Introduction

Around this time last year, we published our first U.S prescription digital therapeutics (PDT) market landscape[1] to provide insight into the potential growth and future directions of this emerging market. We also offered a hypothesis that the path to success would be paved by several PDT developers simultaneously commercializing to collectively “build pressure” towards HCP adoption and payer reimbursement. So, we rolled up our sleeves again, crunched the numbers, and sought input from other players around the industry to give a perspective on where we think the PDT market stands in 2023. In this article, we will provide insight into the data, highlight notable progress over the past year, and identify top trends to watch for in 2023.

To get started, here are our topline PDT landscape observations:

PDTs:

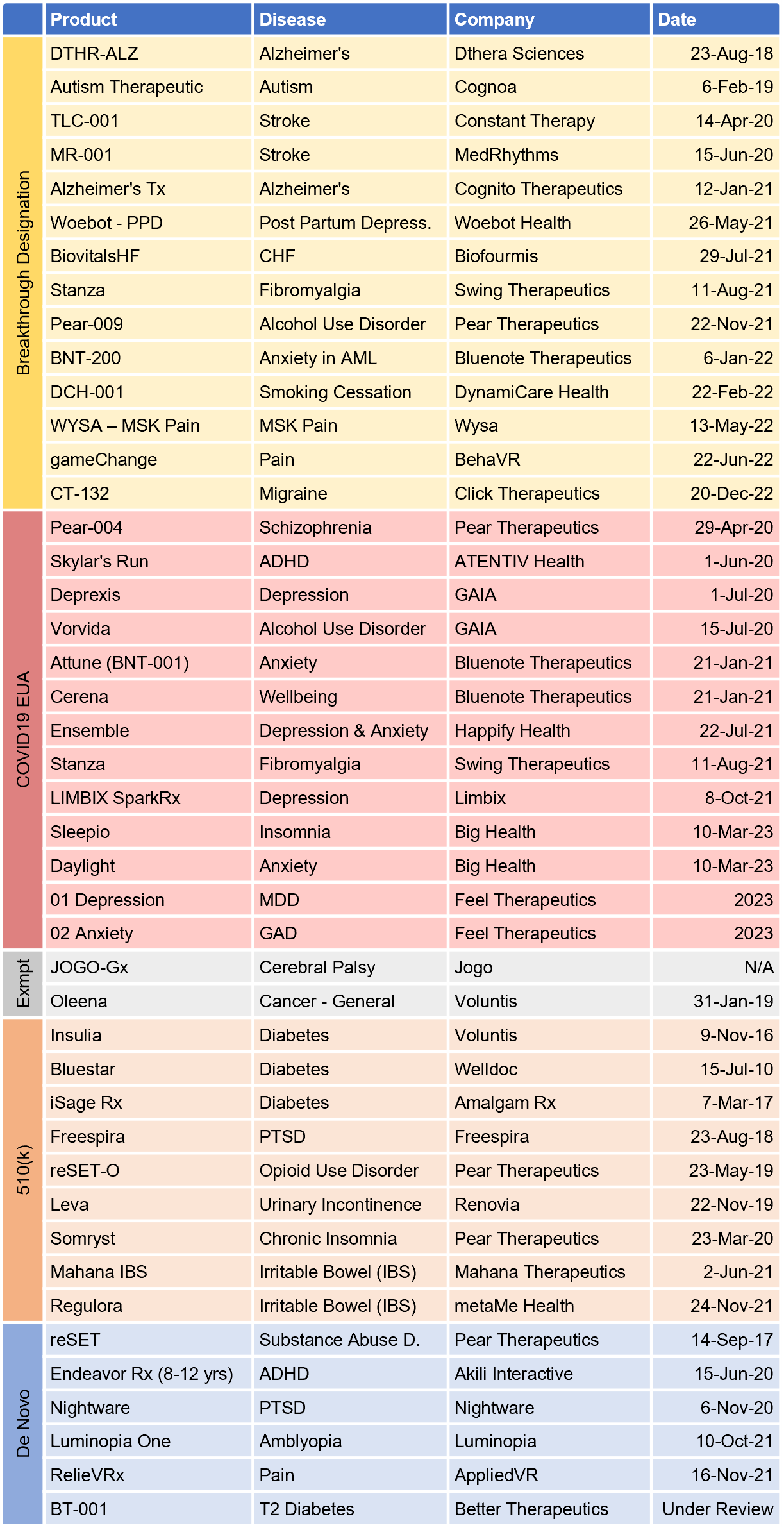

- 154 PDTs were identified with U.S. market intentions; 15 more than last year’s 139

