The pharmaceutical industry stands at a pivotal juncture. While technology enables unprecedented possibilities, many go-to-market (GTM) models remain rooted in legacy approaches, leaving substantial value untapped. In fact, biopharma’s collective ability to generate a positive return on investment (ROI) has lagged many other industries for the past decade, as we explore in the sections below.

Given that reality, we set out to address a fundamental question: how can we re-envision commercialization to be future-proof, human-centered, and high-impact? We wanted to know what approaches and actions are most correlated to commercial success. To find answers, we analyzed hundreds of launches, identifying the critical drivers of success and the persistent barriers to realizing full market potential.

Building on these insights, we developed a new GTM framework—one that integrates strategic rigor with a focus on frontline execution. It places customers, employees, and the realities of the marketplace at its core. This framework is designed for the demands of both today and tomorrow. By tailoring capabilities, investments, and engagement models to the specific needs of each asset, it ensures a precise fit in the market.

Ultimately, this is about more than strategy. It’s about delivering an exceptional experience—for patients, for customers, and for the teams who make it all happen. In this two-part series, we break down the challenge and then offer a formula that biopharma decision makers can use to address it.

Here, in part 1, we describe the current challenges that make it more difficult for biopharma to deliver peak performance, as well as the need for new approaches to overcome those challenges. In addition, we introduce our go-to-market framework as a foundational element supporting those new approaches.

Why Change, Why Now?

The rapidly evolving market environment requires pharma companies to embrace increasing agility in their strategic planning, adapting proactively to new challenges and opportunities. Despite being an engine of innovation and delivering significant scientific advancements, pharmaceutical returns have trailed those of other industries.

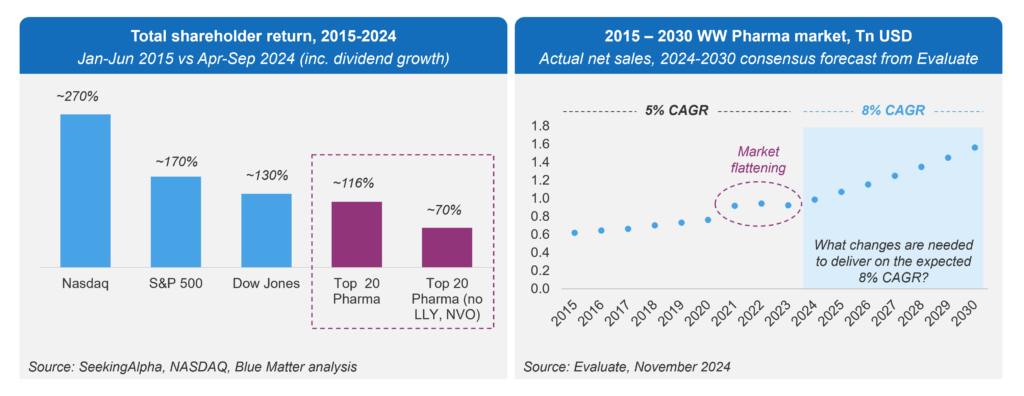

Over the past decade, the top 20 pharmaceutical companies generated a Total Shareholder Return (TSR) of 116%—or 70% if we exclude Lilly and Novo Nordisk, whose share prices surged on the back of semaglutide and tirzepatide. However, major stock indices outperformed the top 20 pharma cohort during this period (see Figure 1).

Figure 1: Total Shareholder Returns, Top 20 Pharma vs. Other Indices

Consensus forecasts from EvaluatePharma suggest the industry could see growth rates accelerate to 8% through 2030[1]. However, the last three years have shown a flattening of market expansion, raising a critical question: what changes must pharma implement to fully realize the potential of its scientific innovation?

To begin answering that question, it’s helpful to understand the key changes or shifts in the market environment that are affecting the biopharma industry. Table 1 provides an overview of these macro-level shifts. In such a rapidly evolving environment, the ability to plan and execute with agility is essential for navigating complex market dynamics and sustaining competitive advantage.

