Developing and commercializing a new therapy is a complex endeavor requiring significant investment, meticulous planning, and strategic navigation. In the realm of Central Nervous System (CNS) disorders, schizophrenia stands out for the unique complexities it presents.

In this paper, we consider the current schizophrenia landscape, key unmet needs, and the advent of muscarinic therapies, as well as their impact on the treatment paradigm. We will also explore the challenges and opportunities manufacturers face in discovering, developing, and delivering these innovative therapies in schizophrenia.

Disease Overview

Introduction to Schizophrenia

Schizophrenia is a severe and debilitating mental health disorder affecting approximately 3 million people in the United States.[1] This complex condition is characterized by a spectrum of symptoms, which profoundly disrupt the affected individuals’ thinking, feeling, and behavior. While the exact cause of schizophrenia remains unknown, it is believed to result from a combination of genetic and environmental factors.

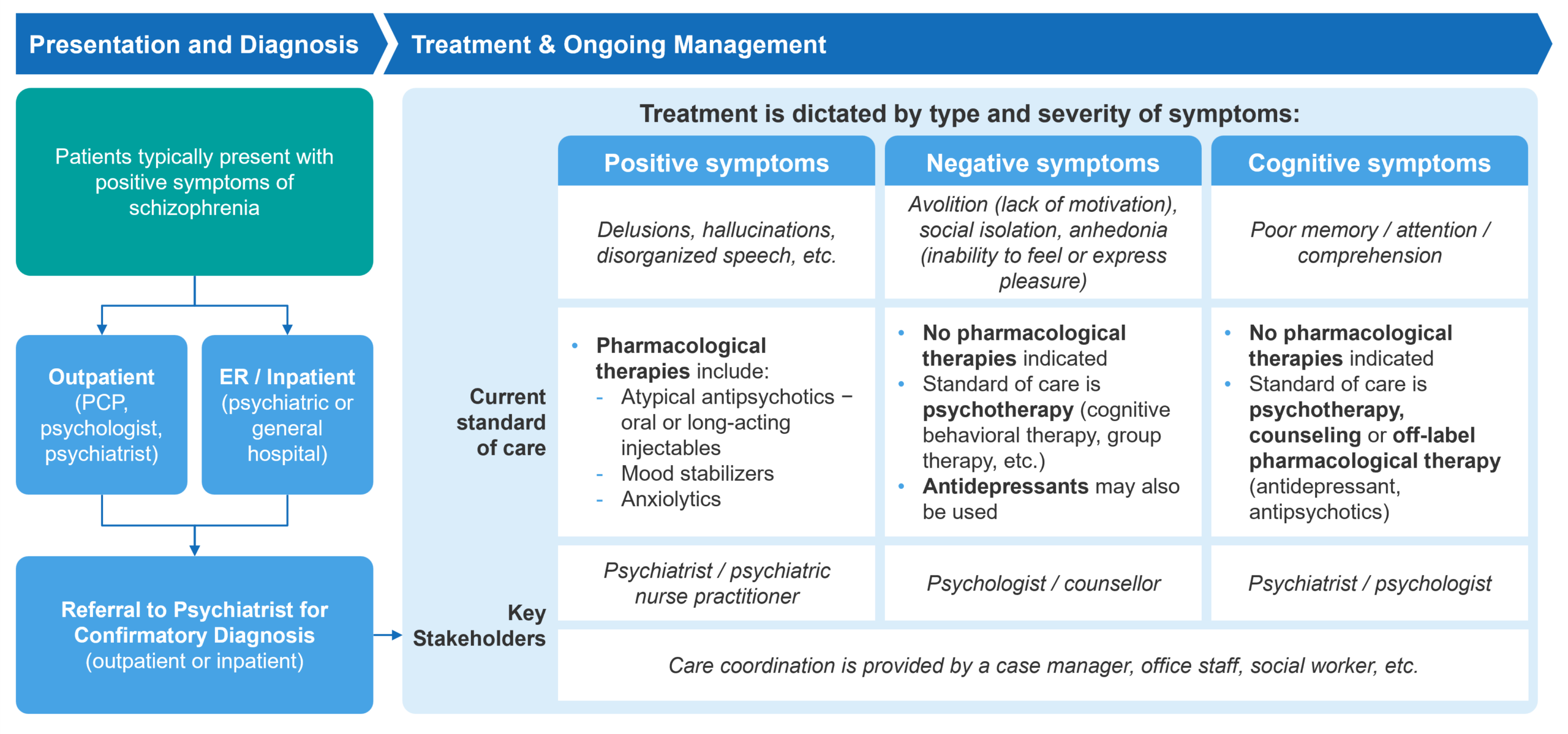

Fig. 1 – Schizophrenia Patient Journey Overview[2]

Typically manifesting in late adolescence or early adulthood, schizophrenia presents significant challenges in diagnosis and management. It’s characterized by a diverse range of symptoms categorized into positive, negative, and cognitive types. Positive symptoms tend to be the most prominent and are typically what lead to a diagnosis. Schizophrenia is primarily treated through a combination of pharmacological methods and psychotherapy, including cognitive-behavioral therapy (CBT).