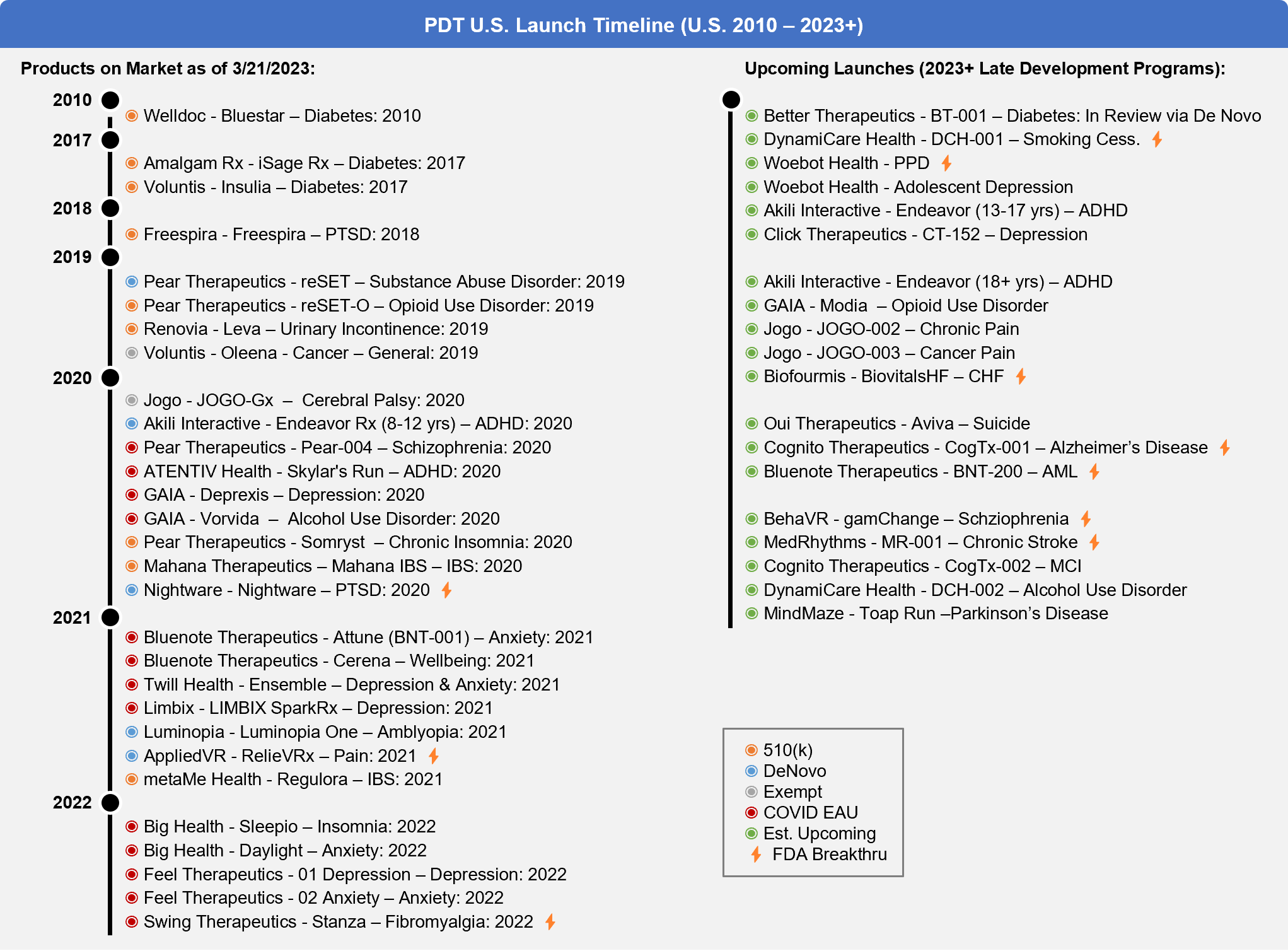

- 29 PDTs are on-market when combining FDA authorized (16; same as last year*) and COVID EUA (13; 5 more than last year)

- 27 PDTs are being commercialized by start-up developers, while the remaining two are commercialized via Orexo pharmaceuticals

- The overall PDT pipeline decreased to 124 from 139, furthermore, several leading PDTs such as Pear Therapeutics (13)[2] and Akili Interactive (3)[3] have noted that they will pause several programs while focusing on commercial operations **

- 19 PDTs are in late development and have the potential to launch in the next few years

PDT Developers:

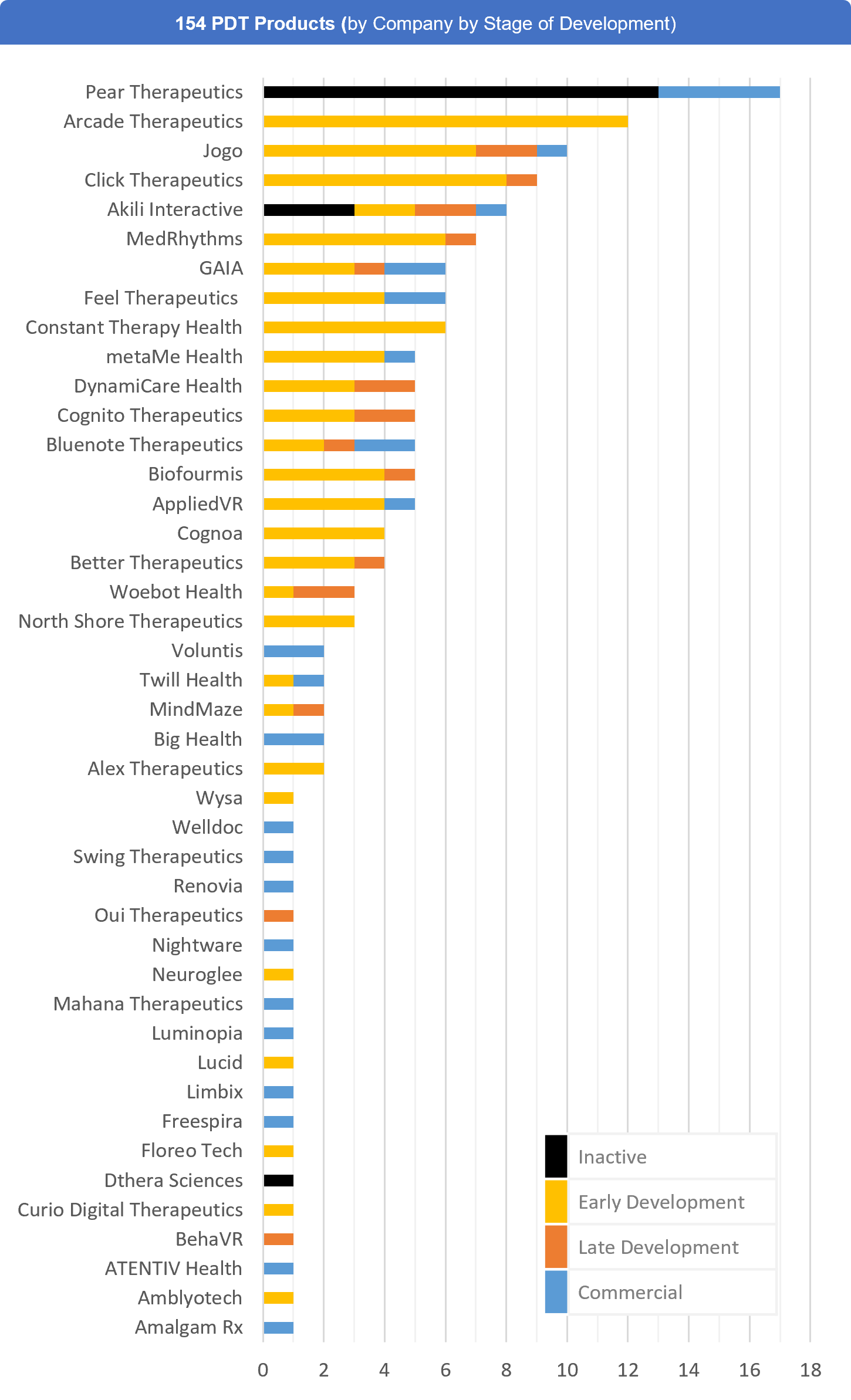

- 43 PDT developers were identified (3 more than last year***)

- The largest PDT developers are Pear Therapeutics (17), Arcade Therapeutics (Formerly Wise, 12), Jogo Health (10), Click Therapeutics (9), Akili Interactive (8), and MedRhythms (7)

- A handful of pharma companies are active in PDT development such as Orexo/GAIA, Otsuka/Click, Boehringer Ingelheim/Click, and Biogen/MedRhythms

PDT Areas of Focus:

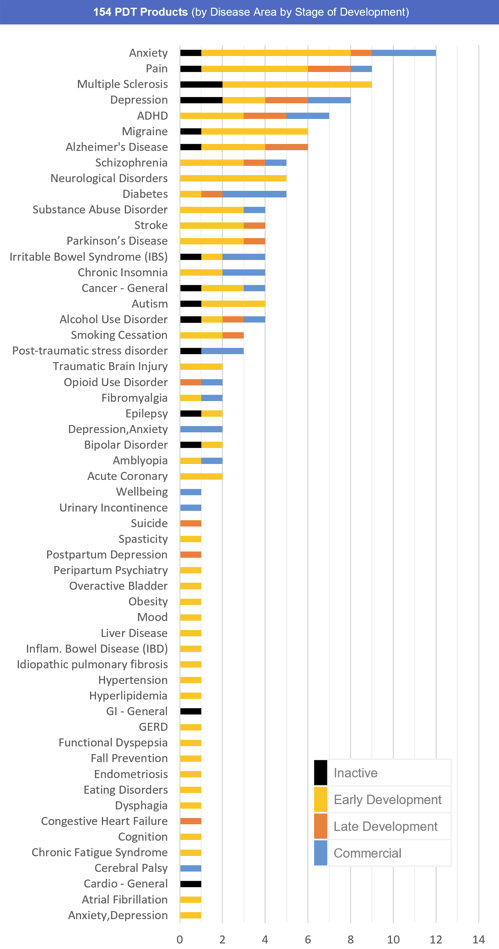

- The top therapeutic areas for PDTs are CNS (119), Cardiometabolic (18), Gastrointestinal (11), Oncology (9), and Women’s Health (5)

- The top indications for PDTs are anxiety disorders (12), pain (9), multiple sclerosis (9), depression (8), ADHD (7), and migraine (6)

* We collapsed Mahana web and Mahana mobile into one clearance for sake of conversation whereas last year we counted it as two separate events (note that Mahana web did receive a de novo clearance)

