Within the biopharmaceutical market, oncology is the largest therapeutic area. US revenues are expected to reach $100 billion in 2023 and rise to $175 billion by 2027, a compound annual growth rate (CAGR) of about 14%.

Meanwhile, the oncology market continues to become increasingly complex, with rising levels of competition and an ever-expanding range of stakeholder dynamics that impact product utilization. In such an environment, it is critical for manufacturers to use data- and insight-driven approaches to optimizing sales force strategy. After all, a sales force is a key channel for customer engagement and a sizeable percentage of the investment in any brand.

Historically, a unidimensional approach to valuing customers and assigning desired reach and frequency were sufficient to inform sales force size and structure. However, the evolving landscape has made it necessary to evaluate sales force strategy across several drivers, which we have incorporated into our recent engagements with clients. In this article, we review some of the key drivers impacting oncology sales force strategy and highlight the importance of insights generation in arriving at the most optimal solutions.

Beyond the expected drivers related to the Sales function, we also have called out drivers across Access and Marketing functions, which must be considered for holistic evaluation of sales force needs. In addition, the outlined drivers can relate to either reactive strategies or proactive actions. Manufacturers react to external drivers that are emerging due to evolving market dynamics while being proactive about internal drivers that are essential to positioning and differentiation in a highly competitive environment.

The drivers covered in this article are not intended to be exhaustive. Rather, they represent some of the key considerations that we have factored in during our engagements in shaping oncology sales force strategy.

Table 1 – Key Drivers Impacting sales Force Strategy in Oncology

Reactive (Externally Driven) Proactive (Internally Driven)

Sales

Access

Marketing

* Clinical Specialists refer to sales representatives in oncology

Although some factors may be challenging to quantify, it is critical to have a nuanced understanding across available data elements, viable analytical methods, and relevant strategic considerations for optimal evaluation of the sales force strategy. In evaluating each of the outlined drivers, we combine strong thought partnership and actionable insights as a key differentiating factor for our clients.

External Sales Drivers

Uptake in Remote Detailing

Although oncology detail volume has almost recovered to pre-COVID levels, in-person interactions only account for about half of the total. This speaks to the strong uptake of remote detailing in oncology and its stickiness as a viable approach to engaging customers. This new in-person/remote detail mix impacts how we traditionally have defined clinical specialist capacity and customer workload. It also must be noted that not all customer segments embrace the detail mix in the same manner. Therefore, data analysis and modeling can help identify the relevant segments and corresponding hybrid detailing to arrive at the best sale force solution.

While remote detailing offers geographic flexibility, savings in travel time, and increased reach and frequency, the interactions are not as effective as in-person. As a result, conversion to prescription may suffer. Therefore, to appropriately size sales teams, it is critical to consider the consequences of the trend toward hybrid detail delivery and the tradeoffs between in-person and remote interactions.

HCP/Account Access Restrictions

Hybrid detail delivery is further reinforced by restricted access to oncologists, with less than 20% of the physicians being accessible. Among all specialties, oncology has the most restricted access, and the trend of increasing access restrictions has persisted over the years.

Therefore, the assumptions about clinical specialist workload must be adjusted accordingly, realizing that achieving even one visit per month among the highest value targets may be unrealistic. The same goes with clinical specialist capacity, where daily HCP calls in oncology are unlikely to surpass two or three, considering the efforts that are required for clinical specialists to reach and engage their targets.

