Last year we examined cell-based therapies through both scientific and commercial lenses. Over the last year, the field has dramatically advanced beyond the recently approved CD-19 CAR-T therapies (KYMRIAH and YESCARTA) into novel cell types and designs with potential across tumor types. In this first part of a two-part series, we will review recent and anticipated near-term clinical, regulatory, and commercial updates. In the second paper, we’ll explore some evolving challenges and innovative solutions for cell-based therapies.

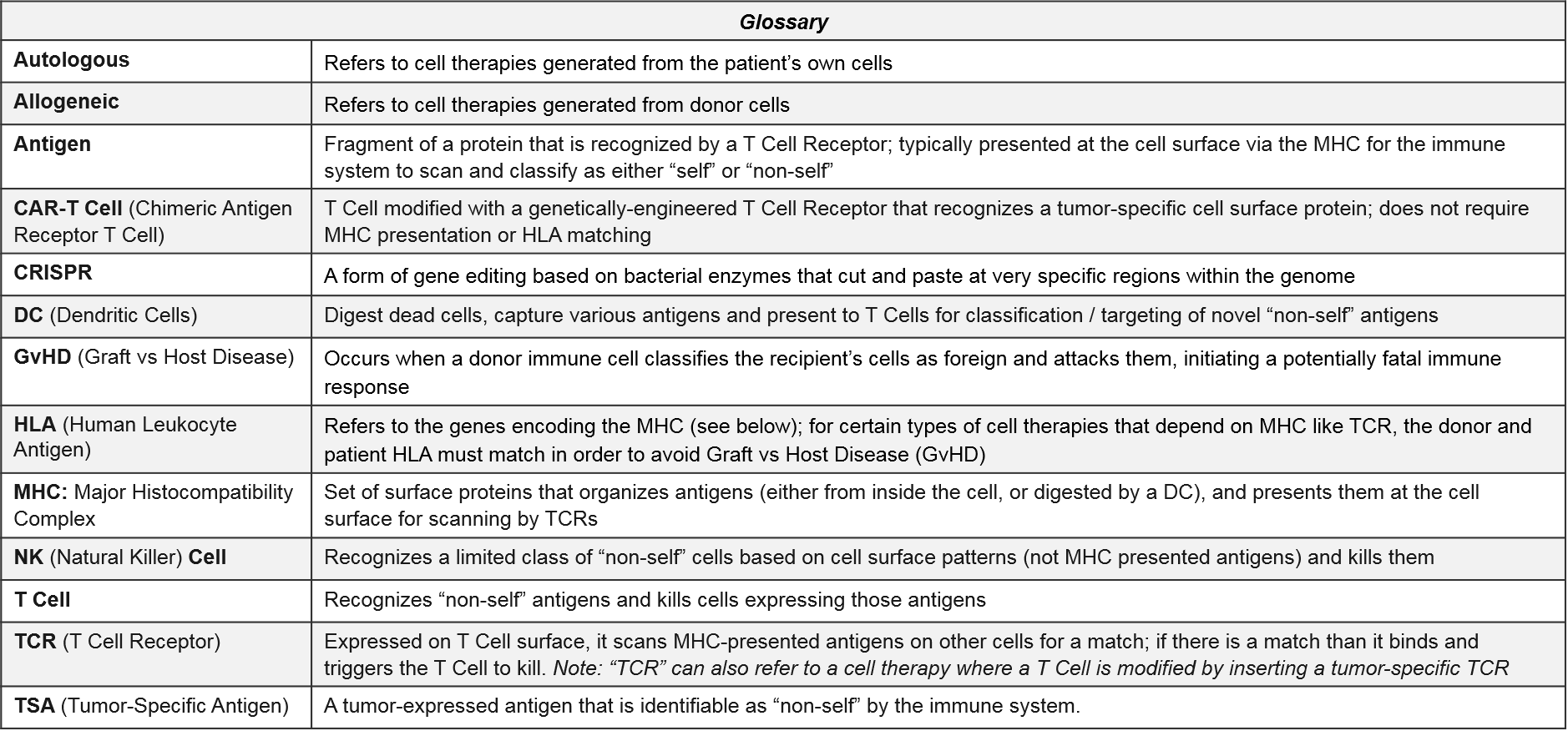

Introduction to Cell-Based Therapies

Researchers and drug developers continue to advance our ability to unlock the cancer immune response. The cancer immune response is a uniquely powerful treatment because when it works, the individual’s immune cells identify cancer cells as “non-self” and kill every tumor cell regardless of how advanced it is or how far it may have spread throughout the body. This can happen naturally, and likely does as seen in historical cases of spontaneous remission. But it is only possible when the immune system is able to recognize tumor cells as “non-self” and successfully activate tumor-specific T Cells. The goal of cancer immunotherapy is to boost or force tumor-specific immune cell recognition and activity, bypassing or overcoming whatever mechanism(s) of resistance are currently blocking immune function. As we have seen with the checkpoint inhibitors and other immunotherapies, when it works, it delivers a strong and durable (even curative) response.

Cell-based therapies differ from other immunotherapies such as the checkpoint inhibitors because they are not small molecule or antibody drugs intended to adjust molecular signaling pathways. Rather, they use living immune cells that have been modified to drive an immune response to tumor cells. There are currently three immune cell types with therapies in the clinic or already approved: Dendritic Cells (DC), T Cells, and Natural Killer (NK) Cells.

- Dendritic Cells do not kill tumor cells directly. However, they work upstream by capturing tumor-specific antigens and presenting them to T Cells to activate and target them to the tumor. DC cell therapies are intended to boost and activate the function of a patient’s existing and non-modified Dendritic Cells.

- T Cells are the classic “killer” cytotoxic immune cells with the ability to recognize and kill foreign cells. Their killing ability is based on highly-specific T Cell Receptor (TCR)-to-“non-self” antigen binding, which activates the adaptive immune system to recognize and respond to those antigens now and in the future. Some T Cell therapies are genetically modified to replace the existing T Cell Receptor (TCR) with either a tumor specific TCR or a Chimeric Antigen Receptor (CAR).

- NK Cells are also cytotoxic immune cells. They are the effectors of the innate immune system, a more primitive type of immunity with more limited ability to recognize foreign cells. Unlike T Cells with their variable TCRs, the entire NK Cell population recognizes the same, fixed set of cell surface patterns and cannot (naturally) be activated to respond to new antigens. NK cell therapies are therefore aimed at forcing recognition of tumor specific antigens.

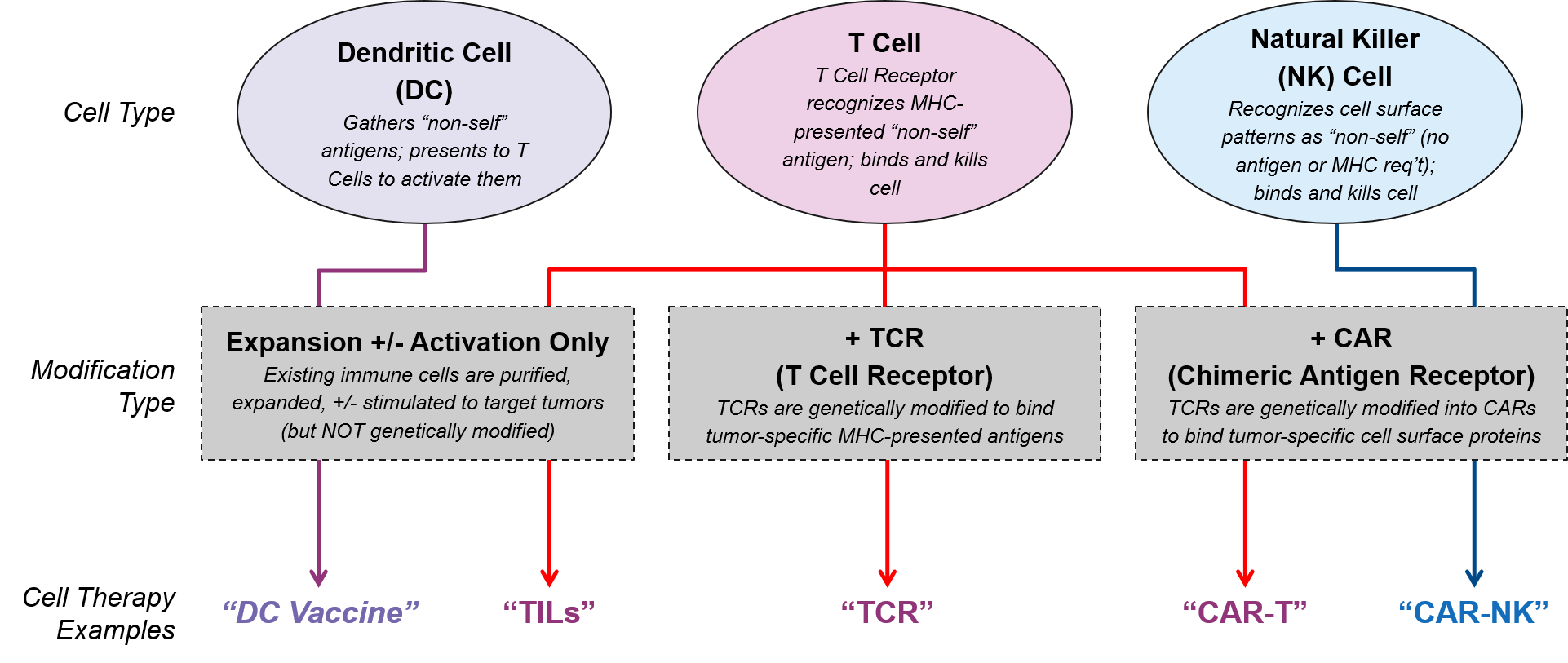

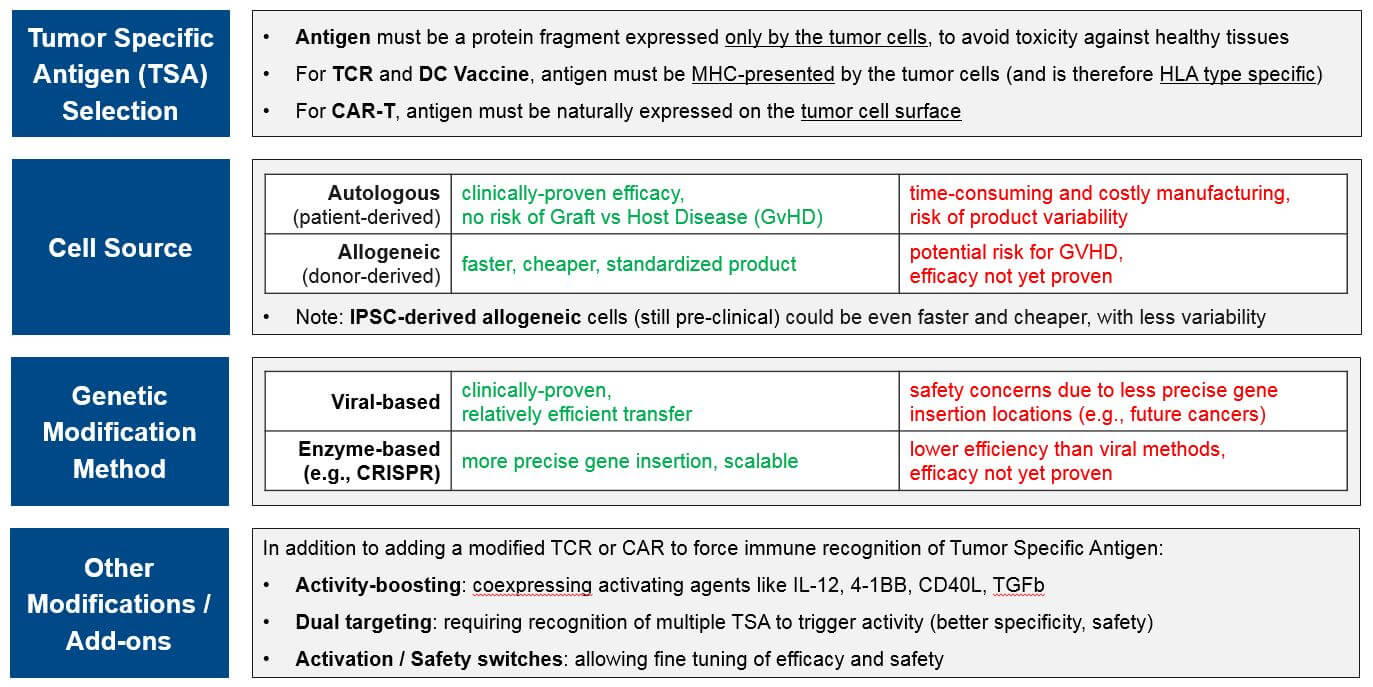

Researchers and drug developers modify these immune cells in different ways, leveraging the intrinsic capabilities of each cell type and enabling them to bypass various mechanisms of immune resistance. This adjustment may simply involve removing a patient’s existing immune cells, culturing them to produce more, and / or stimulating them to be stronger (e.g., TILs). Or it may be as complex as obtaining donor-matched immune cells and genetically modifying them so they can detect tumors (e.g., swapping out their existing TCRs for tumor-specific CARs or TCRs). In addition to these high-level design decisions (cell type and primary modification), cell therapy designers must also choose between various other design criteria, each with benefits, drawbacks, and other considerations:

The cell-based DC vaccine therapy PROVENGE was approved nearly 10 years ago. However, it wasn’t until the dual approvals and market successes of the CD-19 CAR-T cell therapies KYMRIAH and YESCARTA in 2018 that cell-based therapies became major players in the commercial space. With their unprecedented combination of curative potential and highly complex, costly manufacturing requirements, these therapies are forcing manufacturers and the marketplace to reevaluate manufacturing, drug pricing, and reimbursement models. In 2019, there have been significant commercial and clinical updates for these approved therapies as well as numerous commercial stage assets.