** Dthera’s PDT is still counted as it achieved FDA breakthrough status but remains inactive (124 dev programs + 29 on market + 1 inactive = 154 PDTs)

*** Manufacturers removed since 2022 include Bold Health, Introspect, Koa Health, Beats Medical, and developers Bright Insight; often this was decided because the company moved into virtual care service or the company’s PDTs could no longer be validated as active

Overall, our analysis does not indicate a significant growth in the PDT market over the past year as on-market FDA-authorized PDTs remained at or around 16, the overall PDT pipeline is smaller, and several pipeline programs are “on pause.” While there were positive steps in 2022 (see below), the pressure may not be building as swiftly as we hoped.

To briefly consider the “pressure” hypothesis for 2023, we can see that PDT companies are currently navigating heightened market volatility and sparse capital resources while also carrying the financial weight of market development. This burden is substantial and has led to some recent strategic decisions that may resonate throughout 2023 (See Pear Therapeutic’s March 2023 announcement seeking “strategic alternatives”[4]). Let’s be clear, the U.S. PDT market is not developed yet…the key remaining barrier is the lack of a standardized PDT reimbursement pathway with insurers. It is not a new barrier; it is a persistent barrier.

Some PDT companies have gathered financial resources to begin the initial push for payer coverage and reimbursement, though the investment is staggering in comparison to the resulting revenue achieved so far[5]. Without a favorable capital market in 2023 to continually inject cash for PDT companies to build more pressure, there will be a need for reinforcements to keep pushing adoption and reimbursement forward. Our current view is that it is quickly becoming critical for one (or several) of the upcoming pharma partners (Otsuka, BI, Biogen and Orexo) to leverage their marketing muscles to hopefully establish broad PDT market access via reimbursement and improve ROI. Without achieving access, more and more PDTs will need to explore alternative business models (patient self-pay[6], white-label, provider bulk-purchasing, selling off products/company, etc.) to gain access to revenue while they wait-and-watch for someone else to achieve reimbursement.

Just The Data, Please

Below you will find a handful of figures providing an overview of the U.S. PDT landscape based on our analysis. We are happy to provide the underlying data (see methodology section) which includes more details beyond these charts, such as: pivotal trial information, regulatory resources, partnerships, pricing, and more.

Fig. 1 – Market Map of 43 Prescription Digital Therapeutics Developers, 2023

Fig. 2 – 154 Prescription Digital Therapeutics (by Company and Stage of Development)

Fig. 3 – 154 Prescription Digital Therapeutics (by Disease and Stage of Development)

Fig. 4 – Prescription Digital Therapeutics with Active Regulatory Status

Fig. 5 – Prescription Digital Therapeutics Launch Timeline (2010-2023+)

Looking Back: PDTs in 2022

2022 started with Pear Therapeutics and Akili Interactive recently becoming public companies, flush with cash to drive PDT commercialization with accountability to the street. As a result, progress was made, though it was hard fought. Below are some highlights from the year:

- State Medicaid channels engage with PDTs – State Medicaid may not be anyone’s first guess for pioneering innovation, but Pear Therapeutics had a string of wins across states to either pilot PDTs via S.O.R. grant funds (Michigan + others), land value-based contracts (Oklahoma), or to out-right cover PDTs on standard benefits (MassHealth and Florida’s PDL). In November 2022, Pear claimed in their investor report to have access to “10 states, 16 Blues organizations and formulary inclusion by 2 PBMs”[7]. However, several states leveraged alternative funding options and non-standard benefit coverage that may lapse after the pilot timeline, or with the budget year ending. But progress was being made in a critical audience of high unmet need for treating abuse disorders that could set the stage for other insurers to see PDTs make an impact.

