Clinical-stage biopharmaceutical companies typically juggle a wide range of activities—including but not limited to “getting the science right” as they advance new therapies through clinical development, planning the regulatory path to market, preparing to scale manufacturing and supply chain to meet future demand, beginning to plan for eventual commercialization, and/or developing a financing strategy to enable all of these.

Many of those decisions—such as selecting clinical trial endpoints, inclusion / exclusion criteria, and more—seem like they should be driven purely by scientific considerations. However, the reality is much more complex, and those types of decisions absolutely must be guided by the “commercial perspective,” which we discussed in part 2 of this series (for an introduction to all 7 “make or break” factors for emerging companies, you can read part 1 here).

With multiple competing priorities, how can decision-makers most efficiently gather the right insights they need to inform their decisions? In short, this requires appropriate secondary research and data analysis, as well as focused and thoughtful primary research with the external stakeholders who will ultimately decide to prescribe, use, and/or facilitate access and reimbursement to a given therapy…and it usually needs to be done earlier than many leadership teams expect.

Why This Factor is Important

When designing early clinical studies, many companies anchor to the current treatment paradigm, trial designs and endpoints that have been proven in the disease, and perspectives of “friendly” Key Opinion Leaders (KOLs). However, when designing a registrational program and eventually preparing for launch, companies need to be forward-looking to determine what will be required to successfully differentiate and drive adoption in the future market at the time of launch. Doing so effectively includes gaining insights from a broader set of stakeholders who will impact the real-world use of the product.

Generating customer insights early in development is critically important for the very same reasons we outlined for Factor 1. Failing to gather and leverage the right insights can result in negative downstream implications, such as:

- Clinical trial design and data that do not meet the future needs of physicians, payers, or other stakeholders

- Having a competitive disadvantage due to mischaracterizing the current and future competitive landscape

- Sub-optimal market access and reimbursement

- Slow and/or limited market uptake after launch

- Reduced impact on patient care

- Potential reduction in the likelihood of approval

- Potential negative impact on the valuation of the company

However, when a company gathers the right insights and uses them to inform decision-making, it greatly enhances the probability of success. The overall attitude evolves from “Let’s get this therapy approved.” to “Let’s meet the needs of the market in a way that maximizes value to customers and the company.”

Key Questions

At the simplest level, decision-makers need to answer three fundamental questions when making the journey from R&D to commercial:

- What unmet need(s) can our product address, and what is the true market opportunity associated with the need(s)? Answering this question will help clarify the true potential value of the product and provide high-level guidance on how much to invest in development and commercialization.

- What product profile will optimize the value and impact of the product? Answering this question will inform registrational program design and the target label, which will ultimately affect not only approval, but also access and reimbursement, adoption, and utilization.

- Where and how would a company need to invest to realize that value? This question ultimately deals with the capabilities that will be required to launch, the preferred go-to-market model, priority markets, etc., and answering it effectively usually requires a deeper understanding of the market.

Of course, none of the questions above stands on its own, and there are multiple interrelated additional questions underpinning each. Since the foundational insights to answer these questions are highly related, emerging companies should aim to understand a few core types of insights that make the best use of their resources to comprehensively address these key business questions. In the rest of this article, we dive deeper into each, including why it is important and how it informs decisions.

