The Long Road of PDT Market Development

With a very exciting 2021 and 2022 for prescription digital therapeutics (PDTs), a lot of people are asking: Are PDTs on the verge of achieving “critical mass,” the point at which they truly scale up and achieve a sustainable level of market penetration in an environment conducive to growth? Perhaps they are, but it’s still a bit hard to say. Currently, the barriers that continue to drive uncertainty for PDTs all concern market development:

- Access: When will insurance companies finally act to establish standard coverage, coding, and reimbursement pathways?

- Integration: How long will it take to motivate the average clinician to overcome the headache of integration and adoption?

- Demand: When will patients finally demand high-quality digital solutions at scale?

- Competition: How will unregulated and regulated digital therapeutics impact each other’s market potential?

All of these are typical barriers to healthcare innovation, but despite familiarity, they cannot be underestimated for the amount of time and investment required to overcome them. While the PDT industry can celebrate steady progress – especially with numerous regulatory approvals and growing acknowledgement of the clinical benefits from several products – a new therapy can’t prove its true value if it never scales to broad adoption. This is a very real challenge as the PDT market enters a new phase with numerous companies becoming publicly traded. Each of these companies are now under pressure from “the street” to deliver on financial promises and performance that depend on achieving aggressive market development goals in an unpredictable environment.

So the pressing question remains: What will it take to drive PDT market development and scale? The answer is, well, also pressure. A little pressure for everyone!

Building Positive Pressure

While we have noticed a recent trend for PDT start-ups to take the reins of self-commercialization, the one area we suspect they may be underestimating is the need for some good old traditional pharma 101 demand generation. Ask around about what changes the minds of insurers and what you will hear is demand (clinicians mostly, but also patients and even employers). The more requests for reimbursement, medical exemptions, and overall policy reviews tied up in PDTs, the more pressure mounts for insurers to take a stance on how to cover these products.

Building demand can be accomplished using a variety of traditional methods, including KOL advisory boards, conferences, pre-approval marketing, pilots and RWE studies, and more. Those are all tactics that have been long-established in pharma but could always be polished to a new shine with start-up creativity and capabilities (though that’s a longer strategy discussion for another day).

But at the same time, those tactics and investments can be hard to get early buy-in for when funds are limited. So, they often get pushed off until later and later. The reality is that it takes time to do this properly. Key stakeholders must be identified, courted, groomed, and deployed while tactics need to be designed, tested, and validated. All of that takes time, a few years of time.

With this market development need in mind, we decided to look at this problem through a slightly different lens based on the idea that “a rising tide lifts all boats.” Our thinking is that while one or two PDT companies are out there knocking on doors with great messaging and raw determination, it may simply be insufficient to generate the activation energy needed for launching a new market. But possibly, with many PDT companies out there, the combination of their individual efforts could build the necessary pressure and momentum through what amounts to a de facto collective action. We don’t necessarily envision this “collective action” as a centrally coordinated effort. Rather, it’s many individual players pursuing their own interests in the space, but who by default are generally “pulling in the same direction.” However, there may also be some creative possibilities for more coordinated activities.

This stage of PDT market development reminds us of the early Next Generation Sequencing / Comprehensive Genomic Profiling (CGP) diagnostics market. It was also a promising and novel technology that suffered from high variability in experience, variable understanding amongst key stakeholders, and a lack of clearly defined coverage pathways. It wasn’t until multiple CGP players invested heavily in educating the market and actively engaging key stakeholders (such as health techs, CMS, and providers) that momentum built towards a “tipping point” of sorts.

So to investigate further, we undertook an analysis of the PDT landscape in the U.S. to identify how many companies and products exist and estimate upcoming launches to understand how this pressure could be built. Read on to see our analysis and judge for yourself how you as individuals and companies should consider market development in your launch strategies.

A Brief Look at Our Methodology

While we will avoid going into the weeds, it would be helpful to outline the basic methodologies we used in our analysis. This, we hope, will help establish context and confidence in our conclusions.

We focused on companies that have verifiable activity in the U.S., whether through partnerships declaring a U.S. focus, FDA activity, etc. There certainly are more players that could jump into the market, including global companies and those in the broader non-prescription digital therapeutics and wellness landscape.

