In the first three parts of our series, we introduced the rare disease (RD) ecosystem and its interconnected stakeholders. We also discussed the challenges and key considerations for RD clinical trial design – both (pre)registrational as well as ongoing evidence generation after the first approval. Here, we examine the practical considerations of successful clinical trial implementation, given the unique challenges and opportunities of the RD ecosystem.

Unique Considerations for RD Trial Implementation

RD clinical trial design has unique considerations that naturally also impact trial implementation:

- Limited patient population puts pressure on trials to be able to deliver statistically meaningful results from a small dataset

- Disease complexity (including limited knowledge / standardization of clinical characterization and disease heterogeneity) which can mandate the identification and use of novel biomarkers, endpoints, and other measures of disease and / or outcomes

- Requirement for a compelling value proposition given the need to characterize efficacy and safety (as well as set the context for a potentially high price) in a market which may be relatively unfamiliar with the disease

RD trial implementation is particularly impacted by the first two—limited patient population and disease complexity, as these can directly impact enrollment and outcomes measures. However, the value proposition is also critical even at this early stage in convincing trial sites and patients to participate in the trial. Of course, for early stage trials that lack the clinical data, the value proposition will be oriented towards scientific rationale and a transparent discussion of potential benefits (and risks).

Given the tightly interconnected and relatively small set of key stakeholders within a given RD, the biopharma company’s ability to initiate and nurture stakeholder relationships before and during the trial is key to managing implementation challenges. Even if the therapeutic fails to show efficacy and / or safety, establishing foundational relationships and a positive reputation will help the RD company in future endeavors. The RD company can prioritize these relationships by orienting themselves towards the following key questions:

- Who and where: identify and prioritize potential trial sites and sources for patients, and initiate early, foundational relationships with direct partners. These can include existing or emerging Centers of Excellence (COE) / Key Opinion Leaders (KOLs) that could become trial sites, as well as Patient Advocacy Groups (PAGs) that can spread awareness to patients.

- Why: convincing trial sites and investigators to partner, and convincing patients to enroll.

- How: supporting development of trial site capabilities (e.g., complex therapeutic administration), delivering the therapeutic, monitoring outcomes over time in order to prepare a comprehensive data package to enable internal decision-making, external communications, and / or regulatory decision-making.

1. Who and Where: identifying potential trial sites, investigators, and patients

To set the stage for successful RD clinical trial implementation, RD companies must successfully identify and engage with several sets of key stakeholders with similar but not entirely overlapping intents, namely:

- Institutions and individual physicians that are (or could become) COE / KOLs: raise awareness of the upcoming clinical trial, engage as potential trial sites

- Patient Advocacy Groups (PAGs): raise awareness of the therapeutic and the clinical trial opportunity, communicate the opportunity to patients / caregivers

Unlike other disease spaces, for RD these relationships are often brand new. Typically, the RD company is new to the RD space it is entering, and there may or may not be many existing COE and / or KOLs, depending on the rarity of the disease and existing standard of care. As the RD company surveys the existing landscape and considers which relationships to build and how, they should keep parallel goals in mind:

Goal: Identify existing and emerging COE / KOLs and PAGs as potential partners. This important early step of trial implementation is not always as simple as identifying the existing COE / KOLs or PAGs and reviving established relationships. It may also involve an upfront effort of identifying emerging KOLs and initiating a relationship that will help them grow their experience and expertise by participating in future trials. For RD that have no or only a few COE / KOLs, the RD company can begin with institutions that are well established in similar diseases, or at least the general disease area.

Trial site geographic location is also critical for RD because a) there may not be existing COE / KOLs for an ultra-rare disease with no existing treatment and b) regardless of which RD it is, patients will be rare and not necessarily geographically clustered. Therefore, site selection must balance accessibility of existing COE along with establishing a broad geographic footprint that will maximize patient recruitment, enabling large enough trial datasets to support approval (including approvals outside the initial country). Established COEs (or candidate COEs) are typically located in major metropolitan areas, but not all major metropolitan areas will have COEs. RD companies should consider gaps in COE coverage and support newer or potential KOLs in building their expertise to support COE generation in new areas. This will also help set the stage for a successful launch, as more practitioners will have experience with the therapeutic after participating in (or at least having familiarity within the institution) a clinical trial.

Because RD patients are so few in number, one efficient way to inform and invite them to clinical trials is via Patient Advocacy Groups (PAGs). PAGs fill a critical role in the RD ecosystem as a centralized, unbiased node where patients can find the latest information and treatment opportunities.

Therefore, the RD company should also consider the PAG landscape and connect early with PAGs so they can share information about the clinical trial as it prepares to enroll. For more discussion and recommendations on finding RD patients, please see our in-depth discussion here.