Patients with schizophrenia are typically managed by a multidisciplinary team, including psychiatrists, psychologists, primary care physicians, nurses, and social workers. Care is provided across various settings, including inpatient facilities (such as acute psychiatric hospitals, general hospitals with psychiatric units, and long-term care facilities) and outpatient settings (such as community mental health centers, private psychiatric practices, and day treatment programs).

Current Treatment Landscape

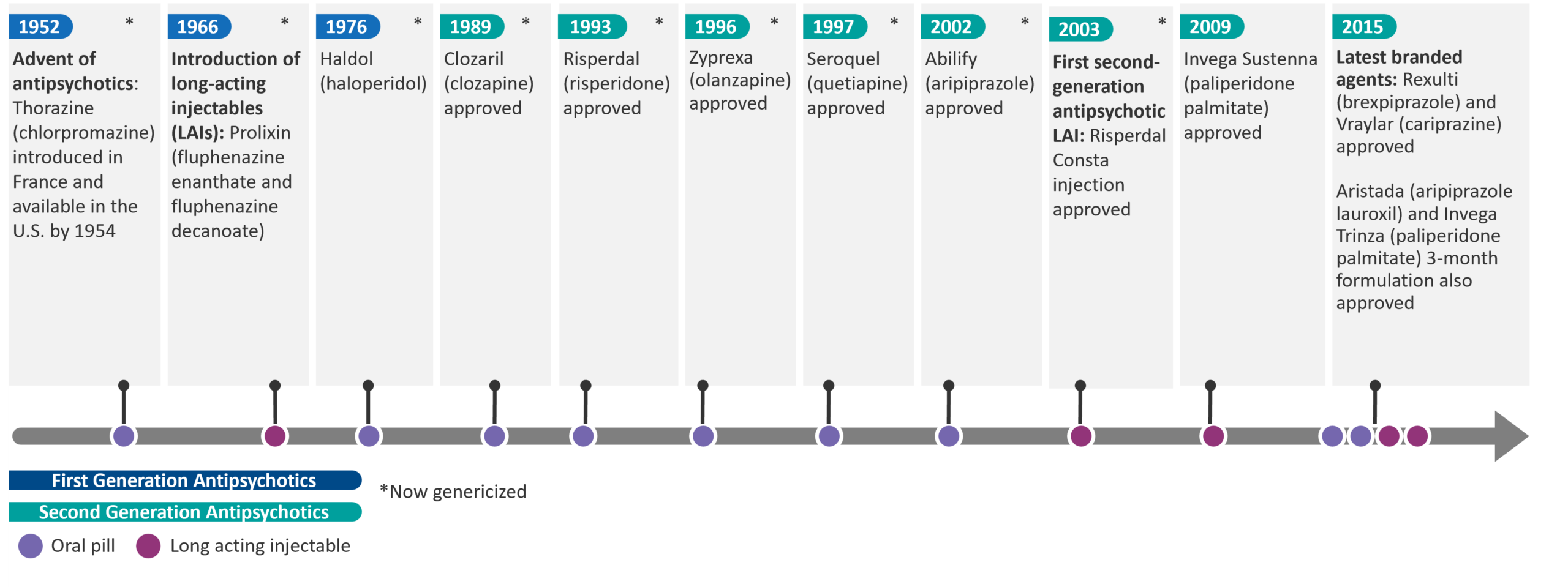

For more than 50 years, typical and atypical antipsychotic medications (first and second generation, respectively) have remained the cornerstone of treatment for schizophrenia, primarily targeting D2 dopamine receptors and 5HT-2A serotonin receptors.

Fig. 2 – Timeline of Antipsychotics

These neurotransmitters are heavily involved in the regulation of mood, cognition, and perception, which are often disrupted in schizophrenia and other psychiatric disorders. Dopamine dysregulation has been associated with positive symptoms of schizophrenia, such as hallucinations and delusions, leading to the use of D2 receptor antagonists to reduce this hyperactivity. Serotonin, particularly through 5HT-2A receptors, modulates dopamine release and is implicated in both the positive and negative symptoms of psychosis. However, blocking these receptors can lead to significant side effects. For instance, D2 receptor antagonism has been known to result in tremors and rigidity due to the pathway’s involvement in motor control. Similarly, interference with 5HT-2A receptors can affect a wide range of physiological functions, contributing to metabolic side effects and weight gain.