Evolving Clinical Specialist Role

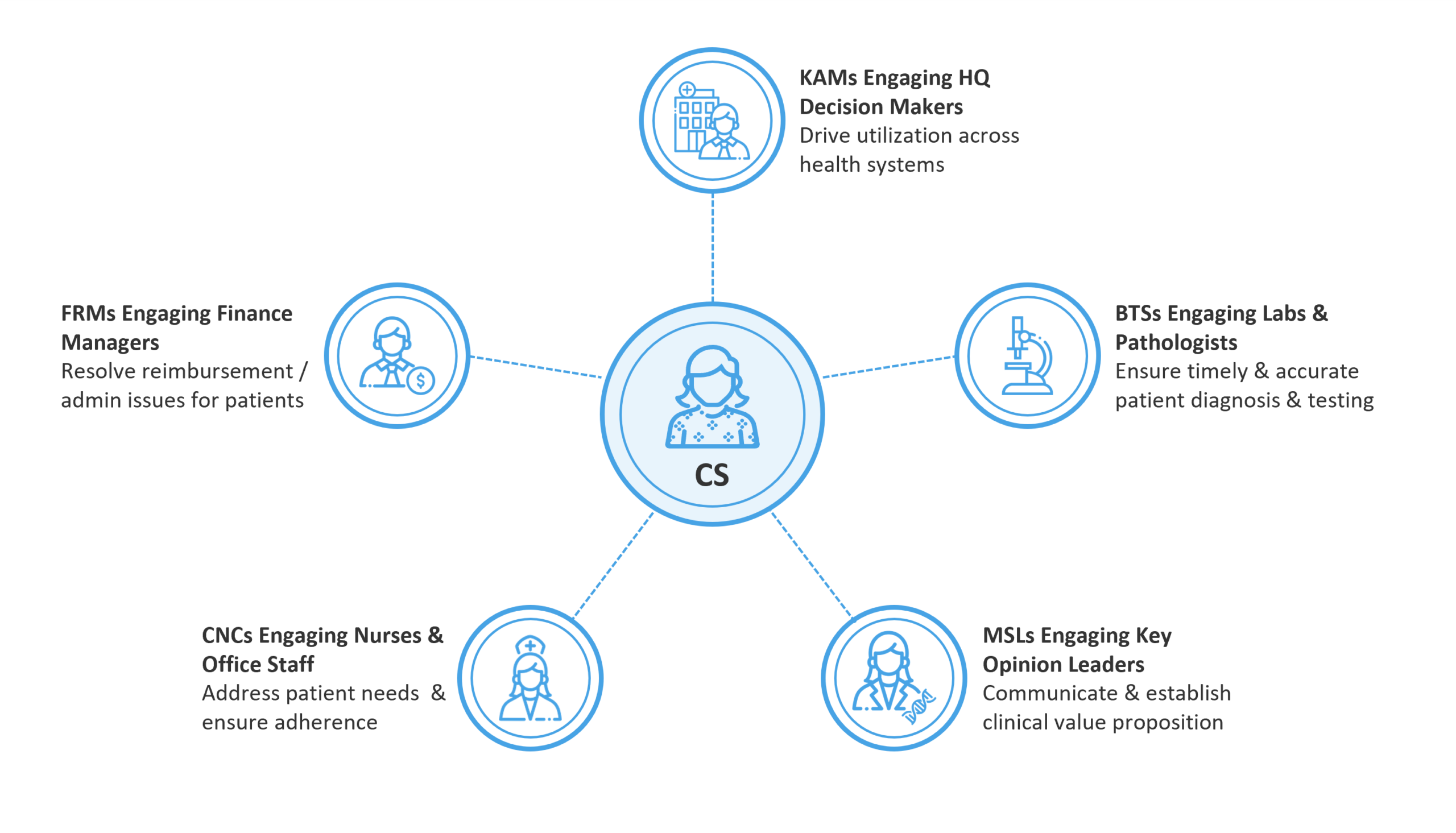

With the expanding market complexities, the role of the clinical specialist also has evolved. Rather than acting as the tip of the spear for manufacturer promotional efforts, clinical specialists (CSs) now act as “quarterbacks” in coordinating and interacting with multiple field teams in best meeting customer needs and delivering holistic solutions.

