As is tradition, we at Blue Matter love to review the year that’s been from the perspective of the Oncology market. Gratifyingly for patients (and our clients), 2024 was another stellar year for oncology and it continues to be one of the hottest areas for research. In fact, oncology therapies accounted for ~30% of all novel approvals during 2024.

Last February, we published our 2024 Oncology Market Outlook. In that paper, we made four broad predictions:

- KRAS will kick into high gear.

- CAR-Ts will focus on manufacturing and the move to outpatient treatment.

- Targeted protein degradation will finally “arrive.”

- Radiopharmaceuticals will grow further, with expanded emphasis on alpha emitters.

Here, we revisit each of those predictions to see how well we did. As is usually the case, in some cases, we were spot-on with our outlook, while in others, we fell short of our optimistic expectations. Here we go…

Prediction #1 – KRAS will kick into high gear.

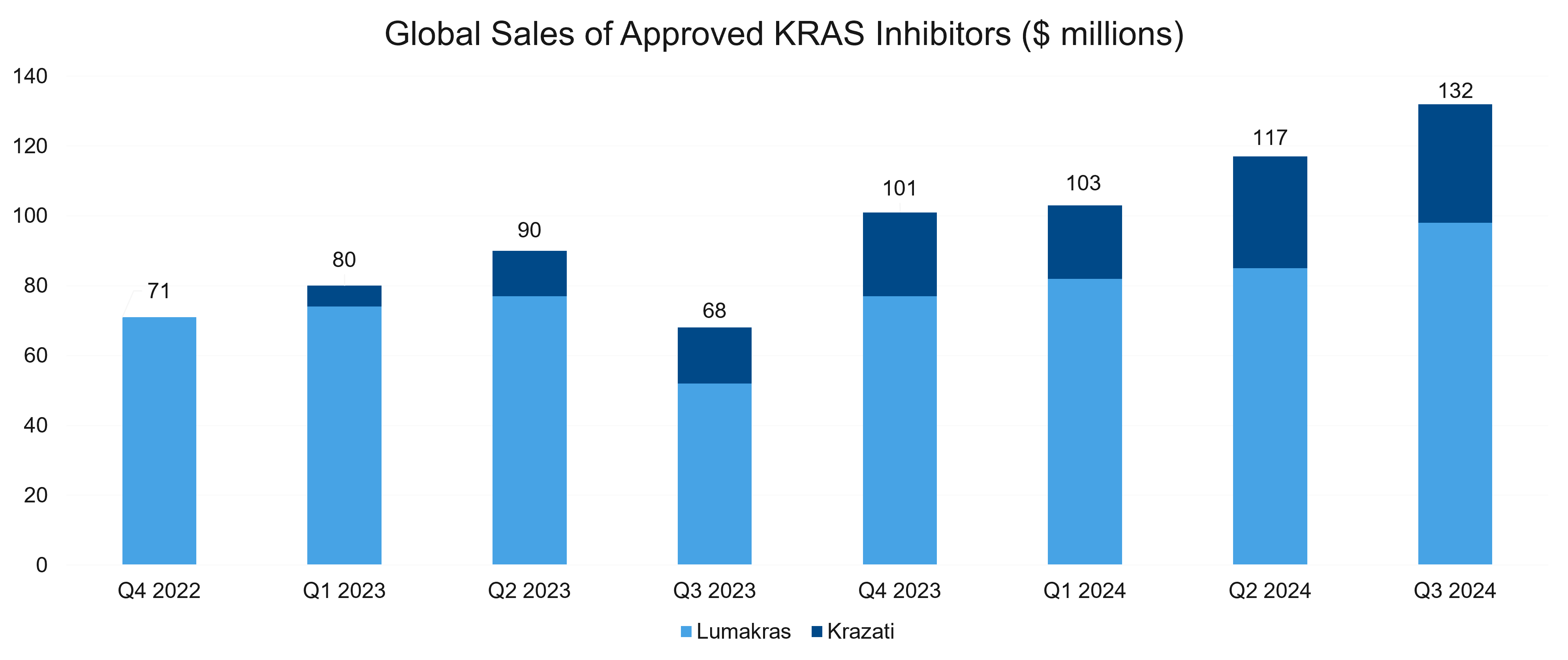

As we had expected in our predictions for 2024, first-generation KRAS inhibitors have continued to make progress commercially, as well as in the clinic. Combined sales for the KRAS G12C inhibitors grew slowly and topped $130 million in Q3. Clinical development continued to progress, and in line with our expectations, the market has seen significant activity from the clinical development, regulatory, and business development (BD) perspectives. Let’s take a look at some key players and assets in the space, providing a brief update for each.

Krazati® (Bristol Myers Squibb and Mirati Therapeutics)

Krazati® made some encouraging progress last year. Krazati with cetuximab was granted accelerated approval for KRAS G12C-mutated locally advanced or metastatic colorectal cancer (mCRC) in June based on the KRYSTAL-1 study. Specifically, the combination was approved as a targeted treatment option for adult patients who have received prior treatment with fluoropyrimidine-, oxaliplatin-, and irinotecan-based chemotherapy.

The study of 94 patients met its primary endpoint, with a confirmed objective response rate (ORR) of 34%, all of which were partial responses. The median duration of response (DoR), one of the secondary endpoints, was 5.8 months. Current late-line standard of care options deliver limited response rates (ORR 1-6%) after progression on chemotherapy ± VEGF/VEGFR inhibitors.

