Better integration of personalized cancer treatments into clinical practice will immensely improve outcomes for patients. But, to achieve the full potential of precision medicine, both pharma and diagnostics must accelerate and broaden their scope of precision medicine beyond their currently limited settings and ensure successful integration into clinical practice. In this installment, we will explore the requirements for success and how diagnostic and pharma companies can lead the advancement of precision medicine.

In Part I of this series, we reviewed the scientific basis of molecular alterations and the technology of the tests that detect them. In Part II, we discussed how precision medicine is currently used in the clinic, as well as the key challenges associated with it. Here, we will focus on the future landscape and the requirements for both diagnostics and pharma companies to achieve broader success.

Key Terms:

- Diagnostic: a test for molecular alterations that indicates or confirms a disease or specific molecular alteration

- Molecular alteration: any change in a protein or its precursors that impedes its normal biological function; This includes both mutations that change the function of a protein, as well as significant increases or decreases in the amount of the protein.

- Precision medicine: collecting information about molecular alterations and incorporating it into treatment decision-making

Evolution of Scientific Understanding and Clinical Application

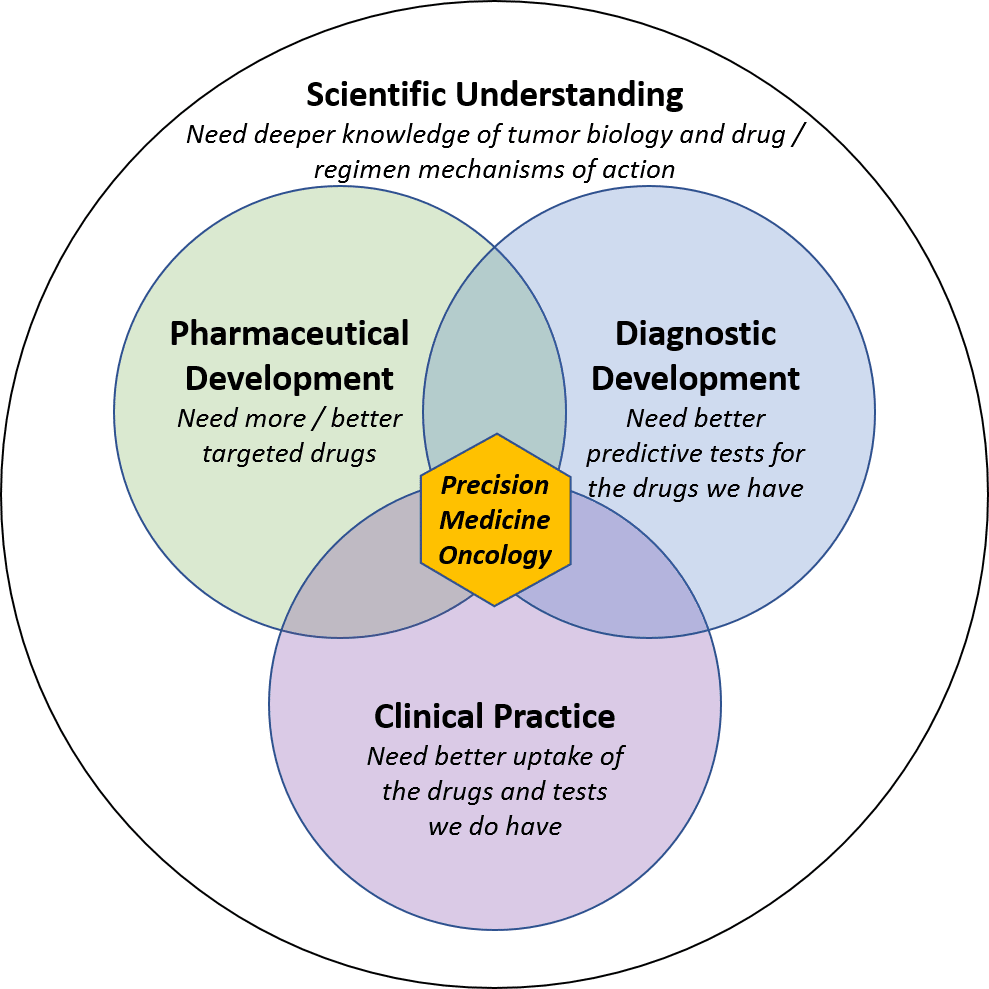

To transform cancer from a progressively fatal disease to one that is curable (or at least manageable), we need better:

