Uncertainty continues to permeate the biopharma deal-making environment, driven by shifting , strained capital markets, and broader macroeconomic pressures. Just a few months ago, we published an article highlighting key questions for assessing how some of these policy changes might shape deal activity. Yet, despite the headwinds, the pace of deal-making has not necessarily slowed. In this piece, we look back at the first half of 2025 to examine how the current environment compares with prior periods.

Global Deal Environment

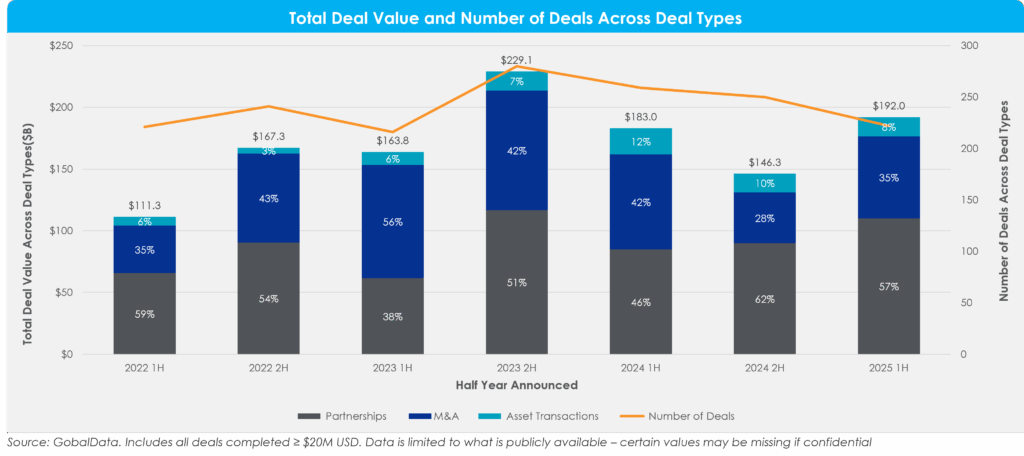

Figure 1: Total Deal Value[1] and Number of Deals Across Deal Type[2]

Total deal value reached ~$192 billion in 2025 1H, rebounding from ~$146 billion in 2024 2H. While deal value has recovered since last year, the volume of deal activity remains muted, with only 222 transactions. That continues the steady decline in the number of transactions since peaking in 2023 2H. Overall, deal value is essentially flat compared with 2024 1H (+5%), underscoring a market that is stabilizing but far from its previous highs.

Among deal types, mergers and acquisitions (M&A) accounted for around a third of deal value in 2025 1H and represented the greatest increase in value from 2024 2H. M&A deal value increased by ~60% from that period, driven by several high-value deals (>$5 billion). Partnerships accounted for ~60% of total deal value, adding up to about $110 billion. This was a ~20% increase from 2024 2H, aligning with a rise in risk-sharing deal structures in a more uncertain environment.