Lumakras® (Amgen)

Unfortunately, Lumakras’ combination with Vectibix® was not approved (so far). The FDA has delayed its decision on the combo’s supplemental new drug application (sNDA) for the treatment of chemorefractory mCRC with a KRAS G12C mutation. The expected decision date was October 17, 2024. The new deadline for action is January 17, 2025. We’ll be watching to see what happens with that decision.

However, there was good news for Lumakras in 2024, as it had positive early data in first-line CRC. The Phase 1b CodeBreaK 101 trial evaluated the safety and efficacy of Lumakras, panitumumab, and FOLFIRI in treatment-naïve patients with KRAS G12C-mutated mCRC. The combination demonstrated an ORR of 75%, a disease control rate (DCR) of 93%, and a median time to response of 1.5 months.

Treatment-related adverse events (TRAEs) occurred in 100% of patients with grade ≥3 TRAEs in 53%, primarily neutropenia, dermatitis acneiform, and diarrhea. No fatal events were reported.

The results indicate a tolerable safety profile and promising efficacy, making it the first data set for KRAS G12C inhibitors in first-line mCRC. A Phase 3 trial (CodeBreaK 301) is ongoing to compare this combination to the standard of care.

Revolution Medicines

In news beyond KRAS G12C, Revolution Medicines shared data from its KRAS G12Di asset, RMC-9805. It triggers tumor regressions in KRAS G12D–mutant pancreatic cancer. About 93% of pancreatic ductal adenocarcinomas (PDACs) have KRAS mutations, with G12D (∼42% of cases) and G12V (∼32% of cases) being the most common.

RMC-9805 demonstrated:

- 30% ORR and 80% DCR in KRAS G12D–mutant PDAC patients

- Early antitumor activity, tolerable safety, and the potential to address significant unmet needs in KRAS G12D-mutant pancreatic cancer

Dose optimization is ongoing in PDAC and other solid tumors. In addition, monotherapy and combination regimens (e.g., with RMC-6236) are under evaluation.

Speaking of RMC-6236, Revolution Medicines initiated its first phase 3 registrational trial (RASolute 302) for that asset. The global trial will evaluate RMC-6236 as a monotherapy in second-line metastatic PDAC. It will compare 300 mg RMC-6236 with standard-of-care chemotherapy in 460 patients, focusing on progression-free survival (PFS) and overall survival (OS) in the RAS G12X subset as primary endpoints.