Generally, we defined PDT companies as those with products that are intending to seek FDA approval as a prescription software-as-a-medical-device (SaMD) intervention with extensive evidence and regulatory oversight. The PDT criteria can include any of the following:

- FDA: FDA authorization, clearance, approval or Breakthrough Designation

- Claim: Self-proclaimed prescription DTx products

- Pipeline: Websites display a product pipeline similar to pharmaceutical companies

With this approach, there are always “edge cases” that occupy a gray area. Overall, we did our best to be inclusive but also verifiable regarding the intent to commercialize in the U.S.

In terms of being a PDT, we think there is a distinction between products intending to be interventions in themselves vs. disease management or symptom monitoring products. We lean our focus towards interventions but have included certain others and may refer to them as “digital companion developers.” While some of these players may have their own products, they also clearly are taking a strategy of co-developing / white-labeling solutions for others.

In addition, we lean towards software-only products but this can be tricky with augmented / virtual reality-based solutions (and others). From time to time, we may include some notable hardware based products if we think it’s warranted, but with a concerted effort to not slide right into including every medical device, such as those for neuromodulation and neurostimulation.

To facilitate our analysis, we created a dataset of PDT companies and products. Readers can access select aspects of the dataset below.

Feel free to use it as a resource, but please attribute it to Blue Matter where possible or risk having trouble sleeping at night due to a guilty conscience (and there’s no app for that)!

Readers wanting full access to the data can contact Jeff Liesch directly at jliesch@bluematterconsulting.com.