- Drugs / regimens

- Predictive tests to guide treatment strategy

- Integration into clinical practice to bring these pharmaceutical and diagnostic tools together

A deeper and more comprehensive scientific understanding of tumor biology and drug mechanisms of action is a foundational requirement for all three of these pillars.

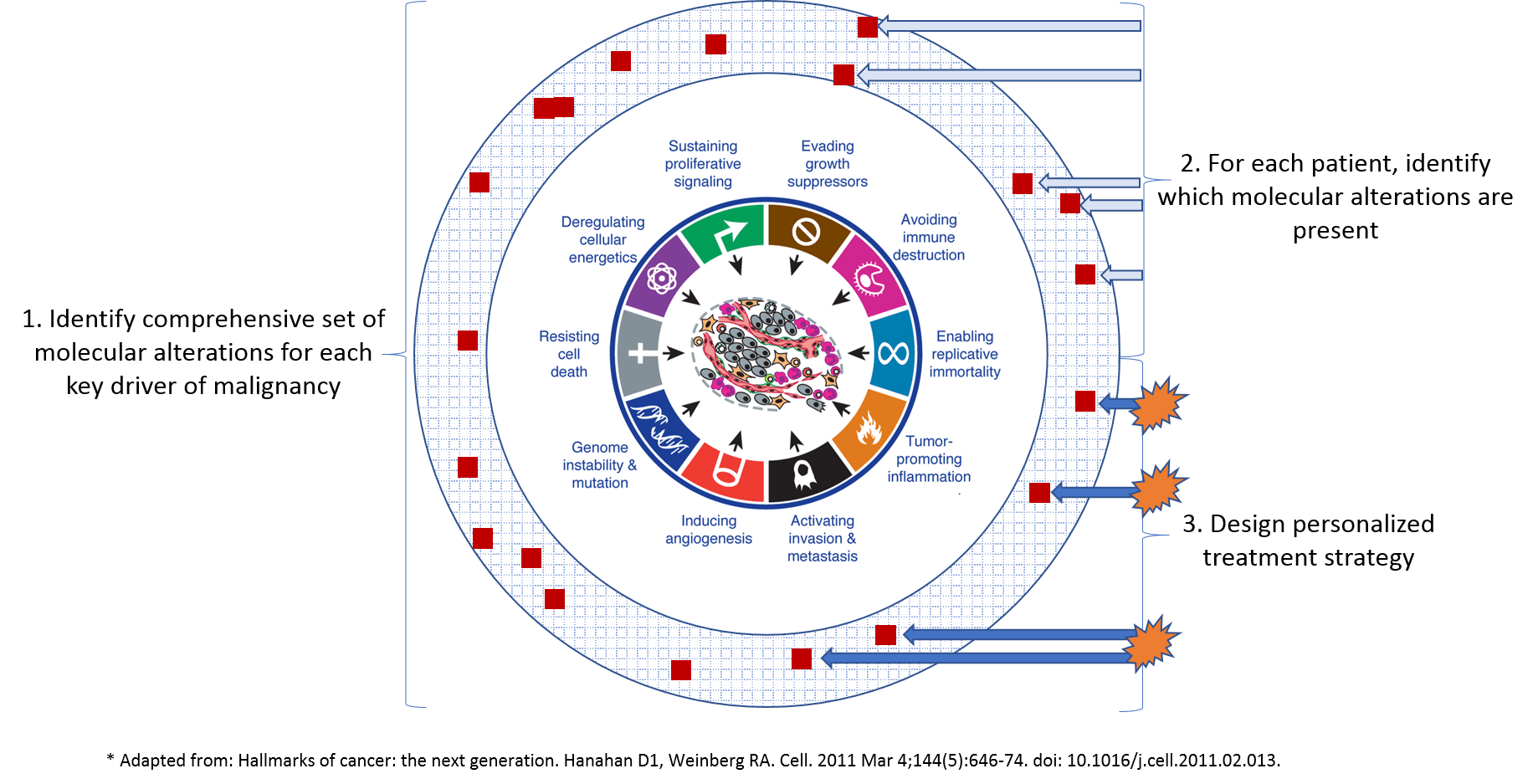

At the general level, we know that a consistent set of drivers cause tumors to form and spread. Each arises as the result of one or more genetic mutations or other molecular alterations. This framework, known as the “Hallmarks of Cancer”, identifies key drivers of malignancy in solid tumors such as:

- Unrestrainable growth

- Angiogenesis (the ability to grow new blood vessels to feed a growing tumor)

- Invasion of other tissues

- Blocking of cell death signals

- Immune system avoidance

While every tumor must have each of these hallmarks (otherwise it would not be cancerous), each tumor develops them via a unique signature of molecular alterations which can also change over time in response to treatment and other environmental pressures.

Some of these molecular alterations are well understood, relatively common in certain settings, and have targeted therapies available to address them. For example, unrestrained growth from HER2 overexpression in breast cancer can be blocked by Herceptin. However, for most tumors, we either cannot definitively identify the molecular alterations or do not have appropriate drugs to treat them.

To translate this general understanding to the personalized level, we need better detection of which molecular alterations are responsible for driving malignancy in each individual tumor. To do that, we need a more comprehensive “dictionary” of all the molecular alterations (and patterns of alterations) that drive malignancy. Importantly, this cannot just be a simple list of all alterations present in a tumor, because many of them are so-called “secondary” or “passenger” mutations which are incidental and not responsible for malignancy (targeting them will not help kill the cancer).

Broader development and adoption of liquid biopsy-based tests will help appropriately refine our dictionary of driver alterations, because the ease of liquid biopsy will enable frequent testing. This information about kinetics can be mapped to treatment and disease response to show which alterations are leading indicators of disease progression. For example, if alteration A appears right before a tumor stops responding to treatment and begins growing, it could be a driver of resistance to treatment.

This general and comprehensive understanding of malignancy drivers would then inform molecular test design such that each individual tumor can be exhaustively mapped for the specific molecular alterations that drive its malignancy. In turn, this detailed understanding of a given tumor will enable a more personalized treatment strategy.