The phase 3 trial was initiated based on promising data from an initial phase 1 study, RMC-6236-001. Key data points are summarized in the table below.

| Efficacy | Second-Line Metastatic PDAC (KRAS G12X mutations) | Second-Line Metastatic PDAC (RAS mutations) | Third-Line or Later Metastatic PDAC |

|

|

|

|

| Safety |

|

||

Astellas

Astellas Pharmaceuticals also shared data from its first in-human KRAS G12D degrader molecule, ASP3082, which showed activity in KRAS G12D positive advanced solid tumors. The therapy showed clear potential, including:

- Promising antitumor activity, particularly at 300 mg, with an ORR of 33.3% and a DCR of 75%

- An acceptable safety profile in patients with advanced KRAS G12D-mutated solid tumors, with Grade 3 TRAEs (e.g., ALT/AST elevation) in 5% of patients and no Grade 4/5 events (the maximum tolerated dose was not reached)

Overall, ASP3082 demonstrated an acceptable safety profile and promising antitumor activity in heavily pretreated patients, especially those with pancreatic cancer, but further studies are warranted to optimize dosing and assess its efficacy in larger patient populations.

Other Activity in the KRAS Space

The companies mentioned above weren’t the only ones making moves. A couple of others are worth noting in some detail. One of those companies is Quanta Therapeutics, who has entered the space with three key molecules:

- QTX3544 (G12V-preferring, entering phase 1 in January)

- QTX3034 (G12D-preferring, in the clinic)

- QTX3046 (G12D-selective, in the clinic)

Quanta Therapeutics claims favorable preclinical properties for its assets but now faces the challenge of demonstrating clinical efficacy against competitors in the pan-KRAS space, such as Revolution Medicines and Pfizer.

On the business development front, Jazz Pharmaceuticals entered a definitive agreement with Redx Pharma to acquire global rights to its KRAS inhibitor program. Per the agreement, Jazz will pay Redx $10 million for rights to the program, including G12D selective and pan-KRAS molecules. Redx is also eligible for up to $870 million in development, regulatory, and sales milestone payments from Jazz, in addition to tiered, mid-single-digit royalties on future net sales of the KRAS inhibitors. Jazz will fund Redx to conduct research and preclinical development, and to complete IND-enabling studies for both KRAS inhibitor profiles.

On balance, we feel good about our prediction regarding the KRAS space. R&D, overall interest, and dealmaking are definitely in “high gear.”

Prediction #2 – CAR-Ts will focus on manufacturing and move to outpatient treatment.