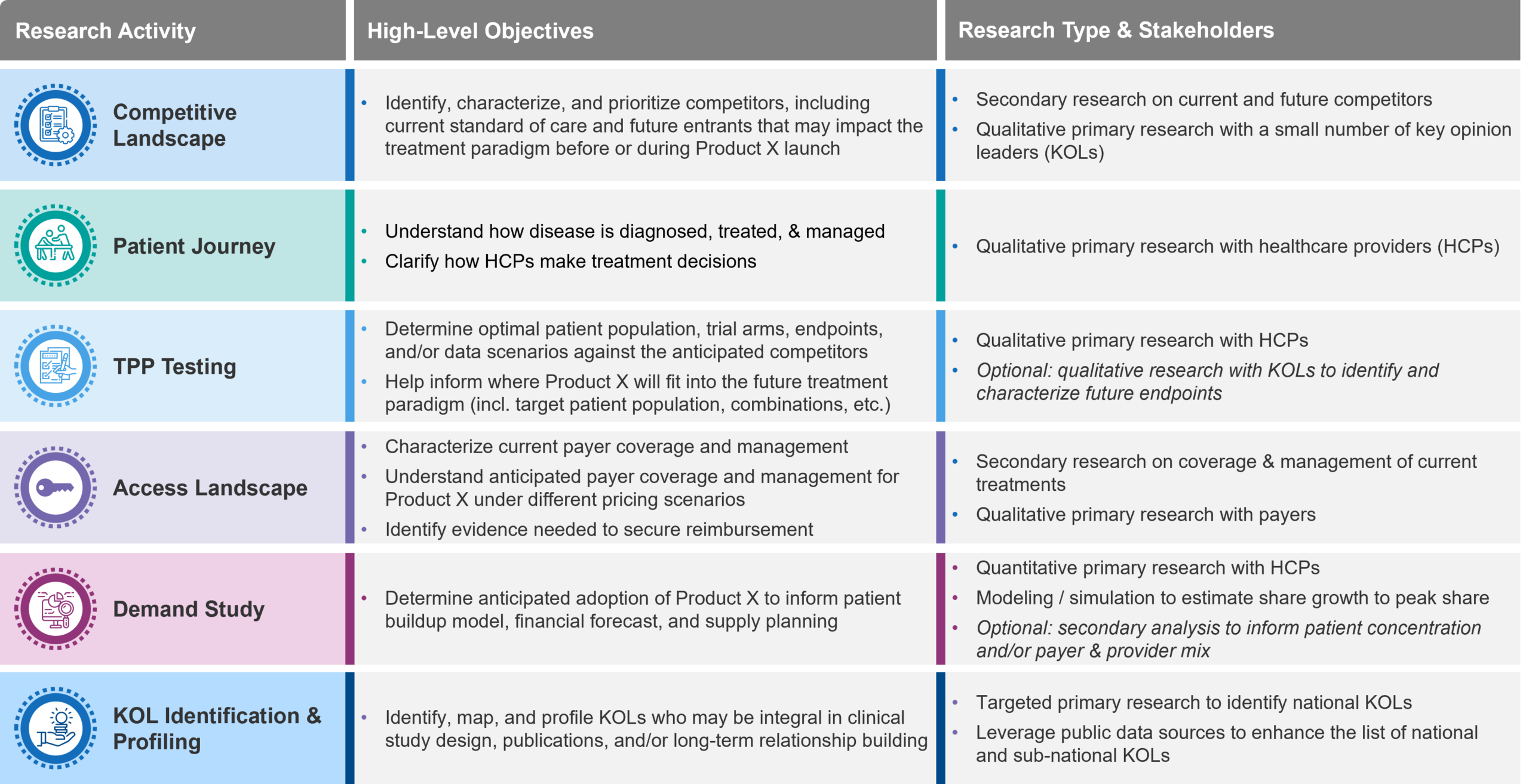

Key Types of Insights and the Related Research

Treatment Landscape

A critical first step involves characterizing the current and future treatment landscape, which can be accomplished through secondary research and a targeted amount of primary research with key opinion leaders (KOLs).

The main objectives of this research are to understand at a high level:

- High-level incidence / prevalence (overall and for specific patient segments), including preliminary insights on patient distribution / concentration (geographically or sites of care)

- The natural history of the disease, how it is diagnosed, and how the pathways to diagnosis can vary

- Current treatment options, including potential differences by patient type or line of therapy

- Potential future treatment options, including characterizing those that are likely to launch before, during, and after the company’s product

This research is critical to developing a foundational understanding that can be used to further guide deeper exploration in subsequent projects, including preliminary hypotheses around potential patient segments, unmet needs, future treatment flow, and where the new product will fit. These insights will ultimately help inform overall product strategy, including target label, clinical trial design, and core positioning and messaging.

Furthermore, this research can begin to quantify the true size of the market opportunity, especially if there is sufficient granularity in target patient segments. For example, having a total available market of every patient with a disease is vastly different from only patients that have received three or more therapies, so understanding these nuances early is critical to informing the total opportunity and value of the product and company.

Treatment Flow / Patient Journey and Unmet Needs

After gaining a foundational understanding of the treatment landscape, decision-makers need to understand in greater depth how the disease is diagnosed, treated, and managed. This is typically referred to as a “patient journey” or “treatment flow.”

