The European Society for Medical Oncology (ESMO) held its annual congress in Paris last month, September 9-13. The conference provided a venue for multiple presentations in the cell therapy space. These presentations showcased data on the efficacy of cell therapies—mostly in solid tumors—leveraging multiple innovations, including a variety of cell types such as tumor infiltrating lymphocytes (TILs) and natural killer (NK) cells. Now that we’ve had a chance to “digest” some of this data, we’ll be sharing some of our team’s thoughts in a series of short blog posts.

Figure 1: Summary of ESMO Cell Therapy Publications by Phase, Tumor Type, Line of Treatment, and Type of Cell

The Rise of “Home Brew” Cell Therapies?

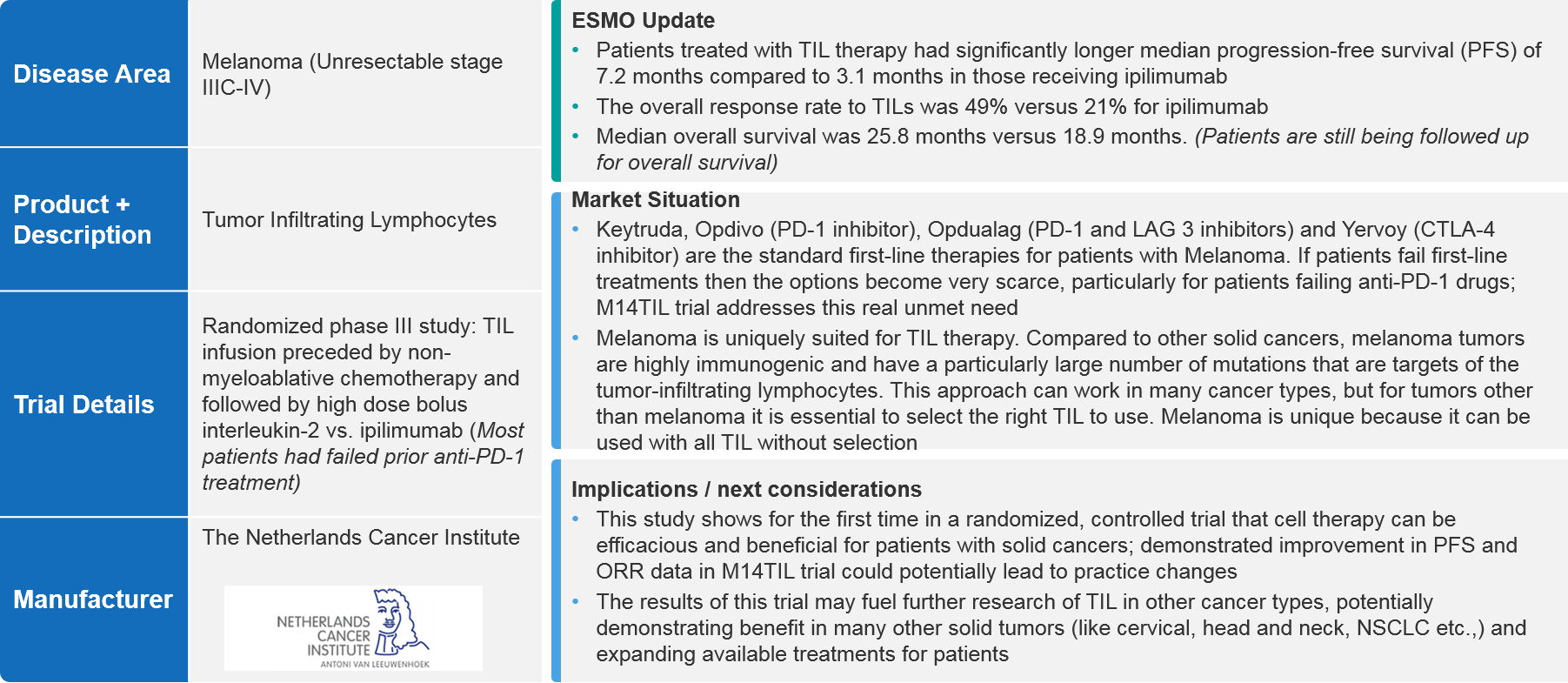

The Netherlands Cancer Institute (NKI) shared data from the first randomized, controlled phase III study comparing an autologous cell therapy using TILs to a checkpoint immunotherapy (Yervoy®). The data were quite compelling and demonstrated efficacy in unresectable stage IIIc-IV melanoma and has the potential to support a regulatory filing. Interestingly, those TILs were manufactured in-house by the NKI (a “home brew”) in a study that it sponsored on its own.

Figure 2: Overview of the Netherlands Cancer Institute M14 TIL Trial

While “home brews” are not the norm, the NKI is not unique in this regard. Other medical research centers are producing cell therapies in-house and sponsoring clinical trials. Many centers in the US and around the world are investing in GMP-compliant cell therapy laboratories, including Case Western Reserve University, the Fraunhofer Institute for Cell Therapy and Immunology, the Mayo Clinic, MD Anderson Cancer Center, the University of Alberta, Moffitt Cancer Center, and dozens of others.

This situation raises some interesting questions:

- Will the trend of medical research centers manufacturing their own cell therapies have a disruptive impact on how these therapies are manufactured and used in the future?

- If it is going to be disruptive, what are the implications for biopharma companies operating in the space?

These questions are important for several reasons. As centers become more involved in running trials on their own therapies, they may compete with biopharma companies for clinical trial patients. This could become especially acute if large institutions follow this route. In addition, the presence of “home brew” therapies have the potential to impact how biopharma companies position their products and how they engage with medical centers, patients, and other stakeholders.