Goal: Establish and expand a landscape presence. RD companies entering a new (to them) space should also ramp up their visibility in arenas that will help establish them as key players. This can include data publications, medical meetings / scientific conference presentations, and DTC communications like press releases. Essentially, when a target KOL does their due diligence on the RD company and therapeutic, they should find credible sources confirming the RD company as a reputable potential partner.

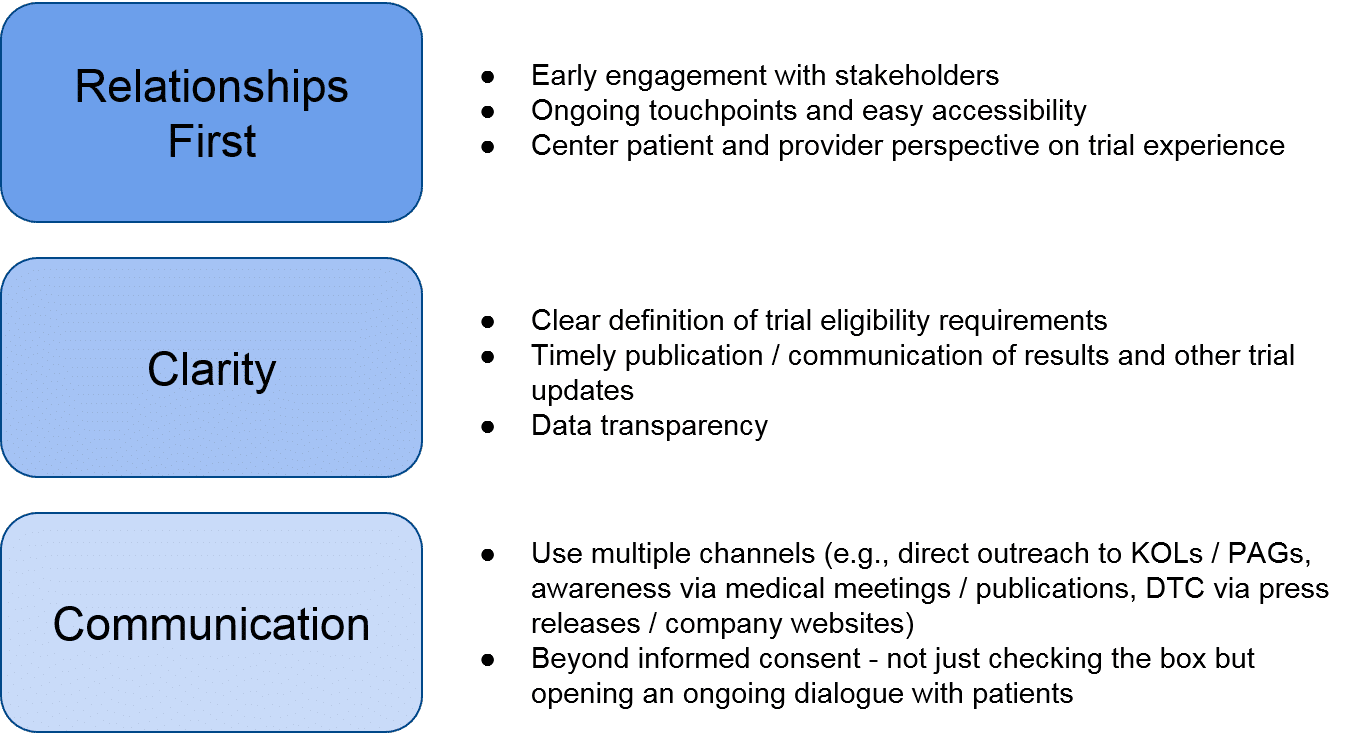

Goal: Initiate a relationship with potential partners. Once potential partners are identified, the RD company can focus on establishing a foundational relationship that will support not just the upcoming clinical trial, but future work within the RD space. Tactically speaking, the RD company can focus on the following to introduce itself as a collaborative partner:

Taken together, these key levers will support a positive reputation for the RD company within the RD landscape, which will help both in the near-term with trial implementation, and over the longer-term as the RD company continues to develop its pipeline within and beyond the initial RD indication.

2. Why: convincing trial sites to partner, and convincing patients to enroll

Once the RD company identifies potential partners, they must make compelling arguments about the value of participating in the clinical trial in phases. These value propositions are communicated first to the trial sites / KOLs, and then ultimately the patients (or families in the case of children with RD).

Potential trial sites / investigators will be balancing multiple factors as they consider trial participation:

- What level of expertise / experience do they already have in this RD? How easy will it be for them to get “up to speed” with an influx of trial patients?

