This is the second post in a series from Blue Matter analyzing the potential impact of Most Favored Nation pricing being enacted in the U.S. If you are new to studying MFN, then please read Guidance for Evaluating MFN: Part 1 – Key Questions for Biopharma Manufacturers.

What new HHS guidance has been released on MFN?

Our first article discussed how MFN represents the potential for a fundamental shift in U.S. and global drug commercialization. Since the MFN Executive Order1 did not provide many details on implementation, manufacturers have been anxiously awaiting more specifics from the Department of Health and Human Services (HHS).

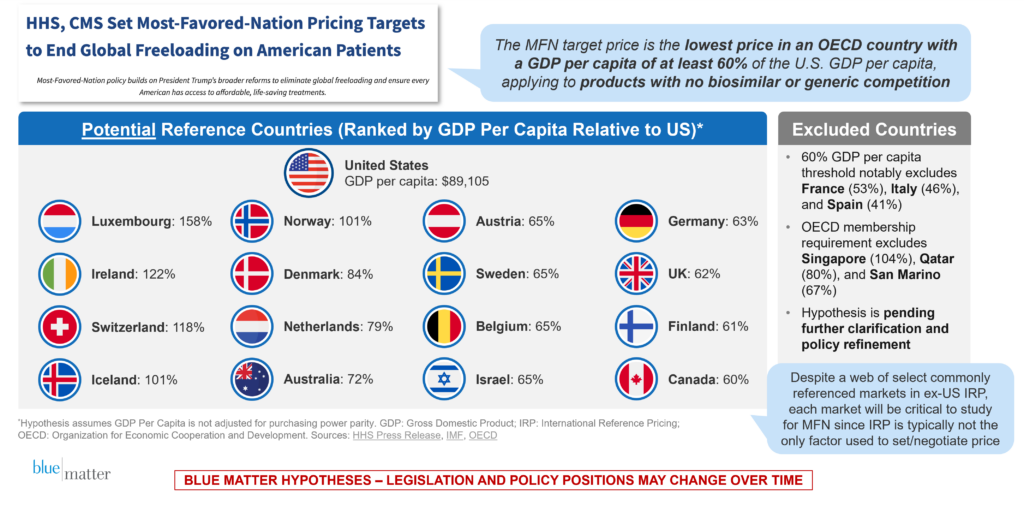

On May 20, HHS issued a press release2 clarifying that MFN target pricing will be announced for products that do not have generic or biosimilar competition, calculated as the lowest price amongst countries with at least 60% of the U.S. GDP per capita. The release did not provide guidance on whether the calculation will be adjusted for purchasing power parity, which would meaningfully impact the list of countries in scope.

For those of you who are curious about which countries may be in scope (assuming purchasing power parity is not included), please see Figure 1 below, which summarizes the HHS announcement and our understanding of the basket of reference countries.

Figure 1: Overview of May 20, 2025 Update from HHS on MFN Pricing and Initial Methodology for Identifying Candidate Countries for Price Comparisons

As a pharma leader, how are you preparing for MFN given the continued uncertainty?

Whether you’re early in product development or preparing to launch, you’ve probably been thinking about the potential impacts at the product and portfolio levels, and perhaps how MFN might affect your broader business model. Some questions that you may be considering include:

- How do we prepare for the future?

- How can my teams build new core competencies / capabilities?

- What would a larger scale direct-to-consumer model mean for our business and for our team structure?

Even if you’re in “watch and wait” mode, you may be trying to think through how you make long-term decisions when there may be short-term announcements that give more clarity. The world lives on speculation, and investors (whether venture capitalists or public) will be projecting how MFN may impact your business.

Each business has a unique risk related to MFN, which may depend on more than their own overseas products. For example, if a company has recently launched a product in the U.S. only, then it may still be exposed to MFN impacts if a direct competitor is required to lower its price due to cheaper overseas pricing. The indirect impact of MFN, even for manufacturers commercializing in the U.S. only, may manifest in price reductions or rebates necessary to obtain access from commercial payers or PBMs.