The oncology sales strategy now considers a wide range of teams, each with a specific objective. Medical science liaisons (MSLs), key account managers (KAMs), field reimbursement managers (FRMs), clinical nurse coordinators (CNCs), and biomarker testing specialists (BTSs) have emerged as critical roles in adequately supporting the various stakeholders involved in patient management and care. Therefore, the sales force size must be evaluated with the other field teams in mind to ensure the appropriate field mix and presence in optimizing product utilization and removing any barriers in an increasingly competitive market. Specifically, as the role evolves, there are implications to the profile of customers engaged, the duration of each interaction, and the conversation topics with a tangible impact on the size of the sales force and the other field teams.

Figure 1 – Field Teams Commonly Deployed to Support Customers in Oncology

Internal Sales Drivers

Optimized “Surround Sound”

The upward trend for physicians adopting digital platforms and virtual resources for obtaining information and interacting with manufacturers was further expedited with COVID-19. Therefore, sales force strategy nowadays must be evaluated in the broader context of omnichannel marketing, where optimized “surround sound” and positive customer experience are key priorities.

This is especially important in oncology where the increased market competition and limitations for in-person promotion necessitate a tailored approach to engaging targets. In this setting, reaching stakeholders according to their preferred channels becomes a point of differentiation, allowing manufacturers to compete for share of voice in a crowded environment. As a result, alternative channels such as video conferencing, remote detailing, and inside sales may be more effective and efficient engagement platforms for some targets, impacting the size of sales force teams.

Account-Level Selling Model

Traditionally, sales force sizing has been at the healthcare provider (HCP) level with the idea that sales representatives deliver details to physician targets. However, with the account-level selling model in oncology, HCP-level sizing tends to translate into over-resourced teams. Rather than calling on individual physicians, clinical specialists visit accounts and interact with MD and non-MD stakeholders as they walk the halls. This engagement model accounts for the fact that multiple HCPs are affiliated with the same account, translating into efficiencies in detailing targets.

This co-location at the account level further drives business capture in an already concentrated market. On average, 20-25% of accounts make up about 80% of oncology business, compared to 30-35% at HCP level. Therefore, it is recommended for sizing inputs in oncology to be informed at the account level through an integrated affiliations database, where HCPs are linked to accounts and accounts to parent organizations.

External Access Drivers

Level of Control by Organized Customers

An estimated 60-80% of hospitals are affiliated with a network or system with organized customers exerting increasing influence in oncology through pathways and formularies. Through evidence-based guidelines and centralized management, organized customers direct oncologists towards preferred therapies to encourage use of safe, effective, and affordable medications.

In driving this value-based treatment approach, organized customers disseminate headquarters decisions (via tools such as formularies, pathways, order sets, etc.) across affiliates to dictate product utilization. It is important to recognize that the management and pull-through of these decisions are not uniform and the resulting tracking and measurement may greatly vary across organized customers. Despite (and at some level, due to) this variation, it is critical to understand this level of control as the sales force promotional efforts certainly will have reduced impact on product use.

Therefore, it is critical to incorporate the level of control by organized customers and willingness to manage into sales force strategy evaluations in oncology. For example, in a prior engagement, we leveraged utilization at the parent and organization level and built a model to quantify the differing levels of control observed across Integrated Delivery Networks. The output was used as a segmentation metric to appropriately inform the size of the oncology sales force team. It is also important to think beyond clinical specialists and deploy Key Account Managers in influencing decision makers at headquarters to drive product utilization.

Payer Management in Oncology

Payer management in oncology is not new and has been expanding, especially among oral agents in crowded markets. Between 2017 and 2022, new U.S. cancer drug prices rose 53%. Meanwhile, the increasing market competition has translated into diminished clinical differentiation among available treatments. As a result, payers are evaluating solutions for better managing costs, access, and quality of care in oncology and placing restrictions on drug utilization as appropriate. Such restrictions will significantly reduce the impact of promotional efforts and reinforce the importance of contracting strategy and manufacturer ability to influence key decision-makers through field payer teams.

