Introduction

The U.S. is the largest healthcare market in the world, and it is an imperative for digital health companies within or outside the U.S. to develop a go-to-market plan to both (1) unlock the full commercial value of their products and (2) gain the confidence of early/mid-stage investors to fund business growth. As digital health solutions are often software-based and can scale easily across borders, market expansion is a very legitimate and attractive element of early business planning. As a result, we have seen an uptick in demand for specialized consulting services that help ex-US start-ups understand the key drivers and barriers to entering the fragmented (and highly complicated) U.S. healthcare system.

In this article, we outline our approach to developing compelling U.S. go-to-market (GTM) strategies for ex-US companies. We offer some additional commentary on the top keys to success. Also included is input on two major segments of digital health with which we have extensive experience: (1) Prescription Digital Therapeutics and (2) AI Medical Imaging Software (diagnostics, clinical decision support tools, etc.).

Go-To-Market Framework for Digital Health

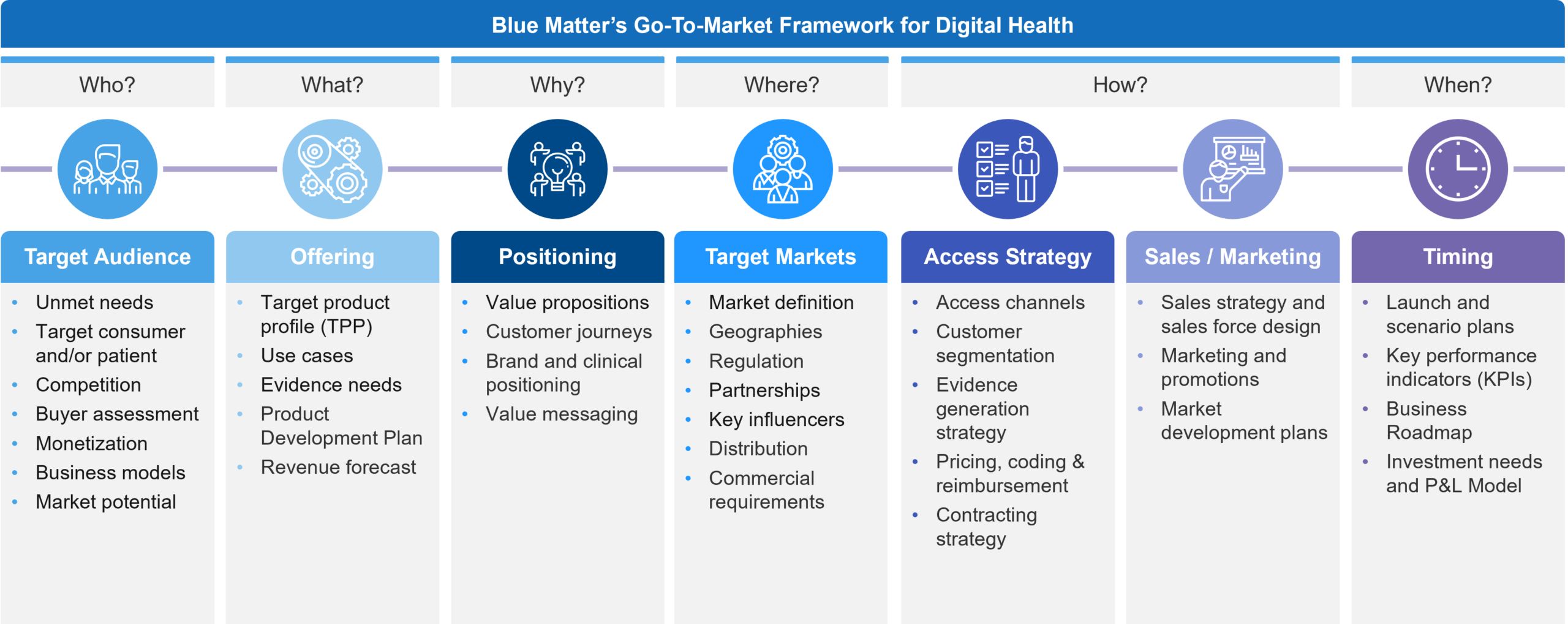

In Figure 1, you will see our GTM Framework that provides an easy to digest menu of all the elements that eventually need to be understood to enter the U.S. market. We use this framework in early discussions to determine a start-up company’s stage of preparedness and to identify which key gaps exist that must be addressed to meet its business goals. Often, the priority is from left (target audience) to right (timing) but we frequently address elements across all the categories to varying depths based on the given situation.

