This is the third post in a series from Blue Matter analyzing the potential impact of Most Favored Nation (MFN) pricing being enacted in the U.S. If you are new to studying MFN, then please read Guidance for Evaluating MFN: Part 1 – Key Questions for Biopharma Manufacturers and Guidance for Evaluating MFN: Part 2 – Impact on Pharma Channel Partner and Customer Business.

As a part of our first article, we highlighted some of the key questions that biopharma companies should be thinking about regarding MFN as they contemplate a deal. This article takes a deeper look into some critical factors to consider for deals.

While there is significant uncertainty about the ultimate impact of MFN on the biopharmaceutical industry, there remains a strong need for external innovation in the industry, and MFN is not likely to diminish that:

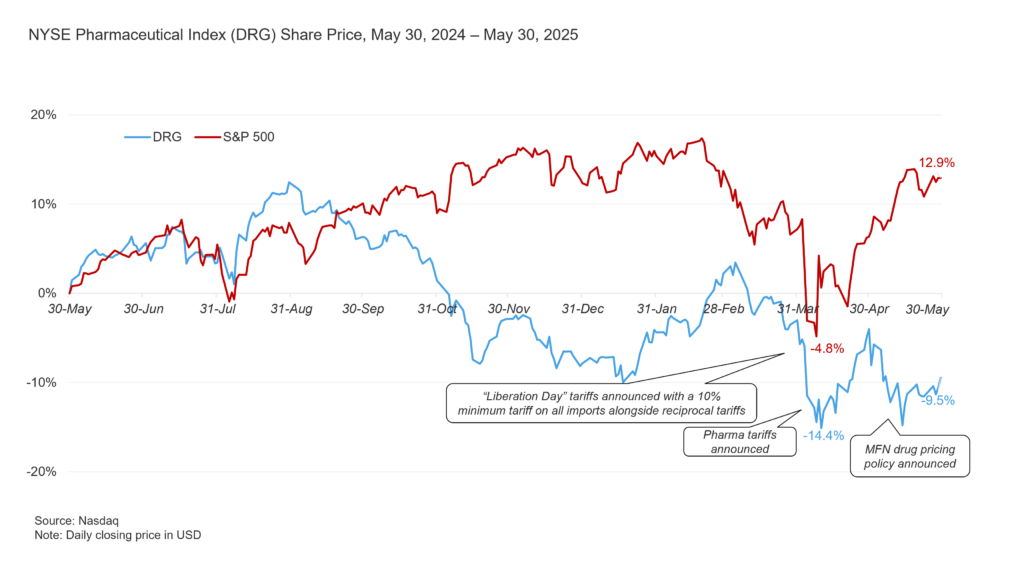

- Industry performance has been lackluster – DRG is down ~10% in the past year (see Figure 1 below). Recent events, such as the tariff and MFN announcements in April and May, contributed to further loss of value for the broader pharmaceutical and biotech market.

- Large and mid-sized pharmaceutical companies need to fill their pipelines. Internal R&D is not sufficient to mitigate the impending revenue loss due to patent cliffs, maintain competitive advantage, and drive growth.

- Although capital markets are currently not as friendly for raising funds and interest rates remain high, large pharmaceutical companies have expressed an appetite for deals in 2025 and have the capacity for deal-making:

- Pfizer: “$10-$15 billion in business development capacity” – CFO David Denton (Apr 2025)

- Lilly: “Open to external research partnerships … to accelerate innovation” – CEO David Ricks (May 2025)

- Novartis: “Actively seeking acquisitions” – CEO Vas Narasimhan (May 2025)

- J&J: “Constantly looking” at biotech M&A – CEO Joaquin Duato (Jan 2025)

- And more …

- As a result, we expect pharmaceutical companies to continue pursuing deals to overcome top-line revenue challenges and drive sustainable long-term growth.

Figure 1: NYSE Pharmaceutical Index (DRG) Performance Since May 2024 (May 30, 2024 – May 30, 2025)

