Interest in psychedelic therapy has risen substantially in recent years, and it’s easy to see why. After decades of being ignored due to legislative action, psychedelic substances now represent an emerging class with the potential to be disease modifying across a range of mental and behavioral health issues. We’ve written about psychedelics before, and that paper from 2021 is still a valuable resource. However, the market has continued to evolve as key players in late-stage clinical trials generate compelling clinical evidence, so it’s worthwhile to visit this topic again.

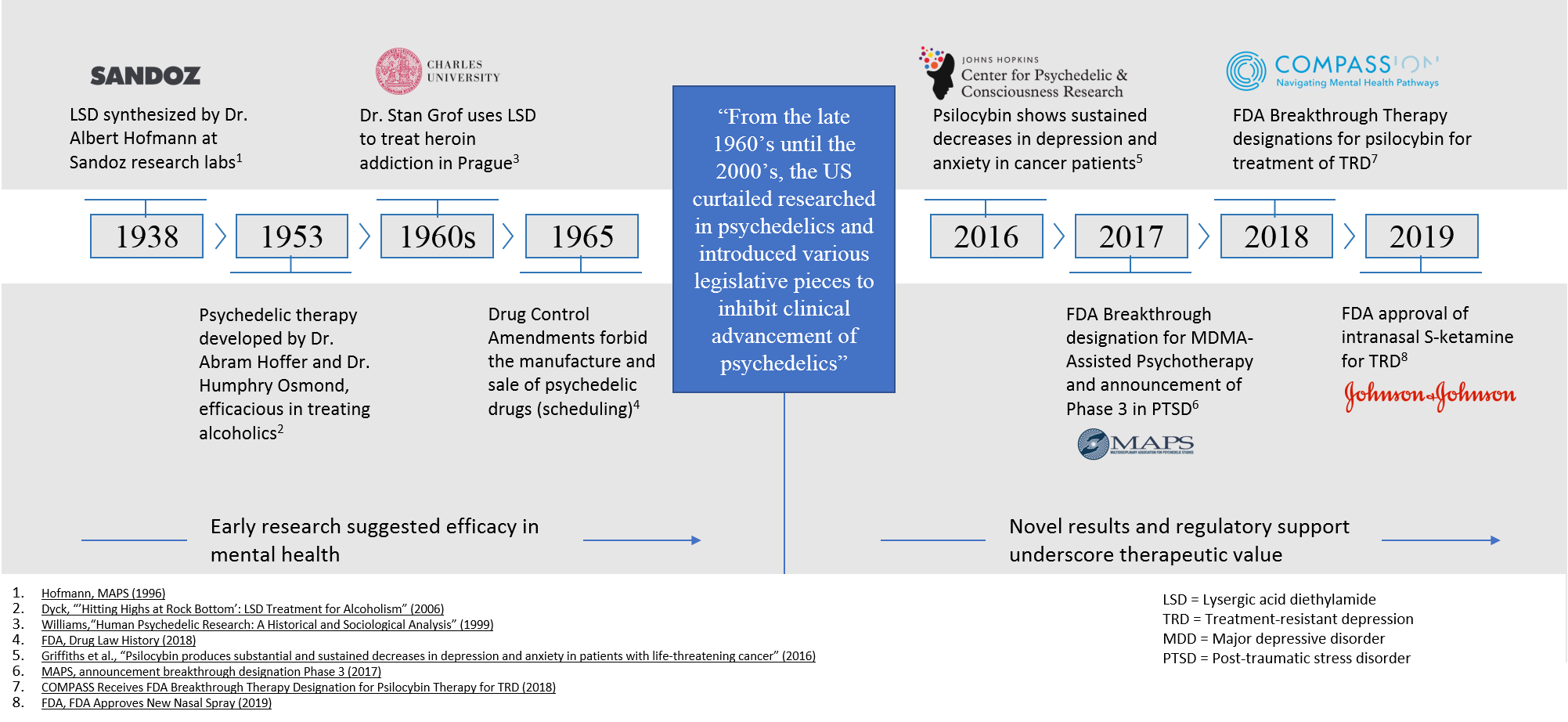

For example, psychedelic therapies for mental disorders such as post-traumatic stress disorder (PTSD) and treatment-resistant depression (TRD) are expected to be commercialized—in combination with behavioral health therapy—in the next two years. They have received FDA breakthrough designation and could be very promising for conditions with high unmet need (see Figure 1).

