Part Two of a Two-Part Series: Commercial Opportunity, Challenges, and Outlook

In Part One of this series, we provided an overview of how the immune system can fight cancer, as well as the reasons it can sometimes fail in the effort. In addition, we explored an extremely interesting class of therapies that show great promise in initiating or boosting the immune system’s ability to eradicate cancer cells: cell-based immunotherapies. Specifically, we outlined the key types of cell-based immunotherapies and provided some insights into how they work.

Part Two of this series explores the commercial opportunities and challenges facing these therapies. It also provides a brief outlook as how the commercial landscape is likely to evolve.

Commercial Opportunity and Challenges

As a class, cell-based immunotherapies have already demonstrated significant potential as well as risks and challenges pertaining to both drug development and commercial success. The key factors are outlined below.

Curative Potential

In both liquid and solid tumors, cell-based immunotherapies have delivered such durable complete responses that they are essentially “cures”. For those tumors that do not respond—or that eventually recur via various resistance mechanisms—theoretically, cell-based immunotherapies could be personalized to adapt, shifting metastatic disease into something chronic that can be managed rather than a rapidly fatal condition.

This differentiates immunotherapies from other systemic (chemo, radiation) and targeted therapies which offer a temporary disease control but ultimately cannot prevent progression in metastatic or otherwise advanced disease. If cell-based immunotherapies can be designed and developed that have either broader or more personalized efficacy, particularly in solid tumors, it will dramatically shift the standard of care, pushing current therapies back to later or salvage lines.

All-or-None / Limited Breadth of Efficacy

Like the broader class of immunotherapies, these therapies tend to work dramatically well in a (sometimes very small) subset of recipients, while the rest receive next to no clinical benefit. This response profile is challenging for clinical development because trials may fail if the responding subset is too small.

Because there are no known predictive markers, in clinical practice there is also a potential opportunity cost if an individual chooses an immunotherapy over something like a targeted therapy which won’t be curative but offers a more “guaranteed” clinical benefit of several months of disease control (for example). This is a commercial challenge because the high cost of therapy may be less palatable with no guarantee of any clinical benefit. In addition to development of cell-based immunotherapies with broader applicability, better prediction of responders will be critical in overcoming both development and commercialization challenges.

Liquid Tumor Efficacy but Solid Tumor Barriers

While leukemias and lymphomas are by their nature very accessible to cell-based immunotherapies (which circulate via the blood), solid tumors have been more challenging to address. This is likely due to several issues. One key challenge is that the surrounding tissue and the tumor itself, referred to as the “tumor microenvironment”, frequently develops both physical and chemical signaling barriers to cancer immunity. This means that even if tumor-specific T Cells are in the body, they may not be able to enter the tumor. Or, if they do enter, they may be suppressed and unable to kill efficiently. The checkpoint-inhibitor immunotherapies make an appealing combination partner for cell-based immunotherapies, as the former address at least one signaling mechanism of tumor-mediated immune suppression.

Long Time to Manufacture, Long Time to Work

Producing patient-specific cell-based immunotherapies takes several weeks at a minimum. In addition, immunotherapies in general take longer to generate a response than do classical therapies because they require inducing and expanding the adaptive immune response (vs just killing cancer cells directly like the classic approaches).

This is a challenge in clinical practice when a patient has a high tumor burden or rapidly-growing tumor. They may not be able to wait weeks or months for a cell-based immunotherapy to be effective. While the biological delay in efficacy may be inherent, it is possible to avoid manufacturing delays for cell-based immunotherapies that are generated in bulk from a donor, i.e., not patient-specific. In clinical practice, protocols could be designed that aggressively treat tumors with either a systemic (chemotherapy and / or radiation) or targeted therapy to “buy some time” while the personalized cell-based immunotherapies are being generated.

High Manufacturing Cost and High Price

For the “personalized” cell-based immunotherapies that must be generated from the patient’s own immune cells, the cost of manufacture can be quite high, contributing to a price of ~$100,000-$500,000 for the currently approved cell-based immunotherapies. Insurance companies will demand robust evidence of significant improvement over standard of care to cover this high price, and out of pocket payment may not be possible for most patients.

It is possible that “pay for performance” models where the price is adjusted based on the individual outcome could make the high end of the price range more acceptable. This would also strongly incentivize manufacturers to design more adaptive protocols that maximize the benefit for each individual patient (adjusting doses, combination and sequencing regimens with other therapies, etc.).

Potential for Severe-to-Lethal Side Effects

The incredibly specific targeting and efficacy of cell-based immunotherapies can be a double-edged sword. In the subset of patients where these therapies are active, they can trigger a positive feedback loop of general immune activation that ultimately impacts the rest of the body, resulting in what is known as Cytokine Release Syndrome, or a “cytokine storm”. This overactive inflammatory syndrome occurs to at least some degree in nearly all recipients and when severe, can damage or destroy key organs, and even be fatal.

