Regardless of the product, launching a new biopharmaceutical drug is a time-consuming, expensive, and complex undertaking. It requires sound strategy, expert planning, and effective cross-functional coordination to get everything done right. The analogy is certainly not new but launch really is akin to conducting a symphony orchestra, ensuring that all members play their parts correctly, and at the right times.

The situation is similar with rare disease (RD) products. However, a number of factors conspire to make launching and commercializing RD products more complex than is typically the case with other specialty products.

In this article, we will quickly review the key differences between RD and other specialty products, as well as the impacts those differences have on product launch. We will then outline a framework that RD product teams can use to organize their thinking—and their work—as they prepare new products for launch and commercial success.

Nine Key Differences Between Rare Disease and Other Specialty Products

Accelerated Time to Commercialization – Due to fewer available patients and smaller studies, faster development timelines, and accelerated regulatory approval and market access (in many cases), RD products usually launch more quickly than other specialty products. Launch is often two to four years from proof of concept. This means that RD companies typically have less time to prepare for launch and must be able to nimbly respond to unexpected environment and market changes.

Relentless Patient Focus – “Patient centricity” is core to the commercialization of most rare disease products and a critical component of the mindset of RD companies. RDs are often genetic, disproportionately affect children, and carry an extremely high burden for patients and their families and caregivers. So, most successful RD companies provide holistic “beyond the pill” services designed to meet the needs of patients and those who support them. Doing this effectively has significant planning and organizational implications.

Partnership and Commitment to RD Community – Patients and caregivers dealing with a given RD often build their own communities for mutual support and for the sharing of information and best practices. These communities are critical to RD product success. By the time of launch, an RD company must have built strong relationships with patients, patient advocacy groups (PAGs), and other key stakeholders. This is critical to understanding patient needs, defining new treatment paradigms, and gaining early treatment access.

Centers of Excellence (COE) Model – Related to the idea of “community” above, a key component in that concept is the idea of COEs. Typically, there are very few experts in a given RD, so the ones that do exist should be able to link up, communicate, and share knowledge. For RD companies, this requires additional focus on identifying (or developing) COEs, identifying and engaging with disease experts, and establishing referral networks.

Patient Identification – Within any RD, patients are, by definition, rare. To serve them, RD companies must find them. Targeted patient finding initiatives are a critical success factor for any RD product launch. It’s vitally important to proactively build the “patient pipeline.”

Fewer Resources – Due to small patient numbers—and the resultant more limited commercial opportunity—RD launches typically use fewer resources and require a more focused, selective launch plan. Smart and efficient use of resources is critical to success.

Agile RD Organization – Due to the factors listed above (e.g. accelerated timelines, the need for patient centricity, limited resources, etc.), any successful RD organization must be nimble, efficient, and highly integrated. This typically requires a different organizational structure and approach than is found with other specialty products. Basically, RD companies and teams must be “purpose built” for commercializing their products.

Superior Customer Experience – As mentioned above, experts in any given RD are rare. That means that most RD product teams must target a very small group of extremely high-value physicians and specialists. These companies must employ engagement models that are perceived as highly valuable and useful by physicians and other customers. Even more important is to ensure a superior experience for the patients by providing a set of well-integrated and meaningful services aimed at eliminating any barriers to treatment and providing the best care possible. Developing these engagement models can be challenging.

Challenging Market Access – While achieving the desired level of market access can be a tough for any product, it can be doubly hard for RD products. Gaining early and broad access for typically high-cost treatments with relatively small clinical data sets and limited health economics data can be a significant hurdle. Early alignment with payers and the disease community on how to effectively demonstrate value is key. Robust plans to generate real world evidence and post-approval data are a must.

Framework for Successful RD Product Launch and Commercialization

Given the factors above, decision makers in RD companies should leverage a framework within which they can organize their strategic thinking, operational planning, and tactical implementation. A good framework can help ensure that nothing “falls through the cracks.”