Figure 1: Blue Matter Consulting’s Go-To-Market Framework for Digital Health

Upon initial review, this looks like any typical GTM framework. However, the digital devil is in the details. In our experience, there are several notable and unique considerations across these elements for digital health specifically. We have outlined a few of these below:

- Target Audience – While the target consumer and/or patient is often defined, the buyers that act as intermediaries for accessing end-users are many. Potential buyers in the U.S. market may include private practice physicians, health systems, insurers, employers, and even pharma companies. We will discuss this more in the next section. It’s educational to learn about potential buyers, but it’s also instructive to see how the competitive landscape plays across them, as well as how some digital health companies target several simultaneously.

- Offering – A key challenge in digital health is that software can change. Typical healthcare products such as pharmaceuticals are well-defined entities that don’t change to meet new needs over time. Digital Health can evolve, and this fact, which is a benefit, can also be a tremendous distraction. We find that different teams within a company often have very different beliefs and perceptions about what their product is, its features, its future, and whose needs it serves. Its critical in our experience to actively define a reasonable boundary around what the product is, what it could be when launched, and future directions. In addition, depending on the business model and product aim, the evidence requirements may be very different. Often, clinical trials are insufficient for commercial adoption and some planning for gathering real-world evidence is required. It’s also important to remember that different buyers often look for different things (for example, employers may want productivity endpoints whereas payers typically want clinical and economic impact).

- Positioning – It is now quite well-known that a key market barrier is the integration of new digital health tools into existing systems and clinical practice. Aligning your value proposition to the flow of patients, the key stakeholders along the journey, and how those stakeholders would want to use and integrate a new product is critical to maximizing a digital therapeutic’s value and overcoming the inertia of adopting novel products.

- Target Markets – Related to buyers, certain products will aim for clinical claims that require oversight and clearance from the FDA for marketing, whereas other buyer options may not. So, understanding the various pathways to the market, the implications for marketing, and expectations for market dynamics is a unique requirement in digital health, which often calls for a flexible approach. We see numerous start-ups taking on both regulated and unregulated markets simultaneously to try and gain the benefits of each, but at the risk of stretching too thin with limited resources.

- Access Strategy – Many times, the biggest question in every GTM plan is, “How do we get paid?” More often than not, an assessment of insurance reimbursement potential and a pathway to achieve it is central to demonstrating U.S. market knowledge to investors. Unfortunately, there is simply no standardized pathway for reimbursement for the majority of digital health products in the U.S. Furthermore, there are varying insurance entities by which one could seek reimbursement who may look to address different needs, while having different evaluation requirements, pricing potential, and willingness to innovate. Specifically, we are referring to national payers, regional payers, integrated delivery networks, state agencies, and the various insurance plans they have such as Medicaid FFS, Managed Medicaid, Medicare, CHIP, TriCare, private plans, etc. (we will cover this in more detail in a future installment).

- Sales / Marketing – While progress has been made in several market segments, there is still a need for market development activities to prime buyers and users to adopt products when they become available. This can be a daunting task that needs to be broken down into manageable “bite-sized” steps. Furthermore, an honest evaluation of the investment needs and potential commercial partners may sway the GTM approach.

- Timing – Start-ups are known to be nimble, and that needs to be the case when entering the U.S. market. Often, there is a staged approach to building a cohesive offering that has tailored product development for engaging experiences, evidence generation activities to support access, and pivots between prioritized business models based on changing market dynamics and business goals.

Despite the many possible discussions across this GTM framework, we’d first like to dive into a foundational question: “Who is the buyer?” In other words, what are the business model options that should be considered? What can the market teach us about which models may fit a business’s goals? And which should a business prioritize for deeper assessment? Investors and digital therapeutics companies need to carefully walk through the process by which a given GTM approach should or should not be considered, and have documentation for the reasoning and arguments to align on selecting an efficient path forward.