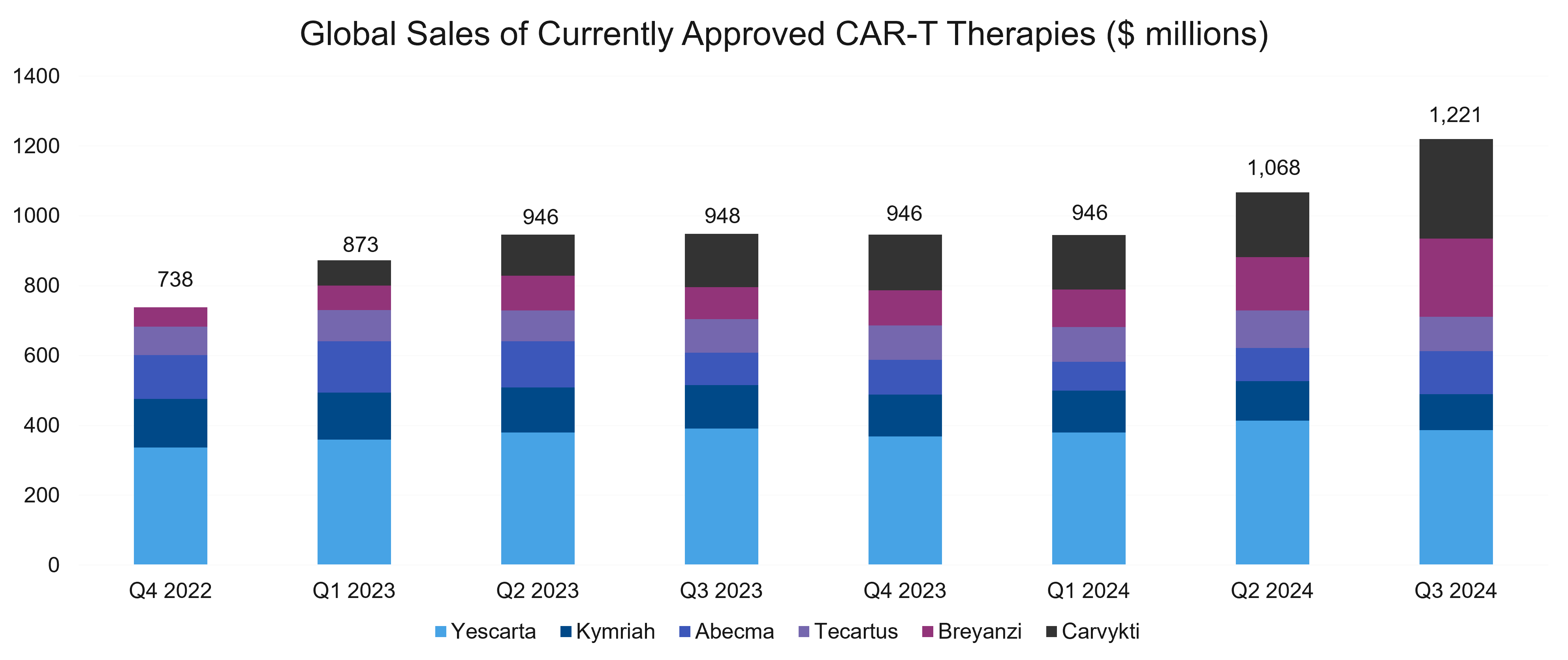

Last year, sales of CAR-T therapies showed a modest yet promising uptick following a bit of a plateau in 2023. The uptick signals renewed momentum in a market now primarily driven by Carvykti® and Breyanzi®.

Carvykti sales were boosted by the FDA’s approval in April 2024 in second-line multiple myeloma. By Q3, sales had surged significantly, highlighting Carvykti’s accelerating market adoption compared to competing therapies. Furthermore, 2024 also brought another CAR-T to the market: obe-cel Aucatzyl®, indicated for relapsed / refractory (R/R) B-cell precursor acute lymphoblastic leukemia.

Also, In line with our prediction, market leaders made several moves aimed at increasing CAR-T manufacturing efficiency and fidelity. In addition, biopharma companies gained significant ground in their pursuit of an outpatient approach to CAR-Ts.

Faster Manufacturing

Progress on the manufacturing front continued apace, led by several manufacturers. Below, we provide a quick overview.

Novartis’ T-Charge platform continued to show promise. In a phase 2 trial of rapcabtagene autoleucel (YTB323) in R/R diffuse large B-cell lymphoma (DLBCL), the platform showed encouraging results. Cell manufacturing time was less than 2 days, far below current norms of 9-13 days. Such a short manufacturing time can support rapid turnarounds while maintaining high response rates. T-Charge has demonstrated the potential for rapid and scalable CAR-T manufacturing with excellent efficacy and manageable safety, setting a new standard in aggressive lymphomas.

In other news, Bristol Myers Squibb (BMS) partnered with Cellares in a deal worth up to $380 million to both scale and speed manufacturing of CAR-T treatments for cancer. As part of the deal, Cellares will integrate BMS cell therapies into its Cell Shuttle automated manufacturing platform. The Cell Shuttle aims to cut manufacturing times in half, reducing production failure rates and labor requirements. Cellares also claims it reduces production costs by 50%. There will be dedicated manufacturing capabilities in the US, Europe, and Japan. This deal supports BMS’ efforts in CAR-T therapies and strengthens US-focused manufacturing.