- Commercial Payers, the VA, and PBMs slowly adding PDT coverage – At BMC, we have been actively engaged in scouring medical and pharmacy policies to track the inclusion or exclusion of PDTs with insurers and PBMs. Without going into details, coverage for several PDTs was achieved across a variety of insurers though the pathway of medical vs. pharmacy benefit was still quite mixed. And either as a glass half-full or half-empty perspective, most national insurers have seen enough PDT activity to establish a beginning policy for the class of products, though almost universally they are denying coverage. These policies classify PDTs as “Exploratory / Investigational” with the defense being that PDTs have not quite proven their impact on “Net Health Outcomes.” In the policies, payers defined medical necessity requirements for coverage (though with a fair amount of wiggle room for payers to do as they wanted). As an example, check out Premera’s medical policy for PDTs and the medical necessity criteria they list to see the challenges[8]. In addition, the VA is allowing access for Orexo/GAIA’s Deprexis and Nightware though there are still local coverage discussions to be had. On the PBM front, multiple options have existed for a few years but with notable expansion of Prime Therapeutics role in getting PDTs into the hands of patients[9]. Finally, Highmark of Pennsylvania initially announced openness to covering PDTs in late 2022 but has since walked the story back a bit to simply being open to reviewing PDTs, but not carte-blanche access yet[10].

- CPT and HCPCS Coding: In-roads and side-roads – While the devil is in the details when it comes to coding, 2022 had clear progress on this front as well. CPT codes were established for paying for physicians’ time to onboard and monitor digital health solutions and more specifically digital CBT applications. So, healthcare providers (HCPs) had some incentives to try PDTs. With HCPCS, there was effort to establish individual codes per PDT, which failed. Instead, there was a single HCPCS code established for all PDTs which made establishing independent product pricing a challenge. Only very recently, has AppliedVR achieved a unique product HCPCS code due to the inclusion of hardware so there is some silver lining to this path[11]. However, both of these milestones again acknowledge that major healthcare stakeholders and industry groups are starting to take a position and engage with defining a path forward. It may not yet be the one the PDT market wants, but there’s more discussion to be had now that the door is open.

- Bipartisan legislation introduced to create new Medicare/Medicaid benefit category for PDTs (S.3791) – Continuing on the themes above, we also saw legislation introduced to establish government level pathways for PDT reimbursement[12]. This would likely be the crown jewel of accomplishments as commercial payers often follow the lead of CMS and Medicare. After all, why would commercial insurers pay all the money and invest the time needed for evaluating PDTs when CMS will do it for them? In countless interviews with key stakeholders, we have heard that while payers see a path to value and benefit from PDTs, they are unlikely to be the first mover and instead, will wait for CMS to set the pace for coverage. The bill has periodically picked up momentum and sponsors, but there is still ground to be covered to get this to a positive outcome.

Looking Ahead: PDTs in 2023

A few parting thoughts on what could help move the PDT market forward in 2023:

- Our first pharma co-development launch: Otsuka + Click in depression – While Orexo jumped straight to commercializing Deprexis, Otsuka would be the first long-term PDT pharma investor to support the launch of a product. With a clearly novel intervention leveraging EFMT (Emotional Faces Memory Task) to treat depression, potentially positive pivotal data, existing payer relationships, a boots-on-the-ground sales force, and a long history as a leader in CNS, it will be interesting to see how Otsuka commercializes and how the market reacts.

- The first strong push into PCP-based commercialization with Better Tx – while currently under FDA review, we expect Better to find its way to market with BT-001 in diabetes and we’re sure they are drooling over the potential for PCP adoption to capture a large market. To date, most adoption for OUD, Insomnia, and IBS is with specialists. Will Better find success with PCP integration into their already busy workflows?

- State Medicaid FFS dominoes via Pear Therapeutics – As the opioid crisis hits states hard, they are finding ways to pay for reSET-O, even if temporarily. Only a few states are truly reimbursing via a standard pharmacy / medical benefit while several others are tapping into State Opioid Response grant (SOR) and other temporary funding. In 2023 we may start to see early signs of whether these programs are showing the impact to states to consider a path to longer-term business and maybe even reimbursement.