Key Questions, 2019 Updates, and Upcoming Milestones: Overview

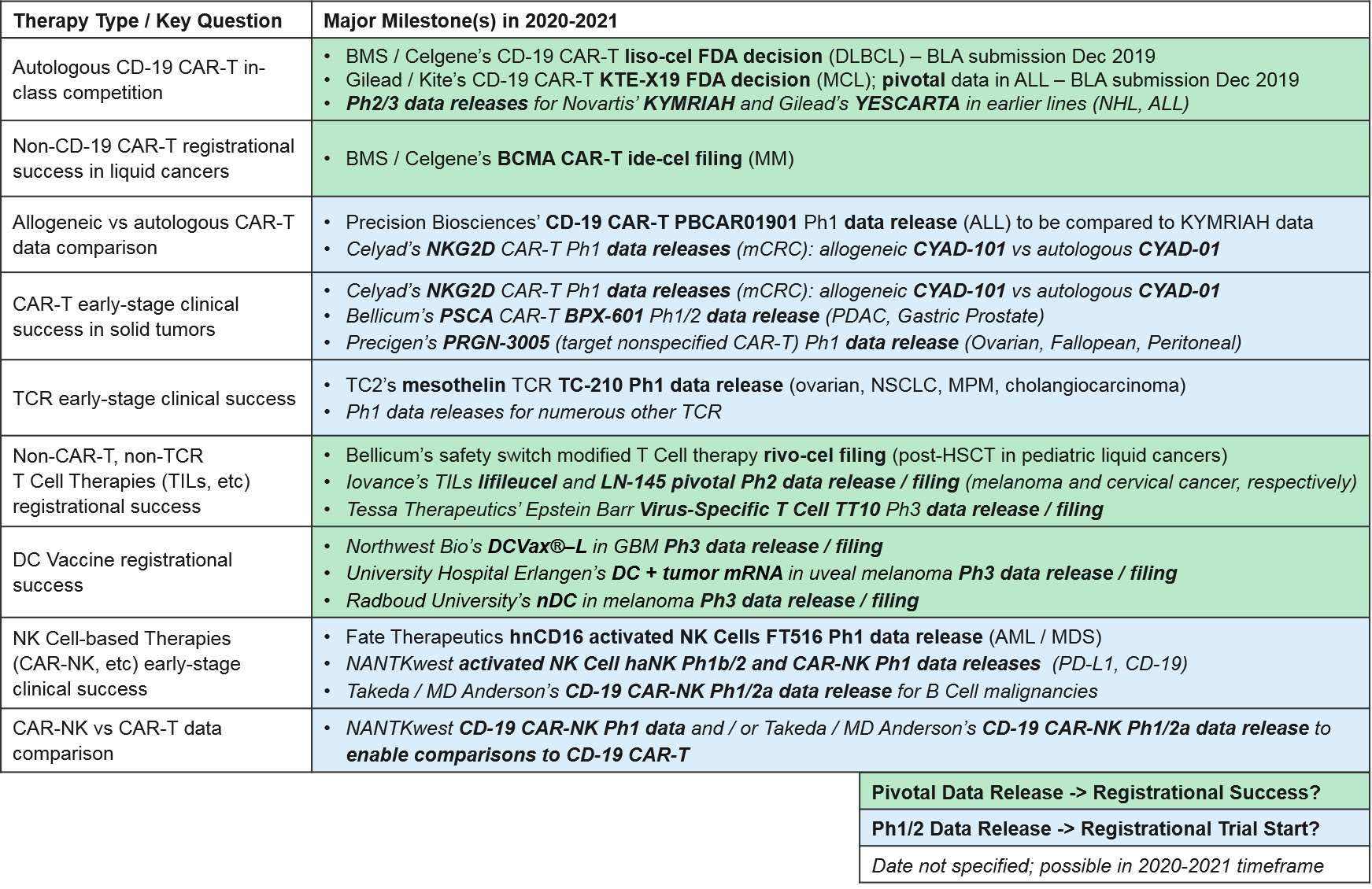

While there have been no new cell therapy approvals in 2019, over the next 1-2 years, we anticipate numerous data releases and several filings / potential approvals. These will inform the overall positioning of the various types of cell-based therapies and enable comparisons between different types, for example autologous (patient-derived) vs allogeneic (donor-derived) CAR-T and CAR-T vs CAR-NK. Specifically:

Autologous CD-19 CAR-T in-class competition: Recent Updates and Near-Term Outlook

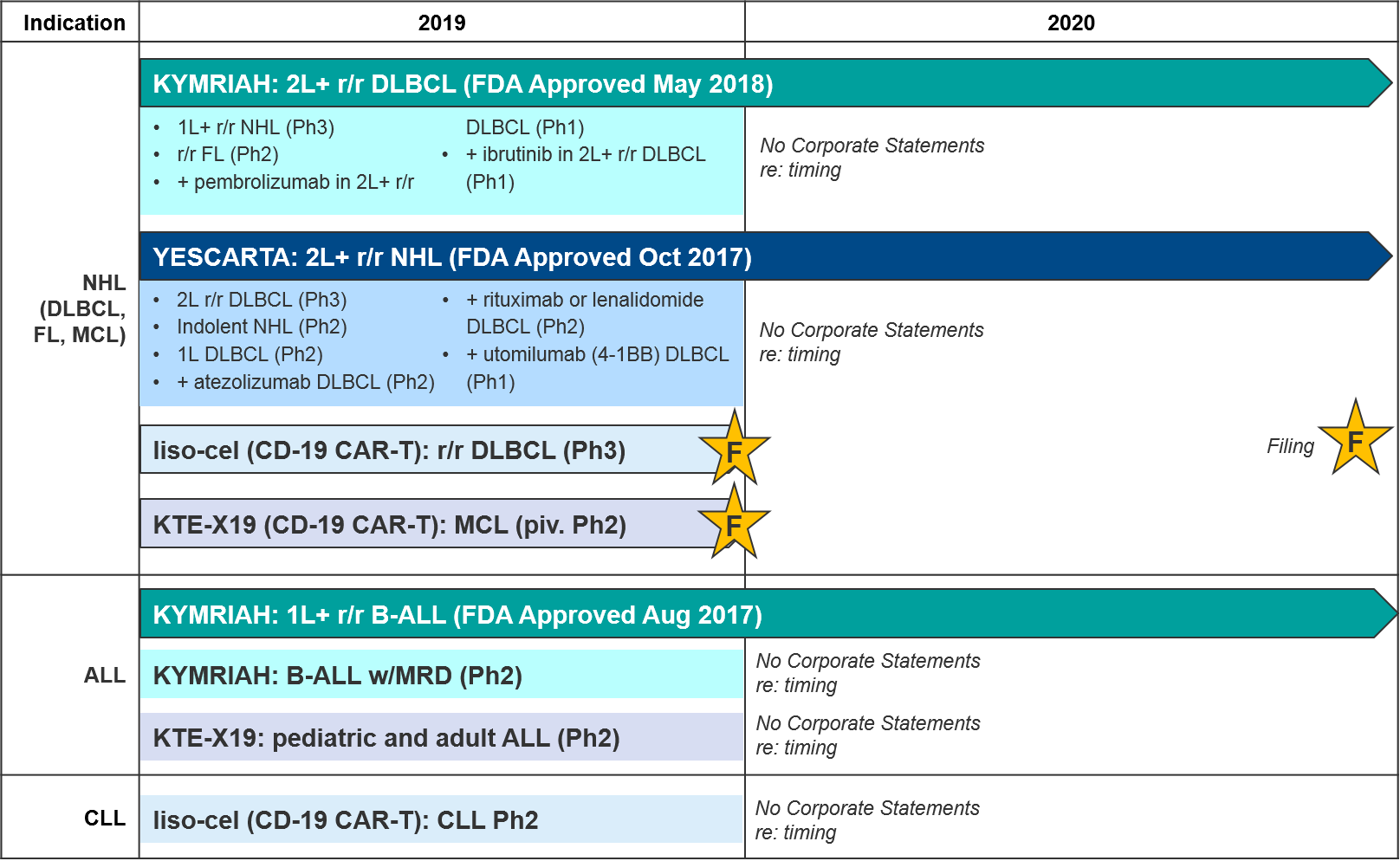

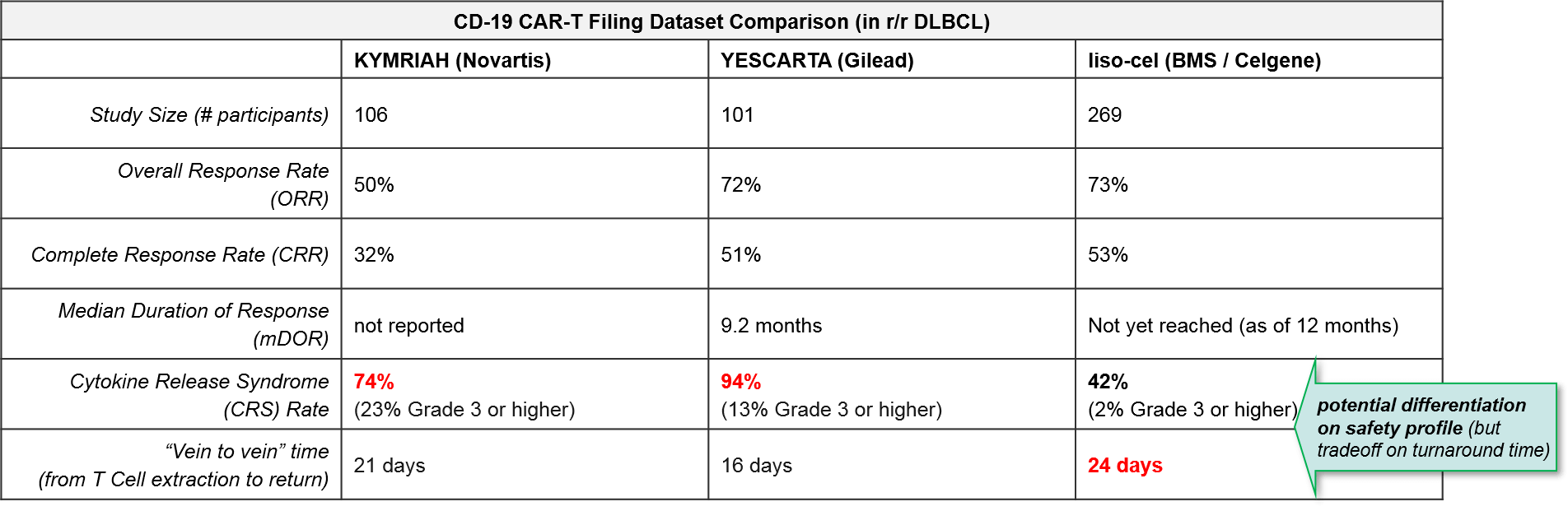

The most established and competitive arena for cell-based therapies is the CD-19 CAR-T therapies in leukemia / lymphomas. There are two approved agents and two more awaiting FDA decision on Biologic License Application (BLA) submitted in December 2019: KYMRIAH (Novartis), YESCARTA (Gilead), liso-cel (Celgene, now BMS), and KTE-X19 (Kite, now Gilead), respectively.

