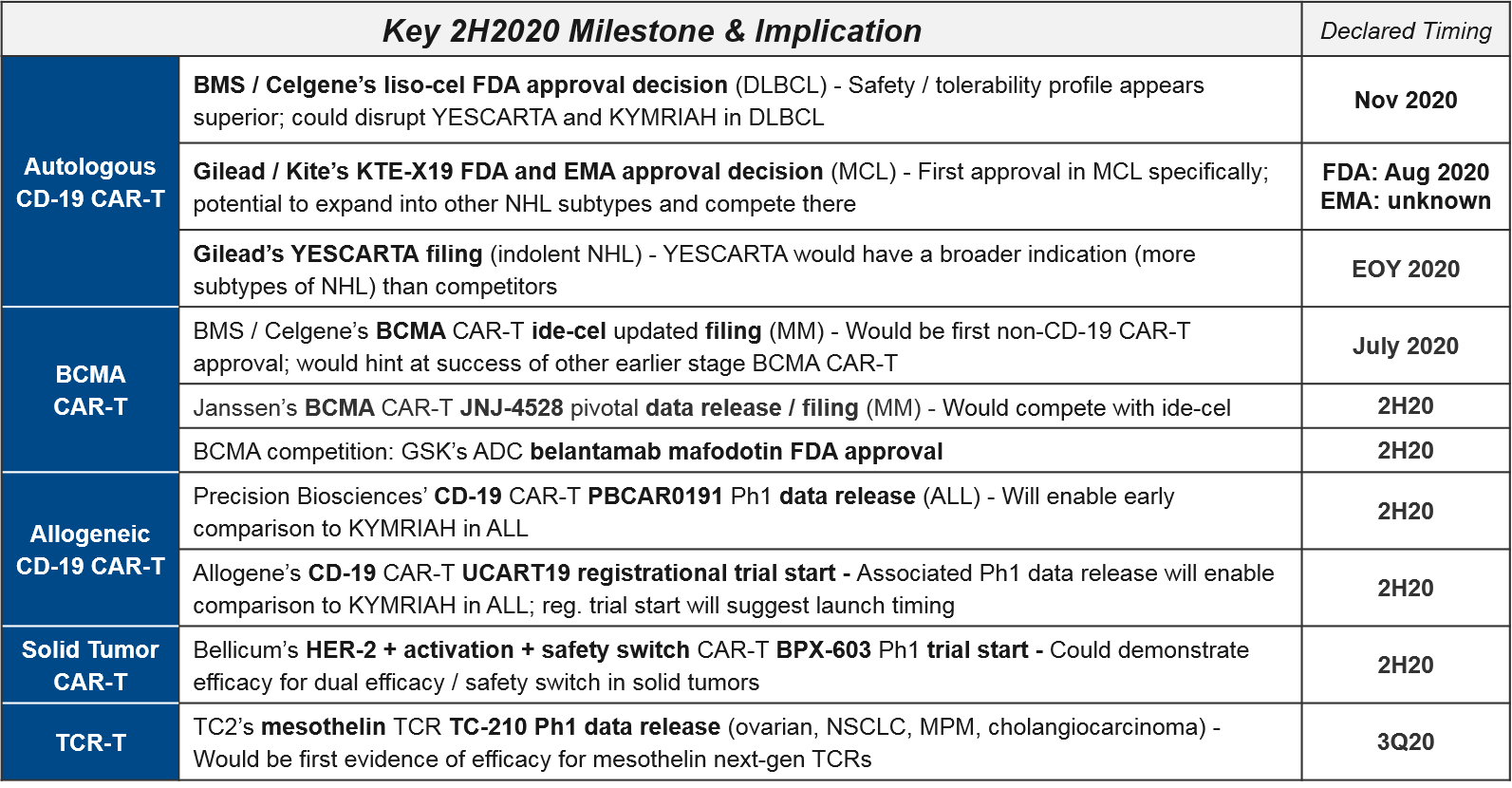

Six months ago, we published an in-depth review of the cell-based immunotherapy landscape, including forward-facing declarations of 2020 data releases, filings, etc. that would address key outstanding questions, namely:

Six months later, despite the unprecedented and unanticipated impact of COVID-19 on corporate operations, clinical trial functions, and regulatory body decision-making, there have been multiple key decisions and updates that both inform these questions and impact the trajectory of specific therapies. Most notably, BMS / Celgene suffered dual setbacks from the FDA, who rejected their BCMA CAR-T ide-cel and delayed a decision on their CD-19 CAR-T liso-cel. Both decisions put milestone payouts at risk.

