Introduction

Over the last decade, advances in cancer care have measurably improved overall survival, and specifically in disease areas with previously high unmet needs such as non-small cell lung cancer (NSCLC) and melanoma1. Importantly, this increased survival is driven by a shift of more patients into two key categories of treatment outcomes:

- Cure: Defined here as a durable status with “no evidence of disease” where the individual is able to resume his or her normal life with minimal burden of screening, etc. This has been historically restricted to early-stage disease which had not yet spread.

- Chronic management: Defined here as a durable stable disease or effective disease control with minimal impact on quality of life from either the disease itself or the therapeutic intervention. For cancers that are not curable, this is the “fall-back” goal.

Of course, there is more work to be done as the overall prognosis for advanced (metastatic) cancer is still quite poor. An incredibly broad and diverse set of stakeholders are all working towards the same goals of improved outcomes, and increasingly working in partnership rather than individually. These include biopharma companies, academic researchers, clinicians, patients and their advocates, as well as payers and government agencies interested in reducing the overall burden on the healthcare system.

With so many distinct viewpoints and activities contributing to emerging trends in cancer care, it can be helpful to characterize them based on expected impact on therapeutic outcomes, namely: how will each trend contribute towards increasing the patient population experiencing either chronic management or—ideally—cure?

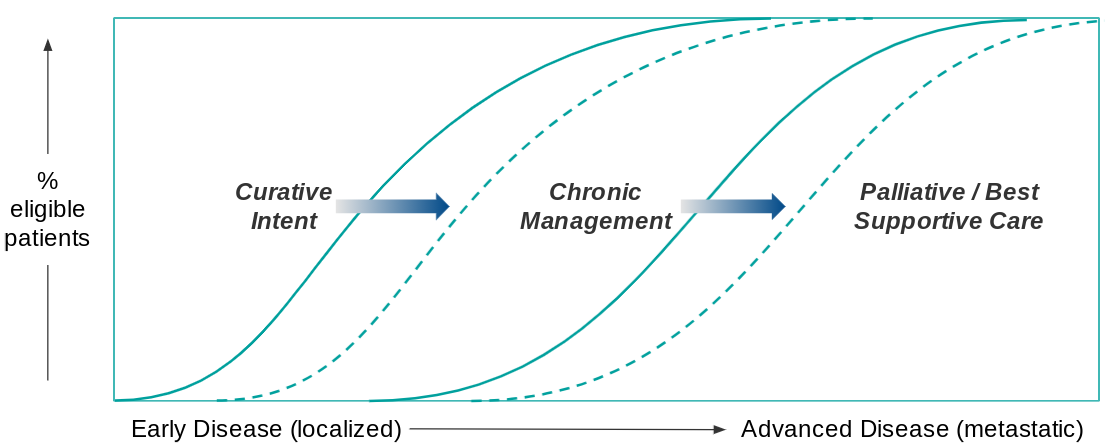

The classic paradigm of cancer care is that therapeutic goals become more conservative as the disease progresses. For an early stage diagnosis, the therapeutic goal is cure (typically by surgical resection +/- systemic therapy to reduce the risk of recurrence).

For more advanced disease, the goal shifts to chronic management, where a combination of surveillance and various therapeutic interventions are used to stop or at least slow disease progression. Eventually, as the disease advances and treatment options run out, the therapeutic goal shifts to palliative care focused on quality of life vs. disease response. Beneficial trends in cancer care therefore increase either the pool of patients eligible for curative intent or chronic management, pushing back palliative care to fewer patients later in the course of disease.

Here, we will explore supporting evidence and anticipated impact of four key trends that will help more patients reach cure or chronic management:

- Accelerated diagnostic development and uptake

- Increased R&D activity for high unmet need populations

- Better translation of complex data into real-world impact

- Enhanced focus on patient-centered experience and outcomes

Together, we expect continued improvements in cancer care and patient outcomes over the next 5-10 years as these trends work in tandem. Below, we describe each trend as well as the organizational requirements and commercial implications for biopharma who seek to remain (or become) leaders in future oncology development.