Just The Facts

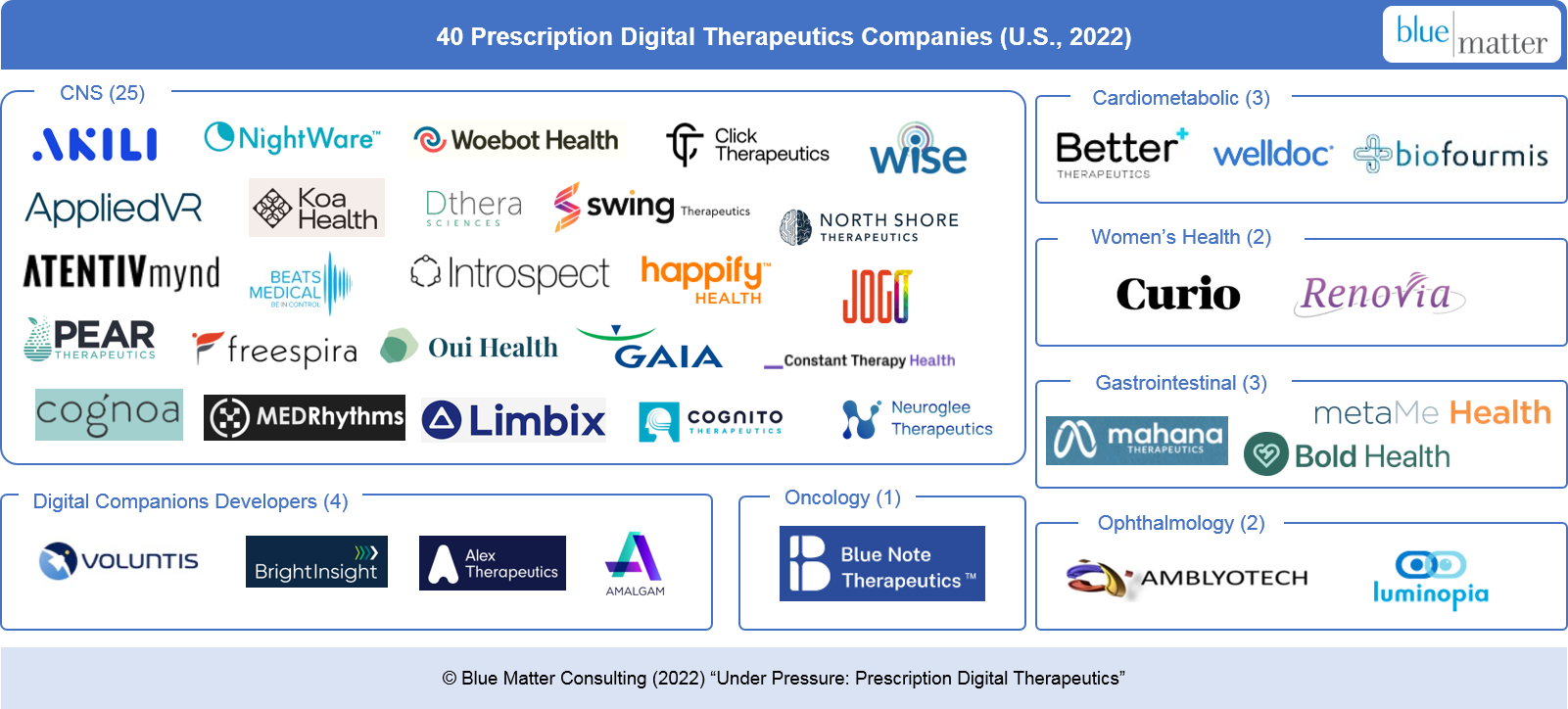

- We identified 40 PDT companies with U.S. market activity (either commercially available or in the pipeline) with their primary focus being CNS (25), gastrointestinal (3), cardiometabolic (3), women’s health (2), ophthalmology (2), oncology (1), and digital companion developers (4). (See Figure 1)

- Only 4 PDT companies have gone public: Better Therapeutics (SPAC in 2021), Pear Therapeutics (SPAC in 2021), Akili Interactive (SPAC in 2022), Dthera Sciences (IPO in 2016 – now inactive).