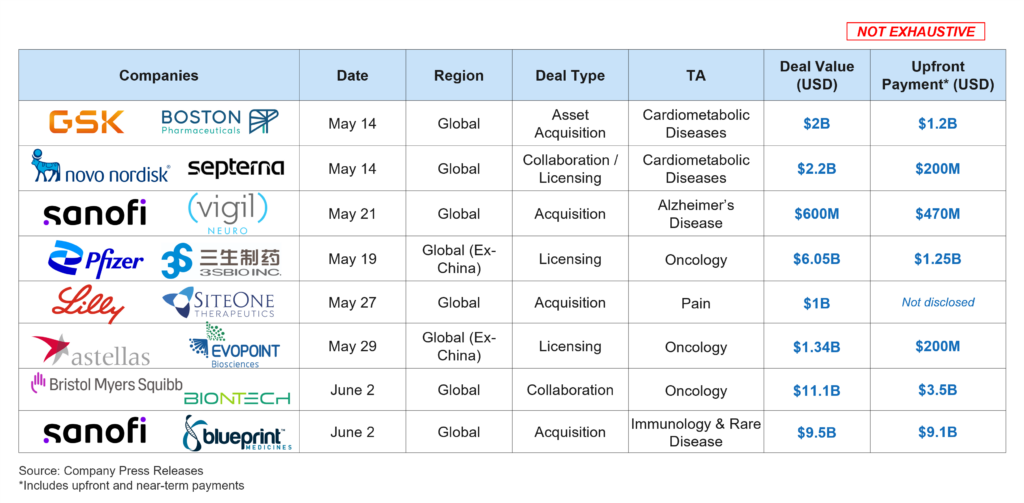

Since MFN was announced on May 12, 2025, we have seen numerous deals announced, including some large strategic deals from large global pharmaceutical companies (see Figure 2 below). These deals were driven by the need for innovative assets that offer the promise of attractive sales and are aligned with the acquirer’s strategy. This indicates that although there is a lot of uncertainty with MFN and other policy changes, companies are making investments in assets that have strategic and commercial value.

Figure 2: Select Biopharma Deals Announced Since May 12, 2025 (that include the US; May 12, 2025 – June 3, 2025)

In this uncertain environment, some biopharmaceutical decision-makers may already be incorporating MFN and other policy changes into their day-to-day decisions, while others may not expect these disruptions to pan out. Regardless, buyers and sellers may need to start critically thinking about the impact of these potential changes on the value proposition of assets or companies, as well as the implications for asset valuations, deal strategy, and structuring.

Below, we outline some key questions in each of those areas. We also offer some guidance for addressing those questions.

Asset Valuations

- How do you properly understand and model MFN related risk to understand the commercial opportunity and value of an asset or company?

- While companies typically may focus on understanding the US market opportunity and value and perform a more cursory look at ex-US markets and values, it is now critical (at least for late-stage or commercial assets) to understand the ex-US commercialization strategy and pricing (especially in the major OECD countries with a GDP per capita of at least 60% of the U.S. GDP per capita) and how that could impact the US commercial opportunity and the overall value of the target asset.

- Gain a better understanding of the payer mix and risk associated with heavier Medicare and Medicaid exposure.

- Consider building pricing sensitivity/scenario analysis to understand what the breakeven pricing point is where the deal NPV/IRR is no longer attractive.

- Identify the other key value drivers (e.g., time to peak, market share, etc.) and better understand how these drivers impact asset valuations and what leeway these can provide to mitigate MFN related risks.

- Consider different geographical scenarios to drive decision making: US only valuation vs. US and ex-US valuation to understand if launching in ex-US markets would diminish value or even with adjusted US pricing based on potential MFN impact, the overall value across markets would be attractive.

Deal Strategy

- Should you look to license/acquire global rights only as compared to US-only rights? Do you focus on US-only targets vs. targets with a global presence?

- Global rights put the acquirer in control of ex-US commercialization strategy: where to launch, in what sequence, and at what price, and provides the opportunity to better manage MFN-related risk.

- If a buyer only gets US rights, they may run the risk that the owner of the asset can drive ex-US launch strategy, sequence, and pricing that could materially impact US pricing under MFN and hence the value proposition of the asset in the US market.

- If a buyer acquires a company with only a US market focus, then MFN risk can be better managed, though the buyer may still face the risk of a competitor launching a product in both the US and ex-US markets.

- Should you look at broader collaboration agreements that can provide more visibility and influence on the partner’s ex-US strategy for the asset?

- Does potential MFN risk impact how one considers deals for early-stage assets vs. late-stage assets, considering some early-stage assets could be 5-to-8 years from launch and may not be as impacted by MFN as late-stage assets?

Deal Structuring

- How can a buyer mitigate MFN-related risk through deal structuring? Do you structure deals with larger back-ended milestones and/or with higher sales milestone thresholds to protect from future pricing risk?

- To secure global rights as compared to US only rights, would you have to offer a higher upfront payment? In such a situation, do you then push for higher sales milestone thresholds or lower royalty rates?

- The flexibility to structure deals will be impacted by the form of deal (i.e., asset license/acquisition vs. company acquisition and private vs. public company with asset-specific and private company deals providing greater deal structuring flexibility).

While we have provided a few critical considerations related to MFN and other policy changes that could impact how companies should plan and evaluate deals, there are various ways in which companies can model MFN risk while evaluating a deal. One must strike a balance between critical analysis and complexity and be more nimble to react to changing policies and dynamics to optimally assess targets and execute value-enhancing deals.

What’s Next

When President Trump’s executive order on MFN was issued almost a month ago, it directed the Secretary of Health and Human Services (HHS) to communicate MFN “targets” to pharmaceutical manufacturers within 30 days, by June 11. Though we do not yet know what will be disclosed publicly on June 11—if anything at all—we will continue to closely monitor the MFN and broader policy landscape. Please follow us on LinkedIn to learn about our future publications or contact us via our website to schedule a call.