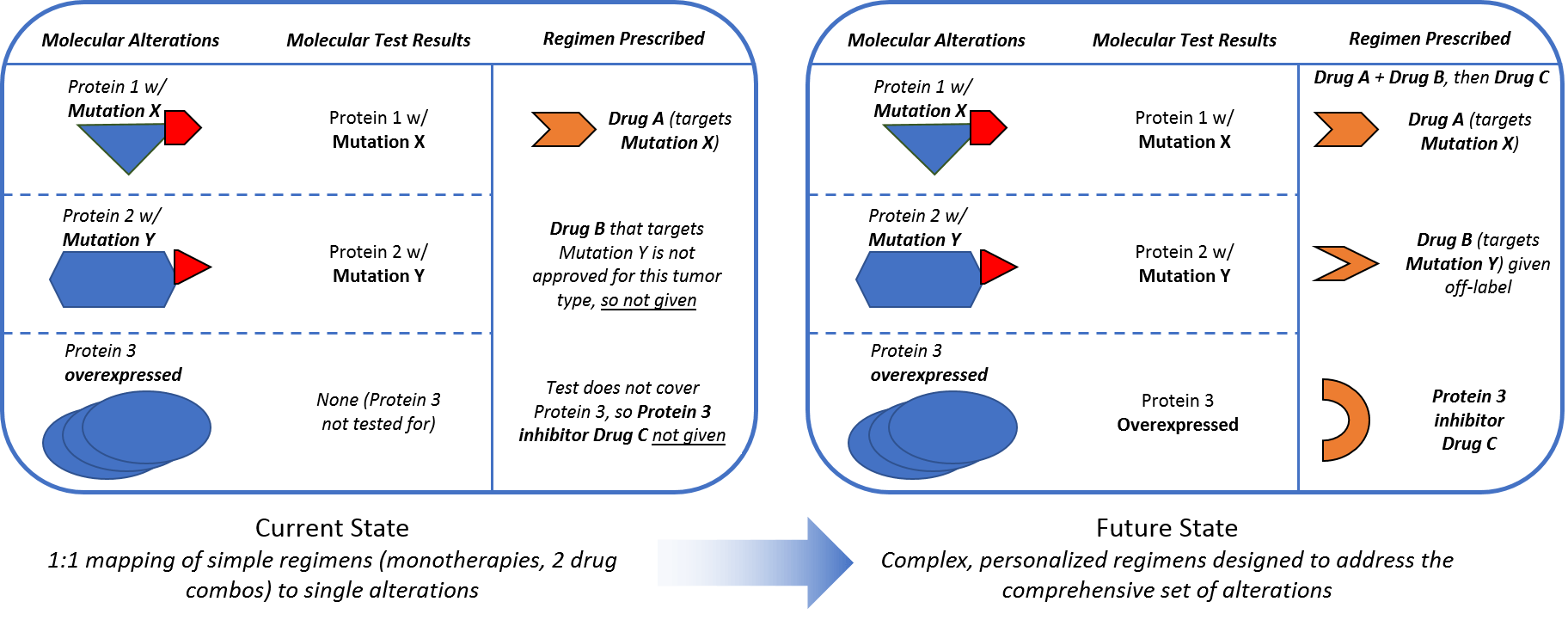

In addition to a more comprehensive understanding of which molecular alterations drive malignancy so that we can detect them via diagnostic tests, we must also evolve regimens to ensure we can effectively target these alterations. A deeper understanding of mechanisms of action—which proteins and pathways a drug impacts—will help researchers and clinicians explore beyond the labeled indications to identify more applications for the drugs we already have. This will also likely involve a shift from simple 1:1 drug to alteration mapping to more complex combinatorial regimens that simultaneously address multiple drivers of malignancy to more effectively suppress the tumor.

Complex regimens require more than just developing more and better targeted drugs. They also require appropriately adjusting regimens with existing drugs to take advantage of our deeper knowledge of personalized tumor biology. Current targeted therapy regimens are aimed at one alteration or pathway at a time. This is typically one drug, or sometimes two where they target two points in the same pathways. An example includes checkpoint inhibitor combos that target both PD1/PDL1 and CTLA (Opdivo and Yervoy), or BRAK/MEK combos that block that pathway in BRAF V600E melanomas. These combos can be very effective when the pathway they target is the primary driver of malignancy. However, this 1:1 mapping of simple regimens to single alterations is not always effective, likely because other alterations are driving malignancy in those resistant tumors.

One challenge of clinical application will be detecting and measuring all the important drivers of malignancy. However, another key challenge will be designing more complex and adaptive regimens to effectively kill evolving tumors without overwhelming side effects or toxicity from the drugs themselves. This may involve:

- More precise sequencing of drugs (rather that giving all at once) to minimize toxicity

- Making overlapping drugs and doses safer by using predictive markers of toxicity

- adjusting regimens before tumor resistance fully takes hold (using information gathered from liquid biopsies or other blood-based markers)

- More personalized therapies such as cancer vaccines or repurposed drugs or combos identified using in vitro screens of the patient’s own tumor cells

Both pharma and diagnostic companies will play key roles in successful evolution to this new precision medicine treatment paradigm.