While there have been advancements in improving the side effect profile from first to second generation therapies, as well as enhancements in treatment adherence through development of long-acting injectables, the core treatment strategy has centered around modulating the dopamine and serotonin pathways to address positive symptoms.

Despite the availability of long-acting injectable formulations that aim to improve adherence by requiring less frequent dosing, many patients struggle with the regular administration of these treatments. The stigma of injectable medications combined with concerns over side effects often deter consistent use.

Patients may also experience fragmented care due to the involvement of multiple healthcare providers and multidisciplinary teams that lack central coordination. In situations without a single coordinating figure, such as a dedicated case manager or primary psychiatrist, it can be challenging to ensure continuity of care and consistent follow-up. This can negatively affect adherence and overall treatment outcomes.

Key Unmet Needs

Two of the most significant unmet needs in schizophrenia are:

- The improvement of side effects to enable better treatment adherence (which are a significant issue since patients are on chronic therapy for most of their lives)

- Comprehensively addressing symptoms (positive, negative, and cognitive, all of which have a significant impact on daily life)

Significant side effects continue to remain a major issue with second-generation antipsychotics. Weight gain and somnolence are particularly common. Weight gain may increase the risk of diabetes and cardiovascular disease, while somnolence can affect daily functioning and quality of life, making it difficult for patients to maintain employment or social relationships. Additionally, patients also experience restlessness, involuntary muscle movements, and hormonal changes. Side effects of antipsychotics contribute to substantial morbidity, an estimated non-adherence rate between 40% and 50%, and subsequent relapses.[3] [4]

