In part 1 of our series on how to build peak performance go-to-market operations, we highlighted the need to re-envision how we think about go-to-market models to increase the likelihood of future success. This is particularly important now, as various macro-level shifts affect the biopharma industry and as market growth slows (despite analysts’ optimistic expectations of an 8% CAGR over the next five years).

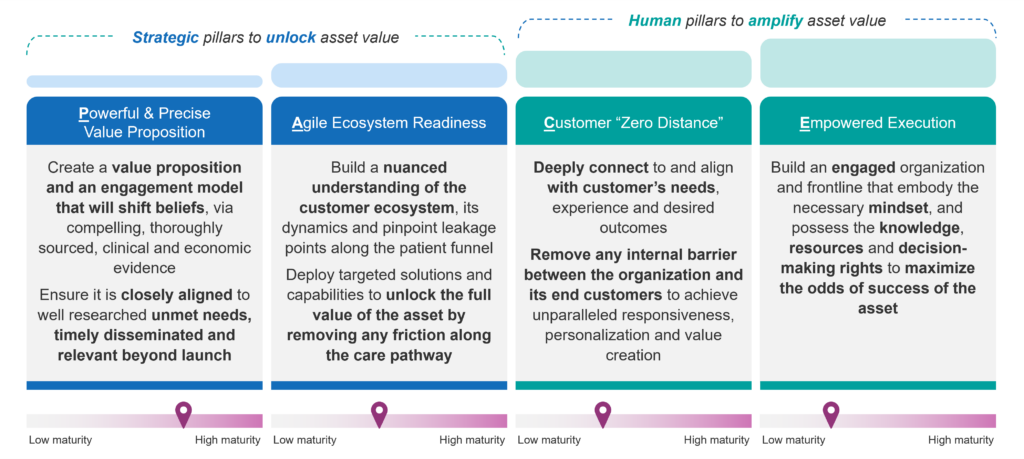

Our analysis of future challenges coupled with a thorough review of 300 launches over the last 10 years led us to identify four foundational pillars that enable companies to unlock peak go-to-market performance. They form the basis for our human-centric framework, PACE (see Figure 1):