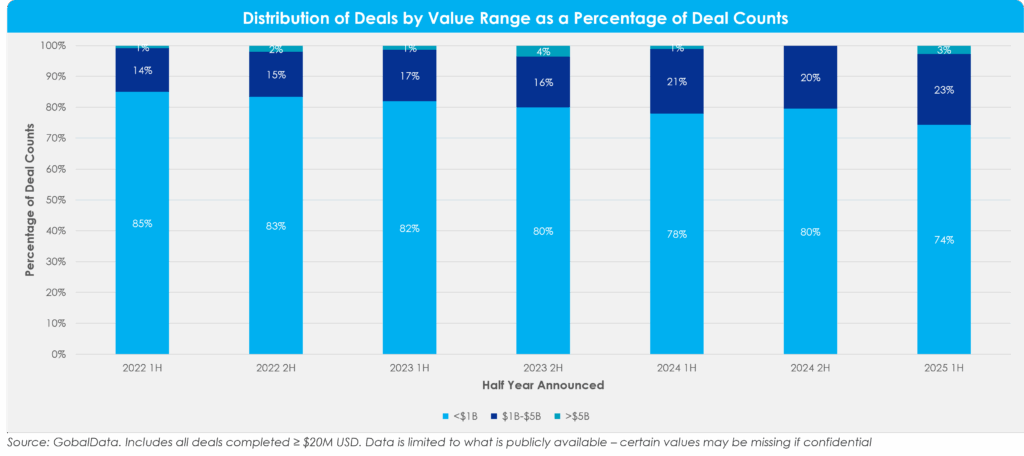

Figure 2: Distribution of Deals by Value Range as a Percent of Total Deals

Looking at deals by size, the share of mid-range deals ($1 billion – $5 billion) has been steadily rising for several years, reaching its highest proportion in 2025 1H. This trend points towards greater medium-sized, bolt-on deals rather than larger-scale deals.

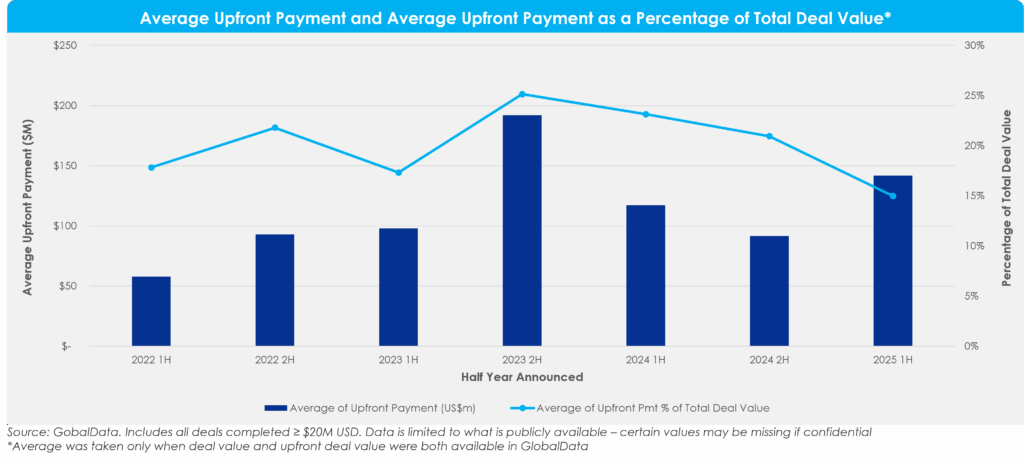

Figure 3: Average Upfront Payment and Average Upfront Payment as a Percentage of Total Deal Value

When considering deal structures, the trend towards de-risked transactions is underscored by a steady decline in average upfront payments as a percentage of total deal value. Although average upfront deal value increased this half from 2024, upfront payments as a percentage of total deal value now represent just ~15% of total deal value. This indicates buyers’ interest in mitigating risk through lower upfront payments and larger contingent payments.