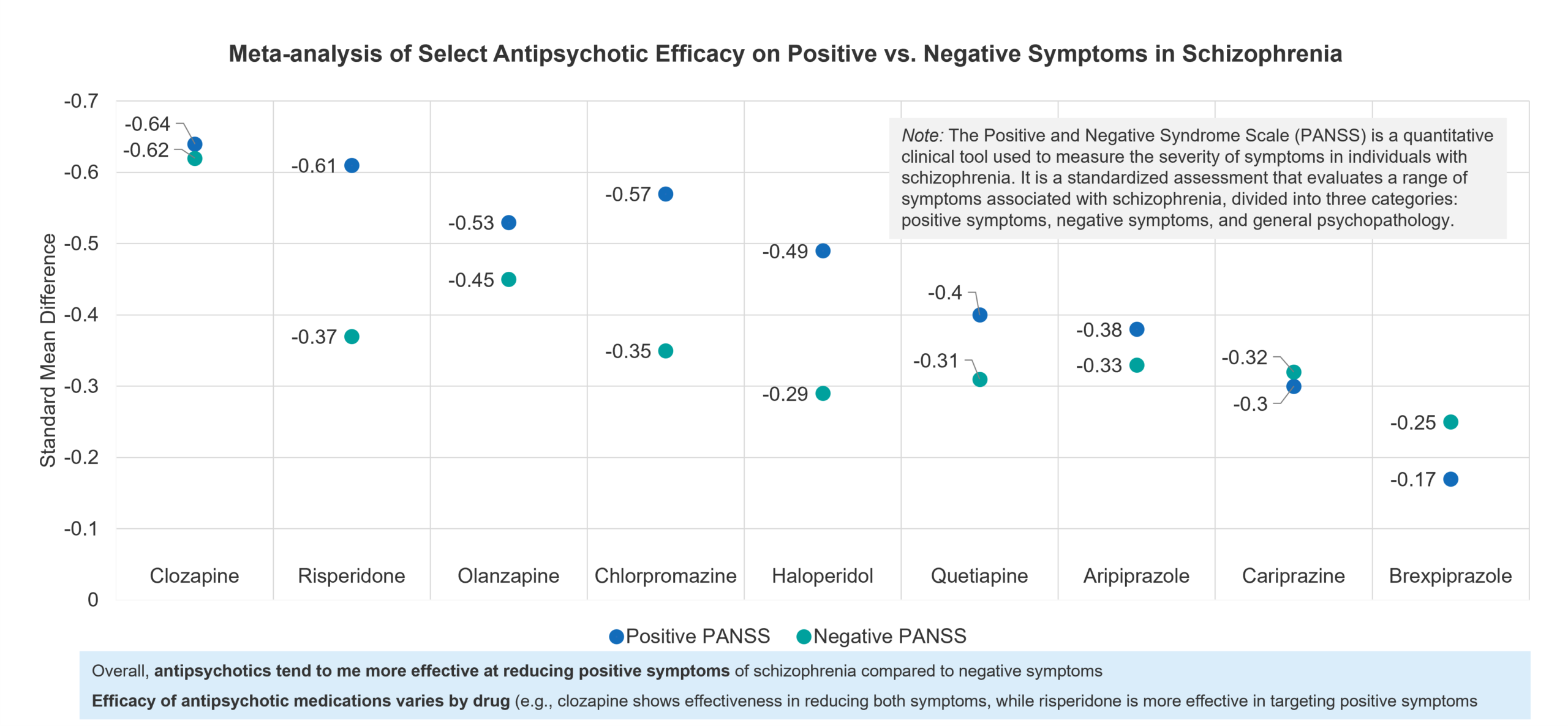

The second area of unmet need mentioned above is the need for more comprehensive symptom management. Although effective against positive symptoms of schizophrenia, antipsychotics are less effective in addressing negative symptoms like social withdrawal and emotional flatness, as well as cognitive deficits, which are critical to overall function and independence.

Fig. 3 – Meta-analysis of Select Antipsychotic Efficacy on Positive vs. Negative Symptoms in Schizophrenia vs.Placebo[5]

While antipsychotics are generally effective in reducing positive symptoms such as hallucinations and delusions, they are less effective in addressing negative symptoms, such as social withdrawal and lack of motivation (according to a meta-analyses assessing 32 antipsychotics across positive and negative symptoms vs. placebo).

Compounding the challenge is the overall heterogeneity of schizophrenia, which means that patients can respond variably to the same treatment, leaving a substantial portion of individuals with inadequate treatment options. Consider that:

- Approximately 30% of people with schizophrenia are treatment-resistant to antipsychotics, defined as not responding to two or more antipsychotic drugs, and many more derive only partial positive symptom benefit. [6]

- Almost one in four people with first-episode psychosis or schizophrenia will develop treatment-resistant schizophrenia during the early stages of treatment.[7]

Overview of the Muscarinic Treatment Modality

Mechanism of Action

Despite the long-standing use of antipsychotics in schizophrenia, a growing demand for better outcomes has driven interest in alternative treatments and pathways. This has led to recent research into the cholinergic pathway, specifically focusing on acetylcholine’s interaction with muscarinic receptors (M1-M5), which are found in the brain and peripheral tissues.

Unlike traditional antipsychotics that directly block dopamine receptors, targeting the cholinergic system offers an alternative approach by indirectly modulating dopamine activity. The cholinergic pathway, particularly through muscarinic receptors (M1 and M4), is thought to play a significant role in negative and cognitive symptoms of schizophrenia, areas where the dopaminergic system is less effective.

By activating M1 receptors, cognitive functions like memory and learning can be enhanced, which is beneficial in treating cognitive symptoms. Meanwhile, activating M4 receptors indirectly modulates dopamine levels, helping to reduce positive symptoms, such as hallucinations, without the side effects associated with direct dopamine antagonists.

However, there are certain inherent challenges with this approach. Because muscarinic acetylcholine receptors (mAChRs) are found in both the brain and peripheral tissues, such as the heart and digestive system, there is concern that targeting them could lead to off-target effects, where a treatment aimed at the brain might also impact other body systems, causing unwanted side effects and toxicities.

Future Treatment Landscape

Karuna Therapeutics is leading the way in the advancement of muscarinic therapies with the development of KarXT, a combination of xanomeline, a dual M1/M4 receptor agonist, and trospium, with a PDUFA date of September 26th, 2024. Originally developed by Eli Lilly for Alzheimer’s disease, xanomeline initially showed antipsychotic benefits but was shelved due to severe side effects. Taking an innovative approach, Karuna paired it with trospium, which doesn’t cross the blood-brain barrier, to minimize the peripheral side effects while maintaining central nervous system benefits.