- Powerful and Precise Value Proposition

- Agile Ecosystem Readiness

- Zero Distance to Customer

- Empowered Execution

Figure 1: The PACE Framework

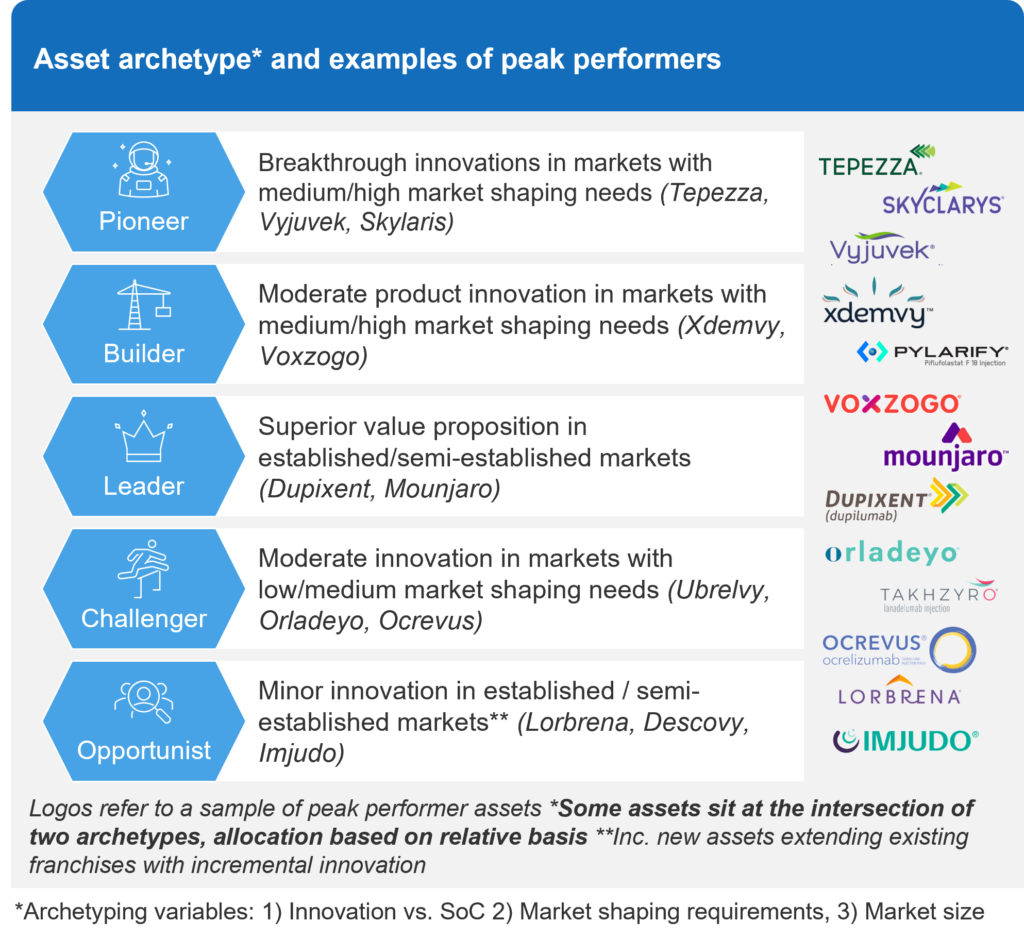

While these four factors form the backbone of high-performing go-to-market (GTM) models, there is no universal playbook for success. In reality, an asset’s GTM performance is shaped by three critical dimensions: the degree of innovation it brings to therapy, the market-shaping efforts required to embed it within the care pathway, and the underlying epidemiology—whether addressing a high-prevalence condition or an orphan disease. The key is not just execution but strategic precision—aligning the model to the unique contours of the asset and the market it seeks to transform. Those variables led us to identify five asset archetypes:

- Leaders

- Pioneers

- Builders

- Challengers

- Opportunists

This distinction carries profound implications for how companies should design their go-to-market organizations, structure their investment and operating models, and craft their customer engagement strategies. Success demands not only the right capabilities in each market but also the right mindset—one that embraces adaptability and precision.

The importance of segmentation becomes even more pronounced when optimizing a multi-asset portfolio. Different product mixes necessitate solving distinct go-to-market trade-offs, requiring companies to balance scale with specialization, efficiency with agility, and investment with impact. The organizations that master this equation don’t just compete—they redefine the rules of the game.