- Will commercial payers follow Highmark into PDT reimbursement? – While the majority of national payers are relegating PDTs to “Exploratory / Investigational” at this point, Highmark may help to convince a few to explore a more standardized coverage option for PDTs. However, they have slightly adjusted their stance for PDT coverage as well and haven’t yet announced any tangible coverage, reimbursement, or payments for a PDT to back up the talk.

- Chatbots are all the rage; will that help Woebot and others? – ChatGPT is everywhere, and Woebot is the first of several compelling PDTs leveraging a modernized chatbot interface that has some passing similarities. These approaches could have advantages over very traditional tree-based discussion logic that limits personalization. As the public experiments with chatbots and tests their limitations and applications it will raise concerns for use in healthcare, or it could pave the way for more interest and conversations with HCPs and payers eager to share in the glow of our AI future. Woebot has been proactive in trying to educate the public on the difference between how they approach a clinical context versus ChatGPT’s use case, and we applaud them and hope that it works.[13]

- HCPCS reimbursement and coding for physician payment? – Codes are now available to pay for both physician time interacting with PDTs (in some contexts) and for reimbursing software-only PDTs and VR PDTs. However, it’s unclear if the payment rates and successful reimbursement of these codes will be compelling for physician adoption. It doesn’t hurt, but will it motivate? As far as HCPCS codes, as long as all PDTs are lumped into a single code, it appears unlikely to provide a path to the potential market most are seeking. We’ll need to see how—if at all—the HCPCS codes could be altered or adjusted, or whether new routes via pharmacy benefits can be achieved.

- Medicare momentum builds, will it be enough – Frankly, we have no idea. But we’ll all be waiting to see that headline of the government giving it some serious thought and/or maybe, maybe, pushing it to the finish line.

- Investment challenges, consolidation or trimming of PDT programs – We’ve seen signs of market challenges hitting PDT companies and causing reduced headcounts[14], de-prioritization of PDT development programs (sources above), and the potential for reduced valuations. We may see more of that as 2023 progresses which could lead to potential acquisition by Pharma (or others such as MedTech or Big Tech), consolidation, and/or doors closing on some developers.

As we sit here in early 2023 looking backwards and forwards, it is apparent that there is still ground to cover for PDTs to make it big. While pressure is needed, our analysis suggests that it won’t be a flood of PDT developers making strides in 2023. We think the market will need new, deeper-pocketed players to make continued progress.

Hopefully you all found this update helpful. Please do reach out if you have any questions or comments as we’re always happy to meet individuals interested in PDTs and Digital Health!

Methodology

Generally, we defined PDT companies as those with products that are intending to seek FDA clearance as a prescription software-as-a-medical-device (SaMD) intervention with extensive evidence and regulatory oversight. The PDT criteria can include any of the following:

- FDA: FDA authorization, clearance, approval or Breakthrough Designation

- Claim: Self-proclaimed prescription DTx products

- Pipeline: Websites display a product pipeline similar to pharmaceutical companies

With this approach, there are always “edge cases” that occupy a gray area. Overall, we did our best to be inclusive but also verifiable regarding the intent to commercialize in the U.S.

In addition, we lean towards software-only products, but this can be tricky with augmented / virtual reality-based solutions (and others). From time to time, we may include some notable hardware-based products if we think it’s warranted, but with a concerted effort to not slide right into including every medical device, such as those for neuromodulation and neurostimulation.

In 2022, we gathered additional data around clinical trial development and regulatory filing to conduct an analysis on time to market. We used this to provide estimates on when new PDTs may launch per year into the future. We chose to not conduct this analysis in 2023 (though the underlying data is in the database) as the 2022 prediction did not appear accurate enough for our satisfaction. Simply put, there are more unknowns in the market than we could capture, so we’ll wait until it’s a bit more reliable and for now have just bucketed late development PDTs together into potential upcoming launches in the next few years.