While there is growing anticipation surrounding the clinical effectiveness of these new options, we have begun to shift our focus to the commercial opportunities and barriers needed to bridge the gap from clinical to real-world use. In particular, there is a tremendous amount of attention around innovating the fundamental care model for mental and behavioral health, and we think psychedelics may help pioneer a path to a more integrated and effective approach.

This article is the first of three that explore this emerging new model. Through the course of this series, we will discuss the unique commercial underpinnings of the companies that are driving innovation in psychedelics. We will next explore how psychedelic-assisted therapy will present new challenges to payments and the provision of care. Finally, we’ll dive into the field of digital health and explore how it may provide relief to the pressures that psychedelics could have on the market to develop new care models. This installment focuses on the emerging business models in psychedelics.

Figure 1 – Timeline of Key Psychedelics Research Milestones: A resurgence in psychedelic therapies is emerging as promising disease-modifying drug candidates progress with regulatory momentum.[1] [2]

Psychedelic Business Models

Recent growth in the psychedelics landscape has led to two distinct types of innovators: non-profit and for-profit (Table 1).

Non-Profit

Non-profit organizations are a unique group in the space. They are focused on providing access to psychedelics for patients with a high unmet need and on reducing the stigma associated with these types of therapies. They do this by investing in research and education, as well as working to influence policy. In large part, they have been responsible for boosting enthusiasm around the adoption of psychedelics, and for many regulatory and policy changes that have shaped the field for the better.

Most notably, the Multidisciplinary Association for Psychedelic Studies (MAPS) is a key player in the non-profit space that has been researching the use of MDMA (methylenedioxymethamphetamine) for decades. MAPS is currently conducting a Phase 3 psychedelic-assisted therapy trial for PTSD, having been funded primarily by philanthropic donors and grantors who have given more than $130 million for research and education.[3] Additionally, MAPS has committed to open science and transparency as one of its key principles.[4]

Another example, the Beckley Foundation, is a pioneer in psychedelic research and has advocated extensively for evidence-based drug policy reform.[5] They have undertaken a global initiative to promote the development of alternative approaches to drug control in order to create more humane, cost-effective, and evidence-based policies.[6]

Notably, drug development is not cheap, but the strategies that these companies are taking buck the typical approach of seeking investment to fuel R&D and eventual commercialization. Removal of a significant portion of the commercial motive force has implications on how these companies will look to sustain their long-term efforts to make psychedelics widely available.