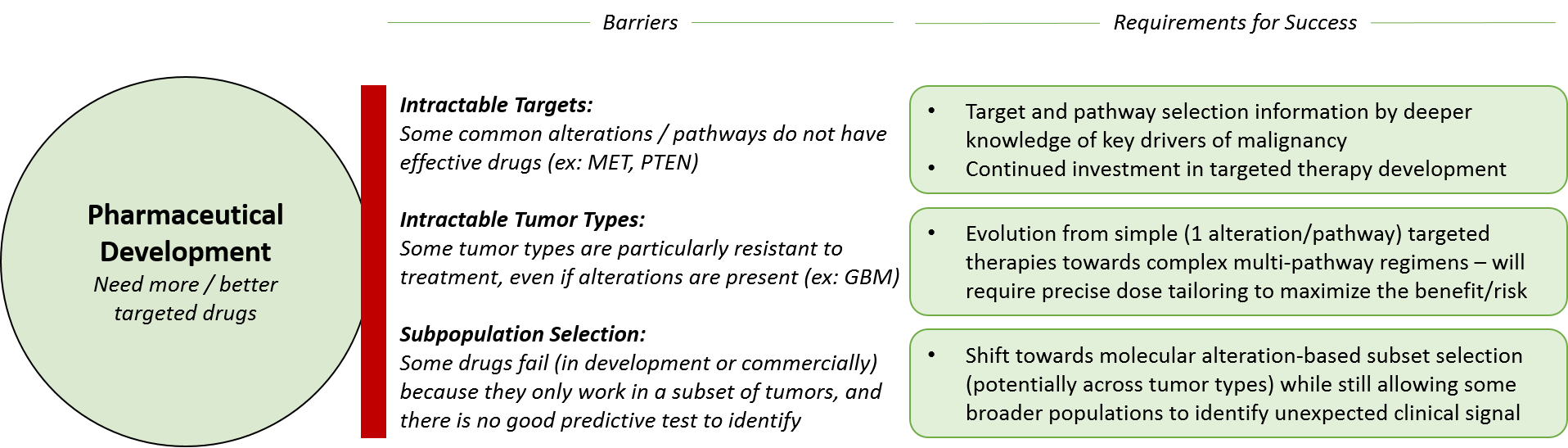

Key Requirements for Success: Pharma

Both pharmaceutical and diagnostic companies must develop their products in a complementary fashion, as well as collaborate to drive clinical integration of both tests and drugs / regimens. Pharmaceutical companies will continue to allocate their efforts across three types of development:

- Maximize launched drugs (broaden indications)

- Evolve existing targeted therapies (next gen drugs)

- Introduce novel targeted therapies (new targets)

Pharmaceutical company research and development teams can leverage deeper scientific knowledge of tumor biology and drugs, as well as emerging clinical data to explore

- New indications or patient subsets for their existing drugs

- How to integrate existing drugs into new and effective regimens

For already approved drugs, one major challenge is that after the patent exclusion expires, there is typically generic competition that results in a lowered price (and profitability) for a drug. So pharma companies must timebound their investments in label expansions accordingly.

That said, it may be that future regulatory landscapes will better incentivize new labels or regimens even past the original expiration date. Or, generics manufacturers might expand their efforts into clinical development to maximize their own profits. Clinicians and other researchers may also step in to further drive expanded development of generics into other “off-label” indications.

In addition to existing drugs, pharmaceutical companies will need to develop new drugs – balancing their investment across improved “next generation” drugs for already drugged targets, as well as developing effective drugs for novel targets. The latter is higher risk, higher reward because previous efforts to drug these targets have not worked. However, if an effective drug can be found, it could have blockbuster potential.