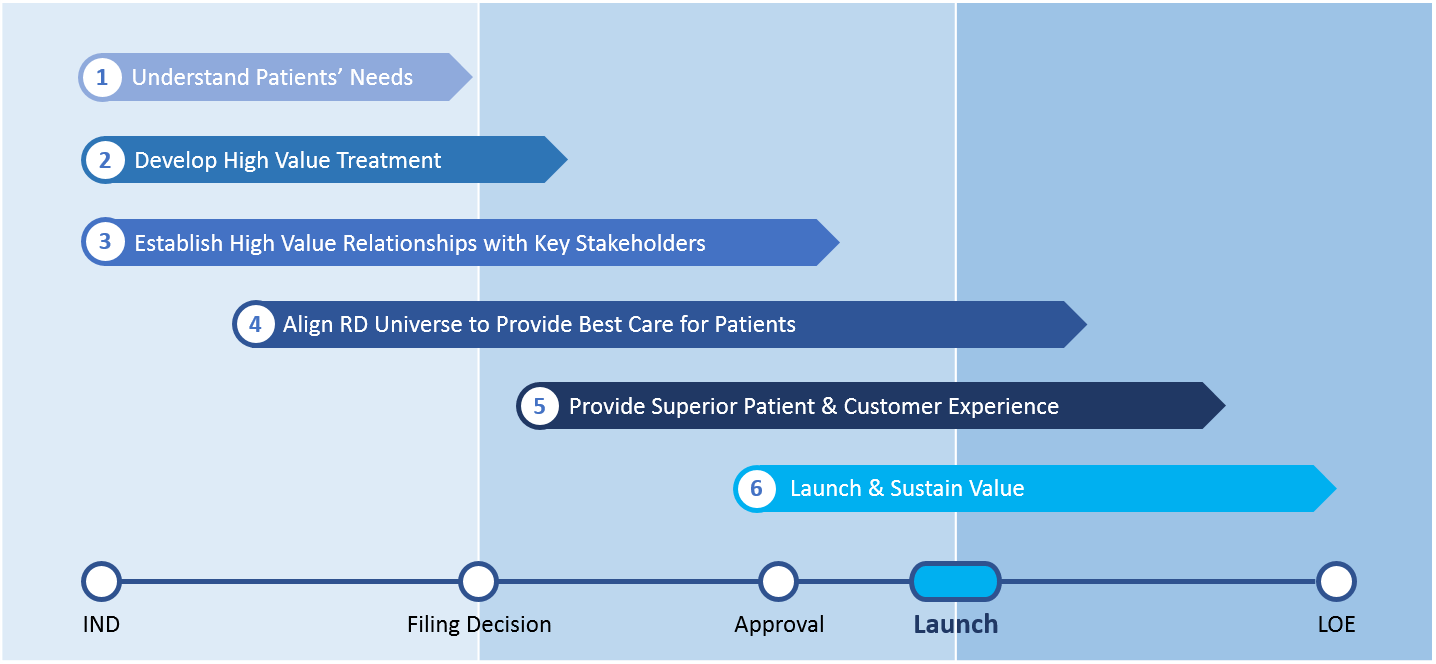

As we studied the most successful RD launches, our team identified six key dimensions that compose our RD launch framework. They are outlined in Figure 1 and arrayed along a high-level product development timeline.

Understand Patients’ Needs

Early in the development process, an RD company must work to understand the patients and their needs. This is key to informing robust development and commercial strategies.

Such an understanding must exist on several levels. For one, it’s vitally important that the company maximize its knowledge of the disease’s epidemiology and natural history. This is critical to estimating the true size of the unmet need, as well as defining appropriate clinical endpoints. Underestimated epidemiology numbers can lower the perception of unmet need in the eyes of payers and can understate the product’s commercial potential. In addition, limited natural history data and poor understanding of disease progression can make it difficult to define appropriate clinical endpoints and treatment outcomes. Also, a good understanding of the disease progression is critical to quantify the treatment effect of a novel therapy to fully quantify its value.

Various forms of patient research are also important. The RD company must be able to identify patients, understand their needs, segment and profile patients, and fully understand the patient journey to diagnosis.

Also important is cataloguing and profiling the relevant patient advocacy groups (PAGs). Later, that knowledge will be very useful as the company begins to engage with those groups.

The work that must be done to fully understand patient needs is highly foundational. The epidemiology and natural history research, patient research, and PAG profiling will lay important groundwork for future commercial success.