Bristol Myers Squibb also shared data from its Nex-T manufacturing platform, which has the potential to develop CAR-T cell therapies in a shorter amount of time with increased product quality. The process is designed to encourage the growth of more uniform and potent T cells, which may prompt a deeper and more durable response in patients. Similar to Novartis’ T-Charge platform, it expands cells mostly in vivo to shorten production time. Interestingly, BMS appears to be focusing on immunological indications for its lead Nex-T asset.

Johnson & Johnson (J&J) and Legend expanded a manufacturing deal with Novartis to include the commercial production of Carvykti. Novartis will perform commercial manufacturing of Carvykti through 2029 at its Morris Plains, NJ facility. Novartis will ensure that there is no impact on capacity for its own CAR-T therapies, such as Kymriah® and its next-generation T-Charge therapies. Manufacturing hurdles, especially for lentiviral vectors, had previously limited Carvykti’s availability, so the expanded production afforded by this latest deal should help clear those hurdles and meet rising demand.

During 2024, we also saw updates for other FasT CAR-T manufacturing approaches. Gilead is working on improved manufacturing approaches for KITE-753, KITE-197, and KITE-363. The company is aiming for a 3-day manufacturing turnaround, shortening production time and ensuring a more uniform product by enriching harvested cells for juvenile T cells. This was an in-house innovation originally developed by Gilead following the Kite acquisition in 2017.

Gracell also shared updates for its GC012F program, a CD19 and BCMA dual-targeting CAR-T manufactured using the novel next-day FasT CAR-T process. Gracell’s technology and its fast production process were likely a significant factor in AstraZeneca’s $1 billion acquisition of the company.

Transition to the Outpatient Setting

The holy grail for CAR-T manufacturers continues to be the eventual transition of CAR-T therapy administration to the outpatient setting. Several studies and articles have highlighted the growing feasibility, benefits, and other key considerations for making this transition.

One recent study, described in Outpatient administration of CAR T-cell therapies using a strategy of no remote monitoring and early CRS intervention, demonstrated the feasibility of use in the outpatient setting, with successful outpatient administration in patients and the early use of tocilizumab intervention to treat low-grade cytokine release syndrome (CRS). The approach reduced the rate and duration of hospital stays, lowered costs significantly, and caused less strain on resources. It did, however, require dedicated infusion facilities, trained staff, 24-hour support, patient education, and caregiver availability.

There were some notable challenges, though. These included a higher patient financial burden and some related insurance complexities, and a reliance on robust infrastructure. Overall, it did show that outpatient administration can be safe and effective with the proper systems in place, saving inpatient resources while maintaining care quality.

There were also some notable developments on the point-of-care front, which allows CAR-T therapies to be manufactured “closer to the patient.” Different point of care models showed progress in 2024. Key updates from Galapagos and Miltenyi Biotec both suggest that point-of-care CAR-Ts could be a reality soon, though their commercial potential is currently unclear.

Galapagos’ investigational CD-19 CAR-T therapy, GLPG5101, showed a vein-to-vein time of only 7 days in a phase 1/2 study, which may eliminate the need for bridging chemotherapy. GLPG5101 leverages Galapagos’ decentralized cell therapy manufacturing platform, which demonstrated impressive results:

- Short Vein-to-Vein Time: Median vein-to-vein time was just 7 days.

- Fresh Cell Delivery: 96% of patients received fresh, fit, stem-like early memory CD19 CAR T-cell therapy, eliminating the need for cryopreservation.

- No Bridging Therapy: The short manufacturing time allowed 91.5% of patients to avoid bridging therapy.

- Consistent Product Quality: Delivered CAR-T cells with strong in vivo expansion and a stem-like, early memory phenotype across all doses.

- Improved Patient Outcomes: Shorter vein-to-vein time and fresh cell delivery align with better efficacy and flexibility in scheduling treatments.

The Galapagos platform underscores the feasibility of decentralized manufacturing in enhancing CAR-T therapy delivery and outcomes.

