Different companies can have dramatically divergent journeys when they decide to enter European markets for the first time. They may be in various circumstances or stages of their corporate evolution when they decide to enter. Some companies think about Europe very early on while others prepare their strategies much closer to launch. Depending on each company’s situation, they will make markedly different choices along the way.

When members of the European Biotech Leader Roundtable gathered in May of 2022 to discuss best practices for entering Europe, all were highly aware that there is no “one size fits all” approach. Of course, there are elements of the journey into Europe that are fairly consistent from one company to the next, but the differences are critical.

What causes these differences? In our experience, they’re driven by a combination of company attributes that include a biopharma company’s strategic vision, available resources, and (most importantly), its level of commitment to Europe. In advance of the Roundtable event, the Blue Matter team analyzed approximately 20 US-based biopharma companies that had entered European markets in recent years. This was a diverse group of companies. Our objective was to gain more insight regarding their journeys to Europe and learn more about the strategic issues they faced.

As a result of our analysis, we developed a framework that grouped these companies into three broad company archetypes. Within each archetype, companies have similar pathways into Europe. This white paper introduces that framework and describes the company features that are usually found within each archetype, as well as a biopharma company’s main strategic imperatives, key challenges, and “typical” journey. Our hope is that readers will recognize their own companies in these archetypes and be able to leverage some of the insights to guide their own journeys.

Developing the Framework

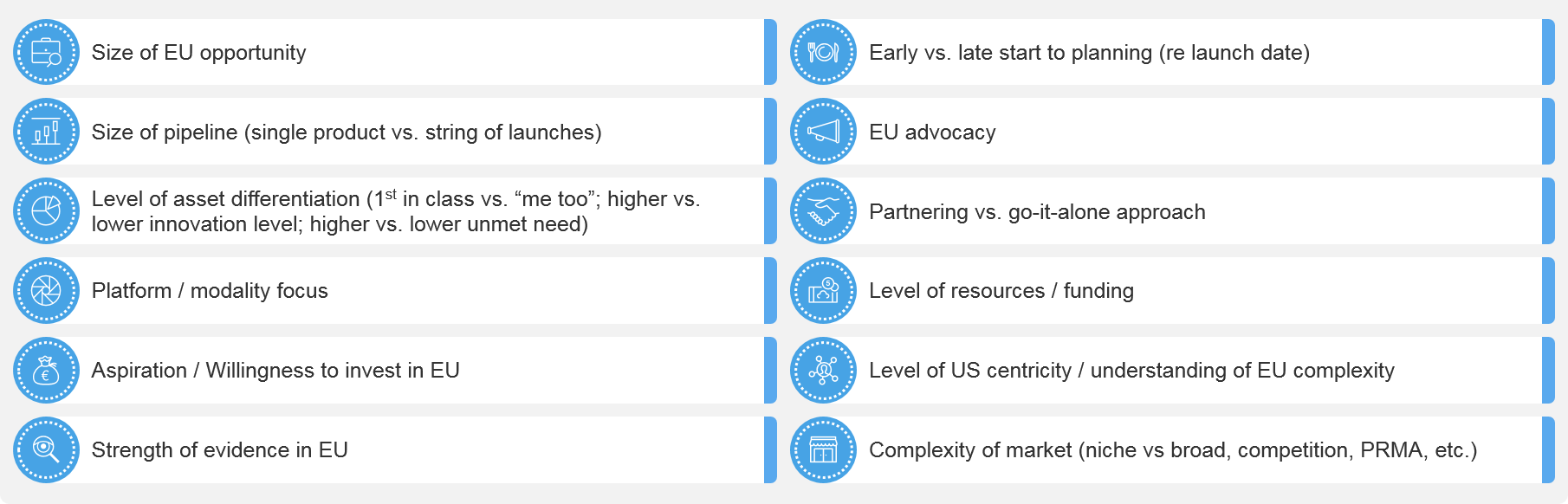

As mentioned, we looked at around 20 companies to develop the framework and the related archetypes. Across the companies, we identified and characterized a range of attributes. Our objective was to assign the companies to groups that share similar journeys into Europe, based on some collection(s) of attributes in common. The key attributes are described below and summarized in Figure 1.