A thorough understanding of the patient journey aims to:

- Characterize the key steps and decisions for how a patient is diagnosed, treated, and managed, including which decisions (or “leverage points”) the company can influence

- Define specific stakeholders (including HCP specialties) and their role in each step of the patient journey

- Determine distinct patient segments and how each is treated, including potential lines of therapy

- Identifying unmet needs along the patient journey and clarifying the features and benefits that HCPs and patients are seeking in a new product that would address these needs

A biopharma company should conduct qualitative primary market research with HCPs to generate deep insights on the patient journey. Investing in secondary data sources at this stage is common, as there are numerous data sources that can provide great depth and breadth to our understanding of customers and the market in general. These approaches can help clarify where a company’s product might fit in the future treatment paradigm to inform registrational trial design, as well as preliminary thinking on key stakeholders and leverage points to guide where and how to invest for commercial success.

Target Product Profile

After gaining a solid foundational understanding of the treatment landscape and the treatment flow / patient journey, the company then needs to define a detailed target product profile (TPP) that will best address the identified unmet needs. The TPP outlines the desired features and benefits of the product, including its target patient populations, primary and secondary efficacy endpoints, safety profile, and dosing and administration, all of which will inform registrational program design and downstream label and positioning / messaging.

While a company can generate an initial TPP using insights collected from earlier research, it is often insufficient to stop there. By testing TPP options directly with HCPs in primary market research, companies can better understand:

- Overall HCP perceptions of pros and cons of the TPP

- Specific product attributes that create value (e.g., patient populations or endpoints to include vs. exclude)

- Thresholds for efficacy and safety data that create inflection points in value

When companies don’t test their TPPs before finalizing their clinical trial design, they can encounter unexpected barriers when launching their product, including, for example: comparator arms that don’t align with real-world clinical practice, primary endpoints that HCPs or payers don’t understand, or an inconvenient dosing schedule that hinders adherence. Only by testing the TPP with likely customers—and specifically the HCPs most likely to prescribe in a real-world setting—can a company uncover these issues early and plan around them accordingly.

Figure 1: Foundational market research activities that clinical stage companies can use to inform pivotal study design and downstream planning.

Market Access Landscape

When a product is still being studied in clinical trials, it is tempting to think of “market access” as a far-off concern to be addressed much closer to launch. That temptation can be dangerous if it results in a lack of evidence that would be critical for payers to provide access and reimbursement for the product, which would end up crippling its potential. Furthermore, mischaracterizing the access landscape can also cause a company to operate under mis-assumptions regarding the product’s pricing potential and true commercial value, which can result in over- or under-investing in development and launch.

When assessing the market access landscape for the first time, a company should aim to:

- Understand current payer coverage, management, and reimbursement for the disease

- Understand payer perceptions of the TPP, including main pros and cons

- Characterize anticipated payer coverage and management of the company’s product within the future treatment landscape, including high-level implications to pricing ranges

- Identify any additional evidence required to secure access and reimbursement (especially if outside of the registrational program)

Assessing the market access landscape usually starts with up-front secondary research to characterize the current payer coverage and management for the disease state, followed by qualitative primary research with payers.

If a company has a vision for its product to be used globally, characterizing the ex-US access landscape before designing registrational programs can be critical to success outside the US. In particular, many ex-US payers (especially public payers) will only reimburse the product if it demonstrates benefit against the standard of care at the time of launch – so companies must clearly understand what payers believe will be the future standard of care and an appropriate competitor.

Demand Study

Forecasting often occurs at multiple time points with multiple levels of detail. An initial forecast is usually based on higher-level assumptions around market size and potential share, but a company can get a much clearer understanding of the product’s patient and financial opportunity after clarifying the likely product profile and position in the treatment flow.

Typically, this deeper understanding is gained through a demand study that involves quantitative primary research with HCPs, backed by modeling / simulation to anticipate the product’s adoption, including peak share and the time it will take to achieve peak share (overall and for specific patient segments). Robust demand studies leverage results of this primary market research with public and third party data sources to build a scalable and customizable forecast model. This can be invaluable to accurate forecasting and valuation, including setting realistic expectations for company leadership and investors / Board of Directors. Furthermore, an accurate patient forecast enables a company to effectively plan right-sized manufacturing batches for initial commercial supply.

KOL Identification and Mapping

Having a good understanding of the key opinion leader (KOL) landscape can help a company select the right investigators / sites for clinical trials and build long-term relationships to seek advice on clinical programs, establish partnerships for future publications / presentations, and more.