In August 2017 Novartis’ KYMRIAH was the first of the CD-19 CAR-Ts to be approved, for 1L+ relapsed / refractory B Cell Acute Lymphoblastic Leukemia (B-ALL). KYMRIAH underperformed in 2018 due to manufacturing difficulties, delivering $76M (vs the projected $159M). This year, Novartis successfully expanded KYMRIAH into 2L+ relapsed / refractory Diffuse Large B Cell Lymphoma (r/r DLBCL) with NICE coverage in February and FDA approval in May, achieving $182M in revenue for the first three quarters of 2019. However, Novartis has continued to struggle with KYMRIAH manufacturing issues with a failure to produce treatment 10% of the time, and other treatments failing to meet FDA commercial product standards. These “out-of-spec” treatments are made available to patients via an expanded access program, but Novartis cannot charge for them. In December, Novartis released real-world data that showed that out-of-spec KYMRIAH product was equally efficacious and safe, setting the stage for them to argue for a loosening of this FDA requirement.

In October 2017, Gilead’s YESCARTA was FDA approved for 2L+ r/r Non-Hodgkin Lymphoma (NHL) and delivered $264M in 2018. While Scotland’s NHS rejected coverage for YESCARTA in February 2019, Gilead released robust 2-year survival data in June, and YESCARTA delivered $334M for the first three quarters of 2019 (as compared to $183M for the same time period last year). In December, Gilead released additional data showing that a single dose of YESCARTA prolonged survival by ~25 months and that almost half of recipients were still alive at 3 years.

Gilead also has another CD-19 CAR-T in pivotal Ph2: a version of YESCARTA called KTE-X19 with a different manufacturing process that includes an additional expansion of white blood cells. In December KTE-X19 delivered positive data in MCL with 93% Overall Response Rate and 67% Complete Response. Gilead submitted a Biological License Application (BLA) for FDA approval in December 2019 and has announced they will file EMA approval in 1Q2020. KTE-X19 is also in Ph2 for ALL, where it could potentially compete with KYMRIAH if approved.

Hot on their heels comes BMS / Celgene’s CD-19 CAR-T lisocabtagene maraleucel (liso-cel), which also submitted a BLA in December 2019. BMS / Celgene released data earlier December 2019 confirming comparable efficacy to KYMRIAH or YESCARTA but notably lower rates of Cytokine Release Syndrome (CRS). This dangerous side effect occurs when the immune system “overreacts” to the antigen and induces a systemic inflammatory response that can be fatal, and liso-cel’s notably lower rates offer a potential differentiation strategy for this product. That said, liso-cel is also the slowest to produce, taking 24 days vs YESCARTA’s 16 days.

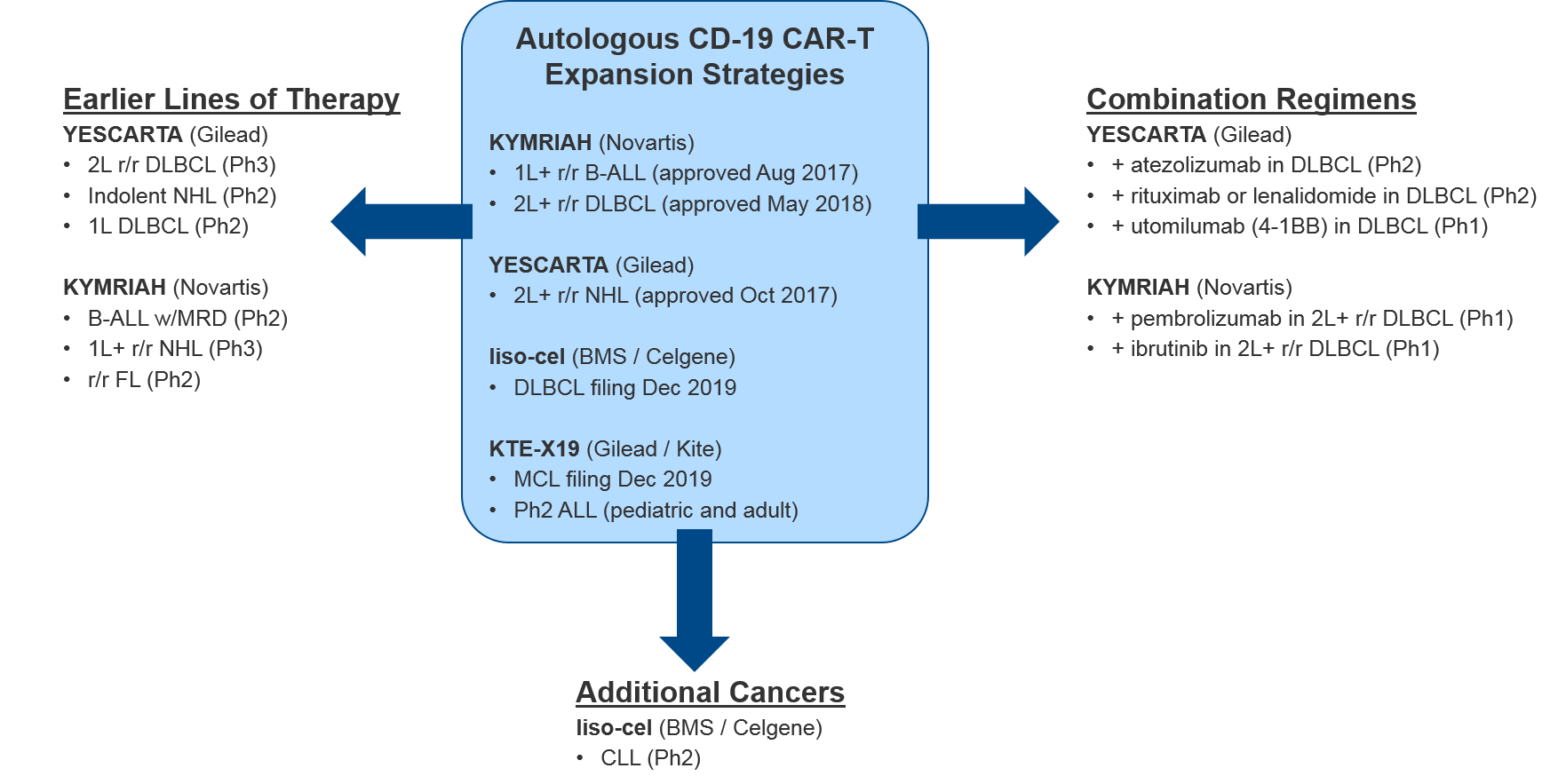

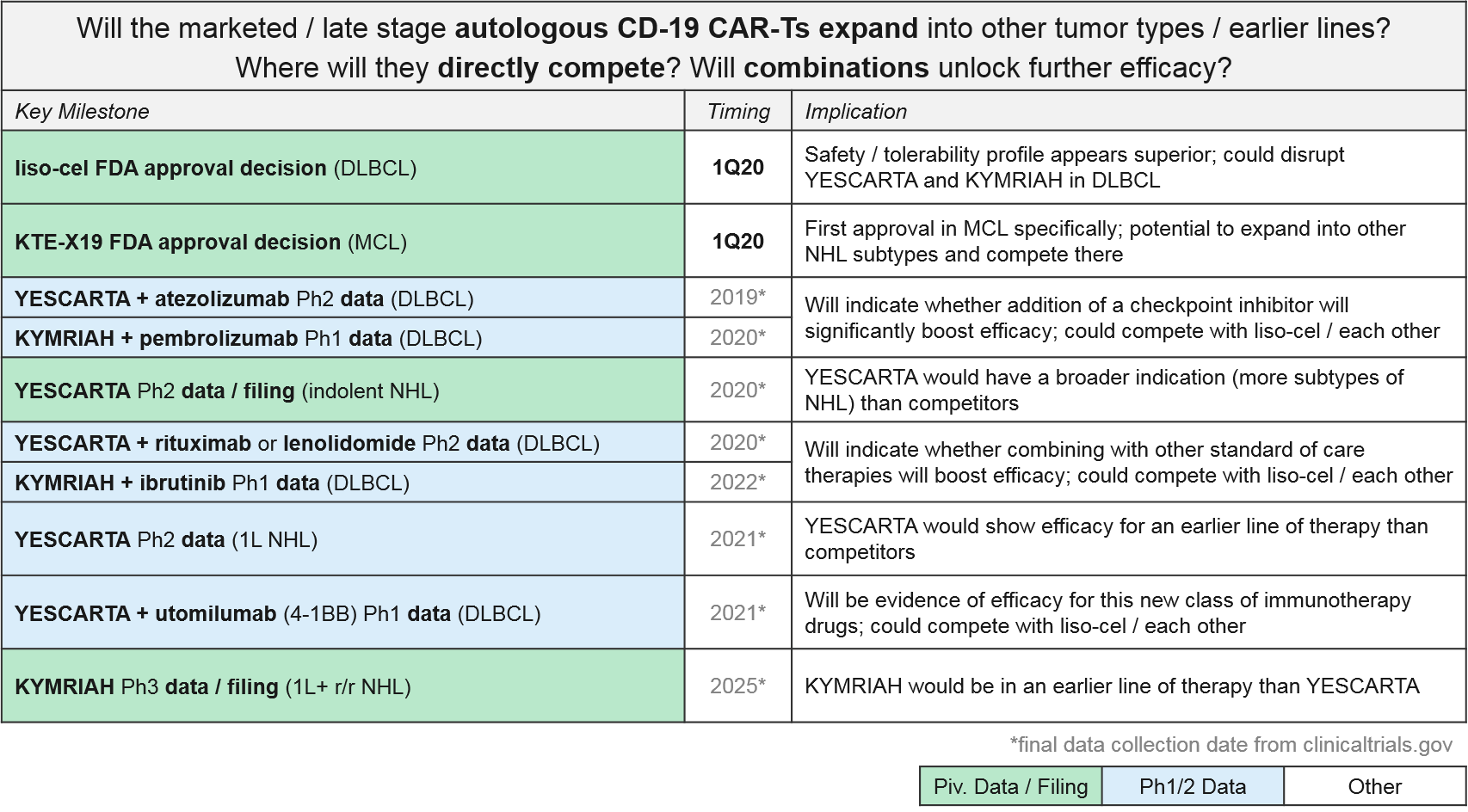

For these major CD-19 CAR-T players (Novartis’ KYMRIAH, Gilead’s YESCARTA and KTE-X19, BMS / Celgene’s liso-cel), their clinical trial portfolios indicate partially overlapping near-term expansion strategies. Both YESCARTA and KEYTRUDA are seeking to leapfrog the other into earlier lines / broader indications in NHL, and to unlock further efficacy with combinations (with standard of care or other immunotherapies). Meanwhile, liso-cel seeks to disrupt both in NHL with a potentially more favorable efficacy / safety profile. Outside of NHL, for the moment both KEYTRUDA and liso-cel enjoy solo presences in other cancer types (ALL and Chronic Lymphocytic Leukemia / CLL respectively).

Novartis (KYMRIAH) and Gilead (YESCARTA) have not provided any anticipated data release or filing dates for their various late-stage trials. But based on the trial end dates they submitted to clinicaltrials.gov we expect clarification over the next two years as the earlier line and combination data emerge, informing our perspective on how these competing products will compare and potentially differentiate.

Beyond Autologous CD-19 CAR-T (Other Targets, Allogeneic): Recent Updates & Near-Term Outlook

Now that the autologous (patient-derived) CD-19 CAR-T have clearly demonstrated their efficacy and market impact, we turn our attention to two follow-up questions:

- Which other (non-CD-19) CAR-T targets will succeed in clinic and in the market? BCMA, others?

- How might CAR-T design be improved for CD-19 and other targets (efficacy, safety, manufacturing)? Specifically, will allogeneic products succeed?

