In part 1 of this series, we described the rapidly blurring line between medical devices and consumer wearables. Typically, medical devices are prescribed by physicians for purely medical purposes while consumer wearables are purchased by consumers for a variety of non-medical reasons, mostly related to general wellness. However, the two categories are beginning to overlap.

This “convergence” is causing some measure of disruption in the market, offering opportunities and risks to medical device companies as well as consumer wearables manufacturers. Here, in part 2, we explore the situation from the medical device companies’ point of view.

The case study on continuous glucose monitors (CGMs), outlined in part 1, illustrates the scale of the opportunity for medical device companies to move their technologies into direct-to-consumer (DTC) wellness and preventative health markets. How should manufacturers approach this opportunity?

Identifying and Prioritizing the Right Problem to Solve

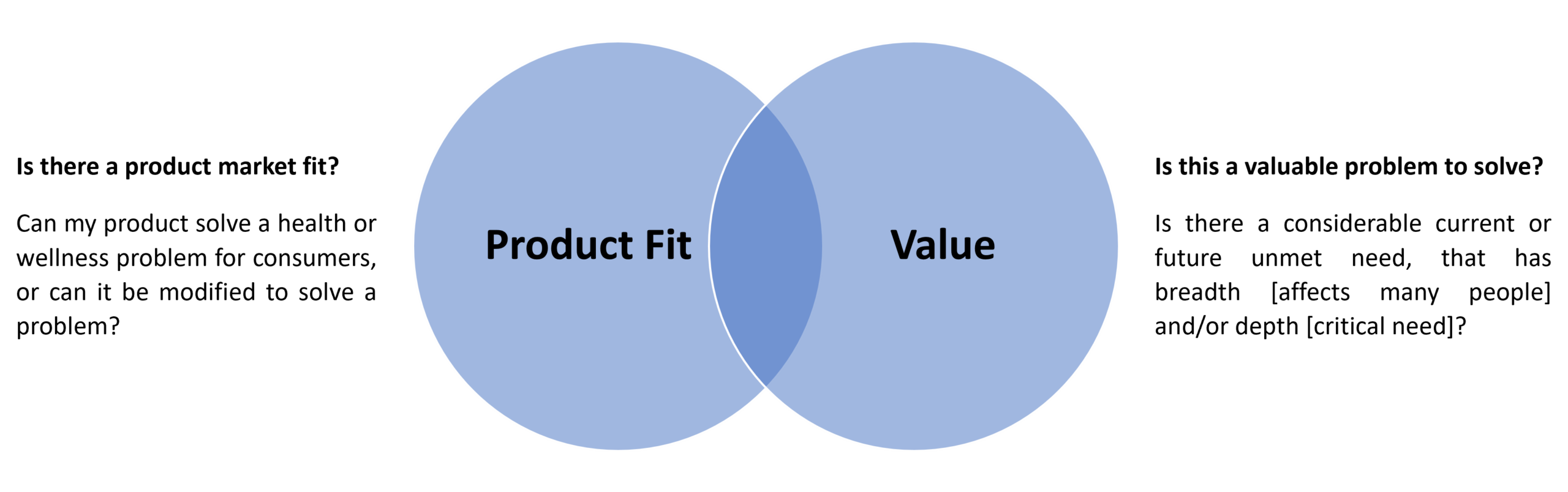

First, medical device manufacturers should assess the consumer opportunities adjacent to their existing medical device positioning to understand which consumer health applications represent the overlap of two key factors:

Answering the first question is highly individualized to the specific market positioning and product functionality of the firm. For example, looking at the CGM case study, there’s a clear opportunity in the metabolic health space. People with dysregulated metabolic systems that may eventually develop type 2 diabetes experience an extended period of blood sugar imbalances in the form of insulin resistance and then pre-diabetes. These imbalances are difficult to manage as they are often difficult for consumers to detect or understand. Medicalized interventions typically only start at the pre-diabetic stage or later, once symptoms become more prominent. This represents a clear unmet need that can be potentially addressed using CGMs, demonstrating product-market fit.