How are our channel partners and customers preparing for MFN?

During this period of uncertainty, it is critical to remember that U.S. biopharma companies exist within a complex ecosystem of channel partners and customers. Entire industries rely on the revenue extracted from the drug value chain, resulting in significant differences in the gross price and net price.

In 2023, the total value of gross-to-net reductions for branded pharmaceuticals was estimated to be $334 billion, an estimated 10% increase from the prior year.3 These reductions were due to government statutory discounts (e.g., 340B program) and rebates/discounts to channel partners and customers.

Before interacting with channel partners and customers, biopharma leaders should put themselves in their shoes. What are some of the existential questions those partners and customers are asking themselves to best prepare for MFN?

Channel Partners

- Specialty Distributors: How will product acquisition be impacted by potential delays in product launch due to MFN? What changes in demand should we expect from our customers due to MFN? How can we best prepare to support direct-to-consumer models while maintaining business-to-business (B2B)? What value-added services (e.g., storage, logistics) can we introduce considering MFN?

- Specialty Pharmacies: How negatively will MFN impact our margins for dispensing costly drugs? Should we minimize our inventory to prepare for potentially lower reimbursement in an MFN-driven world? How do we offset the lower reimbursement margins through additional dispensing? Do we need to adjust our product offerings? How do we establish confidence in our patient pool that we will continue to deliver life-saving drugs effectively?

- Retail Pharmacies: What is the impact of MFN to our business model in the near-term vs. long-term? How will this affect our relationships with PBMs? What products are our primary revenue drivers and how will they be impacted? What decrease in demand should we plan for due to the potential rise in direct-to-consumer models? What should we continue or discontinue to market direct-to-consumer while the impact of MFN is being realized?

Customers

- Pharmacy Benefit Managers (PBMs): How does MFN interplay with other ongoing legislation and investigations into our business practices? How will our revenue from rebates be impacted? What have we done proactively to plan for this (e.g., shifting revenue streams away from rebates) and how do we ensure we do not get sidelined by pharma? How much of a threat are direct-to-consumer models to our success?

- Health Plans: How will MFN lower our drug expenditures? How will this change our relationship with patients, health systems, PBMs, and pharmaceutical companies? For Medical Benefit products, how can we best plan for potential reductions in revenue obtained from rebates? How will we approach access restrictions for products that do not have to reduce price due to MFN?

- Group Purchasing Organizations (GPOs): How might price changes under MFN impact fee-based revenue structures? How will our business models adjust to accommodate potential shifts in pricing dynamics? What additional service offerings or capabilities should we consider to maintain revenue?

- Health Systems: How will MFN impact both our drug acquisition costs and reimbursement in the near-term vs long term? What is the impact of MFN across our patient payer mix (e.g., commercial, Medicare/Medicaid)? Does this vary at all for the outpatient setting (where reimbursement and acquisition cost may be directly impacted by MFN) vs. the inpatient setting (where acquisition cost may be primarily affected)? How should we plan for MFN in the context of potentially reduced 340B reimbursement? How should we effectively train our teams to understand MFN implications?

- Private Practices: How will MFN impact both our drug acquisition costs and reimbursement? What is the impact of MFN across our patient payer mix (e.g., commercial, Medicare/Medicaid)? What’s the likely impact on our net cost recovery? Will our business model be sufficient in a world where margins for drug administration have the potential to decrease? What should we do today to prepare for shifting margins? (e.g., reconsider practice service offerings, administrative overheads)

Looking Forward

As a leader in biopharma who must determine how to best interact and negotiate with channel partners and customers in an MFN-driven world, it’s important to consider the existential questions at the top of their minds. Please follow us on LinkedIn to learn about our future publications or reach out to us via our website to schedule a call. Our team will continue to monitor the MFN and broader policy landscape to understand potential implications for our clients.