On the other hand, Janssen announced promising data for their BCMA CAR-T JNJ-4528, putting them in a competitive position relative to the now-delayed ide-cel. Beyond the autologous (patient-derived) CAR-T therapies, Allogene’s and Celyad’s allogeneic (“off the shelf”) CAR-Ts, Adaptimmune’s TCR-T, and Iovance’s TILs also had a good ASCO with promising data releases.

Here, we review in more detail the revised status of several key milestones declared at the end of year (EOY) 2019.

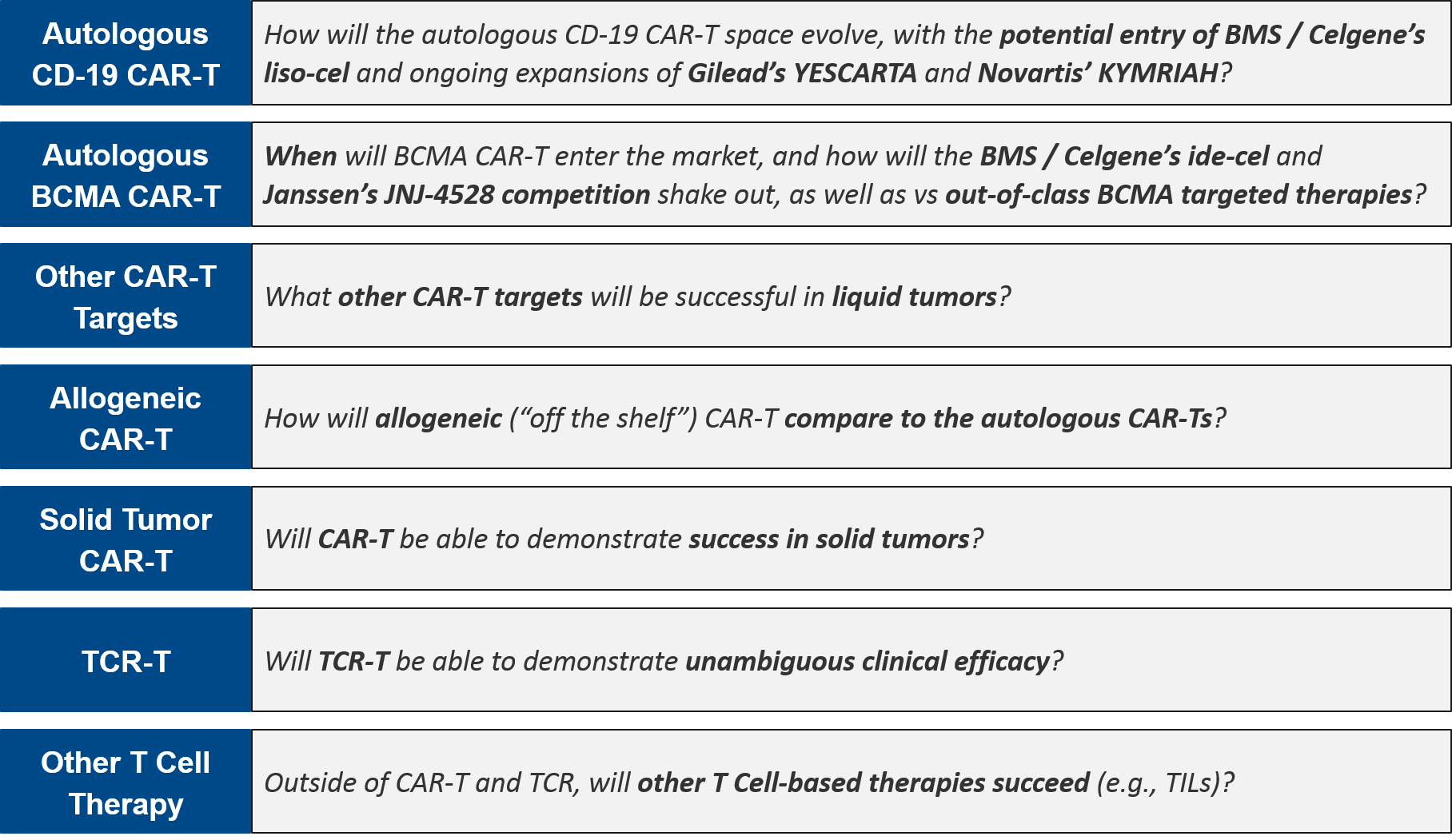

Autologous CD-19 CAR-T

There have been several delays to EOY 2019 declared timelines, most notably with BMS / Celgene’s liso-cel. At the beginning of the year, liso-cel was well-positioned in DLBCL, with a potentially superior efficacy / safety profile that could disrupt the established positions of YESCARTA and KYMRIAH. Indeed, they achieved FDA priority review in February, putting them on track for a mid-year approval. However, in May the FDA pushed back the decision to November, citing the need to review additional data. This new timeline puts Celgene’s Dec 31 approval milestone payout deadline at risk.