Not to be outdone, Miltenyi Biotec’s zamtocabtagene autoleucel (zamto-cel) also uses an accelerated process with fresh cells, no freezing, and fast turnaround times. It delivers a vein-to-vein time of 14 days, achieved by starting lymphodepletion during manufacturing. In addition, Miltenyi plans to move towards a localized manufacturing system similar to Galapagos.

Fast-Manufactured CAR-T Therapies in R/R DLBCL

| Rapcabtagene autoleucel | Zamtocabtagene autoleucel | GLPG5101 | |

|---|---|---|---|

| Company | Novartis | Miltenyi Biotec | Galapagos |

| Target | CD19 | CD19 & CD20 | CD19 |

| Trial | NCT03960840 | Daly II USA | Atalanta-1 |

| Patients | 60 | 59 | 13 |

| Manufacture | Centralized | Centralized | Decentralized |

| Bridging Chemo? | Used in 60% of patients | No* | No |

| Cells Frozen? | Yes | No | No |

| ORR | 88% | 73% | 69% |

| CR Rate | 65%** | 51% | 54% |

| Gr 3/4 CRS | 6% | 0% | 5%*** |

| Gr 3/4 ICANS | 5% | 4% | 0%*** |

| Other AEs | 6 deaths (COVID, respiratory failure, intestinal hemorrhage, septic shock, & TLS) | 2 deaths (COVID & sepsis) | 3 deaths (intra-abdominal hemorrhage (DLBCL), respiratory distress (DLBCL), & sepsis (MCL)) |

Table Notes: *Used in 4 patients, excluded from analysis set; **Includes 4 patients in CR before infusion; ***Safety data for phase 1 only as no DLBCL patients included in phase 2. Source: ASH

Overall, we think our predictions in this area panned out nicely. With significant improvements in manufacturing and good progress toward the goal of outpatient administration, the industry performed as we had expected, and we hope these improvements will help the CAR T class find a sustainable path to greater clinical impact (and profitability)

Prediction #3 – Targeted protein degradation will finally “arrive.”

Overall, we were somewhat disappointed with the manner in which this prediction panned out. While there were indeed several noteworthy developments in the field, which only served to strengthen our belief that targeted protein degradation (TPD) is here to stay, we did not get the one major event we were expecting.

The Phase 3 VERITAC-2 trial was supposed to deliver its topline readout in 2024. This trial is evaluating vepdegestrant (ARV-471, estrogen receptor PROTAC degrader) monotherapy in 2L+ ER+/HER2- metastatic breast cancer. That readout did not happen last year but is now expected in the first quarter of 2025. If positive, ARV-471 will be the first approved treatment in the targeted protein degradation class of medicines.

Nevertheless, the field attracted a lot of interest. Several programs across many different companies continued to progress and generated compelling data.

First up is Arvinas’ ARV-766, an investigational orally bioavailable PROTAC® protein degrader designed to selectively target and degrade the androgen receptor (AR). Preclinically, ARV-766 has demonstrated activity in models of wild type androgen receptor tumors in addition to tumors with AR mutations or amplification, both common potential mechanisms of resistance to currently available AR-targeted therapies. In a phase 1/2 trial in metastatic castration-resistant prostate cancer (mCRPC), ARV-766 demonstrated a favorable safety profile and promising clinical activity, supporting further investigation in advanced prostate cancer. In April 2024, Arvinas entered into a transaction with Novartis, including a global license agreement for the development and commercialization of ARV-766 for the treatment of mCRPC.

Arvinas and Pfizer announced initial phase 1b data for vepdegestrant (ARV-471) in combination with abemaciclib. The TACTIVE-U study evaluated the safety, tolerability, and preliminary efficacy of vepdegestrant (PROTAC ER degrader) combined with abemaciclib in patients with locally advanced or metastatic ER+/HER2- breast cancer post-CDK4/6 inhibitor treatment. It showed a clinical benefit rate of 62.5% and an objective response rate (ORR) of 26.7% with a tolerable profile. These encouraging results support further development in phase 2.