Recently, the immunosuppressive drug tocilizumab has been repurposed to manage this side effect, with reasonable success. Another risk of these therapies is when the tumor-targeted T Cells recognize and attack healthy tissues that express similar antigens. For example, in one notable case a MAGE-A3 TCR therapy ended up targeting a similar brain-expressed protein and killed 2 out of 9 patients in an early trial.

One more theoretical risk is that cell-based immunotherapies developed from donor immune cells could trigger Graft vs Host Disease (this has not yet been observed in clinic, however). To address these risks, some cell-based immunotherapies are being designed with “kill switches” that can be used to self-destruct the cells upon recognition of a serious adverse event.

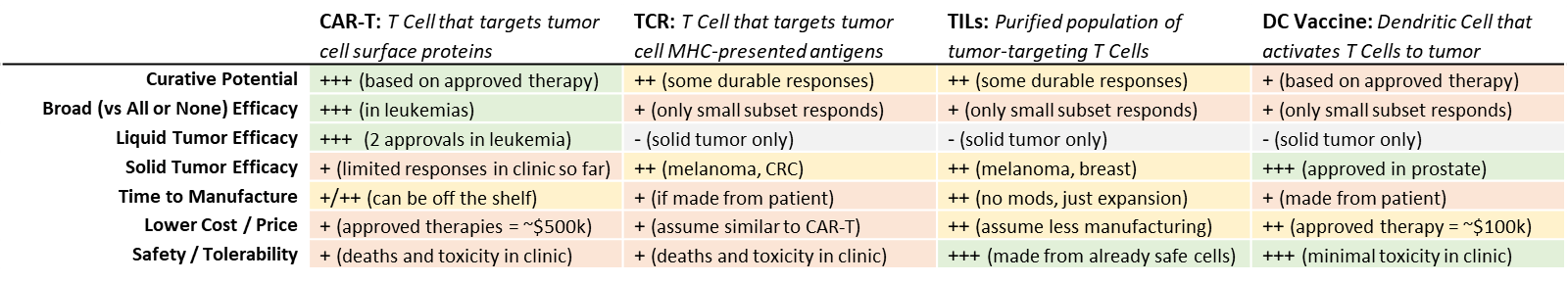

Outlook (Intra-Class Comparison)

While CAR-T therapies are currently the most intense area of focus, they have significant limitations around solid tumor efficacy, toxicity, and manufacturing costs and time. The other types of cell-based immunotherapies are unlikely to displace CAR-T in leukemias, but if they can successfully address these issues, they may find their own niches in other tumor types.