To account for payer impact on optimal sales force size, it is critical to adopt a data-driven approach to understand payer influence at geography level and the corresponding effect on customer segmentation. Therefore, we recommend augmenting the traditional oncology targeting and segmentation with sub-national insights into payer management. This will more accurately inform sales force sizing and avoid over-resourcing in geographies where a hybrid sales and payer strategy may be required.

Internal Access Drivers

Patient Support Programs

Although not a direct input into the sales force strategy, it is critical to complement the sales force efforts in removing access barriers to utilization with effective and comprehensive patient support programs to ensure patient diagnosis, access to treatment, and adherence. Most cancer patients in the US indicate that they struggle with covering the costs of their cancer care. Meanwhile, there is a significant gap in knowledge and awareness of manufacturer support programs among patients and caregivers.

This gap is further accentuated by increasing market competition and a host of new drugs and regimens that may further overwhelm and confuse patients and caregivers through the treatment journey. For optimal outcomes, manufacturers must invest in patient marketing and advocacy group partnerships to ensure that the financial, educational, and adherence support programs are designed from the patients’ perspective, available and accessible to all patients in need. As it relates to the sales force, it is important to measure and track engagement and utilization of patient support programs as they may act as confounding factors when evaluating sales force effectiveness.

External Marketing Drivers

Complex Buying Process

There are multiple stakeholders involved in the care and management of cancer patients with some of the non-oncology specialties playing an important role in the patient journey. In breast cancer, surgeons play a critical role in the early stages of the disease and drive referrals to oncologists for drug treatment. In skin cancer, dermatologists should be considered relevant targets for sales force coverage.

In addition to the non-oncology specialties, the increasing use of biomarkers and companion diagnostics emphasizes the importance of pathologists and test labs in timely identification of eligible patients for treatment. These complexities highlight the importance of linking oncology targeting and segmentation to brand strategy and considering the forecast levers such as diagnosis rate, referral rate, test rate, and treatment rate in shaping the final target universe that will inform the required sales force resourcing.

Patient Dynamics

High drug prices and the increasing use of combination therapies translate into high patient value in oncology. When applying profitability to sales force sizing, this high patient value can skew the results towards a larger team as coverage of low value targets with only a few new patients per year may still translate into a positive return on investment.

Another patient dynamic to keep in mind is the identification of eligible patients and appropriate opportunity size in informing sales force strategy and resourcing. With increased focus on companion diagnostics and rare tumors, identifying the correct patient sub-segments and dispersed patient populations becomes an important exercise in shaping and deploying the right sales force strategy and team size.

Internal Marketing Drivers

Importance of Portfolio View for Resource Allocation

For organizations with a portfolio of oncology products, it is critical to approach sales force strategy and resourcing at the portfolio level. The oncologists in the customer universe are the same 13,000 to 14,000 physicians across all tumors and there is a significant target overlap, especially when evaluating a portfolio consisting of either all solid or all liquid tumors.

A product-level evaluation often leads to over-resourcing of sales force teams and will overlook cross-team synergies and efficiencies. The portfolio view will ensure adequate coverage of all oncology products marketed by the company without exacerbating existing access restrictions. It also will avoid an excessive number of touchpoints to the same target, which can adversely impact customer satisfaction and company image.

Parting Thoughts

Considering the drivers described above, it is evident that yesterday’s methods and solutions may no longer apply to today’s oncology market. An effective sales force strategy must be comprehensive, covering all relevant stakeholders and considering the optimal marketing mix for overcoming utilization barriers and ensuring customer satisfaction.

To address the drivers and evolving market, actionable and relevant insights will be critical in informing sales force strategy. In generating these insights, the traditional approach must be revisited across data requirements, defined customer universe, physician segments, clinical specialist workload and capacity assumptions, and expected field roles and responsibilities. In this process, the Blue Matter Insights team offers clients the subject matter expertise and oncology knowledge needed to arrive at optimal sales force solutions. We operate as strategic thought partners to clients by integrating analytics, market research, and strategy to deliver the required differentiation and positioning for achieving brand goals in the competitive oncology market.