Turning to the second question, the potential consumer health value proposition of medical devices, we can start by examining which consumer-facing markets represent high-value opportunities. Recently, consumerization of health has driven huge growth in several key markets: metabolic health, heart health, and gut health. This growth has, in part, been driven by increased availability of consumer-facing solutions. However, the overall market context is not enough to guarantee that the specific overlap of product and market represents a valuable problem to solve. Companies in this position should also assess the value of the problem in terms of willingness to pay: are consumers, employers, or payers willing to pay to have this problem solved?

Capabilities and Workstreams Needed to Reach New Markets

Once the target opportunity or opportunities have been identified, manufacturers need to ensure they have the appropriate capabilities. Any gap in capabilities will be unique to the specific company and the gap between its historical and target business structure. Two considerations which are almost always applicable in the transition, are:

- Refined strategic planning and opportunity assessment processes

- A reworked focus on design principles, including user experience / user interface for consumer-facing applications

Additionally, many companies will need to consider new:

- Pricing or business model strategies

- Routes to market for their products

Below, we summarize each of these considerations.

Strategic Planning and Opportunity Assessment

The journey must begin with rigorous strategic planning, understanding which opportunities map to the specific company’s proficiency and overlap with consumer needs. This process ensures that manufacturers are not only aware of the market potential but also that they align their products and services with the areas where they can create real value and differentiation. These processes should be iterative and data driven, ensuring they are responsive to the fast-moving consumer health context.

Design Principles

User Experience (UX) and User Interface (UI) expertise: If the company plans to own the user experience, it must invest in the development of user-friendly touchpoints and interfaces. This requires not only technical proficiency in design but also an in-depth understanding of how consumers interact with health and wellness technologies. Effective UX/UI can translate into higher engagement, satisfaction, and ultimately, customer loyalty. There are significant differences between interface requirements for consumer health applications versus the company’s existing medical device requirements, so these should be assessed and rebuilt from the ground up.

New Use Cases: As medical device manufacturers move toward scenarios with little or no healthcare provider (HCP) supervision, a shift towards more autonomous usage by consumers is evident. This new landscape brings with it risk considerations that must be addressed through careful design and compliance measures. The absence of HCP oversight may also confine the device’s application to functions like screening and monitoring, limiting its scope. In this context, companies might consider emulating leaders like Abbott, creating consumer versions of medical devices that expand upon traditional use cases.

Designing for Consumer Segments and Needs: The transition to consumer-facing health and wellness devices requires a significant emphasis on specific consumer segments such as the worried well, peak performers, and those with chronic diseases. There must be a profound alignment with the unique needs and preferences of these varied groups, and different design and functionality considerations will be needed for each segment. This consumer-centric approach ensures that the products resonate with the evolving landscape of consumer healthcare.

Interoperability, Data Ecosystems: Medical device manufacturers may or may not have experience with device interoperability. Integration with other systems, including potentially application programming interfaces (APIs), will also be an important consideration to access consumer health applications. At a minimum the output of the device will need to be compatible with an associated app or platform. Investment in an API will enhance market potential overall, by increasing straightforward integration of data outputs with potential partner or ecosystem participant systems.

Implementation Challenges and Opportunities: This shift will necessitate more design time, the creation of new roles, extensive market testing, and potentially frequent updates or reiterations post-launch. The process requires manufacturers and designers to re-learn how to craft safe and effective devices in the consumerized healthcare landscape. Those companies with prior consumer product experience may find this transition smoother, while traditional manufacturers may face a steeper learning curve.

Pricing and Business Models

Manufacturers will need to consider pricing and business model strategy, a process which will generally be in collaboration with go-to-market partners. There are three typical business models to consider for direct consumer purchase of medicalized consumer wearables. If the go-to-market model is not DTC, then other approaches and strategies will apply.

The first DTC model is a straightforward ownership model: the consumer purchases the device up-front for a specified cost, then owns the device outright for its useful life. This model is not typically preferred, due to consumer preferences to limit higher up-front costs, and manufacturer preferences for ongoing revenue streams.

