Over the course of this series, we’ve covered gene therapies in some detail. We have outlined how they differ from more “traditional” therapeutics and explored how those differences can affect many aspects of development, delivery, and commercialization.

Interested readers can access the previous three installments via the links below:

- Part I provides an overview of gene therapies and reviews three key factors that companies must consider prior to commercialization: the available market infrastructure, the patient experience, and market access challenges.

- Part II offers a deep dive on a fourth factor: the complex supply chain requirements.

- Part III focuses on another very important factor: the significant cost drivers associated with gene therapies.

In this final installment, we look at how the factors mentioned above come together when planners decide whether and how to enter markets with a gene therapy. It’s important to note that there are many strategic components that any biopharma company must consider. It’s far beyond the scope of this article to address them all in detail here. However, we describe some (as appropriate) for companies working to determine which markets to enter and how to enter them.

Deciding Which Market(s) to Enter

When evaluating potential markets, a company will weigh a range of different factors that could relate to the market(s) themselves or be highly specific to the company’s own circumstances. Some of these factors include:

- Level of Unmet Need – It’s pretty much common sense to go where the need is greatest and to “set up shop” where the patients are. However, it’s not always that simple, as a high level of unmet need can be offset by other factors.

- Healthcare System Infrastructure / Potential – It’s important to determine whether a given market has the infrastructure to support—and pay for—a gene therapy. If it doesn’t, then it may (or may not) be worth the investment required to make it work. A detailed analysis is needed to make that decision.

- Level of Investment Required – What will the company need to buy, build, and/or install into a market in order to maximize uptake? Again, leaders will need to analyze a given market to see what will be required and whether the market is worth it over the course of their planning horizon.

- The Company’s Vision and Strategic Context – A company’s long-term vision can play a major role in decision-making. If the goal is to be a long-term player in gene therapy, then it might make sense to make significant investments in establishing CoEs, creating strong supply chains, and hiring robust teams even in markets that—in theory—have “lower” potential. Similarly, a company might decide to enter otherwise challenging geographies (such as various African markets) because it aligns with its overall ethos and because it would help the firm build necessary gene therapy experience that can ultimately carry it into other markets. There are a number of reasons that might compel a company to invest in a market that might not fare as well when it comes to other factors.

Making the decision to enter a market—or to prioritize one over another—typically involves considering a range of factors that sometimes contradict one another. It’s up to a company’s leadership team to weigh these factors against one another, make the necessary trade-offs, and prioritize markets as appropriate.

