Part Four in a Series on Oncology Product Commercialization

As we’ve written before, oncology launches are occurring more frequently, largely due to a rapidly evolving understanding of disease biology and massive investments in oncology research and development. As a result, many indications are becoming more complex and competitive, with a greater number of approved molecules across a broad range of mechanistic approaches. The results of these investments are still largely working their way through the clinic, so we expect this trend to strengthen in the coming years.

Therefore, it is increasingly challenging to demonstrate clear clinical differentiation in oncology: data for agents within the same mechanistic class – or from different classes – may look similar and/or be difficult to compare (e.g., through use of different endpoints; by having data at different stages of maturity). In addition, more frequent launches mean that commercial teams typically have less time to entrench use of their products and establish their brands prior to the launch of competitors.

Differentiation through clinical data is often not enough: Companies must differentiate in how they engage with their all of their stakeholders. They can do this by working to maximize the positive experience stakeholders have with the product

In Part Three of this series, we explored the complex array of stakeholders that biopharma companies must engage with to succeed in the oncology market. These stakeholders range from oncologists to nurses to payers to patients and more, each with its own set of needs and challenges.

Oncologists remain the most important stakeholder group with regards to treatment decision-making. However, other stakeholders are increasingly:

- Affecting the range of available treatment options (e.g., pathways, group purchasing organizations [GPOs], and payers)

- Influential in shaping the perceived value of various therapies (e.g., advocacy groups, government affairs)

- Contributing to treatment decision-making (e.g., patients, caregivers)

In this article, we address how to evaluate the level of influence different stakeholders will have on a therapy’s commercial success and how to effectively engage with prioritized stakeholders. In particular, we’ll offer a framework that a company can use to establish a competitive advantage.

This positive experience should be considered broadly, from end-to-end: From understanding the disease to treatment selection, all the way through administration, reimbursement, and monitoring and follow-up.

Five Requirements for Creating a Positive Stakeholder Experience

Creating this end-to-end positive experience can provide meaningful differentiation, but it requires five things:

- The ability to think holistically across the end-to-end use of the product – The company must identify the stakeholders (and their respective roles) that are involved in selecting, using, and administering the product.

- A deep understanding of the needs and challenges of each stakeholder – This understanding must be temporal in nature, as it must account for how needs, challenges, and expectations for different groups will change over time, pre- and post-launch.

- Strategic and tactical approaches for addressing those needs and challenges – For any given therapy, the company must decide which stakeholders to prioritize, what beliefs and behaviors they want to establish in those stakeholders, and how they will achieve that end.

- The operational excellence to put strategies into action – This includes cross-functional coordination in planning and implementation. Many teams (e.g., commercial and medical) will—to an extent—share some stakeholders (e.g., key opinion leaders [KOLs]). While teams should be careful to ensure compliance firewalls between these two teams (and these frequently vary on a company-by-company basis), they also need to ensure that the information stakeholders receive is aligned to the extent possible.

- The technological capabilities to optimally leverage emerging solutions – This includes using tools such as innovative digital non-personal promotional channels to engage stakeholders, synchronizing digital engagement with follow-up emails and rep visits, and the use of data analytics companies to generate relevant data beyond the clinical data package.

A Framework for Differentiating on the Basis of Stakeholder Experience

Identifying the End-to-End Steps in Using the Product

To begin the process of differentiating on the basis of stakeholder experience, a product team must identify the end-to-end steps that are involved in using the product. The typical steps are listed below and, while it’s important to note that these steps can vary somewhat from product to product, this list is representative:

- Disease Understanding

- Diagnosis

- Treatment Selection

- Treatment Administration

- Access and Reimbursement

- Patient Monitoring and Follow-Up

In addition, it should be emphasized that for some of these steps the set of stakeholders involved will be product-specific. Consider some examples below.

Diagnosis for some tumor types (for the purposes of informing treatment selection) can be relatively simple and made on the basis of imaging (e.g., glioblastoma), whereas for others there is a need for biopsying and more clearly characterizing the molecular profile of the tumor (e.g., NSCLC, not only for histology but also for genetic mutations). This might require breaking diagnosis into several steps, each with potentially different stakeholders. Even when limited to staining and microscopy, this still introduces pathologists as an additional stakeholder to consider. However, tumor genetics are increasingly being assessed via next-generation sequencing (NGS), which frequently involves samples being shipped off-site to central labs operated by specialist companies such as Foundation Medicine and Guardant Health, and introduces an additional process step. In these situations, factors such as turnaround time and the quality / clarity / breadth of information provided to the oncologist can become important determinants of treatment selection decisions.

The list of stakeholders influencing treatment selection can shift across tumor types and across products. Clinical decision support pathways, for instance, are active in some tumors and not others. In addition, some therapeutics have more problematic adverse event profiles, increasing the level of focus placed on nurses.