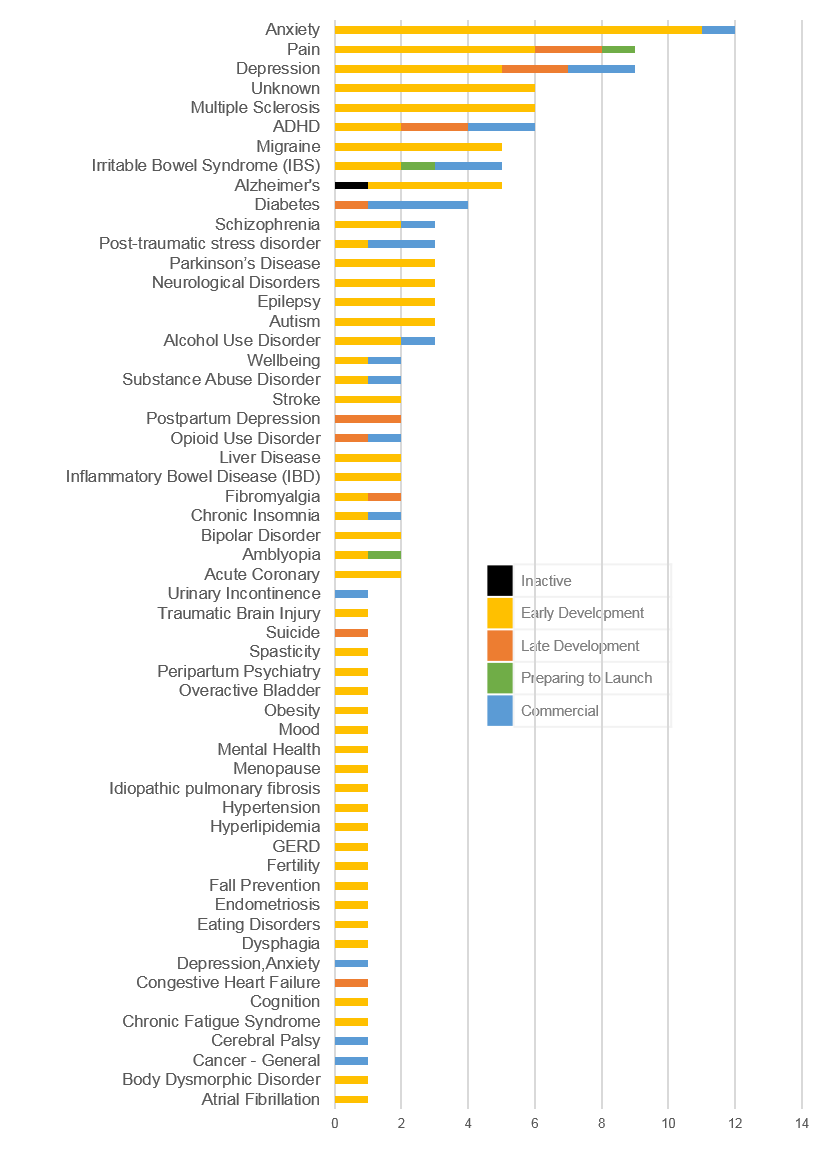

- 139 PDT products were identified overall but more specifically targeting CNS (91, 65%), cardiometabolic (17, 12%), gastrointestinal (10, 7%), and the remaining (21, 16%) across oncology, women’s health, ophthalmology, urology, respiratory and auto-immune. (See Figure 2 and 3)

- The largest pipelines are from Pear Therapeutics (17), Jogo Health (10), Wise Therapeutics (10), Akili Interactive (8), and Click Therapeutics (8). (See Figure 2)

- At the disease level, the areas of highest PDT activity include Anxiety (12), Depression + Postpartum Depression (11), Pain (9), ADHD (6), and Multiple Sclerosis (6) while other areas of high interest are Alzheimer’s, Irritable Bowel Syndrome, and Migraine. (Note: ADHD may be slightly over-represented as Akili has ADHD “products” on its Selective Stimulus Management Engine [SSME] platform targeting different ages but may simply be label extensions) (See Figure 3)