Table 1: Five Macro-Level Shifts Affecting the Biopharma Industry

| 1 | Political Shifts | Key shifts include major pharma reforms such as the Inflation Reduction Act (IRA) in the US and the Joint Clinical Assessment (JCA) in Europe. Plus, funding shifts are challenging the current paradigm in terms of launch priorities (e.g., countries such as Saudi Arabia are emerging as vibrant pharma hubs on the back of important long-term government-led programs like Saudi Vision 2030). |

| 2 | Mounting Profit & Loss Pressures | Increasing cost pressures and intensifying competition across most therapy areas—even highly specialized niches—are prompting companies to streamline their go-to-market approaches. The result is a shift toward leaner, more focused commercialization platforms that can operate efficiently while maintaining a competitive edge. |

| 3 | Advances in Science & Technology | New technologies are creating unprecedented opportunities across the pharmaceutical sector. Yet capitalizing on these possibilities requires a fundamental re-examination of operating models and capabilities, including a sharper focus on the partnership between corporate headquarters and local affiliates. Elevating this collaboration to a top C-suite priority can unlock the agility, efficiency, and innovation needed to thrive in an increasingly complex market landscape. |

| 4 | Evolving Customer Ecosystem | While the evolution of customer preferences is well-documented, far less attention has been paid to the rapid consolidation among healthcare providers. Whether it’s the integration of hospital networks in France and Germany or practice aggregation in the U.S., often backed by private equity investments, decision-making authority is dispersing across multiple stakeholders. In this environment, frontline teams require a new set of capabilities and a recalibrated investment strategy—one that addresses value points across the entire care continuum, rather than focusing solely on prescribers and the downstream portion of the patient funnel. |

| 5 | Reduced Employee Engagement | Reduced employee engagement remains a significant challenge across industries. According to Gallup, only 23 percent of employees report being engaged at work—a stark contrast to the 70 percent seen in high-performing organizations. In pharma, the issue is compounded by the steady trend of layoffs, which reached its highest point in 2024, with 192 company layoffs (vs. 187 in 2023 and 112 in 2022, based on the Fierce Biotech Layoff Tracker. Adding to the complexity, the workforce now includes a greater proportion of Millennials and Gen Z, whose expectations for role design, performance management, and career development differ from prior generations. In this environment, rethinking how roles are defined and how performance is measured is no longer optional, it’s essential for sustaining engagement and driving results. |

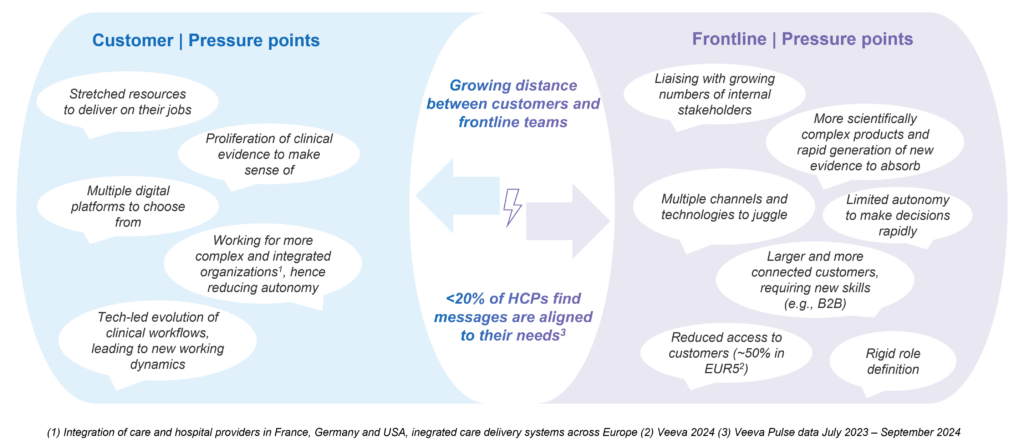

Within the context of these trends, frontline teams are under growing pressure. Historically, they have been the face of pharma with customers. However, today they must contend with multiple factors that are “driving a wedge” between them and their customers.

On one side, their customers are coping with stretched resources as they simultaneously attempt to do multiple things, such as:

- Deliver on their core day-to-day jobs

- Keep up to date with the proliferation of clinical evidence at their disposal

- Orient across multiple digital platforms to choose from while trying to adjust to new operating models brought about by technological advances in (for example) precision diagnostics and automated administrative workflows

- Deal with more complex and integrated healthcare organizations, often with a reduced degree of autonomy

On the other side, frontline roles within biopharma companies also face a challenging situation. For example, they must

- Juggle multiple channels and technologies (i.e., all the new shiny AI toys thrown at them)

- Engage with larger and more connected customers, demanding new knowledge and skills

- Handle more scientifically complex products

- Rapidly absorb and make effective use of new evidence that can come from a wide array of sources

- Liaise with a growing number of internal and external stakeholders, all while having limited autonomy to drive rapid decision making

Figure 2: Pressures Driving a “Wedge” Between Frontline Teams and Customers

So how does all this manifest in the marketplace? Despite nearly 80% of interactions between frontline roles and customers still taking place face-to-face (according to Veeva[2]), fewer than 30% of healthcare providers (HCPs) feel these engagements address their needs.[3] This highlights the urgent need to rethink and elevate frontline performance.