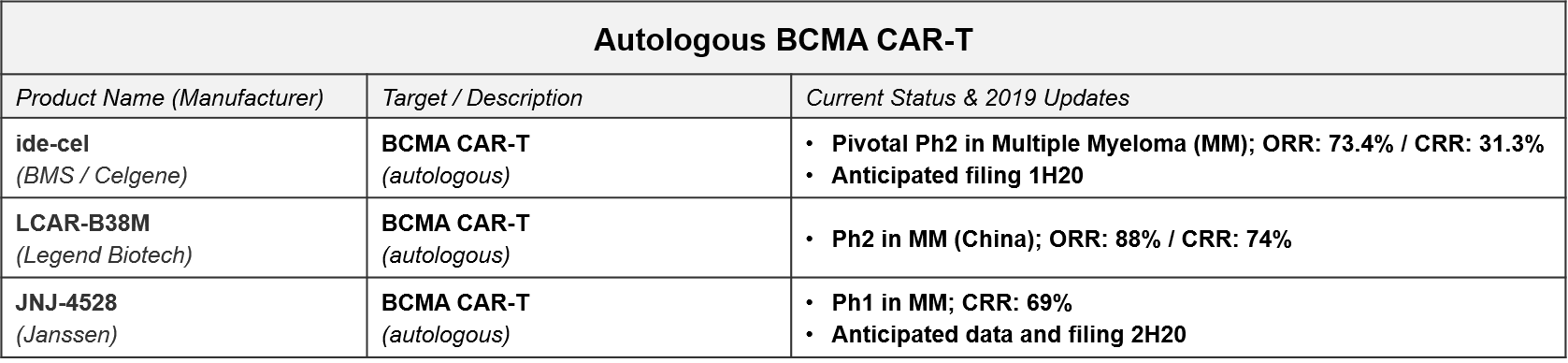

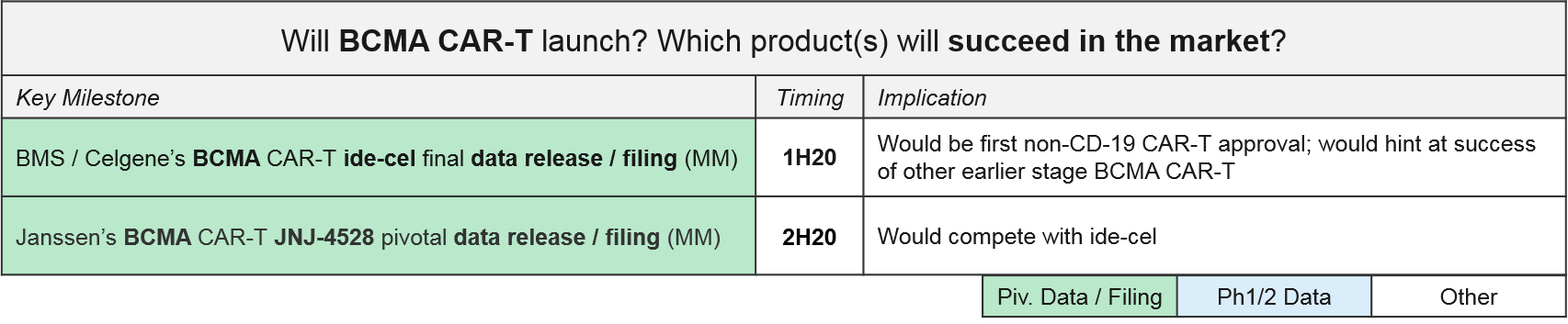

The next wave of CAR-T to reach filing will be the autologous BCMA CAR-T, led by BMS / Celgene’s idecabtagene vicleucel (“ide-cel”, formerly Bluebird’s bb2121). In December, BMS released positive top-line data from ide-cel’s pivotal Ph2 trial in Multiple Myeloma with an overall response rate of 73.4%, setting the stage for filing early next year. Janssen also announced positive Ph1 data for JNJ-4528 (complete response rate of 69%) and an anticipated filing by the end of 2020.

Based on these timelines, we will know by the end of 2020 how the BCMA CAR-Ts will fair in the broader marketplace, both against each other as well as standard of care therapies like daratumumab, as well as vs. emerging experimental therapies like the bispecific antibodies.

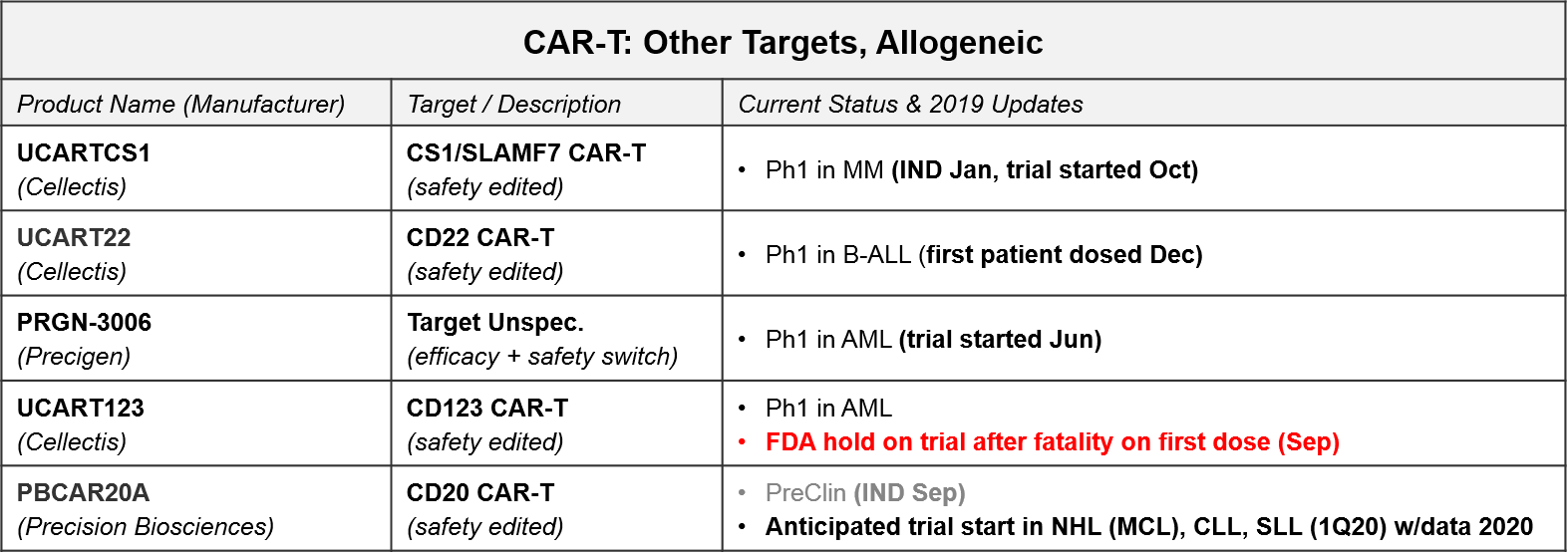

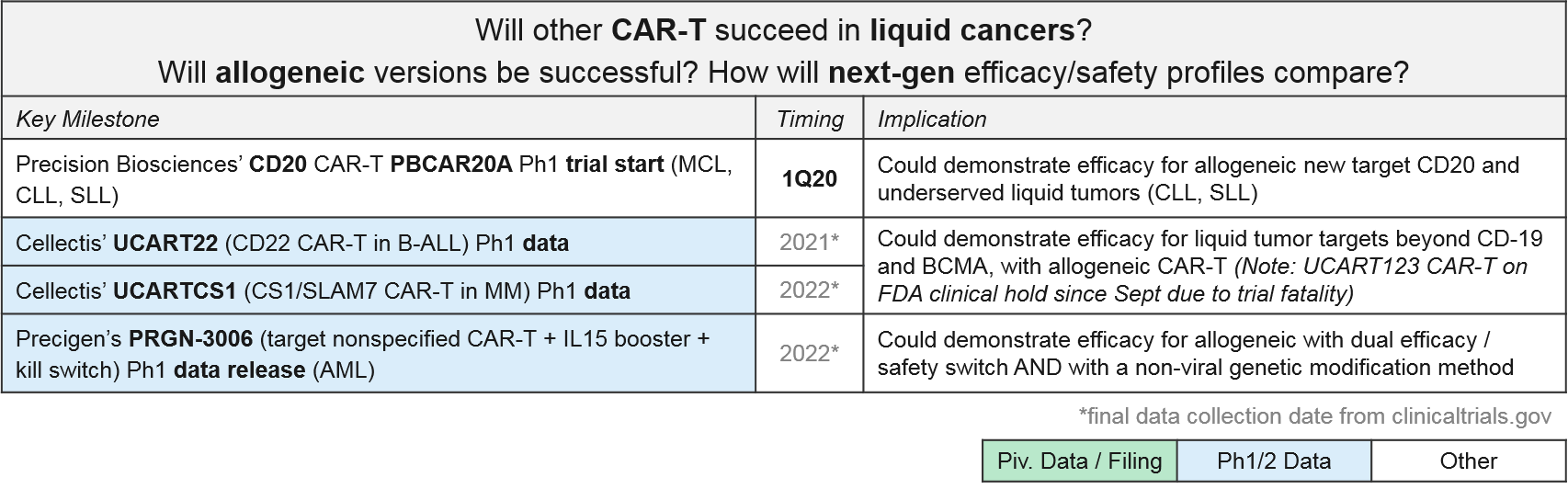

CAR-T for targets other than CD-19 and BCMA are all in Ph1. In addition to addressing the question of which other targets may be successful, these programs are also addressing the second question of optimal design as they are allogeneic (donor-derived) rather than autologous (patient-derived), and many also have non-viral gene insertions and deletions, safety switches, and / or efficacy boosters. These design variations are all in response to known or anticipated risks of T Cell therapies. For example, there have long been concerns that viral gene insertion is not always precisely targeted in the genome and therefore risks future oncogenesis and other unforeseen side effects. Therefore, we are increasingly seeing highly precise gene editing enzymes such as CRISPR used to insert modified TCR or CAR.

In addition to potentially safer gene insertion of the CAR, these next-gen cell therapy platforms are exploring various ways to boost efficacy and improve safety using gene edits and adjustable switches, particularly for those allogeneic products with their potential for Graft vs Host Disease (GvHD; an immune reaction where the donor immune cells attack the recipient cells). For example:

- Cellectis’ UCART is an allogeneic product that uses a viral CAR insertion followed by a gene editing enzyme removal of the endogenous TCR (to protect from GvHD). Notably, their CD123 CAR-T, UCART123, has been on an FDA hold since September of 2019, after the first patient dosed died from Cytokine Release Syndrome. This raises concerns about the safety of these products, so we will continue to watch closely for further clarification on this fatality, as well as any other severe adverse events (AEs).

- Precigen’s Ultra-CAR-T is an allogeneic product with a non-viral CAR insertion plus co-expressed mbIL15 (for efficacy boosting) and a kill switch to shut off the therapy should a severe AE begin.

- Precision Biosciences uses a proprietary gene editing enzyme, ARCUS, in a similar strategy to add in the CAR and remove endogenous genes which could potentially trigger GvHD.

We anticipate multiple data releases over the next few years that will support (or not) additional targets, as well as allogeneic efficacy / safety.