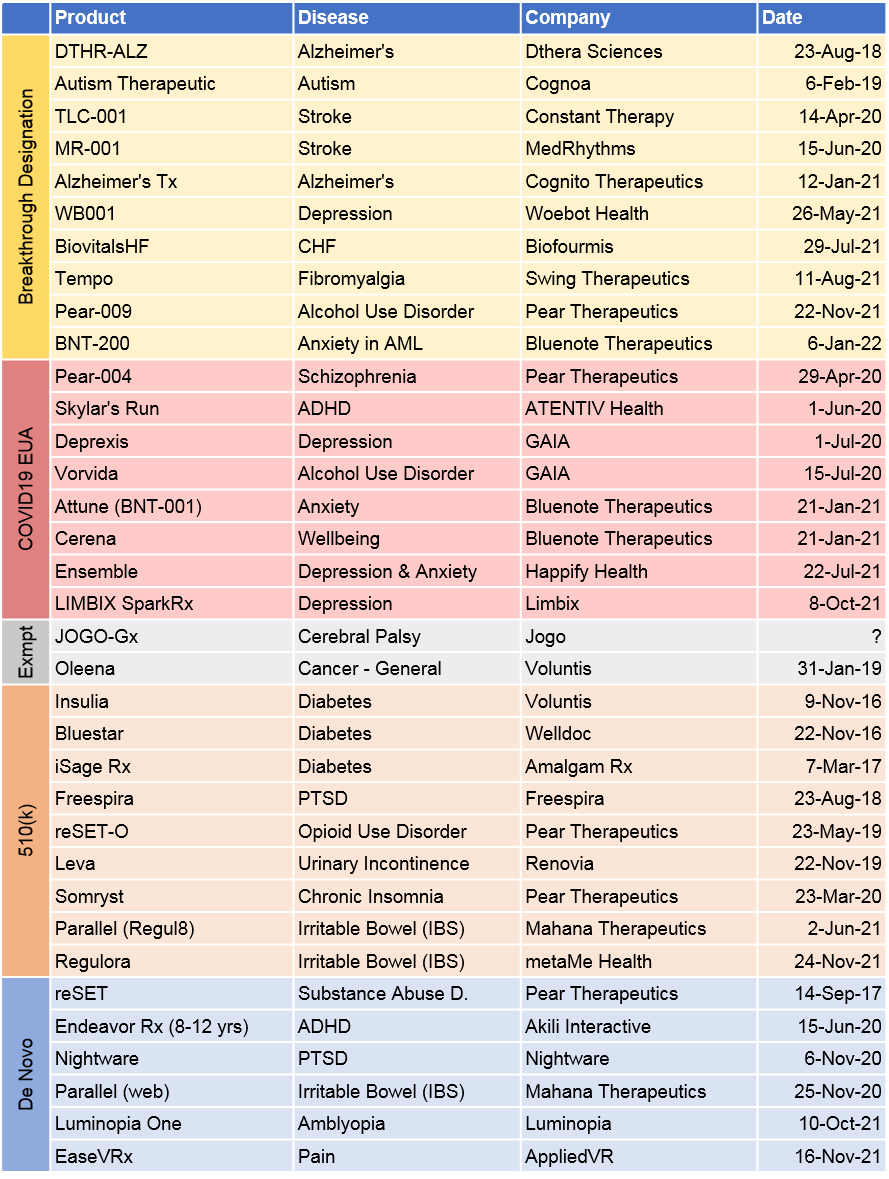

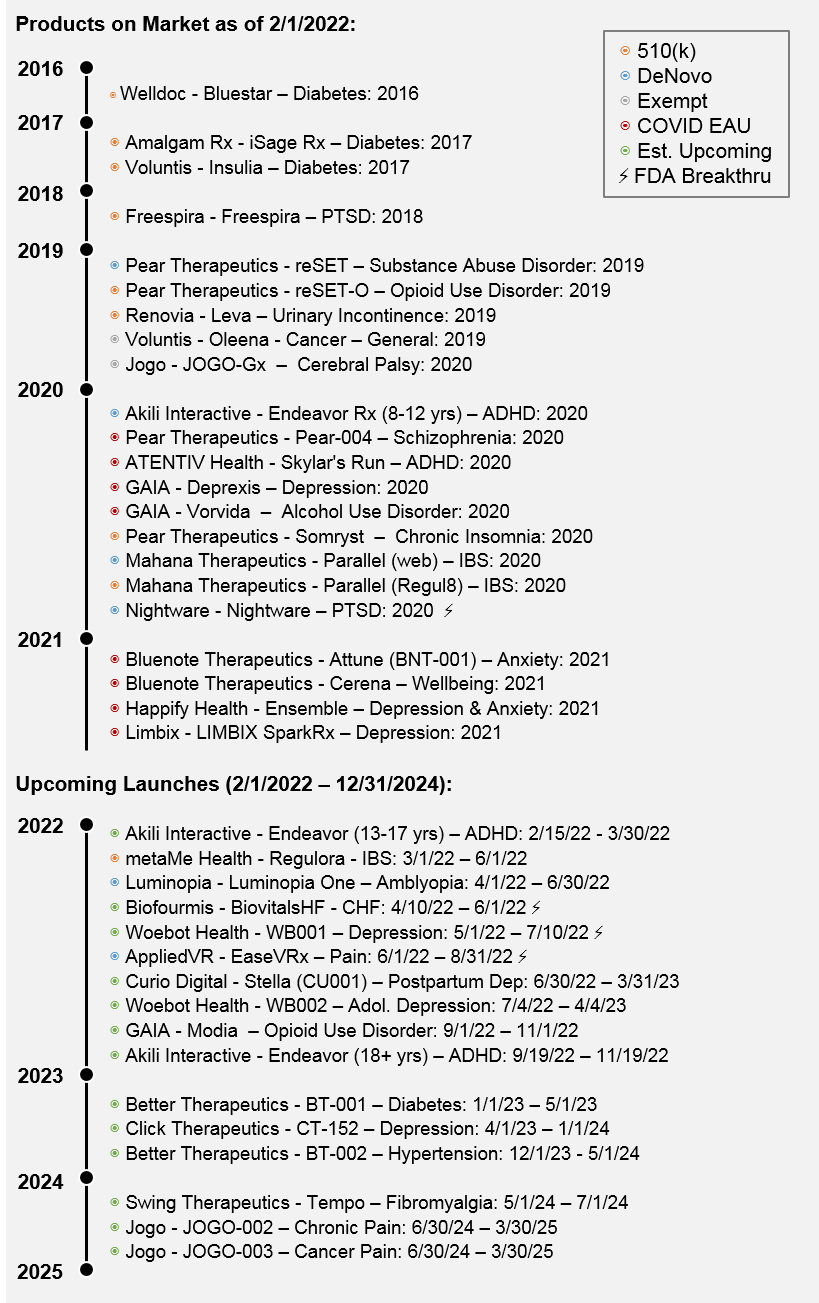

- 17 products have FDA market authorization as SaMD (mostly class II) including 6 via De Novo, 9 via 510(k), and 2 via FDA exempt/discretion. (See Figure 4)