For-Profit

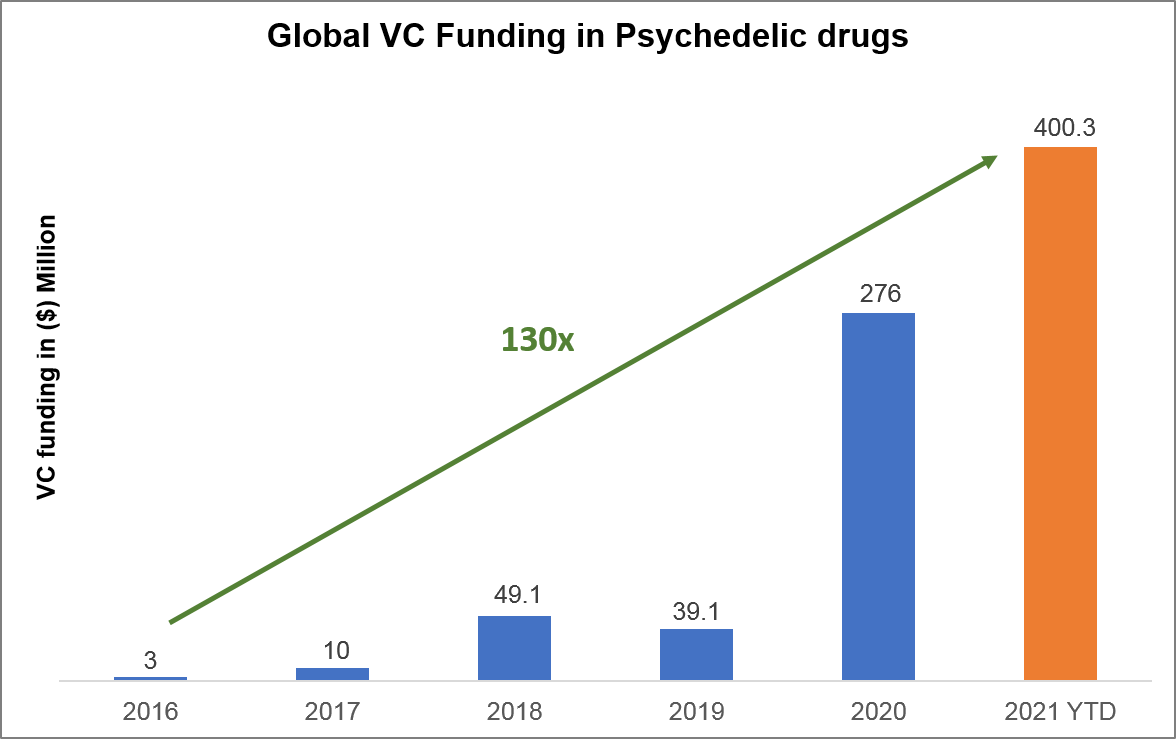

Building off the efforts of non-profit organizations, many venture capital (VC) firms are now investing in emerging for-profit psychedelics companies due to the compelling evidence that has been demonstrated in the space. Globally, VC funding has skyrocketed, having increased from $3 million in 2016 to nearly $400 million in 2021. (Figure 2). A key element of the for-profit companies’ approach is to secure intellectual property (IP) protections, similar to traditional pharmaceutical and biotech companies. Their goal is, as one would expect, is to seek exclusive marketing of branded products in the future and the potential for high returns on investors’ money.

Figure 2 – Growth in Venture Capital Funding in Psychedelic Drugs[7]

To date, most psychedelic research has occurred either with naturally occurring molecules (e.g. psilocybin) or those for whom patent protection expired long ago (e.g. MDMA and LSD). To help sustain commercialization, companies are exploring a variety of strategies to create novel IP that build from off-patent molecules, including new formulations, routes of administration, or improved pharmacokinetic profiles.[8] Examples include:

- Change in formulation – Johnson & Johnson changed the formulation of ketamine to create esketamine. It was approved in 2019 as the nasal spray antidepressant, Spravato®.[9]

- Route of Administration – Compass Pathways, Ltd. developed crystalline psilocybin that can be used orally instead of via intravenous administration. This easier route of administration led to patent approval.[10]

- Improved pharmacokinetic profile – Cybin’s psychedelic, tryptamine, has demonstrated decreased time to therapeutic onset, decreased duration of action, and decreased side effects. Due to these improvements, the company was granted a patent.[11]

At the same time, other (non-profit) organizations are choosing to pursue a non-patented route for advancing psychedelics research and optimize access potential. This includes MAPS, who has pursued an open-patent strategy for its MDMA-AT product and Usona, a company conducting clinical trials with psilocybin with a similar philosophy regarding open science and intellectual property.[12]

As the psychedelics market continues to expand, the dynamics of a market driven by a mix of non-profit and for-profit companies could have interesting impacts on commercial investment and business models. For-profit companies and those with patented drugs may lean more towards generating revenue via traditional commercialization and product sales. Those who pursue the non-profit route—or who have non-patented products—may still be able to generate sufficient revenue to sustain operations. However, it is likely they will need to expand beyond the product to encompass other revenue-generating streams. These expansions may include investing in clinician / behavioral health training programs, investing in care providers that support the use of psychedelics, and by providing other ancillary services for the emerging market. This latter approach presents additional challenges that we will discuss in the next installment.