Drivers and Drawbacks for Medical Centers

In this context, it’s important to consider the potential drivers for medical research centers to invest in manufacturing capabilities and clinical trials. It’s also important to consider some of the key barriers to this investment, as they will have a major effect on whether this trend will be disruptive to the space.

Key drivers include:

- Faster path to innovation – Medical research centers are at the intersection of bench and clinical science, potentially making it easier for them to translate ideas from the bench to the bedside (and vice versa, as experience at the bedside can highlight areas for potential study at the bench).

- Shorter turnaround time – To manufacture branded autologous cell therapies, cells must be harvested from the patient at a site of care (apheresis), shipped to the manufacturer for processing, and then shipped back to a site of care to be administered to the patient, usually under very tight time constraints and handling requirements. With “home brew” cells, there is no need to ship them back and forth, as all the processing is done at the site of care, resulting in a shorter turnaround time.[1]

- A less expensive option – Current CAR-T treatments cost around $400,000 (range $373,000 – $465,000). “Home brewed” therapies can potentially offer a treatment that is ~30% cheaper.[2] These savings would accrue to the treatment centers (in-patient treatment settings) and to patients (out-patient treatment settings). However, payer reimbursement must be in place in order to realize these savings.

While the drivers seem compelling, the reality is not that clear-cut. There are some potential drawbacks:

- Significant need for upfront and continuing investments – State of the art GMP-compliant manufacturing facilities are not cheap. A medical center would need to make a considerable up-front capital investment to build such a facility. In addition, maintaining a facility would require ongoing investments in infrastructure and personnel.[3] In addition, there is a need to continue and innovate the cell therapy product itself to keep abreast of the field.