To successfully develop, launch, and market existing drugs in new indications or regimens as well as novel drugs, pharmaceutical companies must continue to demonstrate clinical efficacy. Development teams must successfully select the “right” patient population where the drug / regimen will prove better than the standard of care, and this decision-making will be improved by learnings from precision medicine. Pharmaceutical companies can work towards success in both directions – either starting with an intractable disease type and interrogating the molecular alterations to design a drug / regimen or taking a drug / regimen and scanning across tumor types and subsets for the most likely “sensitive” group.

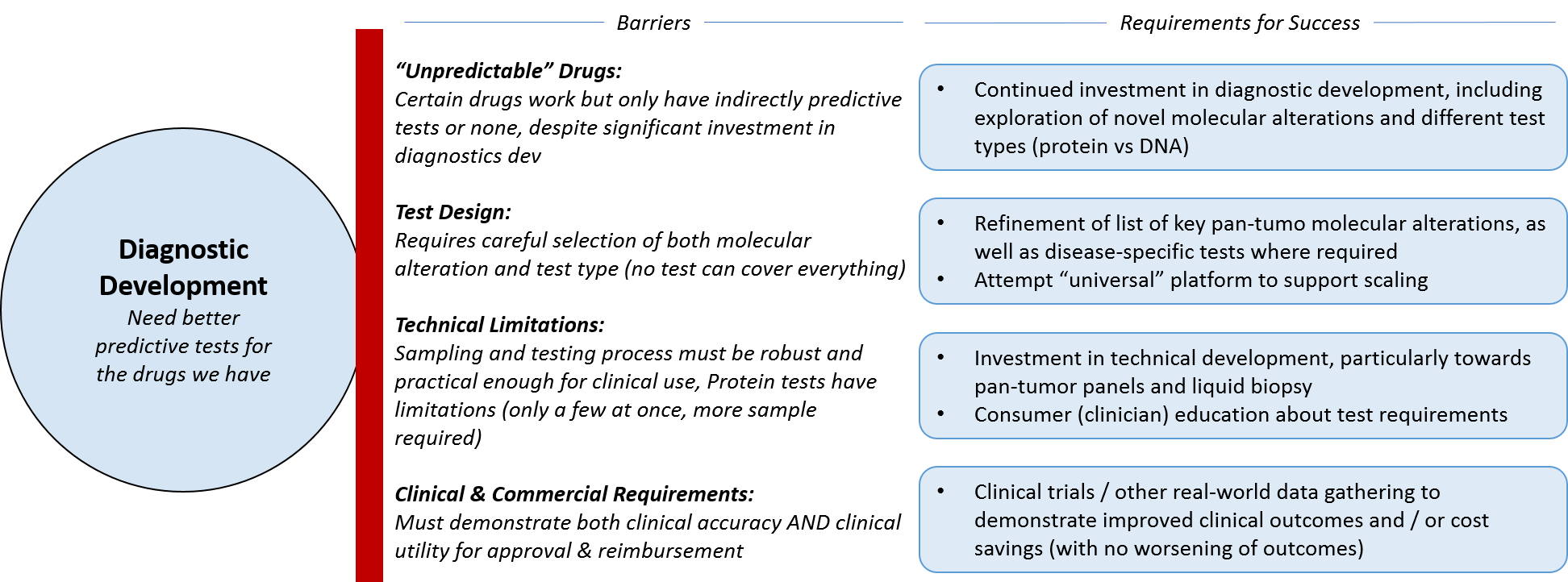

Key Requirements for Success: Diagnostics

Diagnostic companies face similar decisions around maximizing the utility of the platforms and tests they already have vs attempting to shift towards something more novel. In general, there is a movement away from companion diagnostics (single tests paired with single drugs) towards more universal platform-based testing, which will prove beneficial for whichever companies develop the “winning” options. It may be that the market remains somewhat fragmented for the long-term, particularly if no one develops a successful cross-technology platform or service, i.e., one that incorporates not just broad genomic testing, but mRNA and protein expression testing. At the moment, Caris Life Sciences is the only major player that offers all three types of testing – not on the same technical platform but as part of one service.