Insights From High-Value Deals

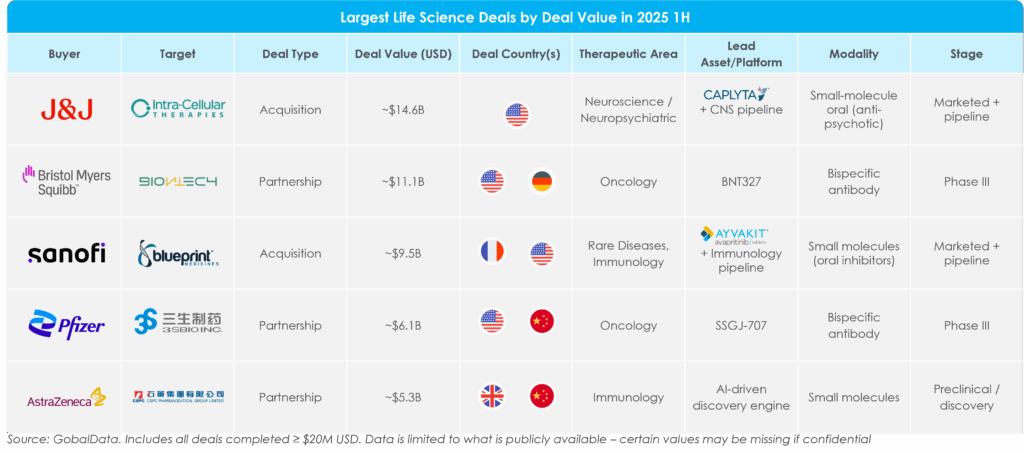

Figure 4: Largest Pharma Deals by Deal Value in 2025 1H[3]

Most high-value deals in 2025 1H involved lead assets that were either already marketed or in a late stage of development, targets in oncology, immunology or CNS, and deals with China-based companies. Consider these illustrative examples:

- In the largest deal of the half, Johnson & Johnson acquired Intra-Cellular Therapies for ~$14.6 billion to expand its presence in neuropsychiatric and neurodegenerative disorders. The deal complements J&J’s existing neuroscience portfolio, which was already anchored in schizophrenia and major depressive disorder (MDD) with Caplyta, approved in the U.S. for schizophrenia and depressive episodes associated with bipolar disorder. Caplyta generated ~$680 million in revenue in 2024[4], with analysts projecting more than $1 billion sales in 2025 and no generic competition until 2040.[5] Intra-Cellular’s broader pipeline of psychiatric assets further reinforces J&J’s push in neuroscience.

- Both BMS and Pfizer made investments in bispecific antibodies targeting PD-L1 and VEGF. These bispecific antibodies are gaining significant attention because they combine two powerful, complementary mechanisms: PD-L1 inhibition, which restores T cell activity against tumors, and VEGF-A neutralization, which alleviates immunosuppressive barriers in the tumor microenvironment. According to BMS[6], this bifunctional approach could enhance precision and reduce systemic side effects while improving delivery and synergizing with other treatments. BMS and BioNTech entered an ~$11.1 billion agreement to co-develop BNT327 in global phase III trials, with registration potential as a first-line treatment for extensive stage small-cell lung cancer (ES-SCLC). Pfizer and S3Bio entered an exclusive ~$6.1 billion global, ex-China licensing agreement to develop SSGJ-707 in phase III clinical trials in China for non-small cell lung cancer, metastatic colorectal cancer, and gynecological tumors.

- Sanofi acquired Blueprint Medicines for ~$9.5 billion, adding Blueprint’s rare advanced (Ayvakit/Ayvakyt, elenestinib) and early-stage immunology pipeline to its portfolio. Sanofi has been steadily growing its immunology pipeline, and Blueprint’s rare immunology assets serve as a strategic fit. In addition, Blueprint’s lead asset, Ayvakit/Ayvakyt, is projected to achieve ~$2 billion in global net revenue by 2030 in a rare-disease space with minimal competition. Ayvakit is a tyrosine kinase inhibitor (TKI) that targets mutated forms of KIT genes and is the only FDA- and EU-approved therapy for both advanced and indolent forms of systemic mastocytosis.

- AstraZeneca entered a licensing agreement with CSPC Therapeutics for $5.3 billion for its AI-driven discovery platform to develop immuno-oncology targets. According to AstraZeneca[7], this platform uses artificial intelligence to analyze the binding patterns of target proteins with existing compound molecules and conduct targeted optimization, with the aim of selecting highly effective small molecules with strong developability.