A subscription model may be more appropriate for many devices, in which consumers pay a regular fee to use the device and associated services. This model may be particularly appropriate for devices with consumables, such as the disposable sensors used in CGMs. Subscription models may also be a good choice for utilization-based models, in which the subscription fee varies based on consumer use of modularized services.

Lastly, various hybrid models might represent the optimal business model. The classic hybrid model is an upfront device payment along with ongoing subscription payments to access specific functions or features. A freemium approach can also be considered, typically most applicable for software devices, in which initial use of the device is free and consumers can choose to upgrade to paid use for more functionality, either through a one-time payment or an ongoing subscription.

For each of these models, optimal pricing will need to be assessed. Pricing is make-or-break in terms of market success, so in-depth pricing research is recommended. Pricing approaches can include

- Top Down (i.e. based on utility to the end user):

- Value-Based Pricing

- Market Penetration/Skimming

- Psychological Pricing

- Bottom-Up, such as:

- Cost-Plus

- Competitive

- Dynamic

- Combination of Top-Down and Bottom-Up Approaches

New Routes to Market: Evolving Go-to-Market Strategy

Companies moving into consumer health and wellness spaces will need to determine the optimal go-to-market strategy. Three potential routes to consider are going direct to consumers, working with an established partner in the new target market, and reaching end users through payers and employers. Each of these strategies can be employed independently or in combination with each other.

Regulatory Considerations: Consumer health and wellness applications of medical device-based functionality will typically invoke regulatory considerations. Many early movers in the space are currently conducting clinical trials to generate an evidence base, often in conjunction with complementary services to the core device functionality. This is of course highly individualized to the specific application in question, and this article should not be taken as regulatory guidance.

Direct-to-Consumer (DTC) Channels: If the decision is to approach the consumer directly, strong DTC channel development and advertising capabilities will be vital. This will involve assessing and prioritizing channels to reach consumers, and developing a nuanced understanding of consumer needs, preferences, and behaviors, and creating tailored campaigns that speak directly to those unique requirements. By embracing a DTC approach, manufacturers can foster a more personalized connection with consumers, positioning their products as essential solutions within the broader health and wellness ecosystem.

Targeting Payers and Employers: Manufacturers should explore opportunities to target payers and employers with preventative programs or wellness initiatives. By focusing on these stakeholders, they can position their products as integral tools for enhancing overall health, reducing healthcare costs, and fostering a healthier workforce. These collaborations can create win-win scenarios where both employers and employees benefit from improved well-being, and manufacturers find new channels to drive growth.

Partnerships and Collaborations: Another strategic avenue to consider is partnering with existing companies or wearables that focus on relevant segments of consumer health. As an example, for metabolic health, relevant partners might have a significant user base focused on weight loss, nutrition, and exercise recovery. Collaborations can leverage the complementary strengths of both parties, allowing manufacturers to enter new markets with a more robust and competitive offering. By aligning with established players in these specialized fields, manufacturers can accelerate their market entry and enhance their value proposition.

White Labeling: A specific approach within the partnership and collaboration consideration is that companies may want to consider white labeling their medical device product for consumer use. White labeling is the practice of a manufacturer supplying the product, which is then branded by the retail or consumer-focused partner with their brand. Consumers are then typically not aware of the underlying manufacturer. This has the advantage of further incentivizing partners to develop this emerging market and allowing partners to develop their own brand equity. Additionally, it reduces risk to the core HCP-focused medical device brand. However, this comes at the cost of the medical device manufacturer developing their own brand equity in the consumer health space and prevents the development of a brand halo effect for consumers who may drive medical device selection in the same therapy area in the future.

Coming Next

Clearly, the growing convergence of consumer wearables and medical devices signifies a monumental shift in the healthcare and biotech sectors, opening up new avenues for medical device manufacturers to diversify into consumer wellness and preventative healthcare.

However, this evolving environment also offers opportunities and risks for manufacturers of consumer wearables. In part 3, we’ll explore the situation with their perspective in mind.