Public data sources, sometimes supplemented with targeted primary research, will help the company identify, map, and profile national and sub-national KOLs. Those individuals can be invaluable to clinical study design, selecting clinical trial sites, and long-term relationship building.

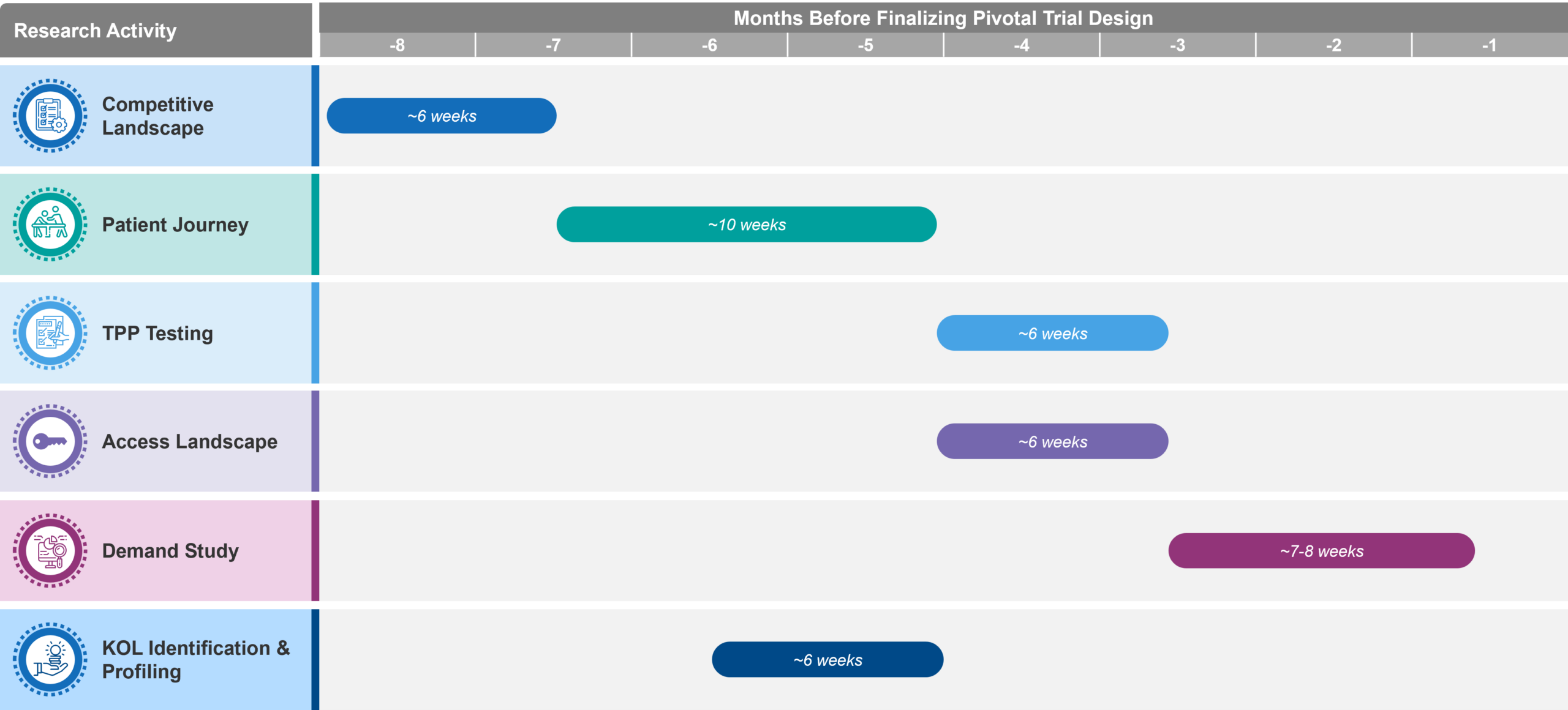

Figure 2: Typical sequencing and timing of foundational market research for clinical-stage companies. Note that this approach will often not be linear, e.g., revisiting the competitive landscape and patient journey as the TPP becomes more defined over time.

Coming Next

Our next installment will cover Factor 3: Integrating the Commercial Perspective into Clinical and Corporate Decisions. While Factor 2 has introduced some of those decisions to help provide context for the early insights needed, our next article will dive deeper into how emerging companies can think through each of these decisions in a more robust and customer-centric way.