Business Models in Digital Health: Who is the Buyer?

A key starting point for any U.S. GTM strategy is to answer “Who is the buyer?” In the U.S. there are several options, and in fact, a lot of companies pursue multiple business models simultaneously. We have found it to be extremely helpful to walk ex-U.S. companies through the various models that may be applicable to their business while layering on more traditional market analyses such as buyers and buying processes, regulatory requirements, competition, pricing and payment, and overall market size. In fact, the approach has been described by some of our clients as a “collab-etition” approach because when walking through each model, a potential collaborator or partner may magically transform into a competitor in some scenarios.

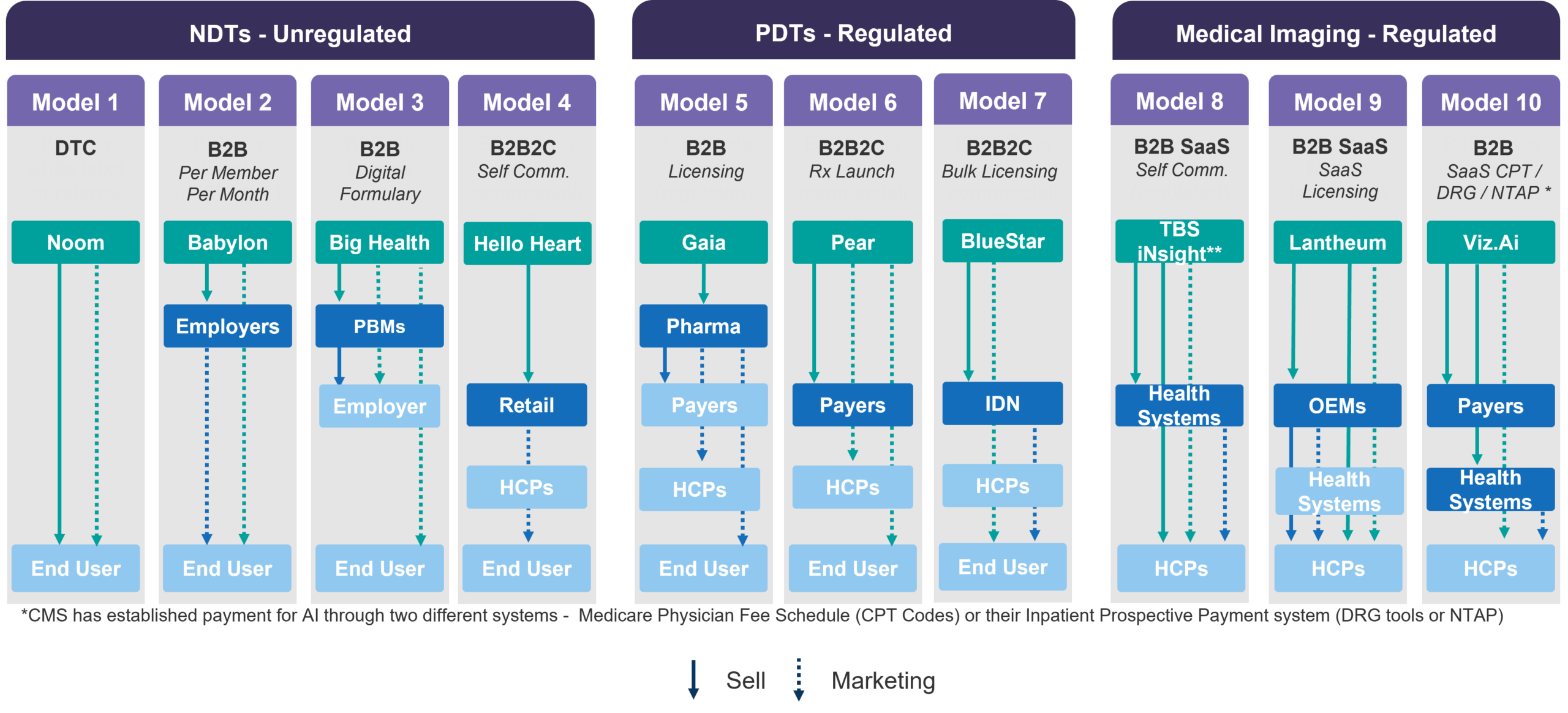

Figure 2 shares examples of ten distinctive business models in the non-prescription digital therapeutics (NDT), prescription digital therapeutics (PDT), and AI medical imaging markets. Notably, two key observations about the U.S. market should already become apparent: (1) Digital health often has a selection of models within regulated and unregulated markets which has profound implications on product development and marketing strategy; (2) In the U.S. the ultimate customer using a product may not be the purchaser of the product. Therefore, a company may need to sell to one stakeholder, but then market to other stakeholders to drive adoption and utilization. This second point has profound implications on the complexity of the commercial team and capabilities.

Figure 2: Selling and Marketing by Business Model varieties

From another, more traditional angle, you will see the familiar approaches of Business-to-Consumer (B2C), Business-to-Business (B2B), and Business-to-Business-to-Consumer (B2B2C) models. While these are helpful concepts at a high level, they require more nuance as the GTM strategy is developed. Here are some specific insights on digital health considerations across these models:

- B2C: Selling directly to consumers offers a more realistic and focused understanding of product-market fit but often requires a much higher marketing investment to cut through the noise of competitors effectively. The customer acquisition costs can be much higher pursuing this pathway.