Asset-Specific Attributes:

- Level of asset differentiation: How innovative & differentiated is the treatment? Is it first-in-class in an indication of high unmet need or is it a “me too” product? What’s the value of the novel treatment for patients, caregivers, payers, and society?

- Market complexity: How big is the overall market and the targeted / addressable market segment? Is it a niche product or of broader utility? What’s the standard of care (SoC) and the level of competition or “crowdedness” of the market (current, but also at the time of launch and in the future)?

- Market access situation: What is the treatment’s value vs. the SoC or other competitors? What is the relevant comparator in different EU countries? What pharmacoeconomic evidence is required (by country)? What pricing levels exist and is the target price achievable (especially opposite the US price)? What potential access restrictions exist?

- Risk assessment: What are the different levels of asset-related risks such as the clinical and regulatory chances of success? Risks related to access, pricing and reimbursement, the supply chain, etc. are also important considerations.

Company-Specific Attributes:

- Size of the pipeline: Is it a single asset or a series of future launches with multiple assets or in additional indications (e.g. based on a platform technology)?

- Company financial situation: What is the level of funding? Does the company already generate revenue via commercialized products or does its commercial success rely on assets that are to be commercialized?

- Early vs. late / stage of commercial launch: A company’s focus and strategy will dramatically differ depending on the expected commercial launch date and the remaining time to launch.

- Level of understanding of European market complexity: Does company leadership understand the complicated nature of the EU market? Does the leadership team have previous experience in Europe? Is there strong advocacy for EU markets in the company’s leadership?

- Company vision & board experience: What’s the company vision for Europe? Is there one? What is the Board’s level of understanding and support?

Figure 1: Key attributes assessed when analyzing US-based companies that entered Europe