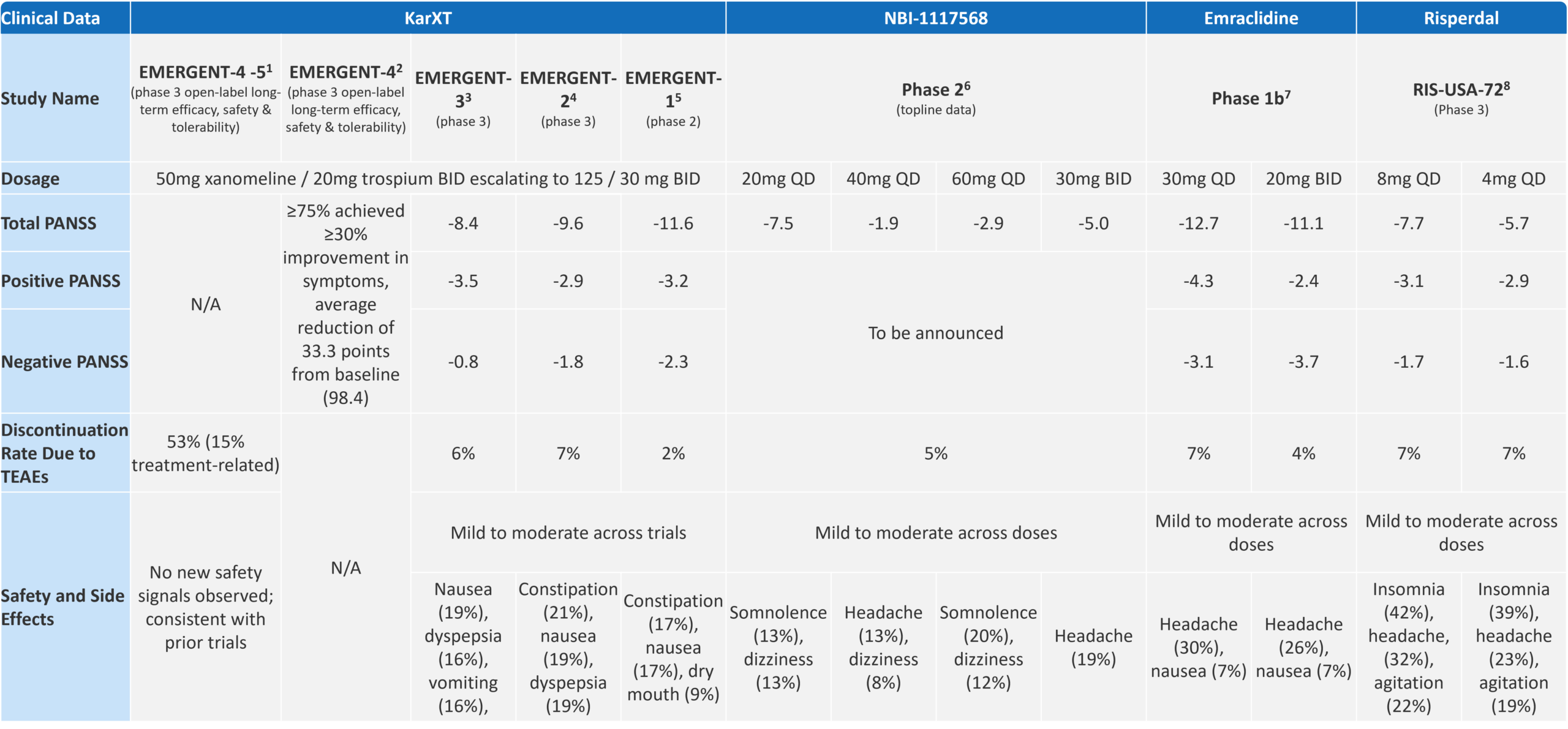

This combination has proven effective, with its most recent Phase 3 study showing a significant 8.4-point improvement in schizophrenia symptoms on the Positive and Negative Syndrome Scale (PANSS). KarXT’s development marks one of the most significant advances in schizophrenia treatment in the last two decades.

Fig. 4 – Key Clinical Data on Muscarinic Therapies vs Placebo

Notes for Fig. 4:

- Long-Term Safety of KarXT (Xanomeline and Trospium) in Schizophrenia” (Poster F74) Interim Results From Pooled, Long-Term Safety Studies EMERGENT-4 and EMERGENT-5. Annual Congress of the Schizophrenia International Research Society 2024

- Maintenance of Efficacy of KarXT (Xanomeline and Trospium) in Schizophrenia” (Poster F264), Annual Congress of the Schizophrenia International Research Society (SIRS) 2024

- Kaul I, Sawchak S, Walling DP, et al. Efficacy and Safety of Xanomeline-Trospium Chloride in Schizophrenia: A Randomized Clinical Trial. JAMA Psychiatry 2024

- Kaul I, Sawchak S, Correll CU, et al. Efficacy and safety of the muscarinic receptor agonist KarXT. Lancet 2023; 403: 160-170

- Brannan SK, Sawchak S, Miller A, et al. Muscarinic Cholinergic Receptor Agonist and Peripheral Antagonist for Schizophrenia. N Engl J Med 2021; 384: 717-726