- B2B: Selling to other businesses enables more efficient selling and larger bulk contract opportunities, but often require a demonstration that the product is acceptable to their employees (hence B2C can help get you to a better position with B2B models) and that utilization will lead to productivity gains or reductions in healthcare spending. As we are no longer in the early market stages of digital health, the B2B channel has become more crowded and competitive each year, driving employers to seek fewer point solutions and more comprehensive offerings. As a result, many digital health companies who cannot develop broader offerings are now pursuing partnerships with employee benefits consultants to be listed within Employee Assistance Program (EAP) portfolio offerings as a sell-through to employers with some success.

- B2B2C: This model combines elements of the above wherein the first sell is to a business, but that some sort of transaction or “sell” needs to also occur from that business to the ultimate customer. Think of normal retail channels: Sell a box of candy to a candy store business, then Mr. SweetTooth buys the candy from the business. In healthcare, it’s not always exactly this way but is sometimes similar to working via payers and/or health systems. In the case of payers, they agree to reimburse a product, but a physician needs to prescribe it to a patient, who may also share in the cost through out-of-pocket payment. Sometimes, we simply refer to this version of the model as B2P, Business-to-Payer. This B2P variety typically yields the highest pricing potential and a relatively captive audience with limited competition. But that limited competition is due to the fact that it takes a lot of effort and money to get reimbursed. Digital health is notoriously stuck right now on the edge of accessing reimbursements but nothing is standardized yet, so it’s still an area of significant uncertainty. This is not to say that B2P and reimbursement models shouldn’t be understood, as investors will ask, so a company must become educated enough to speak to the options, drivers, and barriers and have a stance on when and if reimbursement is a path that leads to success. At the very least we often have roadmaps of how to build a business where B2P is an eventual goal, but not a revenue driver in the near-term.