Gilead / Kite met their declared Q1 filing milestone for KTE-X19 CAR-T (a next generation version of their already-approved YESCARTA, with improved manufacturing), and are on track for approval with priority review from both the FDA and EMA. If successful, this would be the first CAR-T approval in MCL.

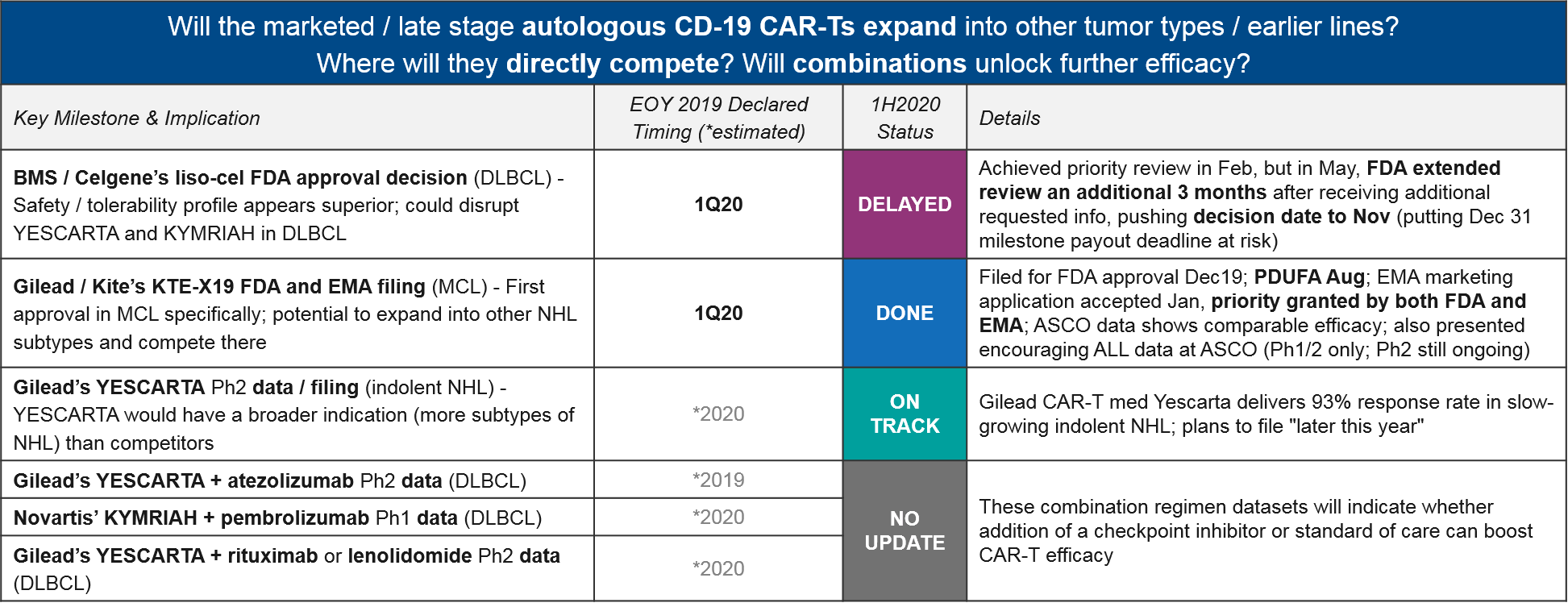

Autologous BCMA CAR-T (and other targets)

At the beginning of the year, BMS / Celgene enjoyed a clear advantage with their BMCA CAR-T ide-cel on track for a first approval in multiple myeloma, ahead of Janssen’s competitor CAR-T JNJ-4528 as well as out-of-class ADC (Antibody Drug Conjugate) competition. However, in May the FDA unexpectedly rejected ide-cel’s application, citing gaps in manufacturing information. Given their March 2021 approval milestone payout deadline, they must resubmit by end of July or risk missing this deadline.