Another impactful trend is towards liquid biopsy for solid tumors; if Guardant, Foundation, and others are able to successfully develop and expand technologies across tumor types, it will open up enormous opportunities, not just for the diagnostic companies but for advancing pharmaceutical development and clinical practice based on learnings from these tests. In parallel, it will also be helpful to obtain frequency of alterations (what percentage of tumor cells contain patterns of alterations), vs just the presence or absence of alterations. As these tests are done over time, this tumor kinetics information will be hugely helpful in predicting response or progression and adapting the treatment accordingly.

As diagnostic companies shift towards a broader, more universal platform type model for their tests, they will have to work with regulatory agencies to forge a new path for coverage and reimbursement. In addition to the classic requirements of demonstrating clinical utility and value, diagnostic companies will also have to negotiate how to handle updates of both the technology and the test interpretations – what is the right frequency and is there a threshold of change that would trigger a new review by regulatory agencies? If diagnostic tests can include not just predictors of efficacy, but predictors of toxicity, this will likely help with reimbursement as well.

In parallel, diagnostic companies can continue to explore other business models. Such models might focus on leveraging the data they obtain regarding novel predictive molecular alterations to partner with pharma companies and other researchers.

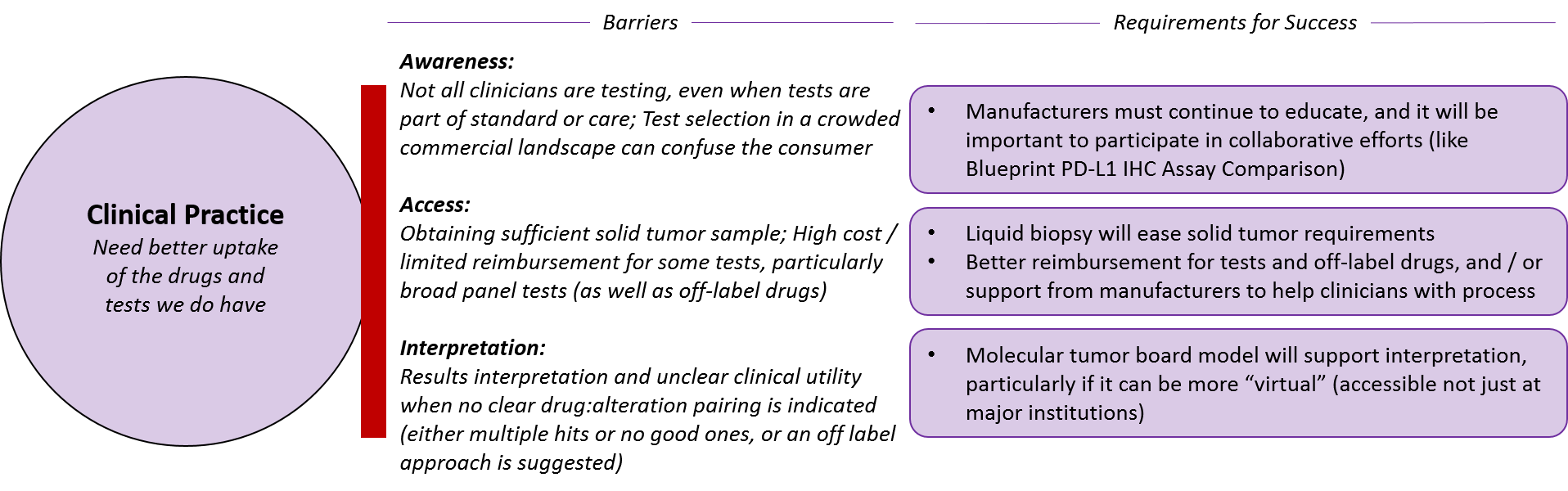

Key Requirements for Success: Clinical Integration

Finally, both pharmaceutical and diagnostic companies must ensure their drugs and tests are appropriately and successfully integrated into clinical practice. This requires not just awareness of the various products but also better access and interpretation.