Readers wanting full access to the PDT landscape data can contact Jeff Liesch directly at jliesch@bluematterconsulting.com.

Endnotes

[1] Blue Matter Consulting’s “Under Pressure: Prescription Digital Therapeutics – How an analysis of the U.S. PDT landscape indicates mounting pressure for a make-or-break next 3 years” (Accessed Mar 22, 2023) https://bluematterconsulting.com/prescription-digital-therapeutics-landscape-2022/

[2] Pear Therapeutics website (Accessed Mar 21, 2023): “On July 25, 2022, the Company announced a restructuring of its operations in which the Company paused its investment in its pipeline of product candidates in order to prioritize certain commercial efforts. The Company intends to suspend most pipeline activities until revenues increase and the macroeconomic environment improves.” https://peartherapeutics.com/science/product-pipeline/

[3] Akili Interactive website (Accessed Mar 21, 2023): “Note: Additional programs in Attention in Autism Spectrum Disorder (ASD), Cognitive Dysfunction in Multiple Sclerosis (MS), Cognitive Dysfunction in Depression (MDD), and Cognitive Monitoring: Screening & Assessments have completed POC trials and ready for Pivotal trials. Programs will be evaluated in connection with Akili’s capital raising and business development activities.” https://www.akiliinteractive.com/product-development

[4] Pear Therapeutics announces process exploring strategic alternatives (Accessed on Mar 21, 2023) https://peartherapeutics.com/pear-therapeutics-announces-process-exploring-strategic-alternatives/

[5] Pear Therapeutics Nov 2022 Investor Presentation (Accessed on Mar 21, 2023) https://investors.peartherapeutics.com/static-files/9e31d461-82f3-4d59-a101-186140d382d2

[6] Akili Interactive’s Q4 2022 Investor Presentation noted 94-96% of prescriptions were completed via self-pay which was approximately $99/month for 3 months. (Accessed Mar 22, 2023) https://s201.q4cdn.com/524504872/files/doc_financials/2022/q4/Q4-22-Earnings-Slides-FINAL.pdf

[7] Pear Therapeutics Nov 2022 Investor PPT (Accessed on Mar 21, 2023) https://investors.peartherapeutics.com/static-files/9e31d461-82f3-4d59-a101-186140d382d2

[8] Premera Medical Policy for Prescription Digital Therapeutics (Accessed on Mar 21, 2023) https://www.premera.com/medicalpolicies/13.01.500.pdf

[9] Par Therapeutics reports second quarter 2022 results (Accessed Mar 22, 2023) https://peartherapeutics.com/pear-therapeutics-reports-second-quarter-2022-results/

[10] Fierce Healthcare (Oct 2022). Highmark steps up coverage of prescription digital therapies as companies see momentum in the payer market. (Accessed on Mar 21, 2023) https://www.fiercehealthcare.com/health-tech/highmark-expands-coverage-prescription-digital-therapeutics-app-makers-see-momentum

[11] HIT Consultant: AppliedVR Becomes First Virtual Reality Provider to Receive HCPCS Level II Code (Accessed on Mar 22, 2023) https://hitconsultant.net/2023/03/21/appliedvr-receive-hcpcs-level-ii-code/

[12] S.3791 – Access to Prescription Digital Therapeutics Act of 2022 (Accessed on Mar 21, 2023) https://www.congress.gov/bill/117th-congress/senate-bill/3791

[13] Why Generative AI Is Not Yet Ready for Mental Healthcare (Accessed on Mar 22, 2023) https://woebothealth.com/why-generative-ai-is-not-yet-ready-for-mental-healthcare/

[14] Akili Interactive to cut 30% of its staff (Accessed Mar 21, 2023) https://www.mobihealthnews.com/news/akili-interactive-cut-30-its-staff