Trend 1. Accelerated diagnostic development and uptake

Trend Overview:

Initially, diagnostic tests in cancer were largely used to confirm the diagnosis and / or generate prognostic information, with the relatively rare exceptions of identifying suitable candidates for the limited targeted therapies available in the 1990s and early 2000s. Within the past 10-15 years however, there has been a rapid expansion of approved targeted drugs that collectively have increased the breadth of targeted therapies. Now, nearly 14% of US cancer patients are eligible.2 Importantly, in the last few years we have also seen approval of the first therapies with pan-tumor indications (NTRK fusion-targeted therapies as well as checkpoint inhibitors for MSI-high tumors). This increased availability has driven a demand for pan-tumor, broad panel tests that can be used across indications to guide treatment decision-making.

The other extremely important diagnostic trend is the development of so-called “liquid biopsies”, i.e., tests that do not require a solid tumor sample but instead can be done on blood, urine, or other bodily emissions. This technological advance not only increases the utility of these tests for non-surgical candidates with cancer, but also opens the door for diagnostic screening to catch cancers earlier. This latter use has dramatic implications for increasing the proportion of patients eligible for curative intent, as earlier stage cancer can be more successfully removed with lower risk of recurrence.

It is also important to consider non-NGS-panel type diagnostic tests. For example, AI-supported imaging algorithms that can help scale screening and earlier detection of progression.

In the near-term, we expect continued expansion of these tests for newly-diagnosed patients, as well as establishment of screening tests for earlier diagnosis. We also anticipate novel uses for these tests in earlier detection of recurrences or progression, e.g., ctDNA tests as a measure of disease burden.

Trend Implications:

In order for this trend to continue, multiple requirements must be met. For one, the pipeline of novel biomarkers must continue to deliver, and must also account for integration of multiple biomarkers to support diagnostic and prognostic utility. In parallel, there must be continued development of targeted therapies to support predictive utility, i.e., tests that predict responses to therapy (as we discuss in Trend 2). Once tests are developed, they must also be integrated into standard of care which requires continued effort not just in regulatory approval, but reimbursement and integration into treatment guidelines, e.g., NCCN.

Finally, as these tools are increasingly adopted into practice, we expect two major implications for patient care:

- For those patients who are in a maintenance phase of treatment, there may be an increased frequency of visits for testing and / or delivery of a maintenance therapy. This will require a shift in provider interactions to accommodate.

- There will be an indirect impact on the shrinking population of patients who do not have a targetable mutation or who have progressed despite intervention. As this population decreases there will be both increased unmet need but lower market value for biopharma to address this need.

For biopharma companies to succeed commercially in the context of this trend, they must be prepared to invest not just in diagnostic development, but also in market education and even pay for testing until reimbursement can be obtained. They must also continue to drive development of new therapies, as we discuss next.

Trend 2. Increased R&D activity for high unmet need populations

Trend Overview:

As discussed above, there has been significant therapeutic advancement for targeted therapies over the past few decades. But there have also been newly-emerged classes of therapy that have dramatically shifted the standard of care in some previously high unmet need cancer types, namely the checkpoint inhibitors in melanoma and NSCLC and the cell therapies in NHL and multiple myeloma.

Importantly, each novel therapeutic approval is not necessarily limited to use as a monotherapy, as we are also seeing dramatic expansion of combination and sequencing approaches in standard practice (e.g., guidelines inclusion). Combinations are both in-class and cross-class, for example:

- Checkpoint inhibitor / chemotherapy combinations used in NSCLC and triple-negative breast cancer (TNBC)

- BRAF-MEK targeted combinations in melanoma

Sequencing advancements are most apparent in the neoadjuvant and adjuvant settings, for example with

- Neoadjuvant checkpoint inhibitor use in TNBC

- Adjuvant (maintenance) use of PARP inhibitors in BRCA-mutated ovarian cancers.

In the near-term, we hope to see additional breakthroughs for emerging therapies, including the antibody drug conjugates (ADCs) and bi-specific T-cell engagers (BiTEs) in solid tumors, as well as broader use of cell therapies in liquid and potentially solid as well.

Together, we anticipate that the improved standard care for the now more tractable tumor types (e.g., NSCLC with targetable mutations, breast other than TNBC, etc) will result in diminishing returns for additional development in these specific spaces. As a result, there will be a shift towards more challenging indications (or patient segments) that will require novel and / or more complex regimens to achieve chronic management.

Trend Implications:

Biopharma companies must be prepared to act quickly and decisively to accelerate development of high value candidates in increasingly competitive tractable markets. In parallel, they must be ready for the “squeeze” as the improving standard of care makes it harder to demonstrate substantial benefit. Options include “doubling down” in these indications with novel or complex regimens, or shifting focus towards higher unmet need areas using the same strategies.