Regional Trends

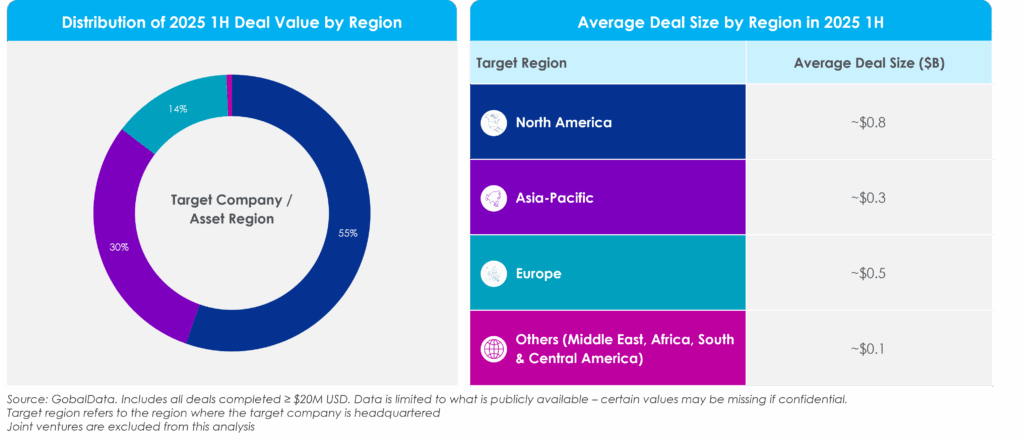

Figure 5: Regional Comparison of Total Deal Value and Average Deal Size

While overall deal value is being fueled by high-value North American deals, the greatest volume growth is coming from the Asia-Pacific (APAC) region, particularly China. This reflects a dual-track dynamic: pharma is willing to pay premiums for North American assets while simultaneously increasing deal activity in APAC, potentially attracted by innovative assets and lower overall deal values.

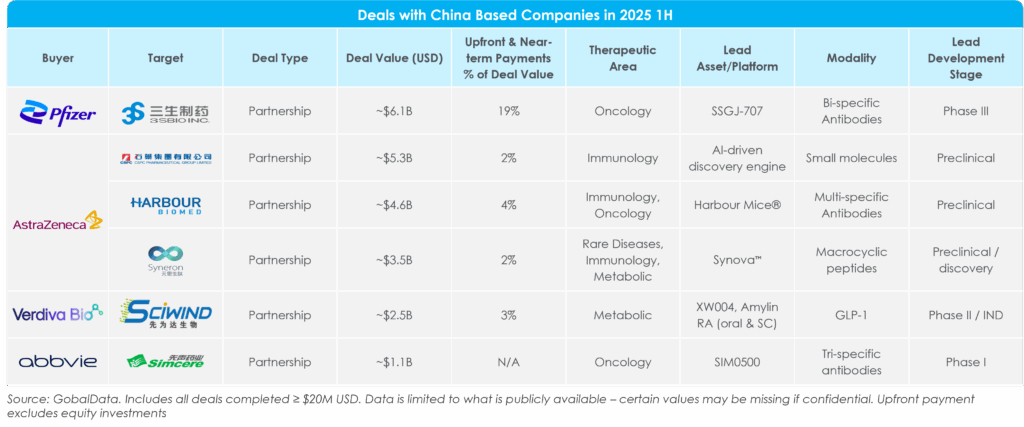

A key driver of deal value in 2025 1H was the surge of U.S. and E.U. companies entering deals with China-based companies for asset rights to global markets, highlighting China’s shift from a cost-efficient R&D hub to a source of globally competitive innovation. This trend is illustrated in Figure 6, which highlights a sample of high-value China-originated deals, many of which center on antibody platforms and other cutting-edge modalities. Deals with assets from China were highly concentrated in high-value therapeutic areas, including oncology and immunology. Most transactions have modest upfront and near-term payments as a percentage of total deal value while leaving larger upsides in milestones, signaling pharma’s preference for more de-risked structures.