Kymera Therapeutics’ suite of programs also showed some promising data. Their STAT3 degrader, KT-333, was well tolerated across R/R hematologic malignancies and solid tumors. This first in class STAT3 degrader showed 95% degradation of the target, was generally well tolerated, and showed high response rates in BV/PD1 refractory classical Hodgkin lymphoma (cHL) patients, as well as responses in other tumor types.

Kymera also presented new data from an ongoing phase 1 trial of its MDM2 degrader, KT-253, at the ASCO annual meeting. KT-253 demonstrated initial clinical proof of concept in patients with tumor types shown to be sensitive in preclinical models, including responses in Merkel cell carcinoma (MCC) and acute myeloid leukemia (AML). It was generally well tolerated without the hematologic adverse events seen with traditional MDM2 small molecule inhibitors.

Updated results were also shared from a phase 1 study of cemsidomide (CFT7455). It is a novel monoDACTM degrader, with dexamethasone in patients with R/R multiple myeloma (MM). It showed an ORR of 22% and a clinical benefit rate of 38%.

C4 Therapeutics also announced initial clinical data from the ongoing clinical trial of CFT1946, an orally bioavailable small molecule degrader of BRAF V600 mutations in solid tumors. CFT1946 demonstrates evidence of monotherapy anti-tumor activity, supporting early proof of concept. At data cutoff, 27 patients were evaluable for anti-tumor activity, which is measured by RECIST 1.1 criteria. And 16 patients demonstrated reduction of target metastatic lesions. C4 Therapeutics also announced the first patient dosed with CFT8919 (its degrader targeting EGFR mutations in non-small cell lung cancer (NSCLC). We await clinical trial data.

Moving on, Nurix’s BTK Degrader NX-5948, earned a fast track designation in R/R Waldenström macroglobulinemia (WM). The agent elicited an ORR of 75.5% at 8 weeks in patients and 84.2% at 16 weeks.

Not to be left behind, Beigene also advanced its BTK degrader, BGB-16673, and showed impressive early data. Among 27 response-evaluable patients with WM, the ORR was 81%, while the major response rate (partial response [PR] or better) was 74.1%.

In summary, the field did make substantial progress in 2024, even if there wasn’t one seminal event. Perhaps 2025 will be the year that targeted protein degradation will truly “arrive!”

Prediction #4 – Radiopharmaceuticals will grow further, with expanded emphasis on alpha emitters.

This prediction was spot-on, as interest in radiopharmaceutical therapeutics (RPTs) reached almost a fever pitch during 2024. Most large players now have a presence either directly or indirectly in RPTs. Furthermore, as we had expected, there was an additional emphasis on alpha emitters, which was seen in research and in business development (BD) deals.

Research activity in the space is quite impressive, with around 25 unique PSMA and SSTR2 targets being pursued. Overall, development in radiopharmaceuticals involves 38 companies and 45 clinical stage programs. This includes eight programs in phase 3, nine in phase 2, and 28 in phase 1/2.

Major Acquisitions in Radiopharmaceuticals

Most RPT acquisitions in 2024 centered around alpha-emitting molecules, reflecting a significant shift from beta-emitters. This is primarily driven by the fact that alpha emitters offer more precise targeting of cancer cells. Below, we look at some key acquisitions in the space.

First, Bristol Myers Squibb completed its $4.1 billion acquisition of RayzeBio, adding a differentiated Actinium-based radiopharmaceutical platform to its portfolio. BMS paid $62.50 per share in cash and approximately 86% of RayzeBio’s outstanding shares were tendered.

The key asset that BMS acquired is RYZ101 (225Ac-DOTATATE). This targets the somatostatin receptor 2 (SSTR2) in gastroenteropancreatic neuroendocrine tumors (GEP-NETs) and extensive-stage small cell lung cancer (ES-SCLC). It’s currently in a phase 3 trial for SSTR-positive GEP-NETs after lutetium-177 therapy and a Phase 1b trial as a first-line ES-SCLC treatment in combination with the standard-of-care.

