The American Society of Hematology recently held its 66th Annual Meeting & Exposition in San Diego, CA. From December 7-10, around 35,000 clinicians, researchers, life science-oriented business leaders, and others descended on San Diego to hear about the latest research in the field of hematology.

With more than 5,000 oral and poster presentations, the ASH event is a big meeting. Given the relatively small size of our Blue Matter contingent at ASH, it would be impossible to comment on everything that took place there. However, we did take a good look at the agenda and managed to focus our attention on some areas that we thought were the most interesting and important. In this article, we share our thoughts on the ASH “key takeaways” for 2024 in a brief, easy-to-read format.

Acute Myeloid Leukemia (AML): Many Many Menins

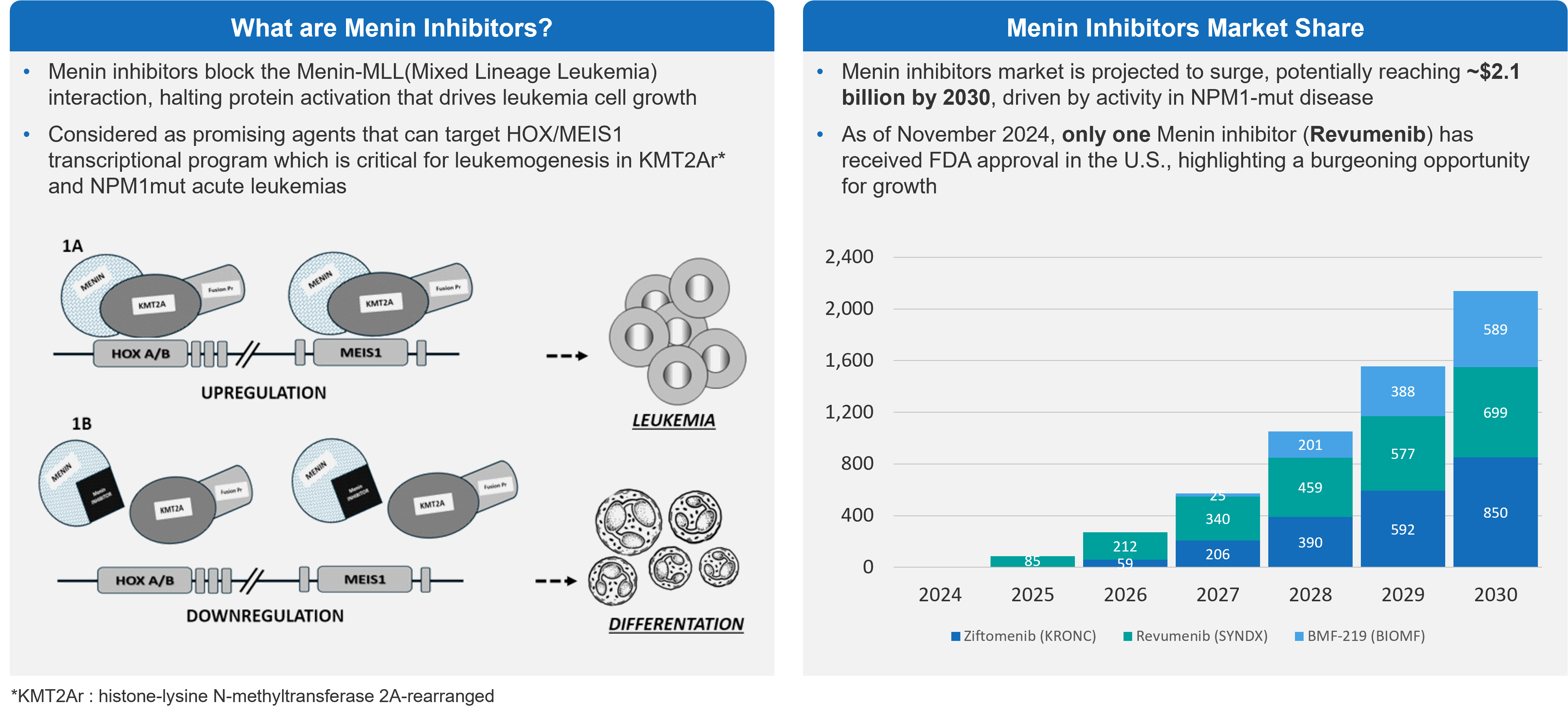

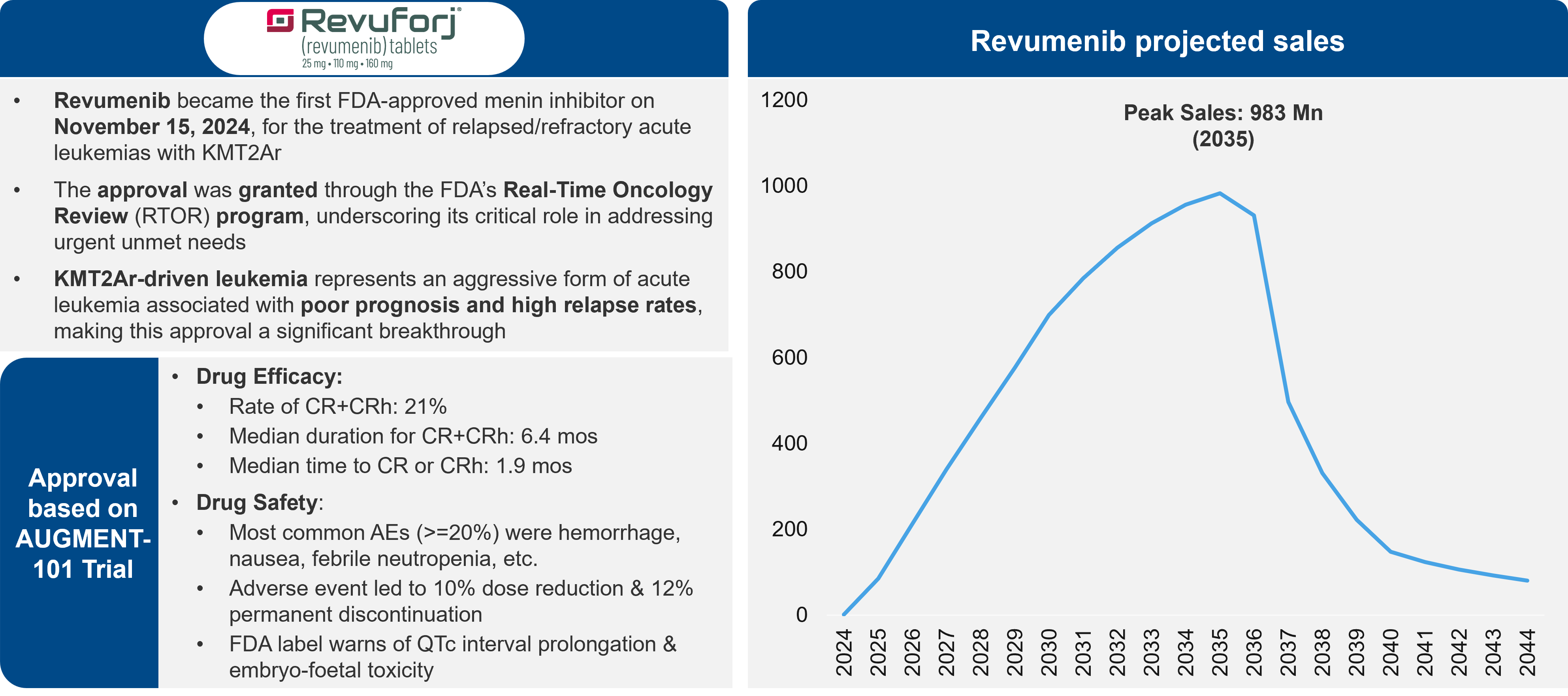

AML is a disease with a considerable unmet need and with limited success in the development of new therapies. However, physicians are excited for menin inhibitors, which leverage a new mechanism of action (MoA) that could provide considerable benefit to patients, particularly those with mutations in NPM1m and KMT2Ar genes. There is one menin inhibitor approved on the market, revumenib. Several others are in development. Questions persist, though, about the size of the commercial opportunity.

Figure 1: Menin Inhibitors Overview & Projected Market Share

Overall, there are about 20,000 AML patients diagnosed each year. NPM1m is present in 30% of those patients and KMT2Ar is present in 5-10%. So, there is some opportunity in around 8,000 patients per year.