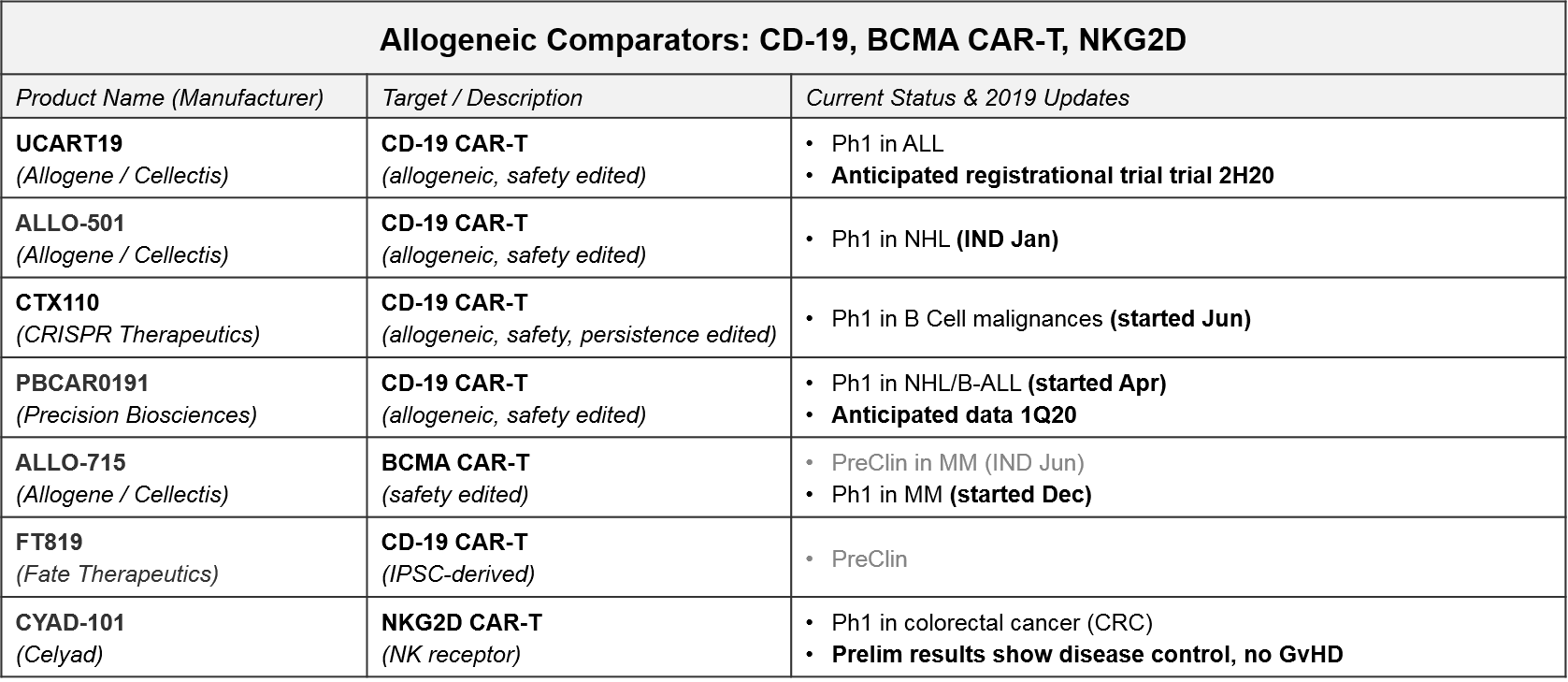

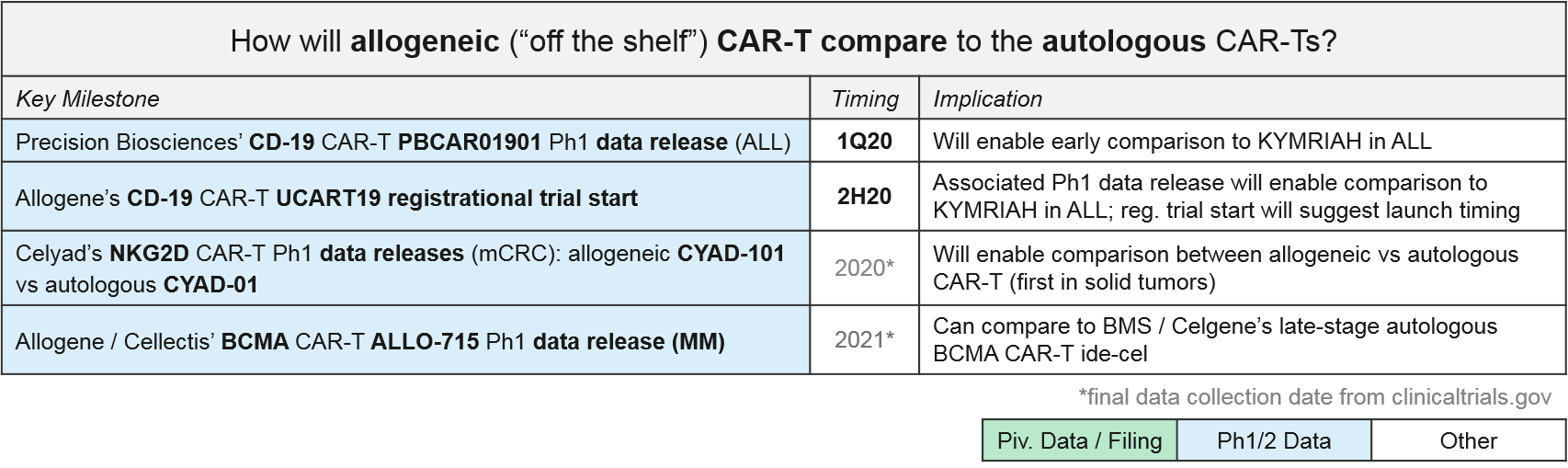

Allogeneic “off the shelf” CAR-T therapies have enormous market potential due to scalability, less product variability, and lower cost. But they must demonstrate comparable or better efficacy as well as safety, particularly the anticipated risk of Graft vs Host Disease (GvHD) where the donor T Cells attack healthy cells (not just the tumor cells). In the near-term we anticipate at several “direct” comparisons between autologous and allogeneic CAR-Ts (i.e., same targets, same tumor types) that will start to answer questions related to these topics. The most mature datasets will be comparing the approved (or nearly approved) autologous CD-19 and BCMA CAR-T to their allogeneic counterparts.

- NKG2D: Celyad has already released preliminary data for their autologous (CYAD-01) and allogeneic (CYAD-101) NKG2D CAR-Ts in metastatic colorectal cancer (June 2019). Specifically, CYAD-01 had 1 partial response (PR) and 6 stable disease (SD) out of 9 patients. CYAD-101 had 1 PR and 3 SD out of 6 patients, and importantly no signs of GvHD. Future data releases will no doubt refine these very preliminary findings, not just to compare autologous to allogeneic, but also hopefully confirming these early signs of solid tumor efficacy.

- CD-19: In 2020 we expect Ph1 data for two allogeneic CD-19 CAR-Ts in ALL: Precision Biosciences’ PBCAR01901 and Allogene’s UCART19. Allogene is planning a UCART19 registrational trial in 2H20. Barring unforeseen acceleration of other programs, this could lead to the first approval for an allogeneic cell therapy. Either way, these data can be compared to KYMRIAH’s ALL data for both efficacy and safety profiles, as well as manufacturing times, costs, etc.

- BCMA: Finally, Allogene / Cellectis has just begun a Ph1 trial for their allogeneic BCMA CAR-T, ALLO-715. Once that data is available, we can compare to BMS / Celgene’s autologous BCMA CAR-T, ide-cel.

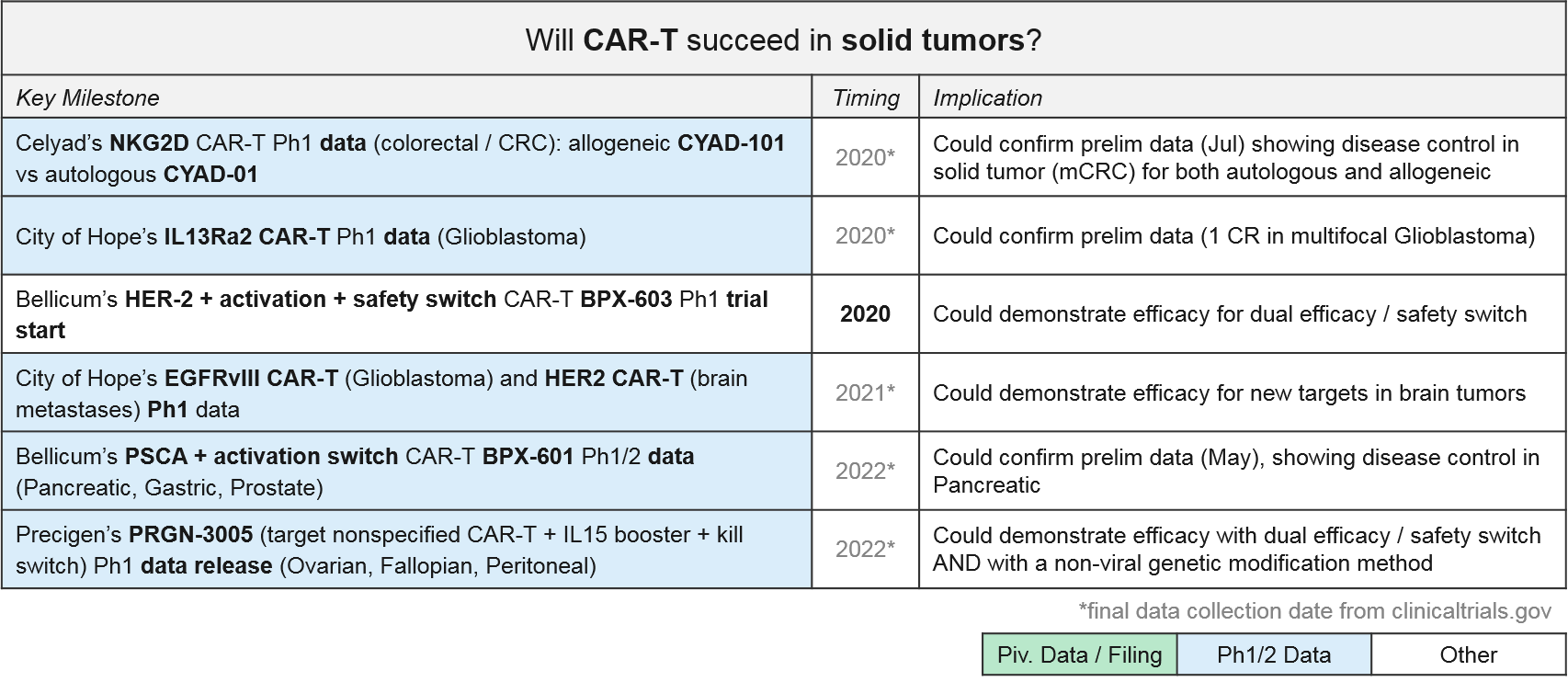

Solid Tumor CAR-T: Recent Updates and Near-Term Outlook

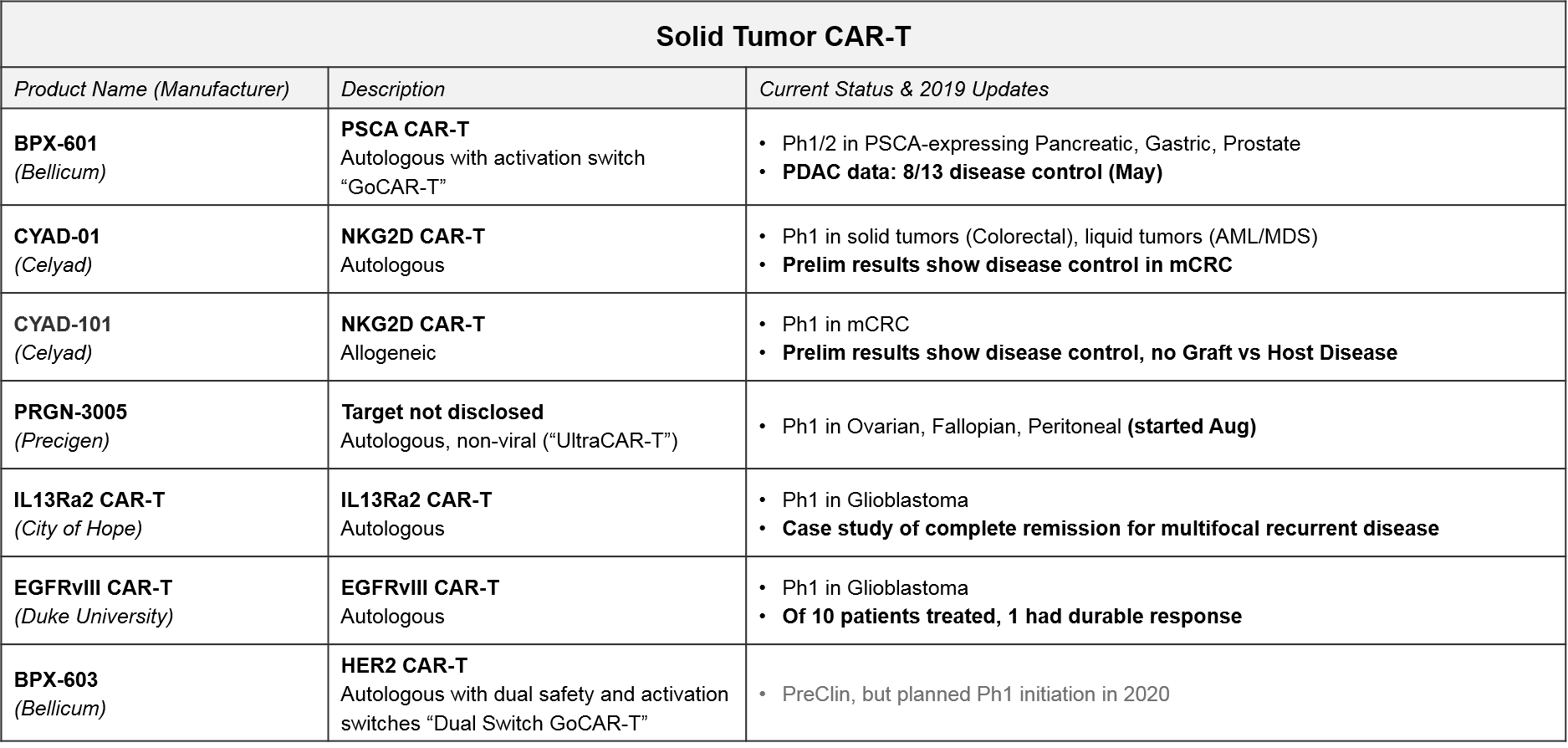

The approved or late stage CAR-T therapies are all in leukemias and lymphomas. For solid tumors, there have been some early signs of efficacy for CAR-T, but there are not yet any approved or even late-stage CAR-T therapies. However, there are several Ph1 and Ph2 programs, a few of which are showing promising early signs of efficacy. Notably, the majority are still patient-derived autologous vs allogeneic.