Milestone payouts aside, this delay also opens the door for both in-class competitors (Janssen’s JNJ-4528, which made a splash at ASCO with “early, deep, durable” responses) as well as out-of-class BCMA competitors, namely GSK’s ADC, belantamab mafodotin, which received FDA priority review in January. If successful, it will now be the first BCMA-targeted approval.

Beyond CD-19 and BCMA, at least one additional target, Precision Biosciences’ CD20 CAR-T PBCAR20A, has entered the clinic on schedule. This sets the stage to see evidence of new target efficacy soon.

Allogeneic CAR-T

Given the significant cost and manufacturing burden of preparing the personalized “bespoke” autologous CAR-T therapies, manufacturers are attempting to prove at least equivalent (if not superior) efficacy of the cheaper and more scalable allogeneic “off the shelf” CAR-T therapies. They also must demonstrate that donor-derived allogeneic CAR-T do not trigger dangerous immune reactions between donor and host immune cells, e.g., Graft vs. Host Disease (GvHD).

While we do not yet have a mature dataset for comparing the newly-developed allogeneic CAR-T to the established autologous CD-19 CAR-T, Allogene did announce additional responses seen with their allogeneic CD-19 CAR-T ALLO-501. This is an encouraging sign. Another Q1 anticipated data release, from Precision Bioscience’s CD-19 CAR-T PBCAR0191, is not yet announced, but is still “expected in 2020”.

Aside from CD-19 CAR-T, Celyad announced additional positive safety data for their allogeneic NKG2D CAR-T CYAD-101, with no signs of GvHD or other donor:host immune reactions.

Cellectis’ allogeneic CAR-T portfolio continues to be plagued with safety issues however. Their CS1-targeted UCARTCS1 was placed on clinical hold as of July 6 due to a patient death from cardiac arrest. This is their second clinical hold, after UCART123 was placed on hold in 2017 after the first patient treated died. While it is unclear whether the recent death is due to the UCARTCS1, both deaths occurred at high doses, raising the question of whether doses can safely go high enough to ensure efficacy.

Solid Tumor CAR-T

Celyad’s NKG2D CAR-T CYAD-101 is also noteworthy as the leading solid tumor CAR-T in clinic. While they did not release additional efficacy data at ASCO, they did announce an expansion cohort in CRC (for FOLFIRI refractive patients). Another solid tumor CAR-T, Bellicum’s HER-2 CAR-T BPX-603 is still on track to enter the clinic later this year, after achieving FDA IND clearance on June 15.

TCR-T

The TCR-T cell therapies differ from CAR-T in that they do not require surface expression of their target proteins but do require functioning immune presentation as well as histocompatibility between donor and host immune systems. They have been under clinical development for quite some time with mixed efficacy and safety data. TC2’s mesothelin TCR TC-210 had previously declared a 1Q20 data release, but in March they announced COVID-related delays would be pushing this out to “mid 2020”.

Adaptimmune’s MAGE A4 SPEAR T Cell (their proprietary TCR platform) ADP-A2M4 did deliver promising durability and efficacy, shown at ASCO. This keeps them on track for their 2022 filing in synovial sarcoma.

Other T Cell Therapy

Aside from CAR-T and TCR-T, there is a notable lack of update on Bellicum’s safety switch modified T Cell rivo-cel, which reached its pivotal endpoint one year ago (in July 2019) but still has not made any updates on filing. Iovance did announce efficacy data for their Tumor Infiltrating Lymphocyte (TIL; an expanded population of each patient’s existing activated T Cells) lifileucel in melanoma, showing a durable response of at least 18.7 months. If approved, this would be the first approval for TILs, which have been under clinical development for quite some time.

Upcoming 2H2020 Milestones

Over the next 6 months we anticipate significant activity with expected filings and FDA decisions, particularly within the autologous CD-19 and BCMA CAR-T spaces. We also look forward to additional data releases on the allogeneic CD-19 CAR-Ts, which will clarify to what extent the allogeneic approaches can supplant the established autologous therapies. Aside from these specific clinical attributes and competitive positioning questions within the T Cell therapy space, we also expect additional clarity on the scope and magnitude of the COVID-19 pandemic impact, particularly on earlier stage clinical trials.