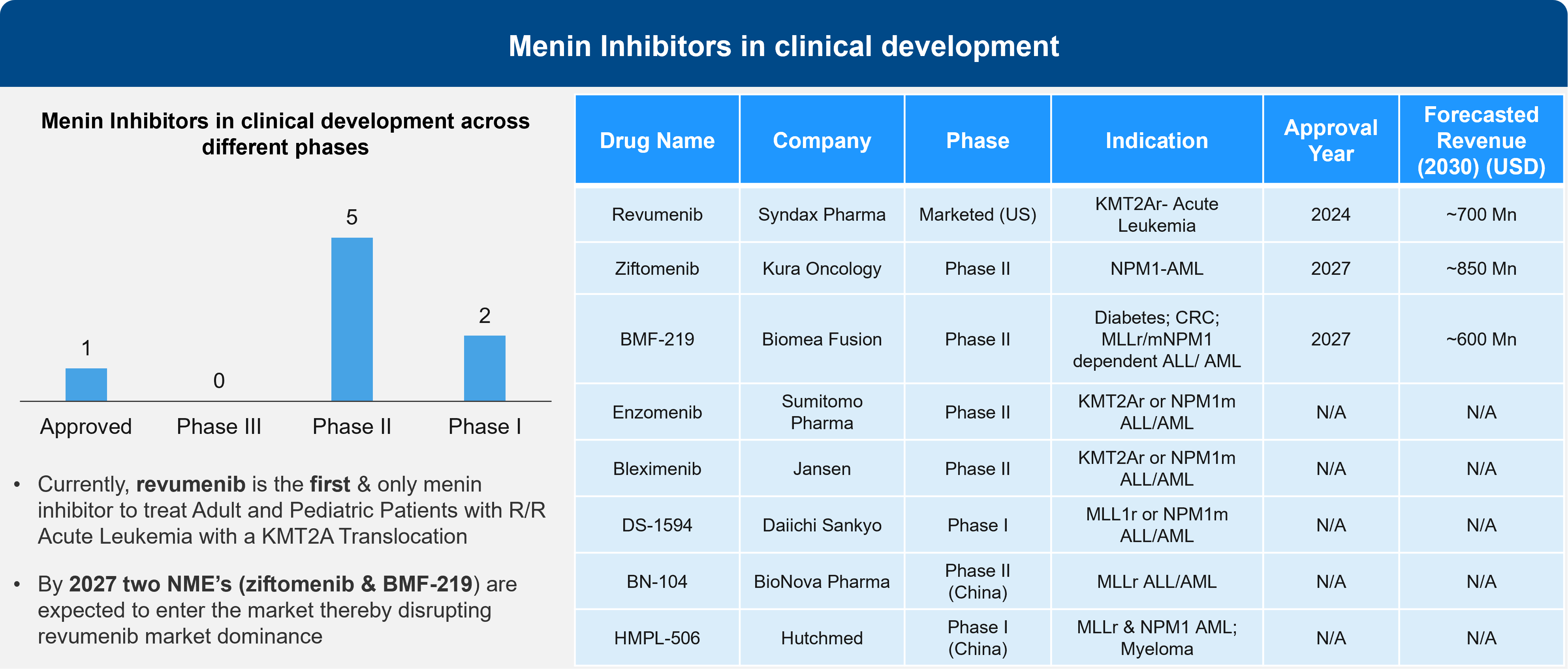

Sessions at ASH addressed 4 different menin inhibitors. While last year’s presentations focused on monotherapy in relapsed / refractory (R/R) patients, this year’s presentations demonstrated that menin inhibitors are likely to shape the treatment paradigm in combination with the SoC, such as venetoclax-decitabine, and the 7 + 3 regimen in newly diagnosed patients.

Figure 2: Menin Inhibitors in Clinical Development

Given that the population is relatively small, some are questioning the commercial opportunity beyond AML. Some point to a high sales potential is if these therapies follow the same path as Gleevec®, a multi-billion-dollar drug. However, a key reason Gleevec has delivered such a strong commercial performance is the long duration of treatment.

Figure 3: Drug Overview & Projections for Revuminib

It will be interesting to see how AML patient segmentation shapes up with the approval of menin inhibitors, given that there is some overlap between mutations underlying menin inhibition such as FLT3 and IDH mutations. Depending on the data, menin inhibition may become the SoC in patients that present with KMT2A and NPM1 mutations and FLT3 or IDH mutations.