- 22 PDTs are on-market / available as of Jan 31, 2022 with 14 PDTs authorized by FDA and 8 launched under FDA’s COVID Emergency Use Authorization (EUA). 3 PDTs with recent FDA authorization have declared launches upcoming in 2022 (Regulora, EaseVRx, Luminopia One). A few companies launched what appear to be unregulated products (4) while also suggesting FDA pursuit (Koa Health, Bold Health, and Beats), which we do not count. (See Figure 5)

- We estimate 21 PDTs are currently in late stage development based on pivotal trial activity (13), possible real-world evidence generation (RWE) through FDA’s COVID EAU (7), and with both FDA COVID EUA access and a pivotal trial (1). Notably, six of the COVID EUA products do not apparently have any pivotal trial activity to maintain marketing if the public emergency declarations are removed (Deprexis and Attune have some activity).

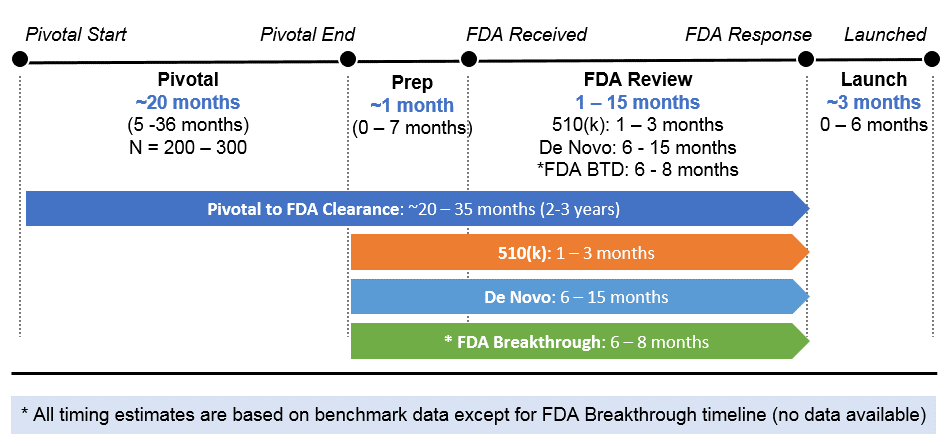

- Using PDTs as benchmarks, we estimate an average pivotal trial size of N=300 (N=200 for 510(k) and N=300 for De Novo and the average goes higher for those whose regulatory approach is not declared) taking ~20 months followed by a time-to-FDA clearance of either 1-3 months via 510(k) or 6-15 months via De Novo pathways. This would suggest a total horizon of 20 – 35 months (2 – 3 years) for products to gain FDA authorized commercialization once a pivotal trial has begun and acts as a useful upper-bound approximation of the time for any unexpected new market entrants. Do note three things: (A) 510(k) pathways may be accelerated even further if pivotal trial data is not required in certain instances; (B) Development programs not based on historical academic studies (e.g. Reset, Somryst) show a trend towards accelerated timelines in the 10-20 month pivotal range and 1 – 6 months for FDA clearance via either path which could reduce the overall pivotal start to FDA clearance estimate to 16 months or less (1.3 years); (C) Numerous FDA breakthrough designations exist in PDTs and may receive accelerated approval. (See Figure 6)

- For our “upcoming launch” analysis we estimated time to launch by taking the stated pivotal completion date plus either 1 – 3 months for 510(k), 6 – 8 months for FDA Breakthrough Designated products, or 6 -15 months for De Novo. We used our best judgment on 510(k) vs. De Novo pathways by product when considering novelty and precedents. (See Figure 6)