In addition to Celyad’s NKG2D CAR-T programs described above, we will also be closely watching Bellicum’s PSCA CAR-T, BPX-601, which already released preliminary data in May 2019 showing disease control in pancreatic ductal adenocarcinoma. BPX-601 is an autologous product using Bellicum’s “GoCAR-T” platform, which includes an activation switch. In 2020, Bellicum’s HER-2 CAR-T, BPX-603, will start its Ph1 trial. This product includes a dual activation and safety switch. Precigen’s PRGN-3005 is an autologous product with an IL15 efficacy booster plus a kill switch, currently in Ph1 for ovarian, fallopian, and peritoneal tumors. In addition, two academic programs in glioblastoma (City of Hope’s IL13Ra2 CAR-T and Duke’s EGFRvIII CAR-T) should be releasing Ph1 data soon, which could confirm their previously reported early efficacy in this intractable tumor type.

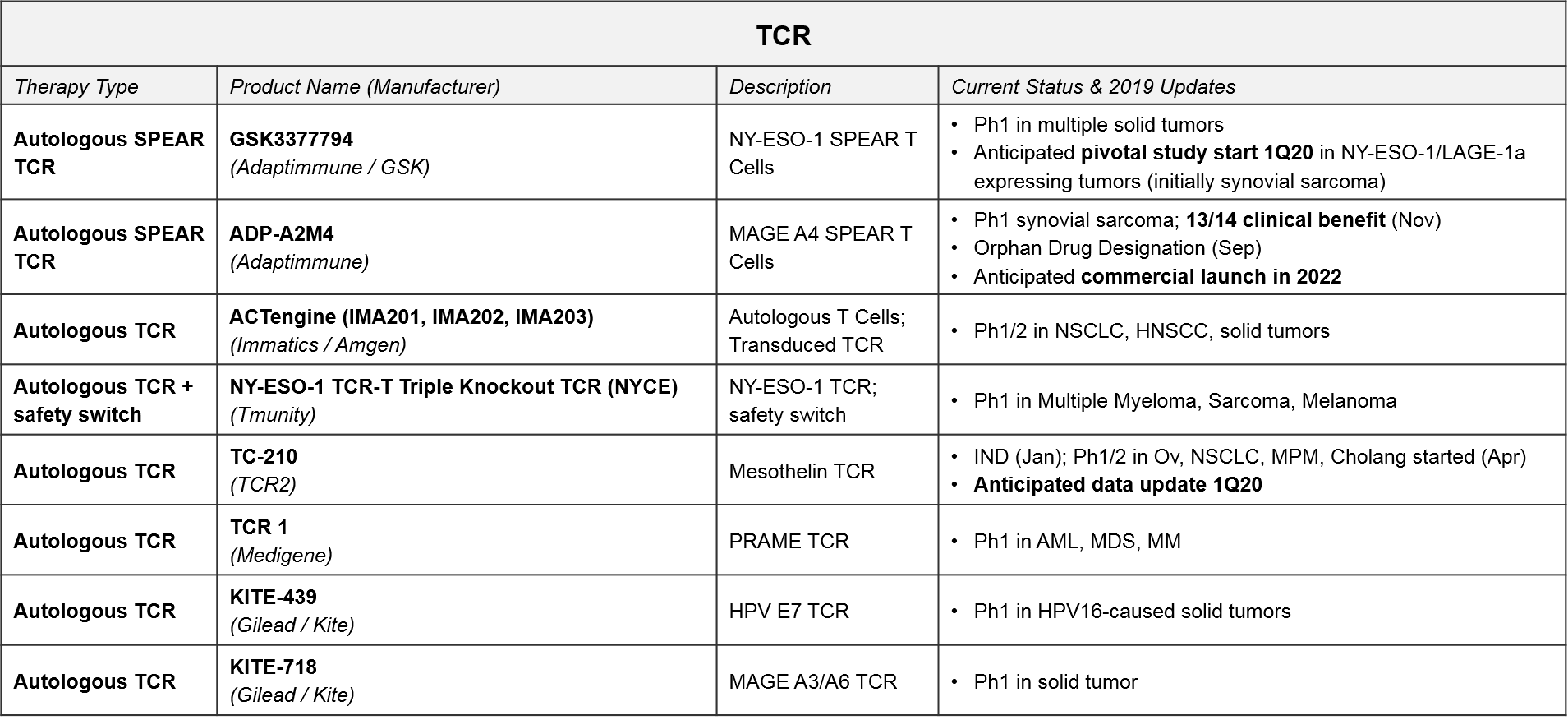

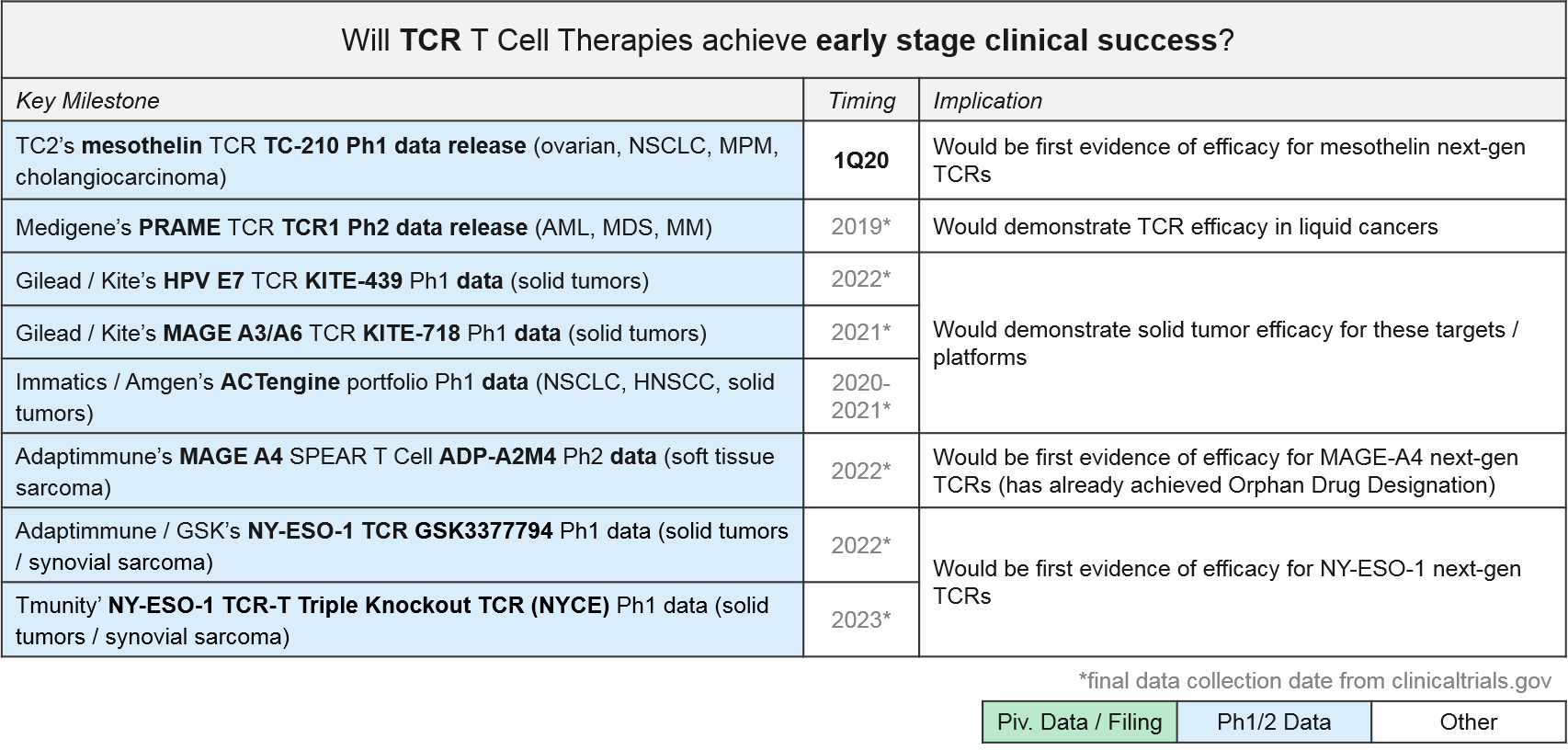

TCR T Cell Therapy: Recent Updates and Near-Term Outlook

TCR-based therapies are genetically modified so that their T Cell Receptor (TCR) will recognize tumor-specific antigens that are MHC-presented by the tumor cells. They theoretically offer broader target potential than CAR-T therapies, which require antigens to be naturally expressed on the tumor cell surface. However, they have historically suffered from limited efficacy (and toxicities) due to immune activation against healthy tissues. Additionally, the MHC requirement can be limiting as it requires donor-recipient HLA matching, and many tumors develop MHC loss as a mechanism of resistance.

Despite these initial challenges, several next generation designs are now in Ph1 and 2 trials. GSK / Adaptimmune’s SPEAR platform can recognize both MHC-presented and cell surface expressed antigens, so it offers both broader targeting potential and a potentially improved safety profile. GSK is developing an NY-ESO-1 SPEAR T Cell (GSK3377794) in multiple tumor types, with an anticipated start date for a pivotal trial in synovial sarcoma in early 2020. Adaptimmune’s ADP-A2M4, a MAGE A4 SPEAR T Cell therapy, achieved an Orphan Drug Designation in September 2019 after reporting responses in soft tissue sarcoma. Adaptimuune is aiming for a commercial launch in 2022. Tmunity’s triple knockout TCR platform also includes a safety switch. Over the next few years, we therefore expect numerous Ph1 and Ph2 data releases that will clarify whether the next generation TCR designs can deliver compelling efficacy and safety profiles in solid tumors.