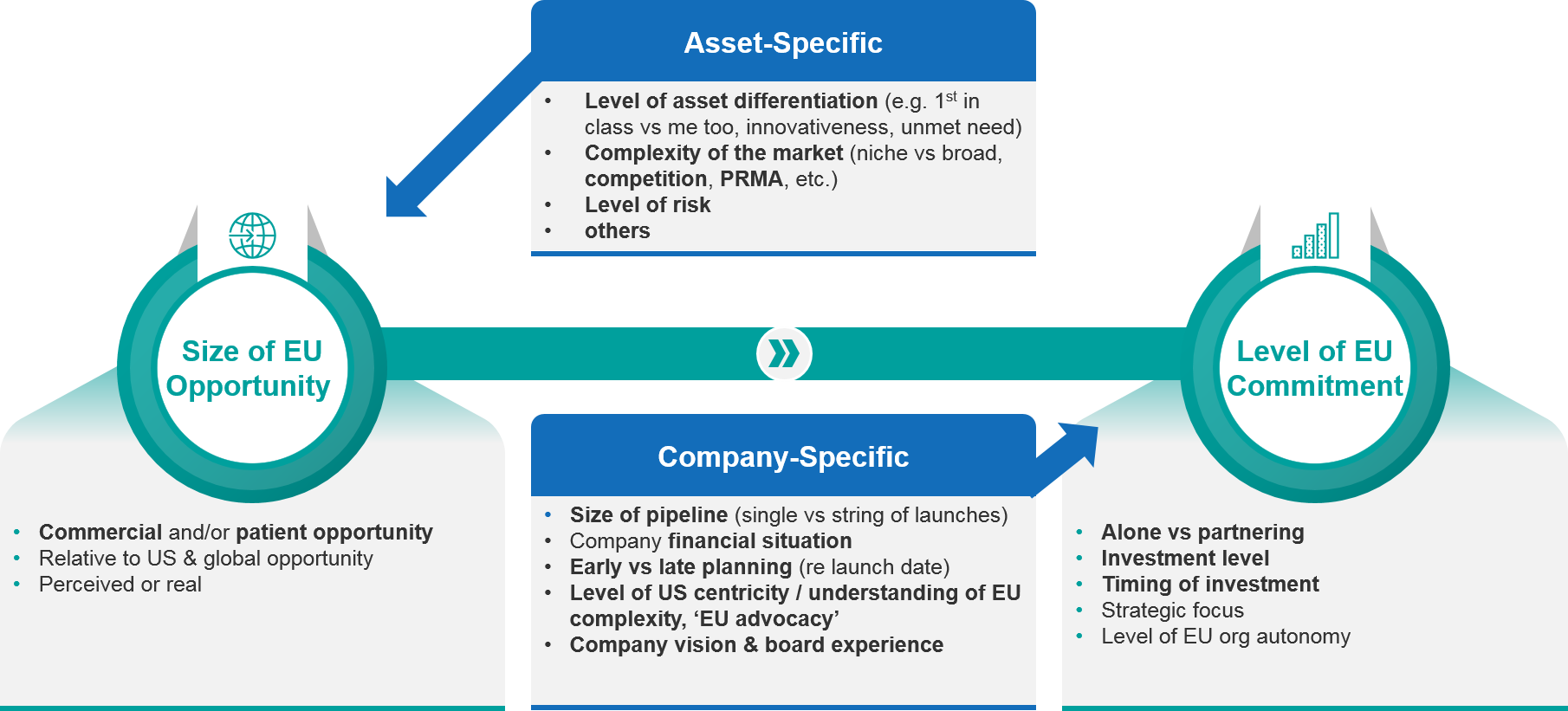

During our detailed analysis, we concluded that the most effective way to group companies was actually pretty simple: according to their level of commitment to Europe. Almost always, a company’s level of commitment was directly tied to its judgment regarding two things, the:

- Overall size or attractiveness of the European opportunity for the product or portfolio in question

- Company’s ability to unlock that value and to actually realize that opportunity

The level of a company’s commitment to Europe will guide critical strategic decisions regarding things like partnering or licensing, timing and magnitude of infrastructure investments, organization-building, and many more. All of the other attributes we assessed ended up serving as important modifiers or contributors, but none were the sole driving factor in how a company’s European market entry unfolded. Figure 2 illustrates the interplay between the attributes, the size of the EU opportunity, and ultimately, the company’s level of commitment to Europe.

Figure 2: How key attributes affect the size of the EU opportunity and a company’s ability to access it

The Company Archetypes

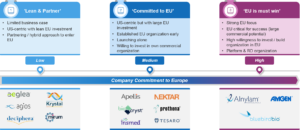

When we applied our simplified framework described above, we identified three broad archetypes of US-based companies according to their level of commitment to Europe:

- Low Commitment – “Seeking to Partner”

- Medium Commitment – “’Lean with Europe as a Secondary Focus”

- High Commitment – “EU is Must-Win”

Before we discuss the archetypes any further, it’s important to note a couple of things:

- The terms “Low” or “Medium” or “High” when describing a company’s commitment level are not intended to convey any judgement about the company or its strategy. For example, a “high” level of commitment is not better than a “low” level of commitment. The best path for a company is dependent on its specific situation. A company’s objectives, strategy, and circumstances may mean that a “low” level of commitment is the best approach in a given situation and would be a far better choice than pouring resources into building a full commercial infrastructure in Europe. However, another company might be facing a totally different set of factors, and a heavier investment (i.e., a “medium” or “high” level of commitment) might be more appropriate.

- A company can move from one archetype to another over time. When placing a company into an archetype, the categorization is really for that specific point in time. In many cases, a company will remain in a given archetype for the long-haul. However, for other companies, circumstances can change. That can cause their level of commitment to evolve and shift them from one archetype to another. These shifts can occur in either direction; a company can start out with a lower commitment and build commitment over time to even end up in the high commitment category and vice versa.

Low Commitment – “Seeking to Partner”

A company in this category typically has determined that the opportunity for its product or portfolio is limited, possibly due to a smaller indication, a niche market, or strong existing or incoming competition. Most often, the key business opportunity is perceived to lie within the US market.