Basic Market Archetypes

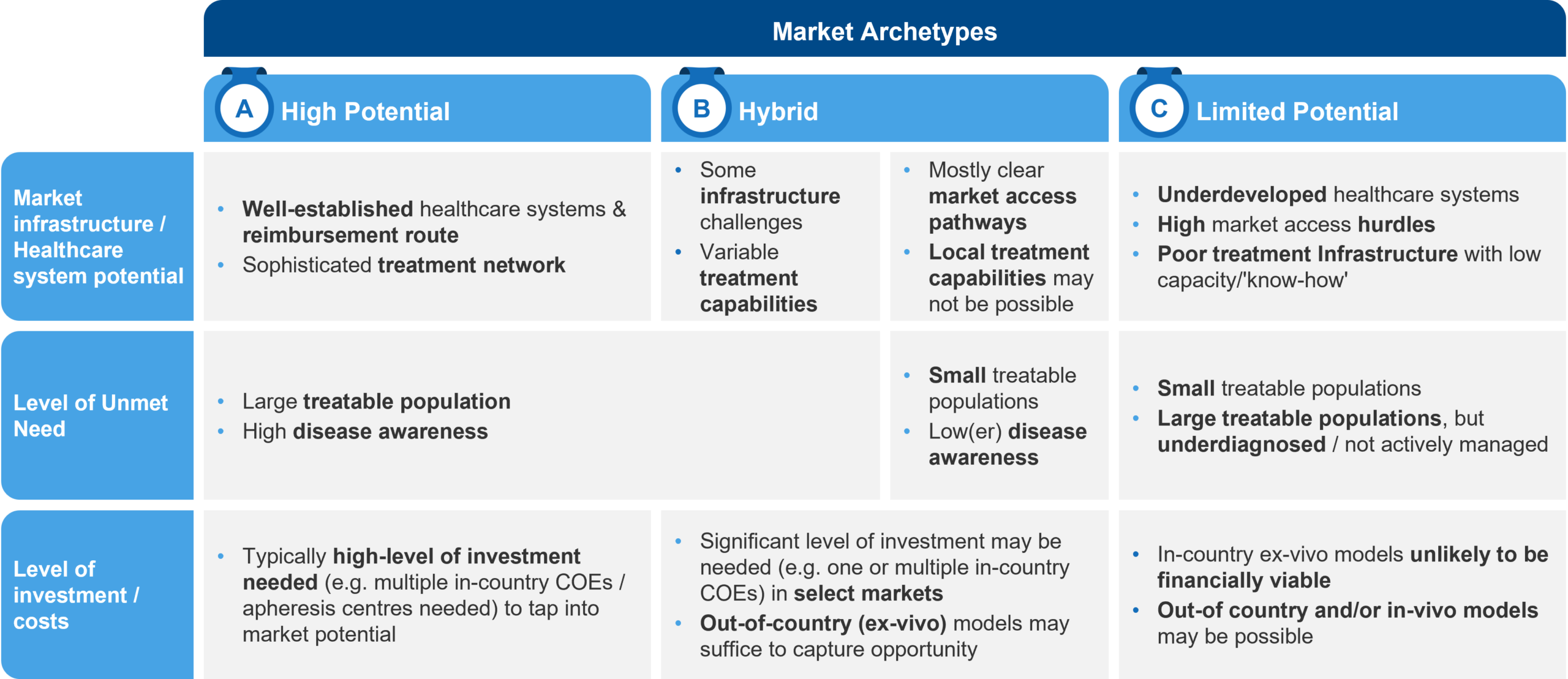

Obviously, not all geographic markets are the same. Different jurisdictions can demonstrate extreme variability when it comes to things like patient population, healthcare infrastructure, the ability to pay or provide access, and so on. When working to evaluate potential markets, it can be helpful to group them by archetype. This can provide a handy framework for prioritization and decision making. We find it helpful to group markets into three broad archetypes.

High Potential Markets

High potential markets tend to be the “usual suspects,” such as the US and major European markets like the UK, Germany, France, Italy, and Spain. They tend to have large-enough patient populations, high disease awareness, well-developed healthcare infrastructures, and the level of market access receptivity that’s needed to support gene therapies.

These markets usually require high levels of investment through in-country models to capture their full potential. As a result, they also need a “high-touch” model from an organizational perspective with in-country roles to support the establishment of a treatment network and to provide ongoing support to the Centers of Excellence (CoEs) that administer therapy.

Hybrid Markets

As the name implies, these markets need to be assessed on a case-by-case basis. Depending on the disease in question and the epidemiology, some markets that are traditionally considered to have “lower potential” might require closer attention. For example, thalassemia and sickle-cell disease (SCD) are disproportionately prevalent in Mediterranean countries—such as Greece, Turkey, and Egypt—that don’t necessarily have the right mix of infrastructure and market access receptivity. However, given the relatively large patient populations and the high level of unmet need, these markets might be quite attractive from a commercial standpoint and justify a significant investment to realize their full potential.

On the flip-side, northern European / Nordic markets have strong healthcare infrastructures and a high ability to pay. However, they have such small thalassemia / SCD populations that out-of-country or regional models (e.g., using one Nordic country as a hub) leveraging a “light-touch” team might make the most sense from an investment perspective.

Limited Potential Markets

These markets typically have underdeveloped healthcare systems with poor infrastructures and a low ability to pay for expensive gene therapies. These factors can dramatically reduce the viability of any significant investment.

Continuing with the example of thalassemia and SCD, this could include countries in Africa or southeast Asia that technically have vast potential because of very high prevalence. From a practical standpoint, though, they are very hard to tap into. Even with high prevalence, the (often) lower rates of diagnosis can make it very difficult to mobilize the patient pool.

The situation becomes even more challenging with ex vivo therapies which require a sophisticated healthcare infrastructure and a high ability to pay. Such markets may require either humanistic access models or may be more suited to in vivo or “2nd generation” ex vivo models that come with process improvements and cost optimization, making the investment more sustainable both for the company and the local governments / payers.

Figure 1: Overview of Market Archetypes and Their Characteristics

Deciding How to Enter a Market

Once a market has been identified as attractive, the question of going-it-alone vs. going with a local partner becomes critical. As more gene therapies are launched, local partners become more experienced, build strong local connections, and ultimately may provide a more suitable entry path than trying to build the required team and infrastructure from scratch.

Deciding on the best approach involves weighing the potential trade-offs of one against the other. A company may decide to go alone because no suitable partners are available. Or, even if a partnership is possible, a company may decide that it’s still in its best interest to go alone and retain more control over the business and how the product is promoted. Given the complexity and cost of gene therapies, keeping that control might make the most sense, particularly in high potential markets.

In lower potential environments or highly unfamiliar markets, a partner may be preferred if one can be found, particularly when local expertise is needed to manage challenging infrastructure or negotiate in complex, convoluted, or underdeveloped reimbursement environments.

Parting Thoughts

Developing a comprehensive commercial strategy for any new therapy is a complicated endeavor. For a gene therapy, the complexity increases dramatically. Effective planning requires a comprehensive and nuanced understanding of the potential markets and their related infrastructures, the patient experience, the market access environment(s), the supply chain requirements, and the cost drivers. It also requires the ability to weigh often contradictory or competing factors when deciding which markets to enter and whether to go-it-alone, partner, or out-license (again, often on a market-by-market basis).

Hopefully, this series of articles has provided readers with a better understanding of the factors to consider and a beginning framework for commercial planning. For more information, or to discuss how to optimize commercial strategy for a gene therapy asset, please contact nkontos@bluematterconsulting.com.