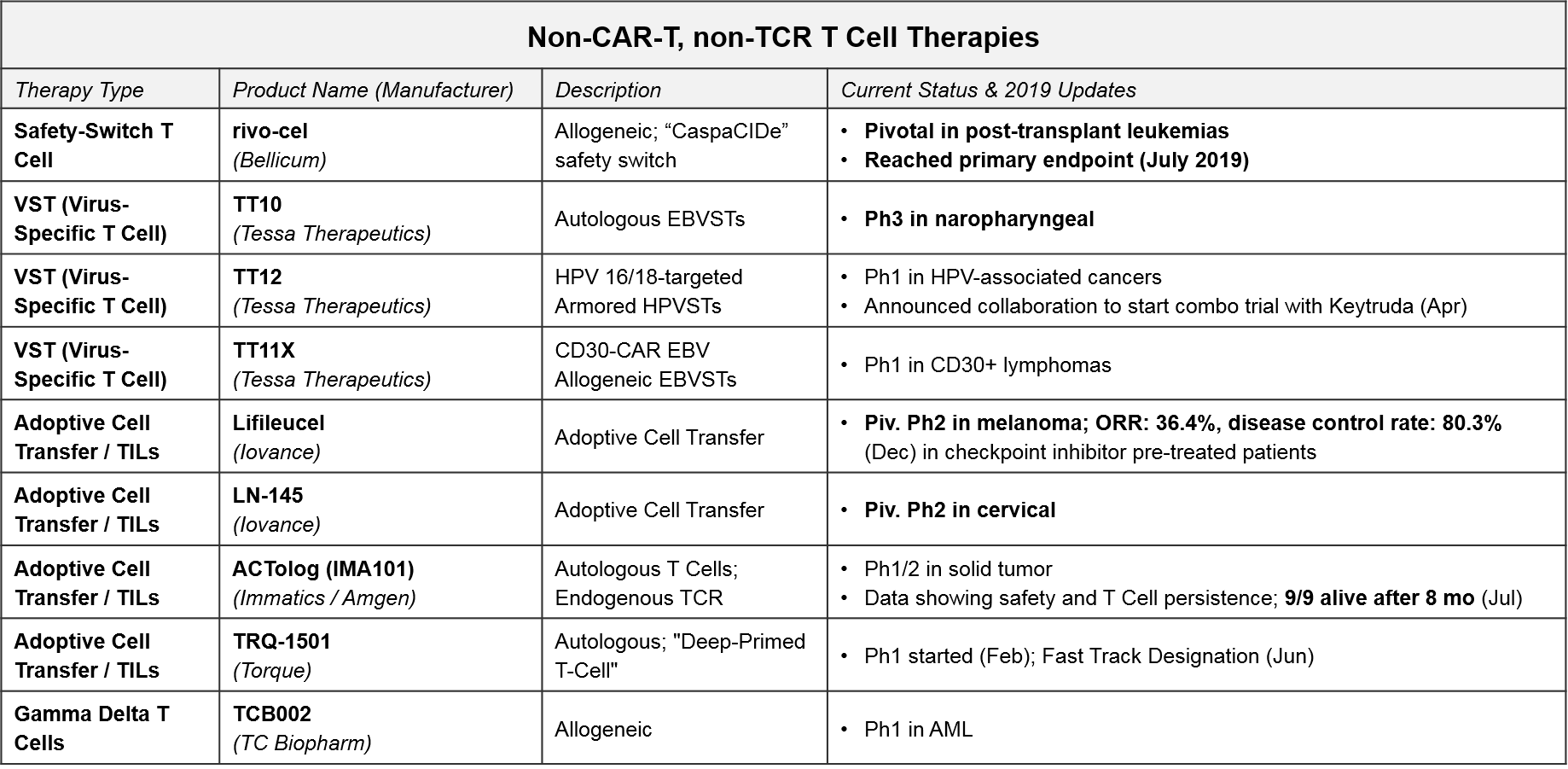

Other T Cell-based Therapies (non-CAR-T, non-TCR): Recent Updates and Near-Term Outlook

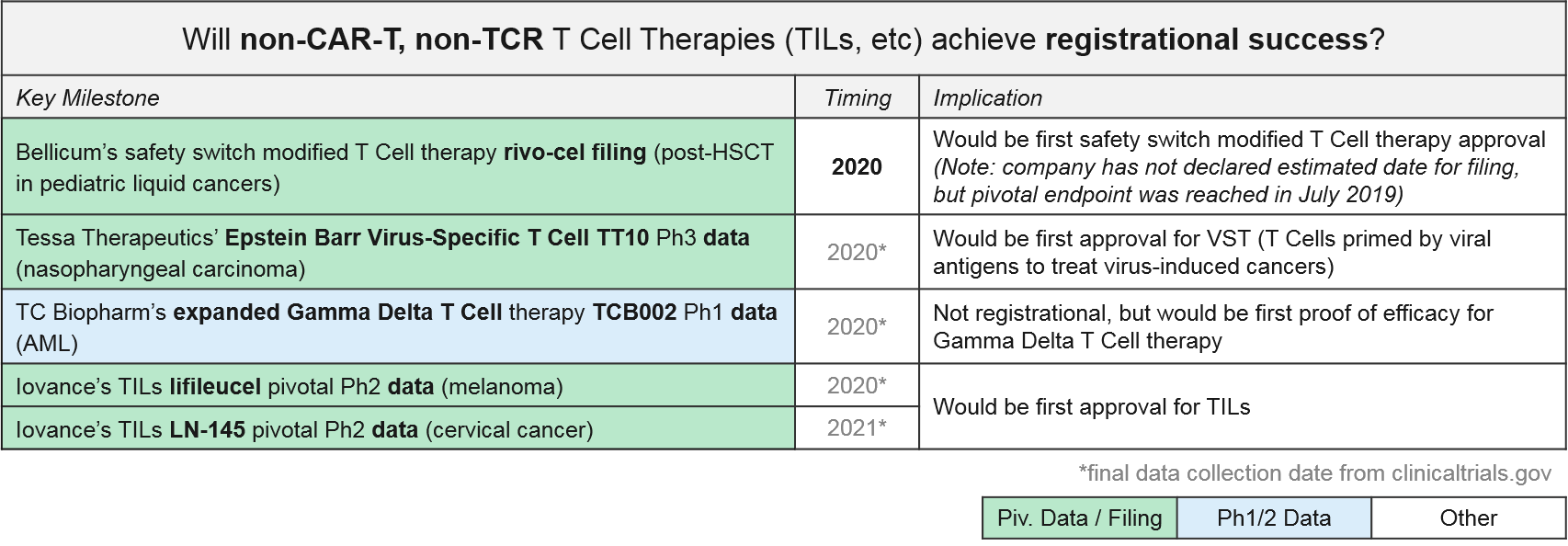

In addition to the CAR-T and TCR T Cell therapies, both of which work by forcing immune recognition via a modified T Cell Receptor, there are several other late-stage T Cell therapies that are either non-genetically modified or modified in non-TCR ways. For example, the allogeneic T Cell therapy, rivo-cel, is relatively unique in that it is genetically modified but not to the T Cell Receptor. Instead it has a safety switch called “CaspaCIDe” added that enables the therapy to be given after leukemia treatment to help the immune system recover function but allows it to be rapidly “turned off” if severe adverse events begin. Rivo-cel reached its pivotal endpoint in July 2019, so we expect filing soon.

Of the other non-CAR-T, non-TCR T Cell-based therapies, the non-genetically modified “Expansion +/- Activation” style therapies are the furthest along in the clinic. Tessa Therapeutics’ TT10 is in Ph3 for nasopharyngeal cancer. With TT10, autologous EBVSTs (Epstein Barr Virus-Specific T Cells) are extracted and purified from the patient’s blood and then selectively activated by viral antigens and expanded ex vivo. In Ph2, TT10 delivered 2 and 3-year survival rates of 62.9% and 37.1% in stage 4 disease, which was very favorable as compared to historical controls. Importantly the treatment has been quite tolerable in clinical trials, with no severe side effects reported.

Iovance’s lifleucel and LN-145, both unmodified but expanded ex vivo Tumor Infiltrating Lymphocytes (TILs), are in Ph2 pivotal trials for melanoma and cervical cancers. In December, Iovance published data for one cohort in the lifleucel trial, showing a disease control rate of ~80% and an overall response rate of ~36% (including 2 complete responses) in heavily pretreated melanoma patients. Depending on when and how the full datasets read out, these or TT10 could be the first T Cell based therapies to succeed in solid tumors.

One other noteworthy asset in this category is TC Biopharm’s TCB002, which is an unmodified, expanded allogeneic Gamma Delta T Cell therapy. Gamma Delta T Cells have a unique type of T Cell Receptor that can bind antigens without requiring MHC presentation, offering a broader potential than the “classic” TCR which require MHC presentation and HLA-matching between donors and patients. TCB002 is currently in Ph1 in Acute Myeloid Leukemia.

Several of these therapies are approaching registrational milestones, namely:

- Bellicum’s rivo-cel, which announced success in reaching their pivotal trial endpoint in July 2019

- Tessa Therapeutic’s EB-VST TT10, currently in Ph3

- Iovance’s TILs lifileucil and LN-145, currently in pivotal Ph2

We closely monitor these data releases to see how these activated but unmodified versions compare to the TCR-modified CAR-T and TCR therapies. Efficacy and safety profiles will be critical comparisons, as well as manufacturing requirements.