As a consequence of the relatively small European opportunity, US companies in this category will limit their investments in Europe by doing one or more of the following:

- Establishing a very lean organization in Europe (the minimum needed per their objectives)

- Licensing out their asset

- Looking for a partner for the initial launches, or

- Pursuing a hybrid approach

Two companies that fit this profile are Aeglea Biopharmaceutics and Agios Biopharmaceuticals. Both are developing treatments for rare diseases, are relatively focused on the US market, and are considering partnering options outside the US.

Aeglea Biopharmaceutics has multiple rare disease products in development. While the company is involved in Europe and clearly invests in EU clinical studies, the indication is small and the business case is limited. As a consequence, Aeglea might consider limiting its investment in Europe by executing a highly focused launch in only a few EU countries and evaluating partnering options.

Agios Biopharmaceuticals can also be added to the same group. After the company decided to divest its oncology portfolio, Agios withdrew its European application for Tibsovo®—its treatment for acute myeloid leukemia—its European opportunity substantially diminished. The company then focused on its treatment for pyruvate kinase (PK) deficiency, mitapivat. As a result, the company reduced its commitment to Europe and will likely invest in a limited launch and / or evaluate potential partners for commercialization in Europe.

Other examples of companies that started their EU entry with “low commitment” are Deciphera and Mirum. However, those companies have shifted or are transitioning to our next category, “medium commitment.”

Medium Commitment – “Lean with Europe as a Secondary Focus”

This relatively broad segment is characterized by companies that are “in the middle”. They don’t have a low commitment to Europe but they’re not highly focused on it, either. Europe is, however, an important part of their strategy.

Typically, companies in this large segment are focused on the US as their key market but they recognize Europe as an important opportunity, as shown by their willingness to invest early and appropriately. These companies are generally committed to Europe and will establish their own commercial organizations to support launches of their key assets.

While medium commitment companies usually decide to establish EU organizations and commercialize their key assets on their own, they carefully evaluate their strategic options. Typically, they build lean organizations and focus on their key EU markets while leveraging partnerships for smaller and less important ones. Representative examples in this segment are Apellis, BioCryst, Nektar, Prothena, Tesaro, and Insmed.

High Commitment – “EU is Must-Win”

For companies in this category, Europe is an early and highly important strategic focus. Europe is recognized as a major market opportunity with a substantial commercial promise and seen as a “must win”. Often, these companies have platform technologies that can be applied to multiple indications or they have significant pipelines of products that are coming to the market in a well-sequenced fashion.

For them, Europe is critically important because a very significant percentage of future patients is located here. High commitment companies typically develop innovative and cutting-edge therapeutic options in underserved life-threatening diseases. Often, they have highly differentiated first and only treatments that bring substantial value to patients, payers, and the healthcare system.

Companies in this segment generally understand the value and the complexity of the European market(s). They also have the understanding, mindset, and vision to become strong global players from the very beginning.

Early on, these companies tend to invest heavily in Europe. Specifically, they

- Invest in substantial clinical programs that are well-adapted to European needs and requirements

- Have strong global regulatory and market access strategies that are well aligned with European needs

- Establish strong and well-resourced European operations

The leadership teams in these companies typically have European experience. The US and EU teams are usually well aligned, and the EU teams are empowered to make the important decisions. Representative examples of high commitment companies are bluebird bio, Alnylam, and Amgen.

Figure 3 – Company archetypes based on level of commitment to Europe

High-Level Strategic Considerations Within Each Archetype

In this section, we look at the most critical issues and the resulting strategic direction for the companies within each group. Note that depending on the specific company situation, the challenges and strategic priorities below may actually overlap. The key issues and related strategic focus are directional and try to capture the most likely situation of companies within the respective archetypes.