- Would building expertise in this RD complement other COE specialties they have or are hoping to develop? Is this a direction they are interested in developing themselves?

- Is this therapeutic a novel treatment in a very underserved RD, e.g., limited or no standard of care, or are there other clinical trial opportunities with other RD companies that they could partner with instead?

- What pre-clinical data / scientific rationale supports the potential efficacy of the therapeutic? How does this compare to competitors, if relevant?

- Do they agree with the overall clinical trial design in terms of appropriate endpoints and feasibility? Does the design enhance credibility for the RD company overall?

Potential trial participants will have similar considerations as well, particularly relating to scientific rationale as it pertains to a theoretical efficacy and safety profile. In addition, the trial design itself will be a key consideration, particularly whether the trial design ensures they will receive the therapy, as well as the feasibility (the number of follow-up visits, the need for travel, etc.). Given the high unmet need in most RD, trial participants will typically be motivated to participate. As with all clinical trials though, it is essential to manage expectations about the benefits and risks so that participants can make truly informed decisions.

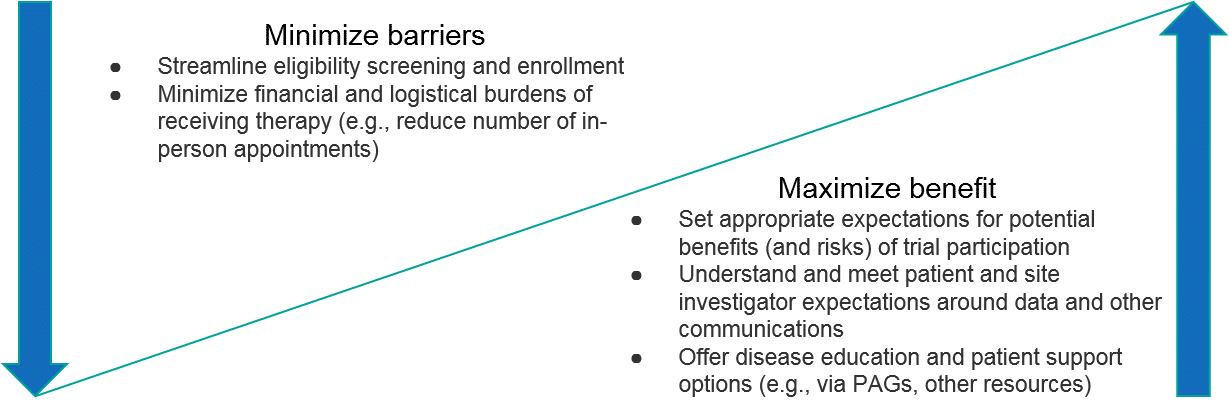

The specific rationale for why to participate will of course vary for each trial. In general, however, RD companies should focus on communicating the potential upside as well as proactively minimizing potential barriers to both trial site investigators as well as patient participants. Importantly, this includes not just the potential efficacy and safety profiles of the therapeutic but extends to the overall “customer experience” of participating in the trial (is it streamlined, minimally-burdensome, are interactions with the RD company positive, etc.). For RD patients, an additional compelling benefit can be helping the community as a whole, e.g., furthering disease understanding or future therapy development.

As with the initial relationship building stage, the RD company’s reputation may not yet be broadly established, so each interaction with a key stakeholder is an opportunity (as well as a potential risk if mismanaged) to build trust and expand a positive reputation.

3. How: successfully running the trial, from delivering the treatment to analyzing the data

Once the trial sites are onboarded and patients are enrolled, the RD company’s focus shifts towards the actual execution of the trial. This includes multiple layers of logistics:

- Distributing the therapeutic (and any relevant comparators or adjuvants) to the trial sites

- Delivering the therapeutic to each individual patient

- Monitoring each patient for efficacy outcomes as well as safety / adverse events

- Managing ongoing enrollment to ensure appropriate randomization and balance across arms (as relevant)

- Analyzing the data, including monitoring interim signals that should trigger a change, e.g., clinical hold for safety, or switching control participants to the therapeutic arm if the therapeutic has strong efficacy