- Neurocrine Biosciences Reports Positive Phase 2 Data for NBI-1117568 in Adults with Schizophrenia” (Press Release). Neurocrine Biosciences, August 5, 2024. Available at: https://neurocrine.gcs-web.com/news-releases/news-release-details/neurocrine-biosciences-reports-positive-phase-2-data-nbi-1117568. Accessed [August 28, 2024]

- Krystal JH, Kane JM, Correll CU, et al. Emraclidine, a novel positive allosteric modulator of cholinergic M4 receptors, Lancet 2022; 400:2210-22

- New Drug Application (NDA) 20-588 for Risperidone. U.S. Food and Drug Administration. Available at: https://www.accessdata.fda.gov/drugsatfda_docs/nda/97/20588.pdf. Accessed [Aug 9th, 2024]

The total PANSS score from the KarXT trial was impressive, particularly when looking at cross-trial comparisons vs. a standard of care option like risperidone (a commonly prescribed medication for patients which has been available since the mid-1990s). While KarXT has begun to showcase the promise of the novel cholinergic pathway, the results for negative symptoms were disappointing.

The trial did not achieve statistically significant improvements in negative symptoms, which remain a critical unmet need in schizophrenia treatment. Karuna Therapeutics has acknowledged this limitation, noting that the trials were not specifically powered to assess negative symptoms. As Karuna’s Chief Scientific Officer, Dr. Walling, pointed out, “The studies that are published here were focused on individuals who were experiencing an acute episode—as such, negative symptoms were secondary. To truly examine negative symptoms, a study has to have inclusion/exclusion criteria that enrich for this population.”[8]

Karuna’s success in the clinic hasn’t gone unnoticed. The recent acquisition of Karuna by Bristol Myers Squibb for $14 billion underscores the significant interest and potential of this treatment pathway.

Fig. 5 – Current Late-Stage Pipeline for Muscarinic Therapies

While Karuna (now BMS) is the furthest ahead, the success of muscarinic therapies has attracted greater interest and investment from other players exploring them in schizophrenia and other psychosis-related disorders (e.g., Alzheimer’s disease). These players include larger companies like AbbVie (which acquired Cerevel in late 2023), Neurocine, and other smaller players such as MapLight Therapeutics and Contineum Therapeutics.

Neurocrine Biosciences recently announced topline data from their Phase 2 trial for NBI-1117568 in adults with schizophrenia, showing that the drug’s lowest dose, 20mg, achieved a statistically significant reduction in the PANSS total score compared to placebo. However, higher doses (40mg and 60mg) did not show the same level of efficacy, failing to achieve significant results. This suggests that the efficacy of NBI-1117568 may be dose-dependent and primarily effective at the lowest dose. Additionally, while the efficacy observed at 20mg was lower than expected and did not match the levels seen with KarXT, NBI-1117568 had a better side effect profile, particularly with a lower rate of gastrointestinal adverse events.[9]

Cerevel Therapeutics is taking an innovative approach with Emraclidine, a positive allosteric modulator (PAM) of the M4 muscarinic receptor, contrasting Karuna’s orthosteric approach with KarXT. Karuna’s KarXT binds directly to the active site of the muscarinic receptors, mimicking the natural ligand acetylcholine to activate the receptor, whereas Cerevel’s Emraclidine binds to a different site on the receptor, enhancing its response only when acetylcholine is present. This approach can offer greater selectivity and potentially reduce side effects, as it avoids constant receptor activation. However, there is concern that allosteric modulators may theoretically show lower efficacy compared to orthosteric agonists, since their action depends on the presence of the natural ligand (acetylcholine).

Phase 1b data for Emraclidine have shown particularly promising results in treating negative symptoms of schizophrenia, surpassing the efficacy seen with KarXT. If these effects are confirmed in further trials, Emraclidine could offer a competitive advantage in the schizophrenia treatment landscape.

Other companies are also exploring similar approaches to KarXT in the muscarinic space. For example, MapLight Therapeutics is developing a molecule that includes a muscarinic agonist paired with a peripheral muscarinic antagonist.

The current late-stage muscarinic pipeline in the US has primarily focused on schizophrenia. However, the overlap in underlying disease processes across various conditions, along with the successful expansion of other treatments from schizophrenia to other psychiatric disorders, suggests it is plausible that muscarinic therapies could extend their therapeutic application beyond schizophrenia.

For instance, drugs such as quetiapine (Seroquel), initially approved for schizophrenia, have also been approved for bipolar depression. Similarly, the antipsychotic pimavanserin (Nuplazid), originally developed for Parkinson’s disease psychosis, is now being explored for dementia-related psychosis, highlighting the potential for muscarinic therapies to offer broader neuropsychiatric and cognitive benefits in the future.