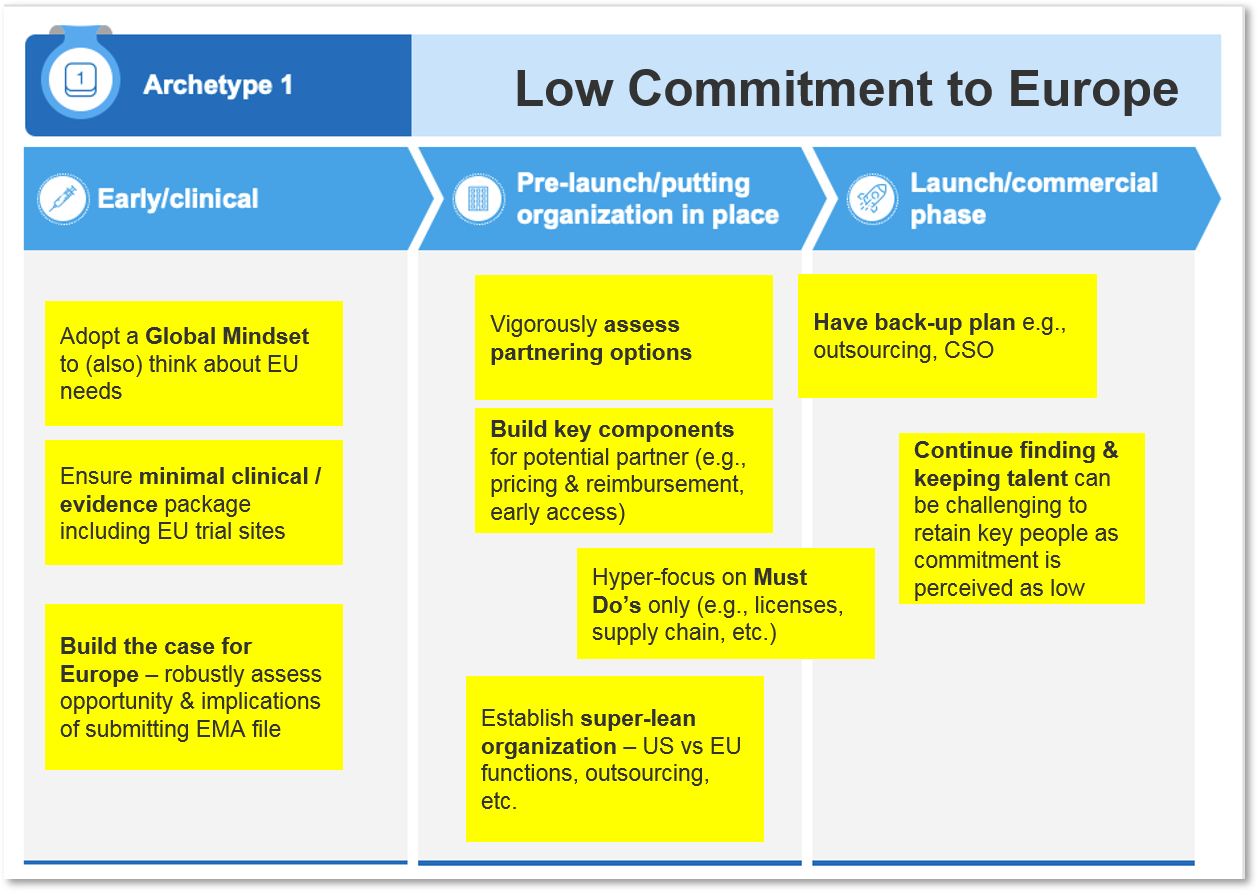

Low Commitment – “Seeking to Partner”