Analyzing Go-to-Market Performance By Reviewing Nearly 300 Launches

By now, the case is fairly clear that biopharma companies should do something different if they want to optimize GTM performance in such a rapidly evolving and complex environment. However, “Do something!” is not an effective prescription. To help determine what that “something” is, we looked at the last ten years of launches to learn how performance has evolved over time and—most importantly—what lessons we can accumulate as we rethink the foundations of future GTM models.

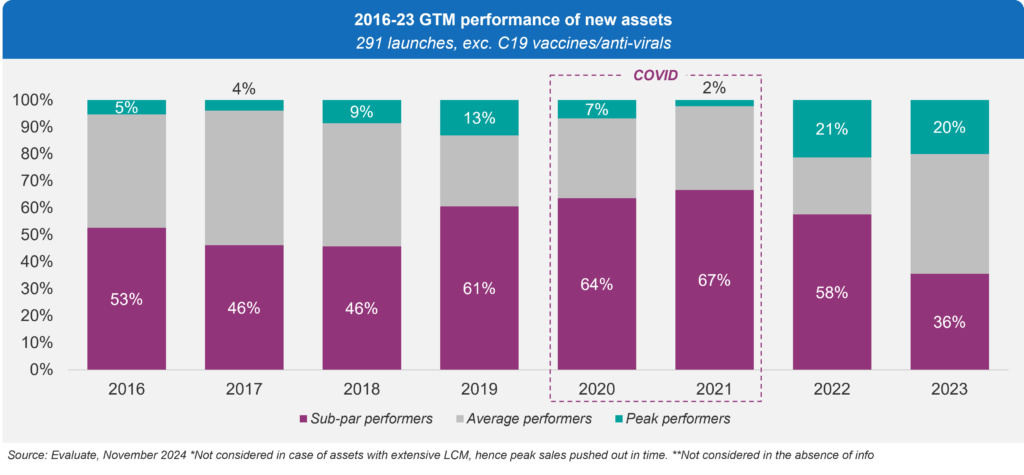

We analyzed nearly 300 launches that took place from 2016 to 2023, excluding vaccines and anti-viral treatment for COVID-19, to understand how performance has evolved and the relevant drivers. Our assessment covered four dimensions:

- Market Share Attainment: We measured uptake at both 12 and 24 months, benchmarked either against the relevant ATC3 class or specific indications – whichever provided the most reliable metric.

- Time to Peak: Recognizing the criticality of speed in a crowded marketplace, we evaluated how quickly each product reached peak sales (we did account for brands with multiple line extensions, hence with a longer time required to reach peak sales).

- Performance vs. Consensus Forecast: We compared actual results to the consensus forecast from Evaluate (specifically, the projections available at the point of FDA approval, ensuring the most current evidence was factored into analyst expectations).

- Innovation in the GTM Model: We conducted a qualitative review by examining multiple sources, such as earnings-call transcripts, third-party industry reports, medical and marketing awards, and our own experience. For example, Tepezza® (in Thyroid Eye Disease) launched mid-COVID-19 by establishing infusion sites outside hospital settings. That was a creative workaround that highlights how innovative GTM approaches can overcome formidable external challenges.

Using those four dimensions, we then grouped the launches into three categories: Peak Performers, Average Performers, and Sub-Par Performers. As illustrated in Figure 3, despite an uptick in overall performance during 2022 and 2023, nearly half of all new assets still fall short of expectations.