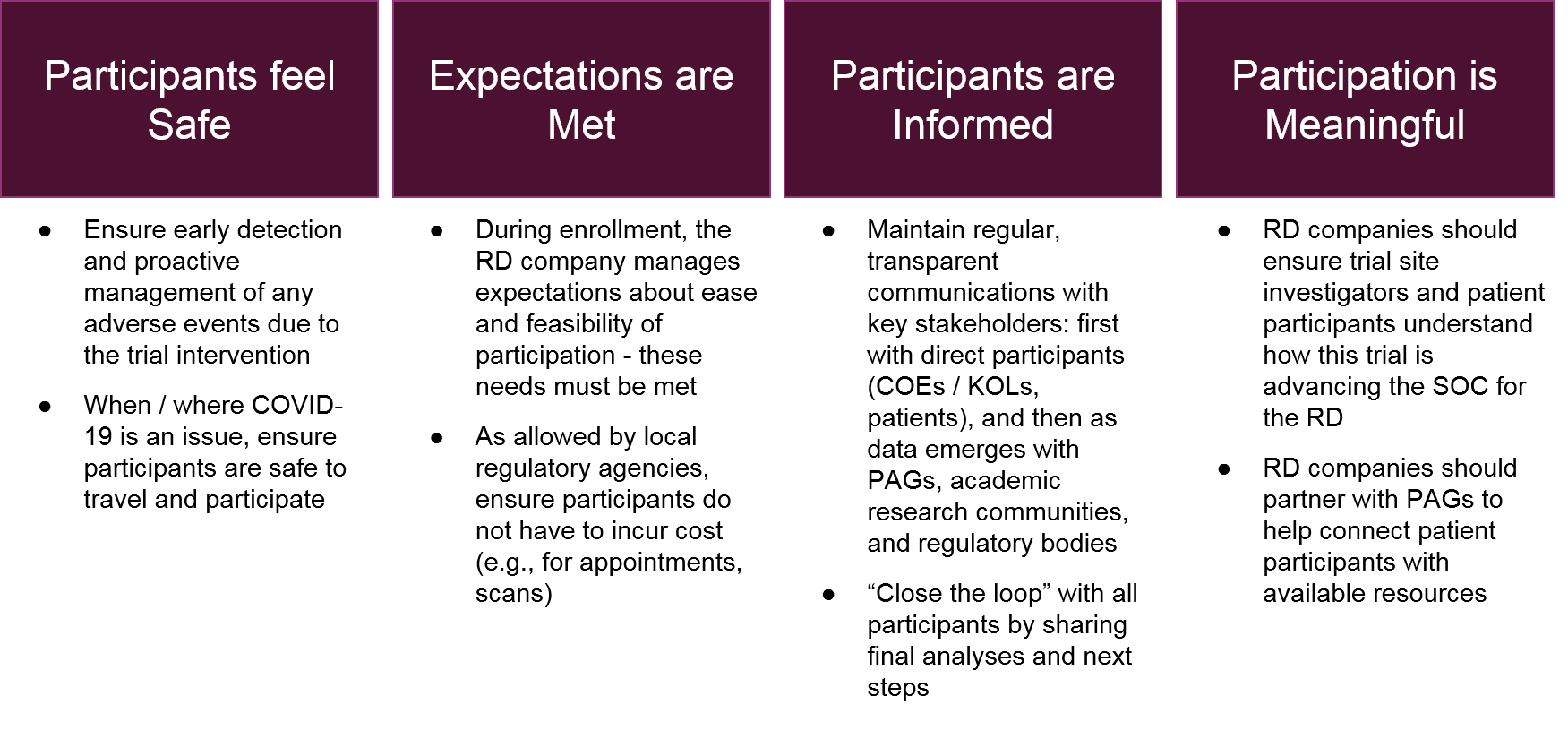

Decisions made during the clinical trial design process drive many of these logistics, and the details will vary depending on the trial design and the therapeutic itself. Generally speaking, however, the company can streamline and improve implementation by prioritizing key stakeholder experiences: namely the trial site investigators and patient participants.

When the RD company is successful at generating and maintaining these stakeholder experiences, the overall implementation will run smoother as compliance with the study parameters increases and any logistical challenges are more acceptable to trial participants. The result is better quality data and an increasingly positive reputation for the RD company across the RD ecosystem.

After the trial itself is complete (including planned follow-up), the implementation focus shifts to data analysis and communication. For registrational trials the key stakeholder will be regulatory agencies, but for all trials the data will be eagerly reviewed by scientific societies / academia as well as COEs / KOLs and Patient Advocacy Groups. As with the recommendations for the enrollment stage of the process, the successful RD company will focus on clarity in its communications. Even if the data is not positive, the RD company can maintain its good reputation with the ecosystem by being transparent about the data and its interpretation, as well as communicating about next steps.

Conclusions

For RD trial implementation, the successful RD company will balance mutually-supportive goals of:

- Ensuring data quality within the trial (via upstream trial design decisions and implementation planning)

- Growing its overall reputation within the broader RD ecosystem (by prioritizing stakeholder relationships and experiences).

In Part V of our rare disease series, we shift our discussion to the post-clinical trial, post-approval environment, and focus in on how RD companies can most effectively work with payers within the RD ecosystem.