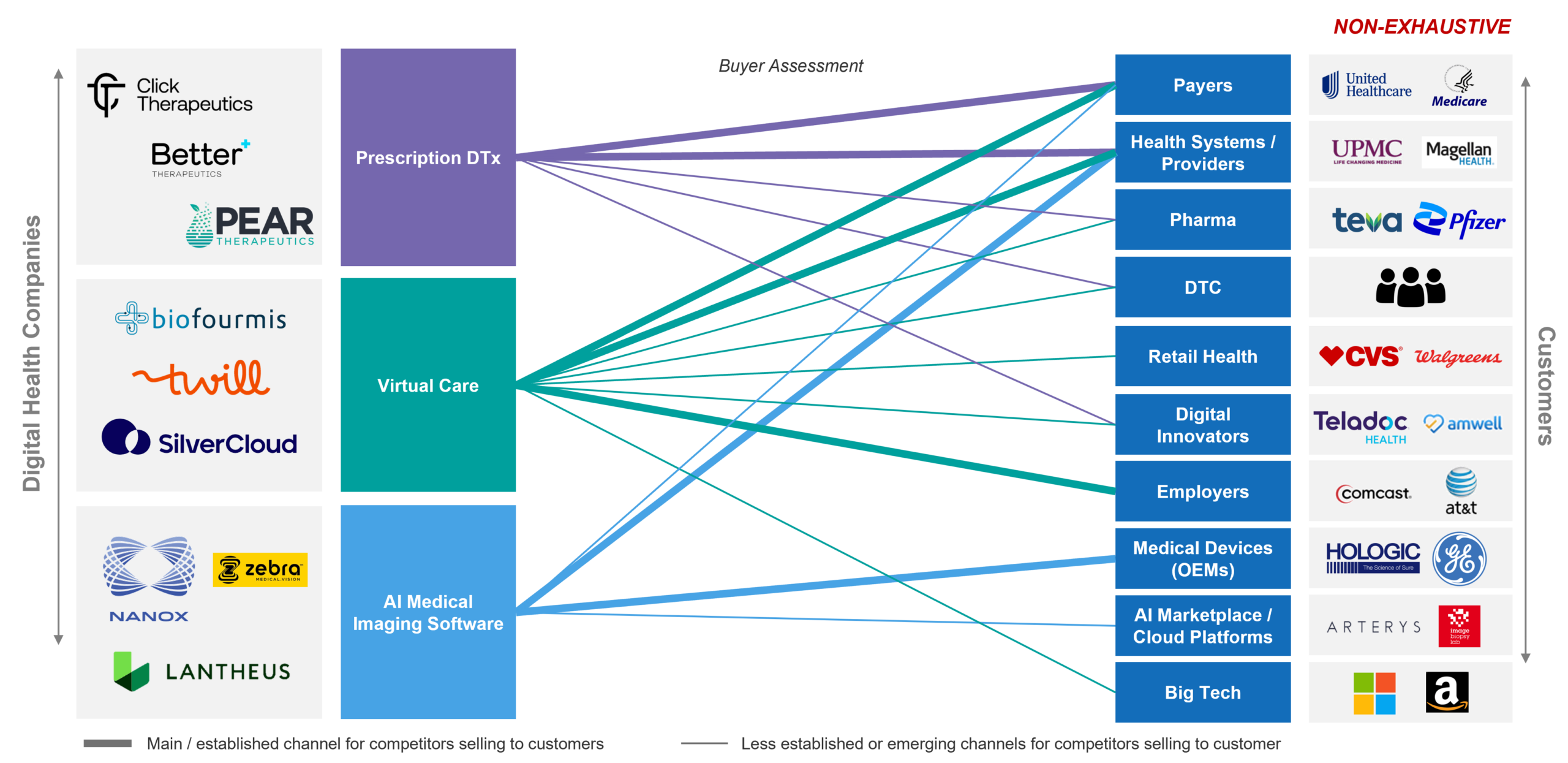

In Figure 3, we illustrate how digital health companies of a few different flavors are pursuing simultaneous business models, as each may not be sufficient to fuel growth or achieve business goals alone.

Figure 3: Collab-etition and multiple models

As the figure illustrates, depending on the market, multiple models may be applicable and may be pursued simultaneously to balance the needs for near-, mid-, and long-term revenue growth, product traction and adoption, evidence generation, value story development, and patience for market development to occur. Furthermore, each of the buyers and players may with one approach be competition, but in other approaches be a potential vital partner. Navigating these options and explaining the rationale to investors is a critical first step to gain confidence in the chosen GTM strategy.

Keys to Success:

While most of what we have shared has broader applicability to digital health products of many types, below are a few concluding thoughts on keys to success for two major segments:

Prescription Digital Therapeutics (PDTs) Keys to Success for Business Models

- Consider real-world experience before seeking FDA clearance – Most PDTs are aiming to be regulated, reimbursed, and high-quality clinical interventions, but the U.S. market is still warming up to them. So, a key to success is to explore avenues for getting the product into patients’ hands in ways that can help the company refine and improve the product experience and engagement. This can also potentially help the company develop a body of real-world evidence to bolster future payer conversations, and to explore the workflow integration needs for eventual commercial launch.