- Regulatory barriers – In the US, modified cell therapies are covered under the 351 regulatory pathway that requires a Biologics License Application (BLA) to commercialize them. In line with that, medical research facilities would need to apply for (and gain) approval to commercialize their therapies, as well as secure reimbursement for them. To make home brew therapies more attractive to medical research centers, the regulatory pathway for some therapies could change to the 361 pathway, a similar pathway that covers stem cell transplants and does not require a BLA.[4] In Europe, the situation might be different. Some countries, such as the Netherlands and Spain, are working to carve out regulatory pathways for cost-reducing innovative medicines.[5] Recognizing the emerging need, the EMA is helping selected institutions to gain broader EMA approval.[6]

- The reimbursement gap is narrowing – In the US, in-patient cell therapy treatments are covered under a Diagnosis-Related Group (DRG) with a drug-specific carve-out. In the earlier days of cell therapy, the reimbursement for many therapies (such as CAR-Ts) did not come close to covering the costs of the treatment. This large gap between cost and reimbursement level presented an incentive for medical research centers to go the “home brew” route. Now, those gaps are narrowing considerably as reimbursement pathways catch up (however, medical centers may still lose money when offering CAR-T treatment), thereby reducing the incentives for medical centers to develop therapies in-house.[7]

Outlook

At this point, it’s difficult to predict whether “home brew” cell therapies will truly be disruptive to the space. In the US especially, the incentives for it seem to be diminishing. Especially under the current regulatory pathways, it seems less likely that large numbers of medical centers would want to take on the required investments—and risks—in clinical development, manufacturing, and reimbursement to go this route. They would, in some sense, need to become biopharma companies with the required infrastructure.

However, there is no denying the current trend. In addition, the regulatory situation in Europe could be more favorable to it, especially in cost-conscious markets. Also, there are no guarantees that the US regulatory environment remains static. Things do sometimes change. In summary, biopharma companies should continue to monitor “home brew” cell therapies with attention to potential regulatory changes that could make them more attractive to medical research centers.

End Notes

[1] David Mitchell, Saad Kenderian and S. Vincent Rajkumar; Letting academic medical centers make CAR-T drugs would save billions, STAT News, Nov. 20, 2019, https://www.statnews.com/2019/11/20/car-t-drugs-academic-medical-centers-save-billions/

[2] Andy Hoffman, Swiss to Take On Big Pharma With Cheaper Cancer Treatment, Bloomberg News, July 18, 2019, https://www.bloomberg.com/news/articles/2019-07-28/swiss-to-take-on-big-pharma-with-cheaper-cancer-treatment-nzz

[3] Renske M.T. ten Ham, et al; Estimation of manufacturing development costs of cell-based therapies: a feasibility study, Cytotherapy, 23 (2021) 730-739, published Feb. 13, 2021, https://www.isct-cytotherapy.org/article/S1465-3249(21)00004-9/pdf

[4] Geethakumari, P.R., Ramasamy, D.P., Dholaria, B. et al. Balancing Quality, Cost, and Access During Delivery of Newer Cellular and Immunotherapy Treatments. Curr Hematol Malig Rep 16, 345–356 (2021). https://doi.org/10.1007/s11899-021-00635-3

[5] Spain Approves First European-Developed CAR T-Cell Therapy for All, Association for the Advancement of Blood and Biotherapies, Feb. 19, 2021, https://www.aabb.org/news-resources/news/article/2021/02/19/spain-approves-first-european-developed-car-t-cell-therapy-for-all; and Patient’s own immune cells effective as living drug for melanoma, Netherlands Cancer Institute, Sept. 10, 2022, https://www.nki.nl/news-events/news/patient-s-own-immune-cells-effective-as-living-drug-for-melanoma/

[6] Brennan, Zachary, Cell and gene therapies from academia: EMA to help 5 projects going after unmet clinical needs, Sept 29, 2022, EndPoints News, https://endpts.com/cell-and-gene-therapies-from-academia-ema-to-help-5-projects-going-after-unmet-clinical-needs/

[7] Kamal-Bahl, et al, Barriers and solutions to improve access for chimeric antigen receptor therapies, Immunotherapy, vol. 14, no. 9, May 27, 2022, https://www.futuremedicine.com/doi/10.2217/imt-2022-0037