| Common Key Issues | Strategic Focus Areas |

|---|---|

Figure 4: Timing of Key Strategic Focus Areas for “Low-Commitment” Companies

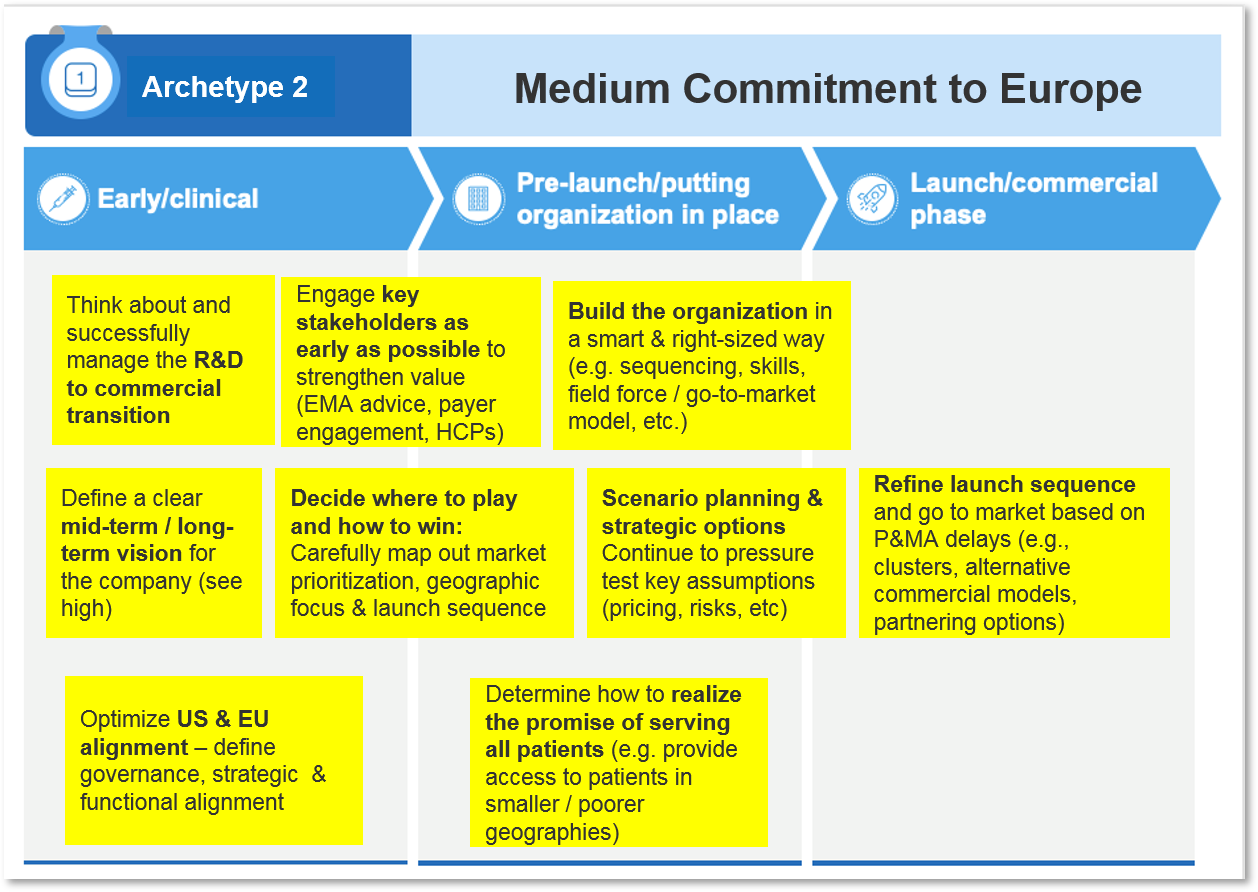

Medium Commitment – “Lean with Europe as a Secondary Focus”