This acquisition expands BMS’ oncology pipeline with RPTs targeting solid tumors and diversifies its oncology portfolio beyond immuno-oncology. It positions BMS as a leader in the fast-growing RPT space, complementing its existing oncology initiatives

In another important acquisition, AstraZeneca acquired Fusion Pharma to accelerate the development of next-generation radioconjugates (RCs) to treat cancer. Fusion’s expertise in actinium-based RCs complements AstraZeneca’s oncology portfolio, emphasizing a shift from traditional therapies (chemotherapy, radiotherapy) to targeted cancer treatments. AZ gets FPI-2265, a clinical-stage radioconjugate targeting PSMA, which is in Phase 2 trials for metastatic castration-resistant prostate cancer (mCRPC). Overall, its expanded pipeline includes radioconjugates targeting EGFR-cMET and other innovative platforms. The acquisition closed in June 2024 and positions AstraZeneca at the forefront of RPT innovation, paving the way for groundbreaking cancer treatments

In a third acquisition, Novartis entered into an agreement to acquire Mariana Oncology, strengthening its radioligand therapy (RLT) pipeline and expanding its research capabilities to address cancers with high unmet needs. The transaction involves an upfront payment of $1 billion and up to $750 million in additional milestone payments.

Novartis will get preclinical-stage RLT programs targeting solid tumors, including breast, prostate, and lung cancers. These include MC-339, an actinium-based RLT for SCLC. The acquisition will bolster Novartis’ current RLT portfolio, which includes two approved RLTs for mCRPC and GEP-NETS.

Business Development / Collaboration Deals

The developments weren’t just limited to acquisitions. BD and collaboration activity was also strong. The table below provides a quick overview of some key deals.

Partners| Description | Key Terms

| |

|---|---|---|

| Novartis extended its collaboration with Japanese biotech, PeptiDream to discover and develop new RLTs using PeptiDream's Peptide Discovery Platform System. The two began collaborating in 2019. |

|

| Aktis specializes in alpha-emitting RPTs. This collaboration builds on Lilly's expansion into the RPT space, following its acquisition of Point Biopharma in 2023. Lilly will gain global rights to develop radiopharmaceutical therapies discovered by Aktis against targets selected by Lilly. |

|

| Radionetics is developing small molecule RPTs targeting G protein-coupled receptors, which are common in many diseases, particularly solid tumors. This partnership gives Lilly the opportunity to acquire Radionetics, expanding its capabilities in RPT. |

|

| Sanofi entered a licensing deal with RadioMedix and Orano Med to develop AlphaMedix, a lead-212 targeted RLT for GEP-NETs. |

|

| This deal further advances Sanofi’s relationship with Orano Med. They will focus on advancing next-generation RPTs for rare cancers, leveraging Orano Med’s expertise in alpha therapies. The partnership aligns with Sanofi's shift to focus on difficult-to-treat malignancies, particularly hematologic cancers (like multiple myeloma and acute myeloid leukemia) and certain solid tumors (such as gastrointestinal and lung cancers). |

|

Source links: Novartis/PeptiDream, Lilly/Aktis, Lilly/Radionetics, Sanofi/RadioMedix/Orano Med, Sanofi/Orano Med

Clearly, there is significant activity in the RPT space, with big companies seeking to bolster their positions via strategic acquisitions, collaborations and licensing deals, option deals, and more. We are excited to see how this market evolves in 2025.

Coming Next

When all is said and done for our 2024 predictions, we feel pretty positive about how things turned out. Next, we’ll stop looking in the rearview mirror and start looking forward. In a couple of weeks, we’ll publish our Oncology Market Outlook for 2025. Once again, it’s looking like an exciting year is in store, and we can’t wait to share our thoughts.

In the meantime, please contact us via our website if you have any questions or would like to discuss development and commercial strategy for your company’s oncology product(s) or portfolio.