Key Commercial Considerations and “How to Win”

In developing and launching muscarinic therapies, pharmaceutical companies must address many commercial challenges to achieve successful market entry and sustained impact. Smaller players will have to go up against the larger and better-resourced commercial leaders (BMS and AbbVie), which will be first to market . Manufacturers will need to consider four key areas to effectively realize the promise of this innovative therapy. Let’s address each below.

Awareness of Unmet Needs

Companies must drive awareness of the unmet needs and the ability of muscarinic receptor therapies to address them. Manufacturers must first determine which unmet needs to emphasize. For muscarinic therapies, the key unmet needs related to poor side effect profiles of existing antipsychotics and their limitations in comprehensively addressing negative and cognitive symptoms are critical to highlight.

They must also educate the market on the promise of this novel mechanism of action pre-launch, ensuring that healthcare providers understand how these therapies fundamentally differ from traditional dopamine pathway antipsychotics.

Additionally, manufacturers should consider highlighting the distinction between orthosteric and allosteric approaches and educate HCPs on the specific advantages or limitations of each. By clearly communicating the benefits of these mechanisms, manufacturers can begin to prime the market to be receptive to the first novel MOA in schizophrenia in decades.

Effective Differentiation

Differentiating muscarinic therapies from traditional antipsychotics is essential as the market evolves. With antipsychotics having firmly been established as the standard of care for over 50 years, muscarinic therapies need to demonstrate not only equivalent efficacy in treating positive symptoms but also a better safety profile. Communicating these advantages will be key in shifting treatment paradigms and encouraging healthcare providers to consider these new options.

For differentiation within the muscarinic class, particularly for those following KarXT, manufacturers should prioritize generating evidence on efficacy in addressing negative and cognitive symptoms. Future clinical trials should be designed to enrich patient populations exhibiting these symptoms to avoid the limitations seen in initial KarXT studies, which have predominantly focused on positive symptoms. By highlighting these unique benefits, companies can position their therapies as comprehensive treatments, setting them apart from competitors and supporting broader adoption.

Optimal Positioning within the Treatment Paradigm

The first aspect of positioning for manufacturers is to define a patient population which will stand to benefit the most from the new therapy and then provide clear guidance to HCPs. Clinical factors such as symptom severity, symptom type (positive, negative, or cognitive), and response to prior treatments are crucial. For example, therapies in schizophrenia may be positioned for all patients or targeted to those who do not respond to current antipsychotics, experience significant side effects, or have inadequately addressed negative and cognitive symptoms. This comprehensive approach ensures the therapy reaches the right patients.

Muscarinics may have the potential to be used either as a standalone treatment or in combination with existing antipsychotics, depending on the patient’s specific needs. While the primary focus to date has been on its potential as a monotherapy, particularly for patients with persistent negative and cognitive symptoms not well-managed by traditional antipsychotics, there is also interest in exploring its use as an adjunctive therapy. This could be especially beneficial for patients needing additional symptom control or those experiencing side effects from higher doses of dopamine-blocking medications. However, the exact positioning of these therapies within the treatment paradigm, including the potential for first-line use, is still being refined as more research emerges.

Manufacturers should consider non-clinical determinants, including the patient’s ability to afford the medication, the likelihood they adhere to the treatment regimen, and the availability of support systems to assist with compliance. It will also be critical to consider how the therapy complements non-pharmacological approaches like cognitive behavioral therapy (CBT) and other psychosocial interventions.

The second aspect involves defining a target prescriber. Understanding the role of various prescribers across different settings of care is crucial. Schizophrenia patients can be treated in the outpatient setting—by psychiatrists or at community mental health centers—or inpatient setting, such as psychiatric hospitals.

Manufacturers need to identify and engage with prescribers who are most likely to adopt and effectively prescribe the new therapy. This involves recognizing the distinct needs and preferences of these prescriber groups and prioritizing those who can most effectively drive early adoption. By understanding and addressing the unique requirements of different prescriber settings, manufacturers can better tailor their strategies to support product uptake.

We speculate that psychiatrists in academic settings will likely be the early adopters of new therapies like muscarinics due to their involvement in research and access to the latest data. Those in specialized psychiatric hospitals handling complex or treatment-resistant cases may also adopt new treatments quickly. Community psychiatrists with high caseloads of treatment-resistant schizophrenia patients are likely to follow, driven by the need for better symptom management.

Broad Payer Coverage with Limited Access Hurdles

To ensure broad payer coverage and minimize access hurdles, manufacturers must navigate the US access and reimbursement landscape. Payers have been known to impose step edits requiring failure on cheaper generic options before approving branded therapies, which could apply to new muscarinic therapies. This underscores the need to communicate robust clinical and economic evidence to payers.