Table 1. Key Characteristics of Non-Profit vs. For-Profit Psychedelics Manufacturers

| Non-Profit | For-Profit |

|---|---|

Examples: | Examples: |

Coming Next

For the most part, all of this new attention on psychedelics centers around psychedelic-assisted therapy. A key word in that phrase is “assisted.” In other words, there’s more to it than just administering a drug and hoping for the best. The medicine is one component in a treatment regimen that can include behavioral health therapy and other components. This reality can have a significant effect on the overall cost of a new therapy, and how it’s commercialized and reimbursed. In Part II, we will explore this aspect of the market in more detail.

End Notes:

[1] Adapted from a presentation by Atai Life Sciences, slide 8, https://ir.atai.life/static-files/3f0ecb56-f1ac-4b72-b1bf-60f3dfa0b401, accessed Oct 3, 2022

[2] Carhart-Harris RL, Goodwin GM. The Therapeutic Potential of Psychedelic Drugs: Past, Present, and Future. Neuropsychopharmacology. 2017 Oct;42(11):2105-2113. doi: 10.1038/npp.2017.84. Epub 2017 Apr 26. PMID: 28443617; PMCID: PMC5603818.

[3] MAPS press release, MAPS Completes Enrollment, as Planned, for the Confirmatory Phase 3 Trial of MDMA-Assisted Therapy for PTSD, May 9, 2022, https://maps.org/2022/05/09/maps-completes-enrollment-as-planned-for-the-confirmatory-phase-3-trial-of-mdma-assisted-therapy-for-ptsd/

[4] MAPS websitehttps://maps.org/about-maps/principles/, accessed Oct 3, 2022

[5] Beckley Foundation website, https://www.beckleyfoundation.org/, accessed Oct 3, 2022

[6] Beckley Foundation website, https://www.beckleyfoundation.org/policy/global-initiative-for-drug-policy-reform/, accessed Oct 3, 2022

[7] Rodriguez Bernate, Laura, Psychedelic drugs: remove the stigma and accept its benefits, Dealroom, Nov. 4, 2021, https://dealroom.co/blog/psychedelic-drugs-remove-the-stigma-and-accept-its-benefits

[8]Cohen, Glenn and Marks, Mason, Patents on Psychedelics: The Next Legal Battlefront of Drug Development, Harvard Law Review, Feb 20, 2022, https://harvardlawreview.org/2022/02/patents-on-psychedelics-the-next-legal-battlefront-of-drug-development/

[9] Al Idrus, Amirah, Psychedelics are getting closer to approval, but the market may not be ready, Fierce Biotech, Aug 17, 2021, https://www.fiercebiotech.com/biotech/psychedelics-are-getting-closer-to-approval-but-market-may-not-be-ready

[10] COMPASS Pathways press release, COMPASS Pathways granted fifth US patent for crystalline psilocybin, Nov 23, 2021, https://www.globenewswire.com/en/news-release/2021/11/23/2339676/0/en/COMPASS-Pathways-granted-fifth-US-patent-for-crystalline-psilocybin.html

[11] Cybin press release, Cybin Files its 12th Patent Further Strengthening IP Portfolio of Novel Psychedelic Molecules and Delivery Mechanisms, May 20, 2021, https://www.businesswire.com/news/home/20210520005334/en/Cybin-Files-its-12th-Patent-Further-Strengthening-IP-Portfolio-of-Novel-Psychedelic-Molecules-and-Delivery-Mechanisms

[12] Cohen and Marks

[13] Psychedelic Invest website, https://psychedelicinvest.com/non-profits/, accessed Oct 3 2022

[14] Ibid

[15] Brown, Kristen and Bennet, Drake, Get Ready for the Magic Mushroom Pill, Bloomberg News, Aug 22, 2022, https://www.bloomberg.com/news/features/2022-08-22/magic-mushrooms-grow-in-startup-labs-as-legal-status-changes

[16] Lee, Yeji Jesse, What to know about the booming psychedelics industry, where companies are racing to turn magic mushrooms and MDMA into approved medicines, Business Insider India, June 30, 2022, https://www.businessinsider.in/science/health/news/what-to-know-about-the-booming-psychedelics-industry-where-companies-are-racing-to-turn-magic-mushrooms-and-mdma-into-approved-medicines/articleshow/85021068.cms