Developing a Strategy to Maximize Stakeholders’ Experience at Each Step

Within each buying process step, the objective is to identify how to make the experience as positive as possible for all stakeholders who take part, within the context of the company’s capabilities and launch resources. To do this, the product team must:

- Identify the stakeholders that are most impacted by—or that most heavily influential in—the process step.

- Understand each stakeholder’s key challenges and needs related to that step.

- Determine which tactics or programs would best address those needs.

In most cases, product teams must make prioritization and trade-off decisions across buying process steps. Not all unmet needs and/or challenges are equally important, and these may vary for each launch. In addition, not all tactics are equally effective. Teams frequently don’t have the resources to optimally address the needs of all stakeholders across each process step, and so a careful consideration of the resource requirements (both financial and team bandwidth) and likely benefits should be made before making decisions.

Using the Framework: Some High-Level Examples

The process of identifying all buying process steps and the stakeholders in each, as well as their key needs and tactics for meeting those needs, can be complex. It’s beyond the scope of this article to provide a comprehensive example. However, we can explore some high-level examples across specific process steps.

Example Buying Process Step: Disease Understanding

The overarching goal is to ensure access to the information needed to understand and recognize the disease, facilitate a diagnosis, and initiate the disease management process. Key stakeholder groups may include the following, each with somewhat different needs:

- Medical oncologists or hematology oncologists must have the latest information on the disease and available treatment options. They must also have the tools and information available to properly educate their patients and address their questions. This is particularly important for tumors with relatively low-incidence, where they may only see a handful of patients per year and the disease will rarely be top-of-mind.

- Patients need access to trustworthy educational materials about the disease and treatment options in order to advocate for their best interests. For some diseases (HER2+ breast cancer in particular), patient advocacy is very strong and there is a wealth of useful information available to help inform patients. However, for others (e.g., bladder cancer), things are much less developed: quality is often variable, and the degree to which the information is conflicting leads to an overwhelming experience.

- Caregivers may need information on what to expect and how they can help, especially for tumors where the age of diagnosis is older (e.g., prostate, pancreatic) and/or patients have higher comorbidities, meaning patients are generally less able to gather their own information.

- Payers need to understand the disease epidemiology and the relative clinical and health economic impact of disease progression, for example hospitalization rates.

Within this buying process step, a pharma company’s programs and tactics may lean heavily toward:

- Disease state education for Med-Oncs, informing them of key population-level aspects of the disease (e.g., etiology, epidemiology, prognosis) as well as key mechanisms underpinning the development of the disease and therapeutic approaches—both current and in development

- Patient-focused educational tools to facilitate oncologist communications with patients, such as brochures, key statistics, and locations of additional resources (e.g., advocacy organizations)

- Educational resources for patients and caregivers, specifically designed for accessibility and easy communication of key facts

Example Buying Process Step: Administration

Once a treatment regimen has been selected, specific stakeholders need to be engaged to ensure optimal administration of the therapeutic. For example:

- Nurses must be able to optimally administer the regimen and educate patients and caregivers on how to manage side effects, as well as ensure adherence and compliance.

- Patients and caregivers must be educated on what to expect from the therapeutic and how to minimize / manage any side effects.

Within this buying process step, a pharma company’s programs and tactics might typically include:

- Nurse-specific messaging, guidance, and tools to aid administration and patient adherence and compliance. This can be carried out by oncologist-focused reps as part of a total office call, but also by nurse-specific field teams and/or call centers, who are often ex-nurses themselves and understand the terminology and attitude to use that will be most effective.

- Patient education materials and tools on adverse event identification and management

Failure to use the right programs and tactics at this step can negatively impact the patient and nurse experience, causing them to push back on the treatment choice. In situations when other therapeutic options are available with little or no clinical efficacy drawback, this may be enough to influence oncologist prescribing preferences.