Early engagement through Pre-Approval Information Exchange (PIE) presentations is crucial to highlight clinical efficacy, safety, specific patient benefits, and healthcare resource utilization (HRU). Schizophrenia is notably costly, with an estimated annual per person direct treatment cost approximately twice that of major depression and more than four times higher than any anxiety disorder.[10] At launch, it’s essential to communicate the cost effectiveness of the muscarinic therapy (Note: the Institute for Clinical and Economic Review (ICER) suggests that if long-term data confirm KarXT’s benefits, including reduced side effects and HRU, it could meet cost-effectiveness thresholds).[11]

Manufacturers must also consider the high proportion of schizophrenia patients covered by Medicaid, which often employs stringent cost-control measures that complicate access to new therapies. Lower payment rates can also lead to fewer providers accepting Medicaid, increasing wait times and creating disparities in service availability.

Addressing patient-specific access hurdles is crucial, especially for schizophrenia patients who may be unemployed and face significant financial barriers, resulting in high out-of-pocket expenses. Caregivers often bear these costs, complicating treatment access. Additionally, frequent changes in healthcare providers can disrupt insurance coverage. Robust patient support programs, including nurse navigators, can assist with navigating reimbursement and provide clinical support, such as managing side effects and educating patients about their treatment.

Parting Thoughts

While muscarinic agonists are not a panacea for schizophrenia, their emergence heralds a pivotal and long-awaited shift in the treatment paradigm. This novel approach promises to complement existing approaches in addressing the myriad of positive, negative, and cognitive symptoms.

For pharmaceutical companies, the task ahead involves more than pioneering scientific discovery; it demands a strategic consideration of market dynamics to ensure these advancements reach patients. By rigorously crafting and executing a comprehensive go-to-market strategy, manufacturers can ensure that this significant scientific breakthrough translates into meaningful clinical improvements, offering renewed hope to millions and reshaping the future of schizophrenia care.

End Notes:

[1] Johns Hopkins Medicine, Mental Health Disorder Statistics, https://www.hopkinsmedicine.org/health/wellness-and-prevention/mental-health-disorder-statistics#:~:text=Approximately%201%25%20of%20Americans%20are,their%2020s%20or%20early%2030s., accessed August 28, 2024

[2] American Psychiatric Association. (2020). Practice Guideline for the Treatment of Patients with Schizophrenia

[3] Desai, PR, Lawson, KA, Barner, JC, Rascati, KL. (2013). Estimating the direct and indirect costs for community-dwelling patients with schizophrenia. Journal of Pharmaceutical Health Services Research, 4(4), 187-194.

[4] Lacro JP, Dunn LB, Dolder CR, Leckband SG, Jeste DV. Prevalence of and risk factors for medication nonadherence in patients with schizophrenia: a comprehensive review of recent literature. J Clin Psychiatry 2002; 63: 892–909

[5] Huhn M, Nikolakopoulou A, Schneider-Thoma J, et al. Comparative efficacy and tolerability of 32 oral antipsychotics for the acute treatment of adults with multi-episode schizophrenia: a systematic review and network meta-analysis. Lancet 2019; 394: 939-51.

[6] Kane JM, Agid O, Baldwin ML, et al. Clinical guidance on the identification and management of treatment-resistant schizophrenia. J Clin Psychiatry 2019; 80: 18com12123

[7] Siskind D, Orr S, Sinha S, et al. Rates of treatment-resistant schizophrenia from first-episode cohorts: systematic review and meta-analysis. Br J Psychiatry 2022; 220: 115–20.

[8] Bender, Kenneth J., Investigational Antipsychotic Demonstrates Efficacy Without Blocking Dopamine Receptor, Psychiatric Times, June 7, 2024, https://www.psychiatrictimes.com/view/investigational-antipsychotic-demonstrates-efficacy-without-blocking-dopamine-receptor

[9] Neurocrine Biosciences press release, August 28, 2024, https://neurocrine.gcs-web.com/news-releases/news-release-details/neurocrine-biosciences-reports-positive-phase-2-data-nbi-1117568

[10] Desai, PR, Lawson, KA, Barner, JC, Rascati, KL. (2013). Estimating the direct and indirect costs for community-dwelling patients with schizophrenia. Journal of Pharmaceutical Health Services Research, 4(4), 187-194.

[11] Tice JA, Whittington MD, McKenna A, Wright A, Richardson M, Pearson SD, Rind DM. KarXT for Schizophrenia: Effectiveness and Value; Evidence Report. Institute for Clinical and Economic Review, January 25, 2024. Available at: https://icer.org/assessment/schizophrenia2024/#overview.