Figure 2: Asset Archetypes and Examples of Peak Performers

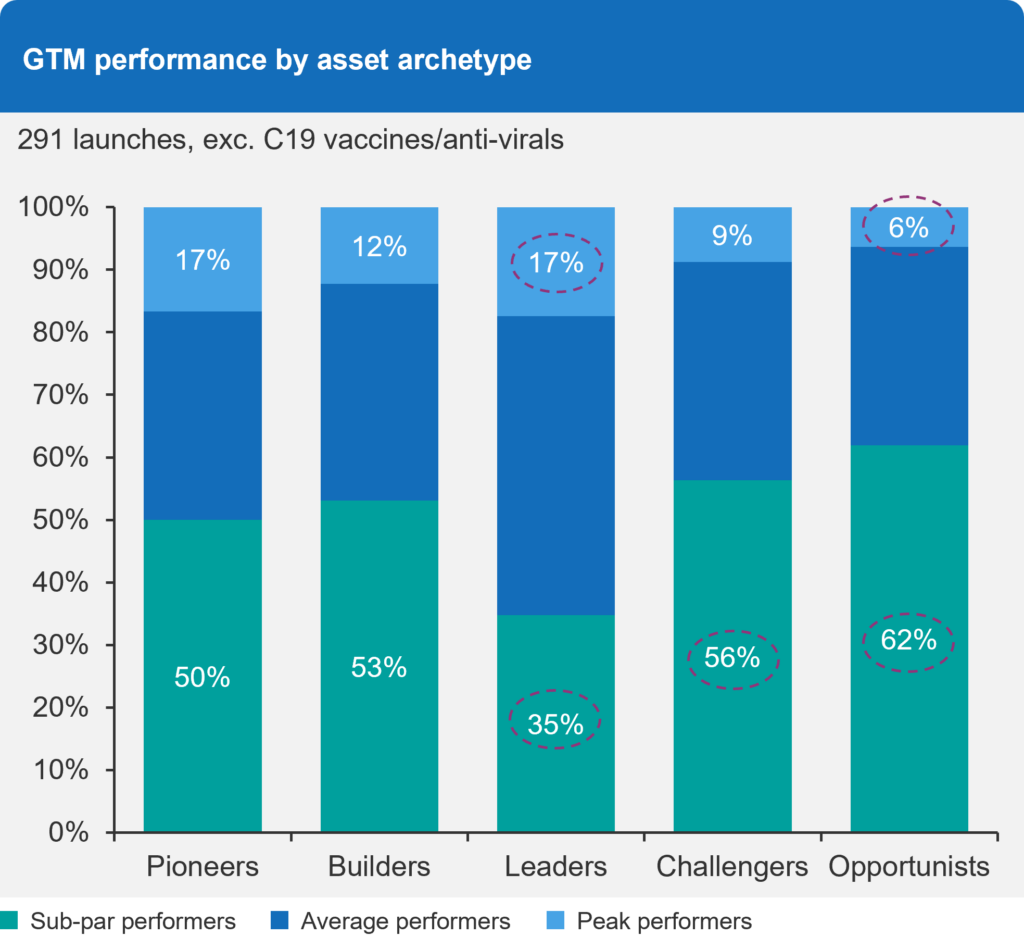

Relative Performance of Assets by Archetype

It’s no surprise that Leaders—those who demonstrate a markedly superior value proposition in an otherwise established market—exhibit the highest rates of success coupled with a lower degree of under-performance. Simply put, developing a great product has a direct impact on go-to-market performance (yet the science does not “sell itself”).

Figure 3 – Go-to-Market Performance by Asset Archetype

On the flip side, Challengers and Opportunists—those who demonstrate a moderate or minor degree of innovation in established and competitive spaces—show the lowest rates of success (9% and 6% of the assets, respectively) and the highest rates of sub-par performance. Besides the different degree of innovation, a further distinction between those two categories lies in their intent and vision for the asset. “Success” is defined differently for each: Challengers are focused on intentionally competing and winning against the standard of care (SoC), while Opportunists aim to secure a sufficient share of the market efficiently, doing what they can with a lean model, while priority and focus are elsewhere in the portfolio.

Finally, Pioneers and Builders also show relatively high rates of under-performance. Both are focused on areas with material need for market shaping and care pathway development. In particular, Pioneers represent breakthrough technologies with paradigm-changing efficacy. Why do they under-perform so often? It’s because building new markets and transforming care pathways call for different investment models and capabilities that not all companies have successfully managed to develop and master.

In the rest of this article, we present relevant case examples and discern valuable insights into what drove success. We also identify some critical challenges and risks to overcome and highlight how the PACE framework can aid optimizing future launches within these archetypes.

Case Examples

Pioneers and Builders

Pioneers and Builders share a critical challenge: the need to shape the market and develop new care pathways. These are often the largest sources of value leakage. This is particularly evident in precision medicine and biomarker-driven therapies where market access hinges on diagnostics readiness.

With over 500 approved therapeutic targets and 1,500 in development, precision medicine continues to expand. Oncology, particularly non-small cell lung cancer (NSCLC), exemplifies both progress and persistent hurdles—more than 10 biomarker targets exist today, yet patient identification remains a bottleneck.

The landmark approval of Herceptin® (1998) revolutionized patient segmentation, shifting focus from tumor location to biomarkers. Since then, biomarker-directed therapies—EGFRm in NSCLC, HER2 in breast cancer, MSI-H/NTRK in pan-tumors—have reshaped treatment paradigms. However, each breakthrough demands a shift in the status quo, requiring systemic changes in testing infrastructure, diagnostics integration, and physician education.

Recent therapies highlight the struggle to carve a space within an increasingly congested system:

- Rybrevant® (Amivantamab, J&J, 2023) – EGFR exon20ins, NSCLC

- Tepmetko® (Tepotinib, Merck Serono, 2021) – METm, NSCLC

- Rozlytrek® (Entrectinib, Roche, 2020) – ROS1/NTRK, NSCLC

- Vitrakvi® (Larotrectinib, Bayer, 2019) – NTRK, pan-tumor

While clinical trials ensure structured patient identification, real-world adoption depends on early and systematic investment in ecosystem readiness:

- Testing Infrastructure: Despite a rise in PCR testing for EGFRm (20% to 80% over 10 years), awareness has not translated to adoption for EGFR exon20ins, which requires different testing methods.

- Internal Capability Gaps: Many frontline teams lack a deep understanding of testing landscapes and customer ecosystem (not individual) needs, resulting in suboptimal commercialization.

- Portfolio Squeeze: Targeted therapies often struggle within large portfolios, where focus is diluted (e.g., Rozlytrek® within Roche’s oncology portfolio). Alternative approaches—carve-out models, divestments to smaller, nimbler companies—should be considered early to maximize asset value.

Some biopharmas have dedicated Precision Medicine teams, yet limited funding and poor cross-functional integration often hinder their effectiveness. True market preparation requires alignment across HCPs, pathologists, providers, and payers to break systemic barriers and improve patient identification.