- According to our analysis we expect by the end of 2024 (3 years from now) there could be 38 PDTs available: 31 PDTs safely on the market via FDA authorization (14 currently available, 3 waiting to launch, and 14 additional entrants) plus an additional 7 that could be available based on handling of EUA launches. (Note Bluenote’s Attune is available via EUA but we expect it to be cleared eventually as it is in a pivotal currently). (See Figure 5)

- As a result, our data suggests that 16 PDT companies may be currently marketing products while 24 companies could be active market developers by the end of 2024 (notably 19 with at least one FDA authorized product and 5 via FDA COVID EAU which may be temporary), (See Figure 5)

The Results of Pressure and Time: Looking Ahead

Our starting hypothesis was that multiple PDT companies “pulling in the same direction” may help drive the demand generation needed for market development. Granted, there is no definitive answer in the analysis, but there is a fair amount to learn and consider for those interested in this market’s potential:

- PDT company activity could grow by >50% in 3-years: We estimate 24 total PDT companies could be commercially active within the next 3 years, which seems reasonably healthy and an improvement from the 16 companies currently in the market. In addition, for those with potential launch windows 2-3 years beyond this horizon, further demand generation and market development activities would also increase pressure.

- The sales and marketing action will be heaviest in CNS: Current data suggests a concentration of activity in CNS. This may indicate that psychiatrists–and possibly some neurologists and therapists–are the key physician targets that could lead to demand generation. In addition, reps from multiple PDT companies may start detailing them using different tactics and messaging. This could be either constructive or confounding, and may lend some support to the idea of coordinating efforts in some ways. Other targeted clinicians may include primary care physicians and pediatricians. However, there are orders of magnitude more of them than CNS treaters, which would drive up sales and marketing requirements and dilute the impact of each dollar spent. Lastly, true specialists, such as GI doctors and oncologists, may contribute some presence but are likely in the minority based on expected upcoming launches and a stronger focus on clinical decision support value from digital companion and disease management techniques.

- Start-ups, not “Big Pharma” will drive market development: Demand generation and market development appears to be mostly in the hands of start-ups. Only three products are currently associated with a pharma partner (Click/Otsuka, Gaia/Orexo, and AmalgamRx/Novo Nordisk). So, emerging PDT companies will likely take on the burden and invest the most in market development while having less capital available to do so. This will raise the risks to their performance that investors or shareholders must get behind.

- The “upper echelon” of PDT companies will set the pace: The five to ten PDT companies with the largest pipelines seem most poised to act as consolidation points if the market takes off (or possibly lags) with five (Pear, Akili, Click, Better, and Gaia) clearly appearing as the “tip of the spear” for the industry.

- PDT companies aren’t typically “slugging it out” with each other (yet): Few markets currently contain competition between rival PDT companies. However, depression, IBS, Insomnia and diabetes are the most likely early playing fields for understanding how this may work. Furthermore, this competition may bridge regulated and unregulated products. Time will tell whether this will be beneficial to market development or possibly a point of confusion that could negatively affect integration and adoption.

- The “fast-followers” will come: As a reminder to all, 510(k) pathways appear relatively easy to traverse, so fast-followers should be expected if the market begins to take off. The IP and brand protection for these products have not been tested yet and could be insufficient. Few of these solutions may be deploying feedback loops to drive superior product design to the degree that search engines (e.g., Google) or other data-based products have capitalized on to protect their markets.

At this point, we should give a nod to industry groups such as the Digital Therapeutics Alliance (DTA), HealthXL, and DiME for working as catalysts to “pull in the same direction” for some of the market development activities mentioned above. Their efforts are definitely valuable and appreciated. But, the driving force behind market development must primarily come from the brand teams, CEOs, CFOs, board members and others within the PDT companies themselves. The internal discussions within those emerging companies are where the real ownership and innovation will originate: It’s on them to make things happen.

In the end, we hope this may drive some interesting conversations within the PDT industry about how to best get over the early market development hurdle. Doing that may be the key to success for everyone. Best of luck to all you innovators…We’re here if you need some help!