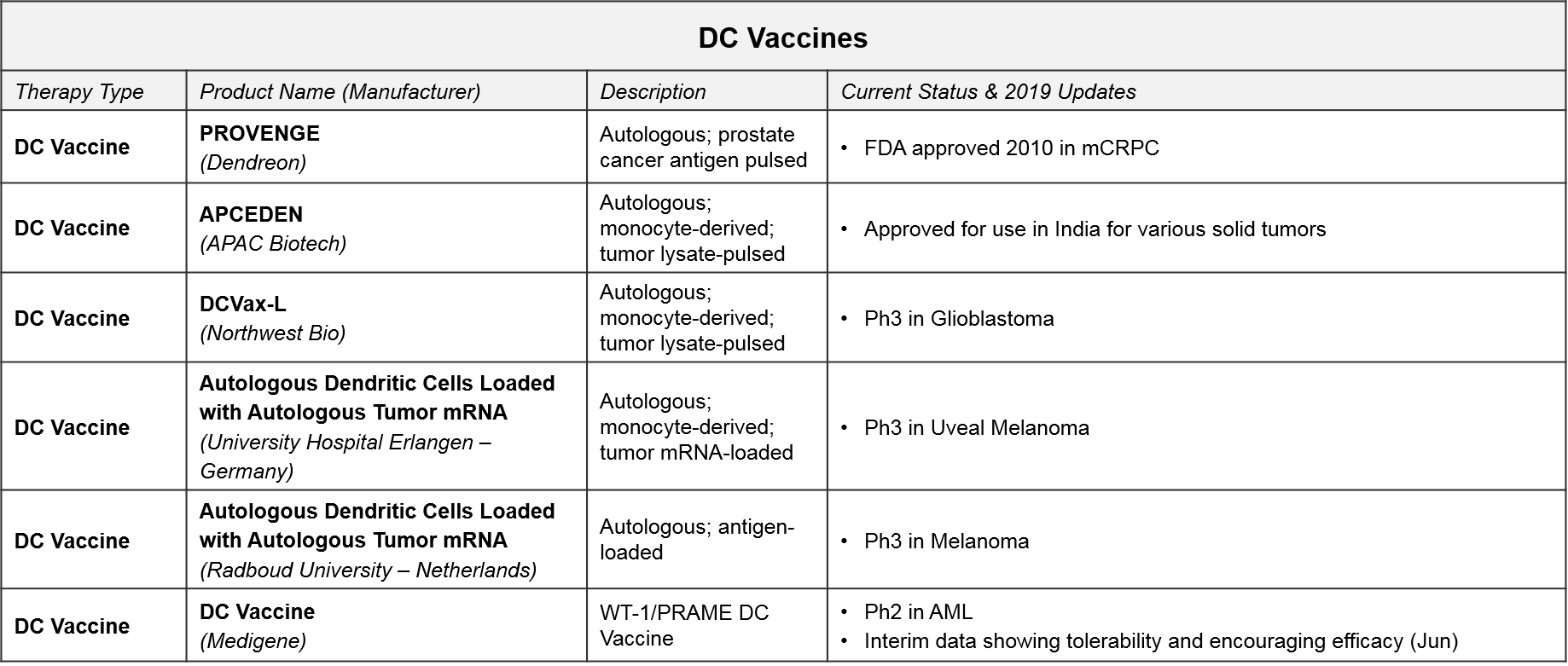

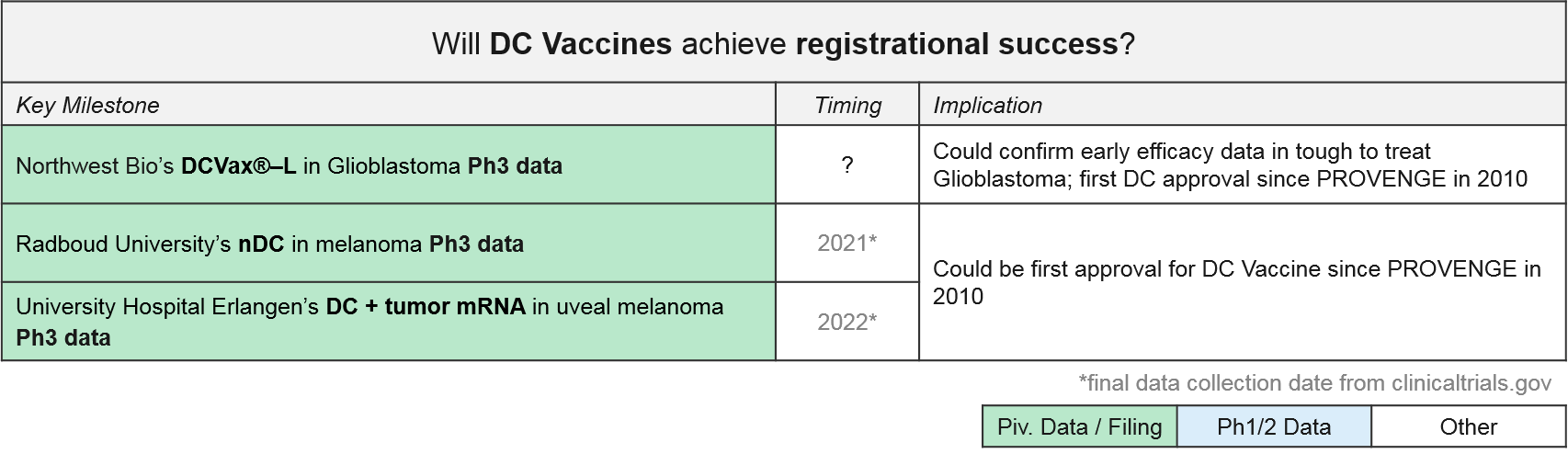

DC Vaccines: Recent Updates and Near-Term Outlook

Unlike T Cells which are direct effectors of immune-mediated tumor killing, Dendritic Cells act upstream by collecting and presenting various “non-self” antigens to T Cells. This activates the T Cells to seek out and kill all cells that display these antigens. In the case of cancer immunotherapy, the goal is to “load” the Dendritic Cells with tumor-specific antigens so that they will present these to T Cells and trigger tumor-specific T Cell activation. The majority of the clinical stage programs are autologous and personalized, meaning the DC are extracted and then exposed to an enriched sample of that patient’s own tumor. While costly and time-intensive, these therapies could be both safer and more effective than direct T Cell therapies because the activated T Cells would be produced and modulated by the patient’s own immune system.

The Dendritic Cell vaccine PROVENGE was the first cell-based therapy approved. It was approved in 2010 for metastatic castration-resistant prostate cancer. PROVENGE has not achieved significant uptake however, due to administration barriers and competition from cheaper, similarly effective drugs. In February 2019, Dendreon released data showing robust 3-year survival data and is also exploring a place for PROVENGE in reducing progression of low-grade prostate cancer. If successful, this ProVent study could unlock significant market potential in this earlier-stage disease.

In addition to PROVENGE, there is one DC Vaccine therapy also approved in India only (APCEDEN), and several other DC Vaccines in late stage development. Interestingly, universities rather than companies are developing two of the Ph3 therapies (both in Europe). With three DC vaccines in Ph3 trials, we anticipate data updates and potential filings within the next 1-2 years. In June 2019, Northwest Bio announced they were nearly finished with the statistical analysis plan that will enable unblinding of their Ph3 data for DCVax-L in glioblastoma. Their interim data release from last year shows a median overall survival (mOS) of ~23 months, plus a “long tail” of responders with a mOS over 40 months; these numbers are quite promising as compared with the historical standard of care.

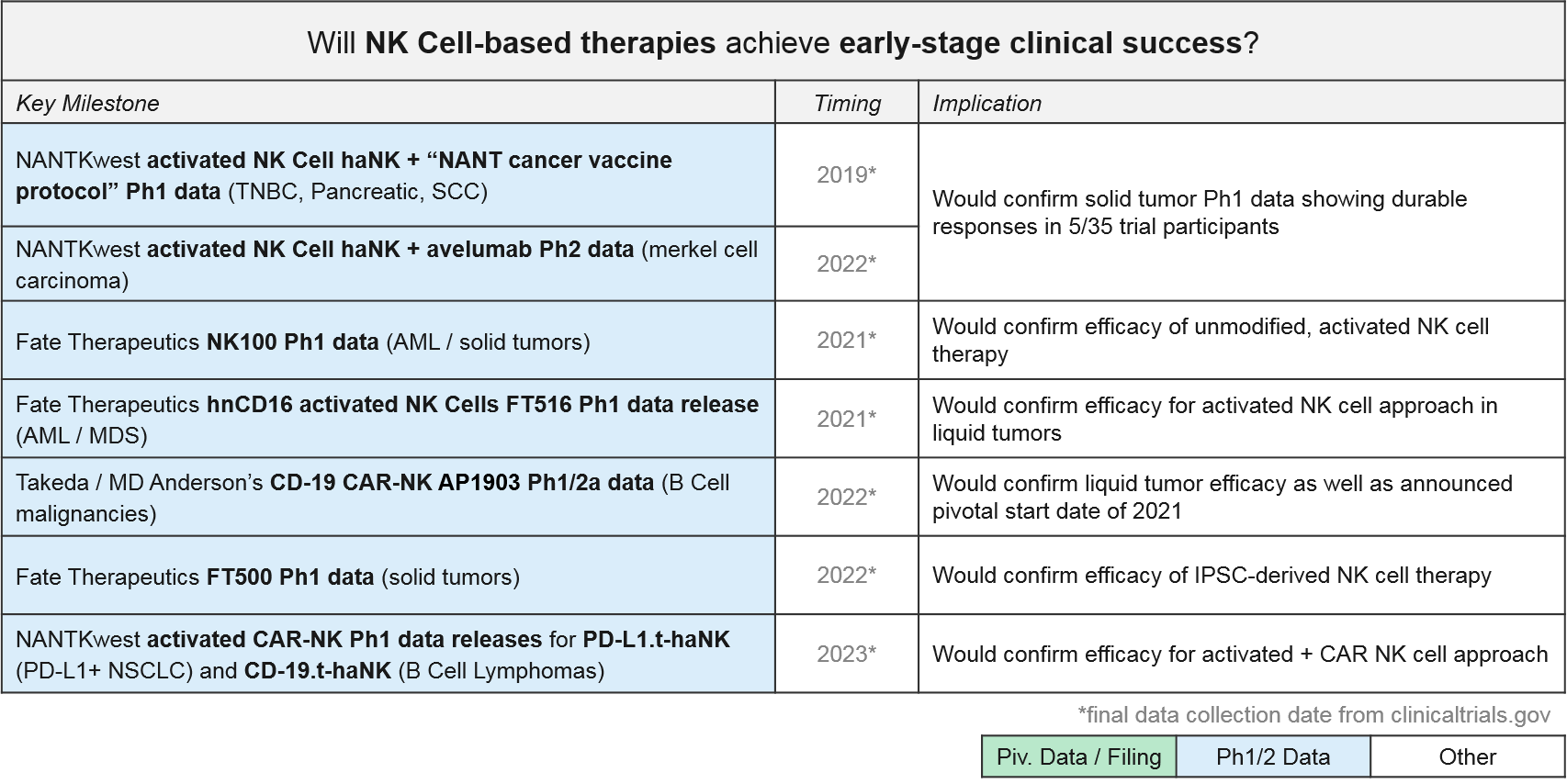

NK Cell Therapies: Recent Updates and Near-Term Outlook

NK Cells are also direct immune effectors like T Cells. Unlike the highly specific T Cells, however, NK Cells have a broad, pattern-based recognition that is innate and fixed (as opposed to variable within and across individuals). Also unlike T Cells, they do not recognize MHC-presented antigens via T Cell Receptors, but rather patterns of various other proteins and molecules on the cell surface. NK Cells can be modified in similar ways to T Cells, i.e., by simply expanding and activating naturally occurring NK Cells, or by modifying them with tumor-specific Chimeric Antigen Receptors (CAR-NK) to force tumor recognition. Because NK Cell-mediated killing can in turn activate the adaptive immune system, generating tumor-specific T Cells, this therapy could be quite effective. And unlike T Cell-based therapies, NK Cells can be used from various sources without risk of GvHD.

NK Cell-based therapies are relatively new to the clinic, but we are anticipating multiple Ph1 data releases over the next 1-3 years. The first ones will be the artificially activated (e.g., the CD16 modified) or simply expanded NK cell populations. Soon thereafter we expect data on the CAR-NK therapies for CD-19 and other targets. NANTKwest has already released preliminary safety data for their PD-L1.t-haNK activated CAR-NK in solid tumors.

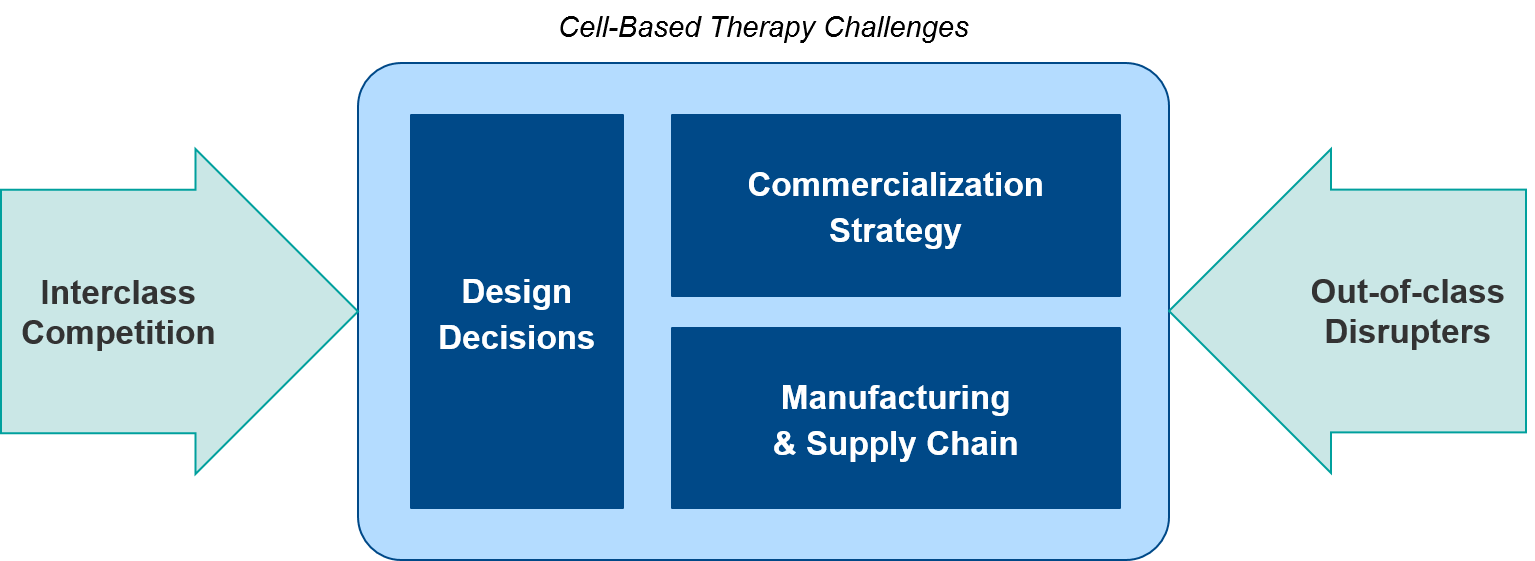

Summary and Introduction to Challenges

Over the next 1-2 years, we anticipate numerous data releases and several filings that will evolve the overall cell therapy landscape. From an individual cell therapy or corporate perspective, each program will face distinct challenges:

- Design decisions (targets, cell source, modular add-ons)

- Commercialization (commercial model, coverage and reimbursement)

- Manufacturing and supply chain (standardization, decentralization)

Taken together, each therapy’s profile along these dimensions will set the stage for differentiation in a competitive marketplace, including both:

- Interclass competition (allogeneic vs autologous, CAR-T vs TCR, NK vs T cell-based)

- Out-of-class potential disrupters (T Cell / NK Cell Engagers, cancer vaccines and viruses, other immunotherapy combos)

In our part 2, we will review each challenge in-depth, along with key considerations for success.