Table 1: Topline Data on Menin Inhibitors from ASH 2024

| Menin Inhibitor | Revumenib | Bleximenib (90/100 mg BID) | Enzomenib | Ziftomenib | Bleximenib |

|---|---|---|---|---|---|

| Company | Syndax Pharma | Janssen | Sumitomo Pharma | Kura Oncology | Janssen |

| Regimen | Monotherapy | Monotherapy | Monotherapy | ||

| Patient Population | R/R KMT2Ar AML | R/R KMT2Ar or NPM1m AML | R/R KMT2Ar or NPM1m AML | ||

| ORR | 63.9% | 47.6%; N/A | 65.2% (KMT2Ar); 58.8% (NPM1m) | 91% | 95% |

| CR+CRh Rate or CR/CRh | 22.7% (61.1%*) | 33.3%; N/A | 30.4% (KMT2Ar); 47.1% (NPM1m) | N/A | 81% |

| CRc | 42.3% (58.3%*) | 38.1%; N/A | 47.8% (KMT2Ar); 47.1% (NPM1m) | 91% | 86% |

*Patients with negative MRD status

Developments in Gene Editing in Sickle Cell

Hematology offers fertile ground for innovation and a quick transition from bench to bedside. Consider that hematology saw the first bi-specifics, the first CAR-T, and the first CRISPR therapy. Now, we are moving to gene editing, particularly with regards to sickle cell disease (SCD).

Currently, SCD patients must undergo bone marrow ablation prior to the engraftment of genetically manipulated cells that introduce fetal hemoglobin (HbF) instead of the defective hemoglobin S (HbS). During the engraftment, patients are susceptible to severe infections that can be life-threatening.

At ASH, Beam therapeutics presented data for BEAM-101, an investigational therapy that uses gene edits to treat SCD. Beam’s product showed rapid engraftment, with 17 days to neutrophil engraftment and 19 days to platelet engraftment. This compares favorably to CASGEVY®, with 27 days for neutrophil engraftment and 35 days to platelet engraftment. While the reasons are unknown at this point, physicians hypothesize that BEAM-101’s faster engraftment might be due to the gentler gene-editing approach that avoids double strand break. Overall, the data appear to show that Beam’s therapy would reduce the chance of infection, as well as the likelihood of vaso-occlusive crisis (VOC), a painful complication of SCD.

Table 2: Topline Data Regarding BEAM-101 from ASH 2024

| Product | LYFGENIA® | CASGEVY® | BEAM-101 |

|---|---|---|---|

| Company | bluebird bio | Vertex Therapeutics | Beam Therapeutics |

| Median Follow-Up (mo.) | 42 | 26 | 11 |

| Neutrophil Engraftment (days) | 20 | 27 | 17 |

| Platelet Engraftment (days) | 37 | 35 | 19 |

| HbF levels (%) | 86% achieved HbF>30% | ~40% of total HbF | >60% |

| VOE – free (% of patients) | 88% | 94% | 100% |

The availability of more gene therapy based products for the treatment of SCD and beta-thalessemia highlights an emerging unmet need in this patient population. The treatments require a prior myelo-ablative / conditioning regimen to free up space for the genetically modified cells. However, myelo-ablative regimens come at a serious risk of adverse events that are of high concern for younger patients. Primarily, these include secondary malignancy and loss of fertility. Novel, gentler or reduced-intensity myelo-ablative regimens will be needed to address those unmet needs.

Minimal Residual Disease (MRD) as an Endpoint

Earlier this year the FDA decided to accept MRD-negativity as a surrogate endpoint for accelerated approvals. However, the FDA’s action has left more questions than answers. At ASH, a panel of FDA representatives discussed the topic, but there was little in the way of concrete answers.

The primary questions seem to focus on three key areas:

- When to measure? The FDA has provided no clear guidance on when to measure MRD and there’s no significant data demonstrating the correlation between MRD over time and treatment outcomes.

- How to measure? The FDA has no position on the preferred method for measuring MRD. Physicians have raised concerns regarding the accuracy and reproducibility of the various tests for MRD negativity.

- How should MRD guide treatment decisions? MRD measurements may guide either treatment intensification or even cessation. Physicians are very interested in the latter, as they would like to be able to offer patients a treatment-free interval. However, the FDA currently does not recommend treatment cessation. Clearly, more information is needed to guide physicians on how MRD readouts should impact treatment decisions.