Figure 6: Deals With China-Based Companies

The following examples illustrate the broader trend:

- AstraZeneca has been the most active big pharma company entering deals in China, layering discovery-stage collaborations across AI, antibodies, and novel modalities. Highlights of the company’s deals in China include a multi-billion-dollar, AI-driven discovery partnership with CSPC; a multi-specific antibody deal with Harbour BioMed, and a macrocyclic peptide program with Syneron Bio. The company also invested in a $2.5 billion R&D center in Beijing[8]. This deal pattern demonstrates how large pharma increasingly views China as an innovation hub worth engaging with early.

- AI is emerging as a core driver of deal-making in China, both for local innovation and for multinational companies seeking a technological edge. Days after the AstraZeneca and CSPC partnership, Pfizer expanded its collaboration with XtalPi to co-develop a quantum physics AI-powered discovery platform.[9] In fact, AI drug discovery was namedas a formal priority in China’s Five-Year Plan for 2025, leading local governments in pharmaceutical hubs such as Shanghai to increase funding for biotech ventures.[10] Big pharma is tapping China’s AI ecosystem as a differentiated source of R&D productivity and raising the bar for competitive deal sourcing.

- Two other compelling 2025 1H deals, Sciwind Biosciences’ ~$2.5 billion milestone-deal with Verdiva Bio and AbbVie’s ~$1.1 billion option-licensing pact with Simcere Zaimin, underscore how pharma is leaning into early-stage bets in breakthrough modalities. While Sciwind collected ~$70 million up front from Verdiva for a metabolic disease pipeline (including a once-weekly oral GLP-1 and amylin receptor agonist), AbbVie secured rights to a phase 1 trispecific T-cell engager in multiple myeloma, with large downstream payments tied to success. The deals highlight pharma companies’ willingness to pay overall attractive valuations for innovative assets/platforms, but via de-risked deal structures with small upfronts and milestone-rich upsides.

Conclusion

Against the backdrop of challenging capital markets, a high-interest-rate environment, policy changes such as tariffs and MFN, and changes at the FDA, total deal volume continued to decline in 2025 1H. However, total deal value increased from 2024 2H and was in line with deal activity in 2024 1H. This was driven by a combination of higher-value deals for late-stage or commercial assets, deals for innovative assets, and deals involving China-based companies and assets.

While some of the macro-level and industry headwinds mentioned above will continue in 2025 2H and questions remain about how the policy changes will affect the industry, we expect deal activity to remain consistent with 2025 1H. This would include continued interest in innovative assets; in high-value therapeutic areas such as oncology, immunology, and CNS; and ongoing activity with Asia-Pacific based companies.

References:

[1] Total deal value refers to upfront payments plus milestone payments.

[2] Deals include the following: M&A (e.g., acquisitions, mergers, asset transactions) and partnerships (e.g., licensing agreements, co-developments/co-promotes)

[3] Deal stage refers to the current highest development stage of the drug at the time of the deal, and/or the drug stage for which companies have entered into the agreement.

[4] BioSpace. Intra-Cellular Therapies Reports Fourth Quarter and Full-Year 2024 Financial Results. February 24, 2025.

[5] Reuters. J&J doubles down on neurological drugs with $14.6 billion Intra-Cellular deal. January 13, 2025

[6] Bristol Myers Squibb. BioNTech and Bristol Myers Squibb Announce Global Strategic Partnership to Co-Develop and Co-Commercialize Next-generation Bispecific Antibody Candidate BNT327 Broadly for Multiple Solid Tumor Types. June 2, 2025

[7] AstraZeneca. AstraZeneca enters strategic collaboration with CSPC Pharmaceuticals focused on AI-enabled research. June 13, 2025.

[8] AstraZeneca. AstraZeneca to invest $2.5 billion in new global strategic R&D centre, biotech agreements, and manufacturing in Beijing. March 21, 2025.

[9] Fierce Biotech. Pfizer expands AI-powered small-molecule discovery collab with XtalPi. June 30, 2025.

[10] China Government Network. Interpretation of the “Implementation Plan for Digital Transformation of the Pharmaceutical Industry (2025-2030)”. April 24, 2025.