- Understand the evolving competitive landscape – COVID has helped move digital health and mental health forward, but with this has come a host of new market entrants. It is critical to spend time to understand the competitive landscape to identify where there may be partnership opportunities or where a customer may already have a “good enough” solution versus your “best solution” which can slow down commercialization. It is also useful to get an understanding of the emerging role of big tech (e.g. Amazon) and retail pharmacies (e.g. CVS) and employers (e.g. Costco) and their potential as buyers / partners. These three are developing more comprehensive solutions but may also be interested in filling gaps in their suites of services to meet particular needs in novel ways.

- Understand the relationship of buyers to potential target patients – Depending on a company’s target population, some channels may need to be vetted early on for feasibility, such as those who are 65+ that require Medicare reimbursement (which does not exist) or for those that may be in Medicare Advantage plans (some potential to access through 1:1 with payers) or if the target group is adults aged 40-65 years to access commercial insurer-based business models. There are more considerations than just these illustrative ones.

- Build early awareness of selling vs. marketing needs – It doesn’t need to be decided completely at this stage, but a good understanding of the eventual requirements for selling vs. marketing products, as well as analogs for spend and resourcing is important. Such knowledge will help guide decision making and business model prioritization, as the whole U.S. market can rarely be accessed right from the start.

AI Medical Imaging Software Keys to Success for Business Models

- Health systems are targets, but payer reimbursement drives incentives – Medical imaging developers’ core business model is almost always to sell directly to health systems, radiology groups, or other provider groups via software licenses or purchase agreements. The keys to success to driving the sell are three-fold (1) defining the value for health system adoption before reimbursement incentivizes scaled use of your tech; (2) setting a pricing strategy and path to gain reimbursement (via specific CPT codes, New Technology Add-on Payments (NTAP), or Diagnosis Related Group (DRG) tools) that pay for the true value you provide; and (3) achieving broad distribution without having to pay for 1:1 integration with every buyer. All of these are complex topics, but it’s important to understand that it can take years to gain specific CPT codes for your product, and you will likely need to enter the market and generate revenue before then. And that ultimately, the CPT codes are used to pay the health system for services that have a domino effect on a percentage of that value that you can capture through your licensing agreements. Lastly, partners often are a compelling consideration to support this long run to peak revenue and distribution.

- Build market confidence with pilots early to enable the longer-term product vision – Building off the previous key to success, reimbursement for AI-driven medical imaging tools is a complex and often time-consuming process but necessary to incentivize health systems to adopt AI technology at scale. U.S. Payers (both public and private) have a high bar of “reasonable and necessary” evidence to determine whether they cover and pay for medical imaging tools. This is further complicated by the fact that for preventative and screening services policy reform and lobbying has led to medical policies being formalized for only a limited subset of services (e.g., like breast or colorectal cancer screenings). So, while working towards gaining reimbursement, identifying, and targeting progressive customers who are willing to integrate AI solutions in the short-term is paramount. But providers & health systems also need time to gain confidence, become comfortable, and ultimately adopt AI driven technologies. Being receptive to pursuing pilots with progressive health systems like integrated delivery networks (IDNs), who are often willing partners in building data and demonstrating full commercial potential, can be an essential initial step to ultimately maximizing the full commercial value of a technology.

- Understand the variability and barriers of the health system buying process – In the US, the procurement and purchasing process is highly variable across health systems. Focusing on identifying and engaging with key product champions within health systems can ensure a smoother procurement process to get a technology integrated into their respective workflows. Increasingly, health systems are deploying dedicated Value Analysis Teams (VATs) or Innovation Teams which help coordinate the assessment and integration of novel technologies. Other health systems rely on Service Line or Capital Budget directors that may aid in the buying process, but this likely requires far more investment, coordination, and engagement on the part of the medical imaging developer. While this may be a bit granular, archetyping your initial buyers based on buying process will play a major role in the success of your initially deployed business model and ultimately, early adoption of your product(s).

Coming Next

As you likely noted throughout this initial piece, access channels and reimbursement for digital health is still very much in flux. In part two, we’ll dive deeper into the highly matrixed and complex US market access landscape, and how it impacts GTM strategies for PDTs and AI medical imaging software.