From a commercial perspective, there will be an increasing need for education and treatment decision-making support so that HCPs understand the utility of various therapies and combination options, including carve-outs of new lines of therapy within each disease (e.g., maintenance, neoadjuvant). Companies will also have to carefully consider pricing and access strategies for expensive and / or combination therapies (particularly when combo partners are not within the same company).

Finally, as patient segments become increasingly biomarker-driven and therefore smaller, some of these indications will be quite rare. So, as discussed above, the commercial model must support patient identification via education and other support of diagnostic use.

Trend 3: Better translation of complex data into real-world impact

Trend Overview:

As both therapeutics and diagnostics advance, there are dramatically increased options for patients as well as technology-based increases in data (e.g., EMR), and associated challenges with developing and integrating the appropriate data into decision-making. Both healthcare providers and payers are extremely interested in understanding real-world patterns of care to improve outcomes as well as manage costs. In parallel, patients, HCPs, and other advocates are increasingly insisting—and rightfully so—on more breadth of evidence about each intervention. Progression-free survival (PFS) or overall survival (OS) will always be important, but other measures will become increasingly demanded, such as quality of life measures that can better support decision-making in an environment with multiple therapeutic options.

From an R&D perspective, there is a similar tension between the enormous amounts of available data and the lagging ability to integrate it appropriately into decision-making. Most biopharma companies are now attempting to accelerate their clinical development programs via adaptive trial design and other iterative models that adjust as data emerges.

To the extent that various players are successful at integrating complex data into decision-making, we can expect to see accelerations for both R&D as well as integration of new therapies and diagnostics into standard of care, which collectively will improve patient outcomes in both early and later stages of disease.

Trend Implications:

One major challenge for biopharma is ensuring the ability to handle larger and / or highly complex datasets via computational capabilities, either in-house or via “Big Data” partnerships. But data insights alone will not be sufficient. Companies must also be willing to shift internal decision-making to “trust” this data, for example using modeling or AI-generated findings vs. actual clinical data to drive portfolio decisions.

As products enter the market, there will also be an increasing need for Sales and Medical functions to successfully communicate highly complex information to treatment decision-makers, including explaining how the insights were generated and why they should trust the results.

Trend 4. Enhanced focus on patient-centered experience and outcomes

Trend Overview:

As these trends continue to expand the patient population eligible for chronic management, there is also an increasing expectation of outcomes measured not just by OS or PFS, but those that take into account the likelihood that patients will be on therapy for extended periods of time as their disease is managed. This means increased focus on safety and tolerability of therapy, as well as benefits to quality of life (QoL) beyond just survival. We see this demonstrated with increasing use of secondary endpoints in clinical trials that include Patient Reported Outcomes (PROs) and QoL results.

As the number of treatment options grows in various indications, patients and advocacy groups are also increasingly leveraging their power as consumers, working to include their perspectives in both development approaches (e.g., clinical trial design) as well as integration into standard of care (e.g., participation in conferences). Taken together, we expect a beneficial trend in product development goals not just being increased efficacy, but tolerability / safety, dosing ease, etc.

Trend Implications:

Success in the context of this trend will require robust consideration of the patient as key stakeholder, not just in name only but with real investment in validation of novel QoL endpoints, as well as pipeline management decisions that incorporate them. In addition, healthcare practitioners will need to shift patterns of care from acute (time of diagnosis or progression) towards chronic with an associated focus on tolerability and other QoL measures.

Biopharma will need to expand their regulatory and reimbursement data packages beyond traditional efficacy and safety to include PRO/QoL data, and in turn those decision-makers will have to expand their own models to more holistically consider product value.

Conclusions

In summary, there is much to be optimistic about in the future of cancer care, not just from a patient perspective with increasing opportunity for chronic management or even cure, but from a biopharma perspective as well, with shifting but also expanding opportunity into new markets for earlier detection of both diagnosis and progression with goals of cure or chronic management.

References:

- Annual Report to the Nation on the Status of Cancer, Part 1: National Cancer Statistics. Islami F et al. J Natl Cancer Inst. 2021 Jul 8. https://doi.org/10.1093/jnci/djab131

- Updated estimates of eligibility for and response to genome-targeted oncology drugs among US cancer patients, 2006-2020. Haslam A et al. Annals of Oncology. VOLUME 32, ISSUE 7, P926-932, JULY 01, 2021. https://doi.org/10.1016/j.annonc.2021.04.003