Pharmaceutical and diagnostic companies will continue to need to drive awareness of their products. But, particularly in a fragmented marketplace, clinicians will increasingly look to more “impartial” parties, such as guidelines bodies or broad, impartial collaborations.

One recent example is the Blueprint PD-L1 IHC Assay Comparison project. There has been market confusion with the numerous PD-1/PD-L1 targeted drugs have reached the markets with various paired diagnostic PD-L1 tests, and the Blueprint project is providing a direct comparison between the diagnostics (by testing each one on the same samples to see which ones provide similar or different results). All the major diagnostic and pharma manufacturers are participating and the ultimate goal of the program is to provide not just interchangeability information, but head-to-head comparison of clinical outcomes as well,

In terms of access, it will obviously be easier if pharmaceutical and diagnostic companies can obtain traditional coverage for their products. But in situations where clinicians or patients must pursue reimbursement on an individual basis, manufacturers can provide appropriate guidance and logistical support for off-label reimbursement requests, which can be quite logistically burdensome for individual practitioners.

In addition to clear guidelines for use from manufacturers and guideline bodies such as the NCCN, tumor molecular boards may emerge as a key resource for interpretation. This model is not focused on tumor types as are traditional tumor boards, but rather includes various specialists who may be disease-focused (e.g., a lung oncologist) or pan-tumor specialists (e.g., a molecular biologist or radiologist). Ideally, these tumor boards would be available broadly (not just in major institutions) and the learnings would be captured and made available, potentially even as part of automatically-generated diagnostic test reports.

Snapshot of the Future

We are already seeing successful integration of precision medicine in clinical oncology in several settings. One notable example is Genomic Health’s Oncotype Dx tests. These use a set of mRNA expression tests to refine the likelihood of recurrence for breast and prostate cancer beyond what can be determined by histological analysis. The breast test can also be used to determine which tumors are likely chemo-resistant (and chemo can therefore be skipped as it’s unlikely to provide any benefit).

Certain experimental immunotherapies are also precision-medicine based, for example personalized cancer vaccines. These are not vaccines in the classical disease prevention sense, but rather involve determining which alterations in an individual’s tumor are most likely to trigger immune response, and the creation of a unique “vaccine” that exposes the immune system to those alterations in hopes of triggering an immune response to eradicate the tumor.

These vaccines are under clinical investigation and are also in relatively common use in for-profit clinics in Europe, where they are combined with other immunotherapy treatments like checkpoint inhibitors in hopes of boosting response. While these clinics have not traditionally done a great job of publishing their outcomes data, if these approaches demonstrate consistent efficacy, they should begin to publicize it more accordingly.

Finally, there is also the in vitro screening of compound libraries against tumor cell samples. This treatment is offered via clinical trials (ex: https://clinicaltrials.gov/ct2/show/NCT02654964) and also for-profit clinics. It is a complementary approach to genomic screening that bypasses the hunt for molecular alterations in favor of directly testing cultured tumor cells for sensitivity to a large library of approved drugs. When these results are combined with knowledge of molecular alterations in the same tumor cells, we might identify new predictive markers of response.

Furthermore, we expect precision medicine to expand not just in oncology but across medicine more broadly. Learning from oncology will inform best practices in how to apply precision medicine for other aspects of health and wellness, for example:

- Predicting response, resistance, and toxicity for all drugs (not just in oncology)

- Screening and monitoring for various conditions via liquid biopsy

- Refining knowledge about disease susceptibility based on germline variants, enabling preventative treatments

We have already made major advancements in leveraging knowledge about the human genome and its connection to health and disease. With successful expansion of precision medicine oncology through both pharmaceutical and diagnostic company advancements, we anticipate many more.