Beyond oncology, rare disease therapies also rely on early and accurate patient identification and care pathway development. Tepezza®, Vyjuvek®, and Ogsiveo® demonstrate the impact of ecosystem readiness. We covered Tepezza® and Vyjuvek® in part 1 as virtuous examples of companies successfully investing in infrastructure development to ensure market fit for their therapies (both of them feature as peak performers). Here, we would like to draw attention to another peak performer, Ogisveo® (Springworks Therapeutics), approved by the FDA in November 2023 for the treatment of desmoid tumours[1]:

- Ahead of launch, in addition to early launch preparation, SpringWorks secured an ICD-10 code to optimize patient identification which resulted in an overall increase in the patient pool by ~50% (7,000 to 10,000 in year one).

- Early advocacy shaped clinical guidelines, ensuring strong ecosystem readiness.

- Peer-to-peer engagement drove rapid adoption, achieving 77% active prescribers in CoEs and expanding reach to 420 prescribing centers (vs. 90 sarcoma CoEs), with 57% in community settings.

We also find cell and gene therapies in these categories (Pioneers and Builders). Despite their promise, cell therapies have struggled commercially, hindered by lack of care pathway readiness, cumbersome patient journeys and short-term evidence concerns that reduce payer and prescriber confidence. Roctavian® (BioMarin, hemophilia A) is the latest example. Poor market adoption forced the company to streamline its commercial operations.

For Pioneers and Builders, success hinges on more than just scientific innovation. Early, strategic investments in diagnostics, market preparation, and commercialization models determine whether a breakthrough reaches its full potential or gets lost in the system.

Leaders

Great science alone is not enough. A breakthrough product backed by compelling evidence is a powerful advantage—but it’s not the sole determinant of success. Biktarvy® (Gilead) and Mounjaro® (Lilly) exemplify how strategic execution, beyond scientific innovation, turns potential into market dominance.

Biktarvy’s success stemmed from more than its high efficacy and three-tablet-regimen-in-a-pill convenience. Gilead’s orchestrated market entry—leveraging multi-channel evidence dissemination and rapid ecosystem integration—propelled it to blockbuster status within a year, dominating both treatment-naïve and switch patients.[2] Despite not being first to market, Biktarvy’s patient website quickly became the most visited HIV patient resource.[3] Gilead continued to reinforce its leadership, releasing BICSTaR[4] (2024)—a four-year study confirming long-term efficacy, safety, and 95-97% adherence rates.

Lilly’s tirzepatide (Mounjaro/Zepbound®[5]) disrupted the metabolic space from launch, immediately challenging Novo Nordisk’s semaglutide (Ozempic®/Wegovy®) with superior clinical efficacy. But Lilly didn’t stop at data:

- Competitive Positioning: The SURMOUNT-5 study (2024) directly demonstrated superiority over semaglutide in a head-to-head trial.

- Customer-Centric Expansion: In 2024, Lilly launched LillyDirect[6], an end-to-end digital healthcare experience, streamlining direct patient access to tirzepatide.

- Bold Manufacturing Investments: To prevent supply shortages and solidify global market presence, Lilly committed $27 billion in U.S. manufacturing, along with multi-billion-dollar expansions in Ireland and Germany—a strategic bet on weight-loss adoption in a relatively underdeveloped market (yet) for anti-obesity medications, but highly important.

Both Biktarvy and Mounjaro embody a defining trait of Leader assets—the ability to make bold, decisive moves at speed. From pre-launch preparation to commercial execution, sustained leadership isn’t an accident—it’s a mindset embedded at every level of the organization.

Challengers and Opportunists

The evolution from Leader to Challenger to Opportunist is a natural progression in competitive markets. With fewer white spaces and increasing convergence in therapy areas, the question becomes: how to win market share efficiently and effectively by creating a sustainable competitive advantage?

Since Keytruda® and Opdivo® launched over 10 years ago in metastatic melanoma, the PD-(L)1 market has grown rapidly with 10+ players, globally. The successes of opportunists, later-to-market, anti-PD-1 inhibitors highlights key winning strategies that have positioned them as competitive and patient-friendly options in the market:

- Craft distinct value propositions with a targeted, defined need:

-

-

- Focus on adjacent indications of greater unmet need, leveraging established class perceptions, but on a new indication, such as Bavencio® (avelumab) in Merkel Cell carcinoma, and Libtayo® (cemiplimab) in cutaneous squamous cell carcinoma.

- Focus on non-clinical benefits, optimising convenience and resource utilisation, such as the growing wave of sub-cutaneous formulations from the China-developed Enweida (envafolimab) in 2021 to Tecentriq® last year and Keytruda and Opdivo finally following suit with approvals expected soon.

-

- Enhance customer and patient engagement: embrace digital tools like mobile apps, telemedicine, and patient support systems, along with peer support and patient-centric marketing campaigns to build stronger connections with patients, improving their overall experience and outcomes

Ultimately, organisations needed to focus on a singular differentiation—a lean GTM strategy—rather than dilute their efforts through multiple customer engagement channels.