Figure 3: Go-to-Market Performance Categories, 2016-2023

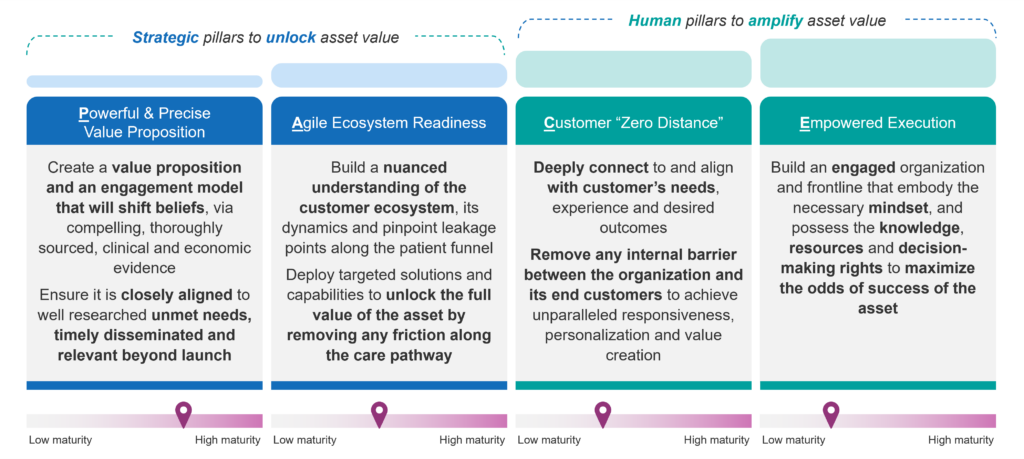

Overview of the PACE Framework

Drawing on lessons from historical launches and factoring in future market shifts, we developed a human-centric model that consolidates four fundamental pillars essential for driving peak product performance. We call this the PACE framework (see Figure 4). Also in Figure 4, the reader will note that we have benchmarked where the biopharma industry collectively stands along a “maturity scale” related to each pillar. The ratings on those maturity scales are a function of multiple factors which include the launch analysis, our direct experience, and our recent Best Practice Commercialization Organization Study Report, which surveyed more than 20 executives from large/mid-sized pharma as well as emerging biotechs. Below, we briefly describe the PACE framework’s pillars at a high level. Blue Matter has actually developed a granular framework that builds on 10 success factors for each pillar which is used in our client engagements.

Figure 4: Overview of the PACE Framework (a human-centric approach for peak performance GTM)

The first two strategic pillars are foundational to unlock the value of an asset:

- Powerful and Precise Value Proposition

- Agile Ecosystem Readiness

Powerful and Precise Value Proposition

A peak performance GTM model delivers a value proposition and engagement model that shifts beliefs via compelling, thoroughly sourced clinical and economic evidence. It is closely aligned to well-researched unmet needs, is disseminated in a timely manner, with adequate priming ahead of launch, and remains relevant well beyond launch. Some great examples include Lilly’s Mounjaro®/Zepbound® in type 2 diabetes and obesity, as well as Takeda’s Takhzyro® and BioCryst’s Orladeyo® in hereditary angioedema.

It’s important because, as evidence requirements and competition grow (even in smaller or niche therapeutic areas), rapid differentiation is vital to outpace future market entrants. Achieving this hinges on two critical factors:

Evidence aligned to key belief shifts – Evidence generation should be closely tied to the key target belief shifts that are required to nudge customers along the adoption ladder. It’s more than just an instrument to support a dialogue with regulators and payers, it should provide the necessary confidence to physicians to utilize the product (within the appropriate target population indicated in the label) and tackle any prescribing inertia. And triggering belief shifts must start much earlier than launch with appropriate disease state education and advocacy-building initiatives. Xdemvy®, commercialized by Tarsus for Demodex blepharitis and one of the best launches in the eye care space to date, is a great example of how a powerful, evidence-driven, narrative can lay the foundations to achieve peak performance.

Pull-focused engagement via high-quality content – Orchestrating synchronized touchpoints—both digital and face-to-face—can generate “pull” from the market rather than relying purely on push strategies. By integrating these engagements across channels, companies can more effectively shape demand (e.g., expand referral flows and diagnosis rates in rare, underdeveloped segments), accelerate adoption, and maintain relevance in an increasingly crowded landscape. Yet, pharma must boost the quality of digital content and the corresponding customer experience, as these are currently far from excellent, according to a recent report on the state of customer experience in the pharmaceutical industry.[4]

Agile Ecosystem Readiness

High-performing go-to-market (GTM) teams develop a deep understanding of the customer ecosystem, diagnosing its dynamics and pinpointing leakage points in the patient journey. By deploying targeted solutions and capabilities that remove friction across the care pathway, they unlock the full value of each asset and drive more meaningful outcomes for patients and providers alike.