Development and Commercial Outlook

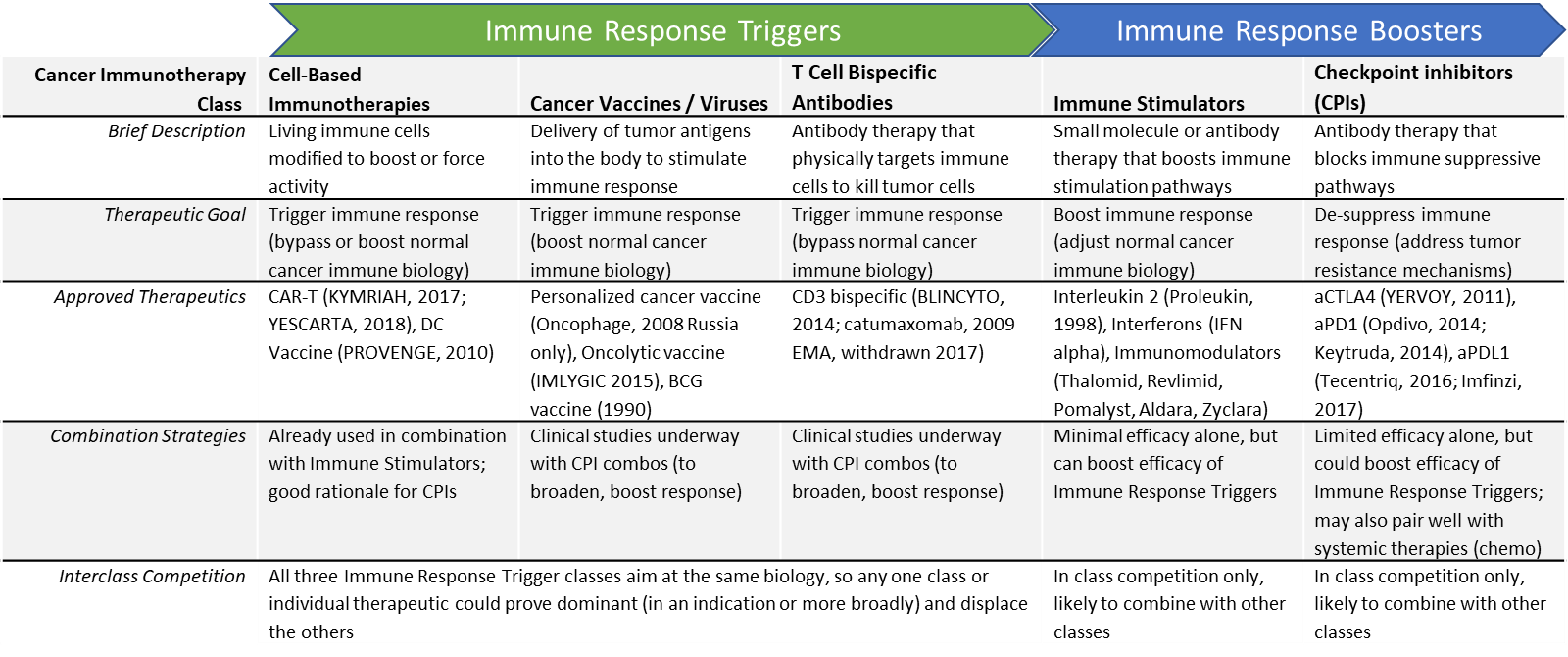

Cell-based immunotherapies must find their position within the broader class of immunotherapies

The curative potential of cell-based immunotherapies is confirmed in at least one other class of immunotherapies: the checkpoint inhibitors (CPIs). CPIs also share the downside of the “all or none” response, and no truly predictive marker is yet identified. It remains to be seen whether cell-based immunotherapies can achieve broader efficacy in more tumor types.

In parallel, other classes of immunotherapies such as personalized cancer vaccines and bispecific antibodies are being heavily invested in and showing strong clinical promise as well. Some of these therapies may be combination partners for cell-based therapies, while others are more likely to be competitors for their same niche of “Immune Response Trigger” immunotherapies.

Combinatorial regimens may be required (challenging pricing and reimbursement)

It seems likely that some tumor types or individual patients may require immunotherapy combinations to maximize the cancer immune response. This could involve inter-class (e.g., CAR+T plus anti-PD1 checkpoint inhibitor) or intra-class (e.g., DC Vaccine + CAR-T). These combinations are already being explored in the clinic. One potential future landscape involves a “toolbox” of various cancer immunotherapies that can be mixed and matched for each individual patient and adapted over time to address resistance. This would result in both immense clinical complexity (how do we capture this in guidelines) as well as pricing challenges (additive pricing would result in astronomically high prices).

Over the next few years, numerous clinical datasets will be reading out, providing important insights into which individual therapies or immunotherapy classes could have the commercial potential to either displace or partner with the currently dominant checkpoint inhibitors and CAR-T therapies.

For some tumors, personalized targeting could be required (bumping time and cost of manufacture).

Right now, cell-based immunotherapies are mostly focused on a few known TSAs that are indication-specific, i.e., specific cell surface proteins or tumor antigens that are known to be broadly expressed in specific tumor types. It may be that for tumor types that are more heterogeneous, a personalized approach will be required, e.g., determining potential TSAs from each tumor using bioinformatic approaches, and generating targeted T Cells accordingly. While this has potential to dramatically broaden efficacy, the manufacturing cost and complexity would be much higher. It remains to be seen whether the market can bear a higher price, even with curative efficacy.

Outlook

Cell-based immunotherapies are well-poised from a scientific standpoint to effectively trigger cancer immunity and have already demonstrated curative impact in some settings. However, the approved / late stage therapies are only active in specific indications or in subsets of patients within an indication (with no known predictive marker). It may be that some individual tumors are simply intractable to cell-based immunotherapies, or it may be that they require a more personalized antigen selection and / or a combination strategy to boost immunity or address resistance mechanisms.

Numerous therapy and regimen designs to address these issues are under development. As more are tested in trials and deliver clinical data, we expect to see clarity around the true potential of cell-based immunotherapies within the next few years.

Aside from efficacy, cell-based immunotherapies face competitive threat from other immune triggering cancer immunotherapies (viruses / vaccines, bispecific antibodies). Many of these alternatives are significantly easier and cheaper to manufacture. Therefore, equivalent or greater clinical efficacy from a more cost-effective therapy remains a significant development risk for cell-based immunotherapies. That said, some types of cell-based immunotherapies (namely CAR-T) are exploring “off the shelf” / donor-based manufacturing strategies that could make them more competitive in terms of pricing.

To make a long story short: There is no crystal ball that will tell us exactly how cell-based therapies will evolve—or how successful they’ll be—in the coming years. They do, however, show tremendous potential, and we are confident that some cell therapies will have a disruptive effect on the market in the coming years, becoming a key part of the oncologist’s armamentarium.