| Company Key Issues | Strategic Focus Areas |

|---|---|

Figure 5: Timing of Key Strategic Focus Areas for “Medium-Commitment” Companies

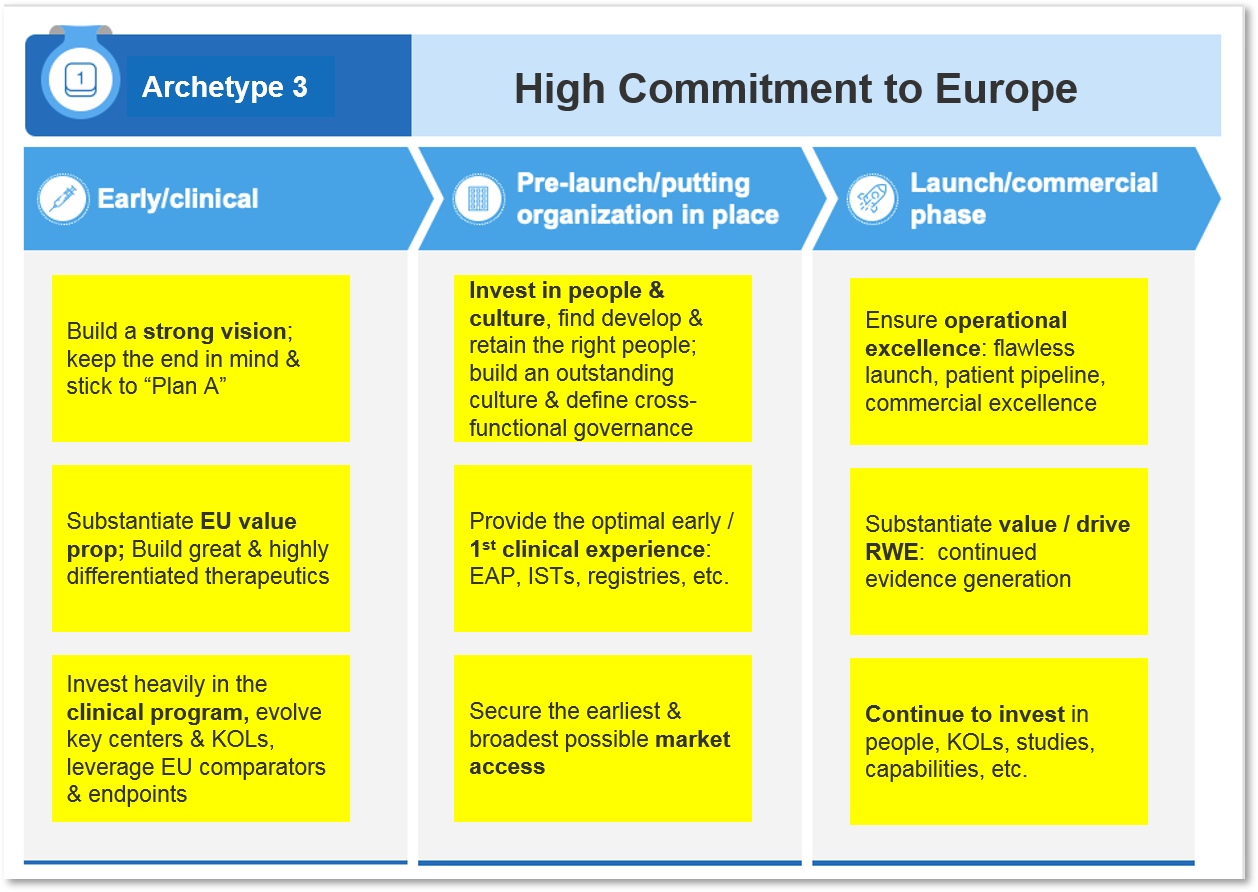

High Commitment – “EU is Must-Win”

| Common Key Issues | Strategic Focus Areas |

|---|---|

Figure 6: Timing of Key Strategic Focus Areas for “High-Commitment” Companies

For obvious reasons, the set of strategic imperatives for companies in the high commitment archetype is the most comprehensive and requires a significant investment of time and effort. Generally, there will be some overlap of issues and strategic directions across the different archetypes, though the emphasis on key issues will vary substantially from one group to the next. In the end, the strategic direction of a company will be determined by its unique and very special situation.

Parting Thoughts

With this white paper, we have attempted to provide a simple and intuitive framework to help US-based biotech companies characterize their level of commitment to Europe and, depending on that commitment level, identify a set of high-level strategic issues they’ll need to address. Companies can use the proposed framework to “self-diagnose” their archetype or, the consultancies that support them may use it to provide a specific set of strategies to use as they prepare to enter Europe.

Certainly, the set of strategic recommendations will need to be customized and depends on the specific situation for each respective company. However, we believe that the proposed framework is an attractive and powerful way to quickly assess and diagnose a US-based company’s situation while providing a solid first perspective on what it takes to succeed in Europe.