The next battleground awaits; obesity, with a projected $100 billion+ market and numerous phase 2+ assets, obesity is the ultimate GTM challenge and a prime test case for GTM excellence—especially given the high cost of entry—whether through organic development or M&A. Success for Challengers and Opportunists depends on targeted strategy execution across the PACE pillars:

- Powerful and Precise Value Proposition: The market is shifting from pure weight loss to broader co-morbidity benefits (cardiovascular risk, liver health, renal function). Winning strategies must clearly define patient subpopulations, generate compelling evidence, and identify underserved segments, e.g., lean muscle preservation or a mass-market play for lower BMI groups prioritizing speed and safety over extreme weight loss.

- Agile Ecosystem Readiness: “Ecosystem readiness” will remain vitally important and will matter even more for players who have the ambition to challenge the Lilly and Novo Nordisk status quo. However, we still anticipate that new players will “piggy-back” on the market development efforts of the current incumbents, barring any new super-competitive value propositions. A good example of such ecosystem development efforts is Novo Nordisk’s transformational prevention unit (TPU). It’s a pioneering division merging science and business to support multi-sector partnerships and redirect focus from the immediate costs and budget impact to better convincing payers of the long-term and wider societal impact of obesity.

- Zero Distance to Customer: In such a competitive environment, achieving “zero distance” to the customer becomes particularly important. This goes beyond customer centricity. It means an active shift in the GTM organization to remove any barriers that create friction and slowness in proactively tackling customer needs. It transcends well-crafted messages aligned to customer needs, often requiring an overhaul of the operating and investment models of a company, as well as its ways of working and mindset. For Challengers in obesity, it means decluttering the GTM model to double-down where it really matters. It also entails leveraging data and technology to aid precision, including “nurturing” a new customer base away from the traditional pool of high prescribers among endocrinologists, obesity specialists, and primary care physicians (the latter only in selected markets), all of which are overserved by the current incumbents.

- Empowered Execution: Lastly, fostering “empowered execution” will shift decision-rights closer to the customer, helping to improve the responsiveness of GTM operations (local head offices and frontline teams) to local dynamics and customer needs. This ultimately reinforces the asset’s competitiveness and its ability to win patient share in the dynamic portion of the market.

For Opportunists, even more disciplined resource allocation is critical, using rigorous segmentation and tech-enabled execution to maximize impact.

Whether in obesity or oncology, later entrants must be laser-focused on differentiation—through unique value propositions, lean GTM models, and ecosystem engagement. Those who execute with speed and precision will carve out their place in an increasingly crowded but lucrative landscape.

Conclusion

Different asset archetypes face distinct challenges and strategic imperatives at launch. A clear strategic intent is critical to shaping the right go-to-market approach. The PACE framework provides a structured lens to align business needs across archetypes:

- Pioneers and Builders: Success depends on Agile Ecosystem Readiness and achieving Zero-Distance to Customer—ensuring the right infrastructure and patient pathways are in place. This requires a “builder” mindset in the GTM team and targeted investment to unlock patient identification and activation at the top of the funnel, where most of the value lies.

- Leaders: Winning will be about three core levers—crafting and amplifying a phenomenal evidence-based narrative, priming and pulling customers early for rapid uptake, and embedding a leadership mindset across all GTM functions.

- Challengers and Opportunists: With fewer white spaces, success hinges on ruthless prioritization of business drivers and wiring the organization for speed—enabling rapid execution on the ground.

For companies managing multi-asset portfolios, trade-offs across archetypes are inevitable. The PACE framework simplifies complexity, focusing on the choices that truly matter. As Michael Porter said, “Strategy is about making choices.” The key is making the right ones.

End Notes:

[1] SpringWorks investor relations materials, earnings call transcripts

[2] https://www.globaldata.com/store/report/hiv-digital-marketing-trends-and-analysis/

[3] https://clarivate.com/life-sciences-healthcare/blog/biktarvy-the-booming-blockbuster-drives-hiv-market/

[4] https://www.gilead.com/news/news-details/2024/scientific-leadership-spotlighted-as-gilead-presents-research-data-across-its-broad-and-innovative-hiv-treatment-portfolio-and-pipeline

[5] FDA approved Mounjaro (tirzepatide) for T2D in 2022 and Zepbound for weight loss in 2023. In Europe tirzepatide is available as Mounjaro for both indications.

[6] LillyDirect also channels diabetes and migraine medications from Lilly, in addition to weight loss therapies.