Develop High Value Treatment

For many RDs, the disease itself is not well understood, nor are the unmet needs related to it. Different stakeholder groups (patients, physicians, payers, and others) are likely to have different expectations around value and how that value should be measured. In this environment, developing and supporting value messages becomes even more challenging because in RDs, there is often little (or no) competitive or standard-of-care data to use for comparison.

Therefore, a company must engage early with a comprehensive array of stakeholders to fully grasp their needs and expectations. This can start with a therapy area assessment based on secondary research, but it must move quickly into primary research with clinical experts, payers, regulators, and others as appropriate.

All this work must inform development of a well-constructed target product profile (TPP). Without valid inputs from key stakeholders, the TPP and related value messages might be improperly developed, building the product on a very shaky foundation.

Establish High-Value Relationships with Key Stakeholders

By now, the theme of “early engagement” should be obvious. To this point, we’ve talked about early engagement as key to collecting information that will be vital to clinical and commercial planning. However, over time, the nature of that engagement must go beyond merely collecting data and become one of providing value. For the RD company, the goal is to build productive long-term relationships with disease experts, PAGs, and even payers and regulators.

The RD company must be strategic about identifying its key stakeholder groups, understanding their individual goals and needs, and developing individual engagement plans that will help meet those needs. Done correctly, this engagement results in payers and regulators that are well-informed and easier to work with, PAGs that will champion and advocate for new treatments, clinicians that are better able to diagnose, refer and/or treat patients, and more. A multi-faceted engagement plan is instrumental to fully unlocking an RD product’s commercial potential.

Align RD Universe to Provide Best Care for Patients

In most rare diseases, patient identification is a challenge. Many patients are undiagnosed and may suffer for years, “bouncing” from one physician to the next before finally getting a proper diagnosis. In a market situation such as that, it can be extremely difficult for a pharmaceutical company to understand the size of the market, identify patients, target physicians, and change the status quo.

For a given rare disease, the pharmaceutical company must identify and engage with existing Centers of Excellence (COEs) and treatment and referral networks. Where no coordinated referral networks exist, it may be necessary to help build them.

These things are easier said than done. In any case, the RD company must deploy systematic approaches for

- Identifying, mapping, and segmenting COEs/referral networks

- Determining the needs of COEs/referral networks

- Engaging in value-added ways with COEs/referral networks

Ultimately, these efforts will make patient finding easier, as well as improve diagnosis and treatment rates.

Provide Superior Patient and Customer Experience

Once a company has determined the needs and objectives of its key stakeholder groups (most notably patients and clinicians), it must build patient and customer experiences that optimize care while further enhancing relationships.

RD patients and their caregivers are often faced with difficult treatment journeys. By improving the experience at key touchpoints throughout the journey, the company can significantly improve patient and physician adoption. Because of this, holistic “beyond the pill” services are often extremely important components in the success of RD products.

Physicians and disease experts are likewise extremely valuable. Every interaction that a pharmaceutical company has with members of this elite group is very important, should be value-added, and often conducted at a senior level.

It’s crucial that the company analyze the needs of these stakeholder groups and strategically build suites of support offerings that directly address the needs of each group. The company’s RD organization should likewise be optimized to deliver on that patient-centric and “high-touch” business model.

The basic approach for doing this involves these high-level steps:

- Analyze stakeholder needs

- Design holistic support services

- Define customer engagement model

- Develop and implement organizational blueprint

Launch and Sustain Value

During the 18-24 months before launch, planning and management efforts begin to accelerate. At this stage, the team must develop an integrated, cross-functional launch plan, then implement it effectively.

At the operational level, this plan must outline all key deliverables, timelines, responsibilities by function, team and/or individual, and interdependencies. It should also document how the launch team members will communicate, maintain accountability, and measure progress.

At the strategic level, the team must develop and launch appropriate programs for maximizing the product’s commercial value. These can include an early access program (EAP), methods and processes for capturing real world evidence (RWE), and more.

In short, this part of the framework is focused on ensuring a flawless launch while simultaneously setting the product up for long-term success. It is the “last mile” before a product hits the market.

Conclusion

Obviously, there is no way that a 1,900-word article can deeply cover all aspects of launching and commercializing a rare disease asset. However, we have outlined a framework within which decision-makers can organize their efforts. Each RD product is unique and faces its own set of market factors and circumstances but, hopefully, this article will help provide a foundation on which to begin building.