The above issues aside, many physicians also have concerns about the availability of MRD testing to all patients, highlighting potential health-equity issues across the world. In the absence of clear FDA guidance, the biopharma industry will need to take a proactive lead role in addressing these questions and generating the data required to use MRD as an effective endpoint.

CAR-Ts: The Next Frontier in Non-Hodgkin Lymphoma (NHL)

Faster Manufacturing and Shifting Unmet Needs?

Interesting data was presented on YTB323, a CD19 CAR-T therapy using the T-Charge platform that seems to promise a faster manufacturing and turnaround time than other CD19 CAR-Ts. While much attention was focused on the therapy’s two-day manufacturing time, the QC processes still require about 10 days to complete. Overall, this can result in a total turnaround time of up to two weeks, which might be faster than other CD19 CAR-Ts, but not radically faster.

YTB323’s efficacy was comparable to other CD19 CAR-Ts, with a complete response (CR) rate of 55%. Out of 51 patients there were 10 deaths, mostly due to disease progression. Four deaths were due to infection or tumor lysis syndrome (TLS).

Healthcare providers were interested to know whether any of the patients in the study had been previously treated with CAR-T therapies. The answer was no, as patients who had previously been given CD19-targeting treatments were excluded from this study. However, the physicians’ comments on this topic indicate that the unmet need has shifted. There are now multiple CD-19 treatments on the market, and physicians are more interested in the benefit that novel CAR-Ts developed in non-Hodgkin lymphomas can provide to patients who have progressed on other, standard of care (SoC) CD19-CAR-Ts.

Next-Generation CAR-Ts

Data was also presented on next-generation CAR-Ts that leverage dual targeting:

- A CD20xCD19 targeting CAR-T (zamtocabtagene autoleucel) from Miltenyi Biomedicine

- A CD22 targeting therapy

Both appear to deliver compelling outcomes in heavily pre-treated patients, including patients who were previously exposed to CD19-targeting CAR-Ts.

However, Long term b-cell depletion remains an issue with patients who require intravenous immunoglobulin (IVIg). Interestingly, most patients who relapsed did not demonstrate antigen loss, suggesting that subsequent CD19 or CD20 targeting therapies might be applicable.

This is not a new concept, as Rituxan® (a CD20 mAb) was repeatedly used during the pre-CAR-T era as part of the R-CHOP and R-ICE combinations across lines of treatment, especially in patients that showed benefit from prior lines of treatment. The fact that CAR-Ts can provide a treatment-free interval can further support this finding and impact potential future treatment options, as patients do not progress while on treatment. The same thought can be carried over to BCMA-targeting agents, when considering sequencing. Assuming that a patient benefited from a long-term treatment free-interval post-CAR-T, it could justify rechallenging with a BCMA-targeting agent in a similar fashion to Rituxan in diffuse large B-cell lymphoma (DLBCL).

Stay Tuned…

The innovations in hematology and oncology are sure to continue as we move into 2025. Check our blog frequently or follow us on LinkedIn to stay abreast of things. For example, we will be writing a 2025 market outlook in oncology shortly. In addition, we’ll be providing summaries from ASCO, ESMO, ASH, and other meetings throughout 2025.

References:

Figure 1 – Image: https://pmc.ncbi.nlm.nih.gov/articles/PMC11036224/; For Chart: Evaluate Pharma as accessed on 9 Dec 2024)

Figure 2 – For chart & content in table: Evaluate Pharma as accessed on 9 Dec 2024; For individual assets: https://ir.syndax.com/news-releases/news-release-details/syndax-announces-fda-approval-revuforjr-revumenib-first-and-only; https://ir.kuraoncology.com/static-files/32a2abb6-8731-454a-b1be-6e1cfb86abf8; https://biomeafusion.com/oncology/; https://ash.confex.com/ash/2024/webprogram/Paper194827.html; https://ashpublications.org/blood/article/144/11/1206/516663/Preclinical-efficacy-of-the-potent-selective-menin; https://pubmed.ncbi.nlm.nih.gov/36841758/; https://www.bionovapharma.com/pipeline/pipeline.html; https://www.hutch-med.com/wp-content/uploads/2024/04/pre240408_AACR24_506.pdf)

Figure 3 – For Revumenib overview- https://ir.syndax.com/news-releases/news-release-details/syndax-announces-fda-approval-revuforjr-revumenib-first-and-only, For chart: Evaluate Pharma as accessed on 9 Dec 2024)