The Framework Overview Table

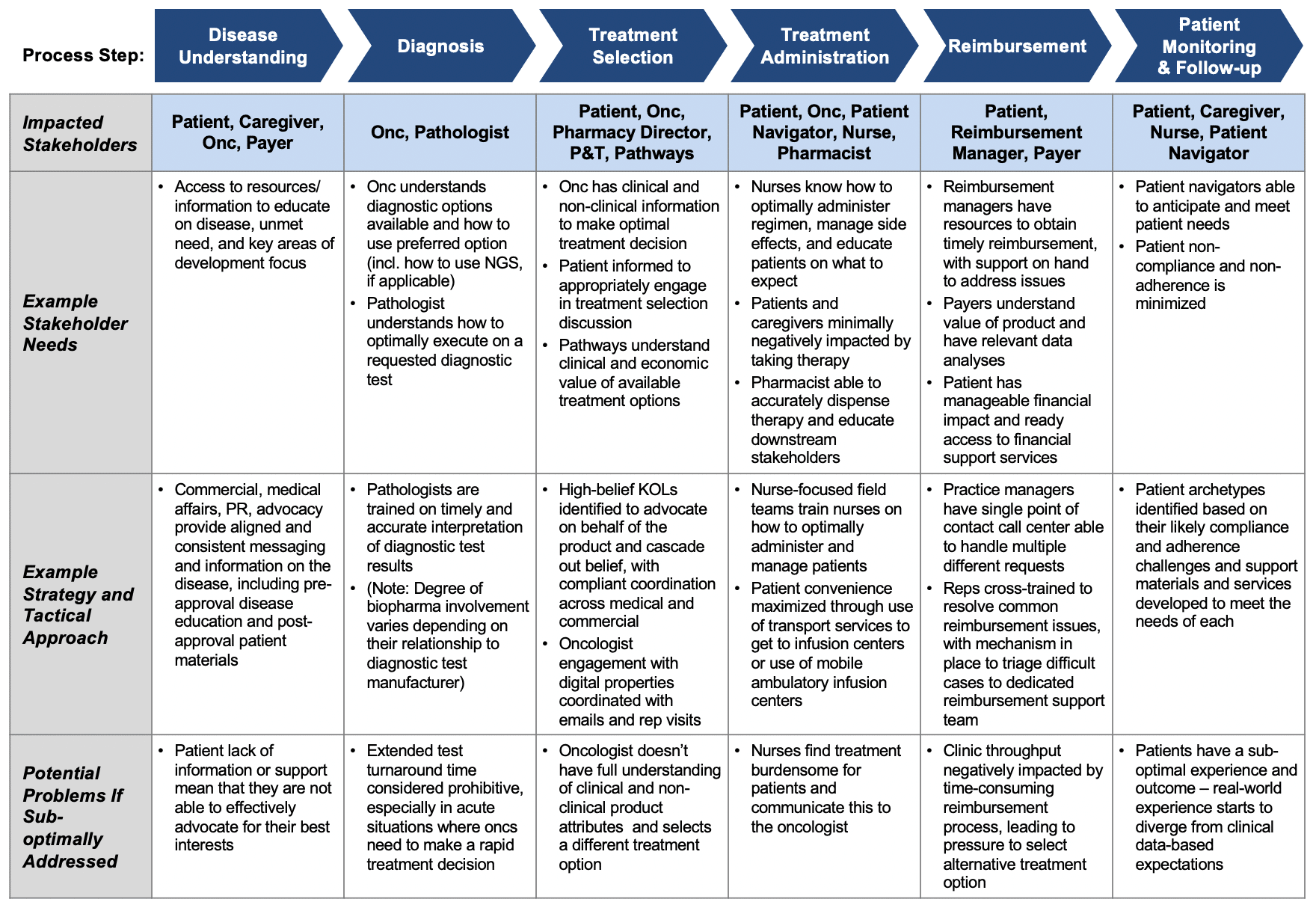

Table 1 provides a high-level look at a typical / potential product buying process, highlighting:

- Range of buying process steps

- The key stakeholder groups in each step

- Key needs for each stakeholder

- Types of strategic and operational approaches pharma companies might employ

Table 1: Example Buying Process with Key Stakeholders, Needs, and Tactics at each Step

Implementing the Framework

Implementing a framework like the one above begins with a strategic evaluation to determine the relevant steps, stakeholders, and their needs and challenges. To inform that effort, the product team needs to answer a range of questions, including:

- What is the level of patient education and/or advocacy support?

- Is this an oral or infused agent?

- Where will it be prescribed? Hospitals (including in-patient or out-patient) or clinics? This is critical to understand as it informs the reimbursement pathway and associated challenges as well as the importance of site-specific stakeholders such as pharmacy directors and P&T committees.

- Will it be used primarily in academic centers or community sites of care?

- Will there be a diagnostic associated with the product? If so, will this be single gene testing or comprehensive genome profiling / NGS?

- What will be the level of clinical differentiation?

- What will be the level of competition? Incumbent vs. future?

- How tightly will it be managed by payers? Do pathways seek to manage access?

Also integral to this process is determining how to operationalize it. Once all stakeholder groups are designated, their needs analyzed, and potential tactics or programs are identified, the company must:

- Understand its level of resourcing and organizational capabilities

- Prioritize programs and tactics, incorporating any necessary trade-offs

- Understand its ability to successfully execute, including the identification of any capability gaps and development of plans to mitigate these

- Ensure that compliant cross-functional alignment and cooperation are optimized

Proper planning and implementation of this approach is recommended for products launching into intensely competitive environments, as the aggregation of marginal gains with stakeholders across multiple buying process steps can lead to meaningful points of non-clinical differentiation resulting in enhanced commercial success.