As healthcare systems evolve and therapies grow in complexity—with correspondingly larger budget impacts—decision-making rarely rests with a single prescriber. Multiple stakeholders now influence adoption, making it critical to understand how and why these groups reach consensus, and how best to shape it. Top-performing launches—such as Tepezza® and Vyjuvek®—demonstrate the importance of starting ecosystem mapping and market shaping efforts early, well before the formal launch window. This proactive approach helps ensure that critical stakeholders are prepared to embrace new therapies the moment they become available. Krystal Biotech’s topical gene therapy, Vyjuvek®, serves as a compelling example of how to design a highly effective patient journey. By implementing a thoughtfully crafted suite of patient-centric solutions and ensuring seamless connectivity between centers of excellence and the home setting, Krystal achieved rapid adoption of their premium-priced therapy.

The second set of pillars centers on the “human” dimension. The human factors often spell the difference between a good launch and a truly standout one. They capitalize on people’s energy, creativity, and dedication to amplify the value of the product far beyond its core attributes. They are:

- Customer “Zero Distance”

- Empowered Execution

Customer “Zero Distance”

Customer-centricity and “customer obsession” have become common watchwords, yet we believe organizations must go even further. True customer alignment calls for deep insight into needs, experiences, and desired outcomes. In addition, it calls for the removal of internal barriers that stand in the way of delivering consistent, personalized value.

This concept of “zero distance” to the customer draws on Haier’s Rendanheyi management model, pioneered by CEO Zhang Ruimin. By embedding zero distance at every level of the organization, biopharma companies can achieve a new standard of responsiveness, personalization, and impact far beyond traditional customer-centric approaches. Yet, as referenced earlier when we talked about the wedge between customers and frontline teams, the road to achieving “zero distance” is still long despite all the investments in technology (e.g., next-best action tools, generative AI applications, etc.).

In a resource-constrained environment, biopharma companies must focus on what truly matters to their end customers, decluttering their GTM approach from outdated, redundant, and/or costly practices. In our analysis, we have observed that over the last decade, the ratio between selling, general, and administrative (SG&A) spends and revenue generated from new launches or growth products has nearly halved. This provides further proof that go-to-market operations will need to do more with less[5]. This shift calls for “first-principles thinking” on how budgets are allocated, as the traditional incremental logic to SG&A investment allocation is no longer sustainable. Ultimately there must be a much tighter alignment between how value is distributed along the patient funnel and where investment and customer engagement efforts are placed in order to more effectively, and efficiently, activate the customer ecosystem.

Instead, global and regional headquarters should function as service platforms, providing timely support and enabling local teams with the right tools and capabilities to bring the best value to customers, at speed. By doing so, organizations can co-create high-impact solutions, foster stronger partnerships with healthcare systems, and ultimately deliver greater value where it matters most: to patients.

This pillar is particularly important in driving peak performance for two asset archetypes that will be articulated further in the second installment of this series, “Builders” and “Challengers,” which account for nearly 50% of all the assets covered.

Empowered Execution

The final part of the peak-performance equation is building an engaged organization and frontline teams that embody the necessary mindset and possess the knowledge, resources, and decision-making rights to maximize an asset’s odds of success. This step is often neglected in the GTM model design process, often ending up with organizational configurations where frontlines have limited decision rights and resources to drive innovation closer to the customer. Too often, customer-facing teams have an abundance of centrally-created content, data, and tools, but have not been equipped with the mindset or skills to make the most of them. According to Veeva, more than 70% of centrally created medical and marketing content is not used locally.

When we hand real decision-making authority to the people closest to our customers, something profound happens: they take ownership. They feel a sense of autonomy and pride, which in turn drives deeper commitment and creativity in how they serve. But that’s only part of the story. Empowering frontline teams also demands a culture of proactive accountability, continuous learning, and an unwavering focus on outcomes that matter. Incentive systems should be redesigned to more closely resemble the practices followed by best-in-class examples of “empowered execution” such as Ritz-Carlton or Zappos. Inside an organization, this shift creates a palpable sense of purpose, encouraging everyone to align to the vision and the ambition behind the asset. More individuals feel engaged and inspired to deliver real results for their customers and ultimately, the patients.

Our analysis unsurprisingly showed that assets with the highest potential for peak performance include those we categorize as “Leaders”, such as Dupixent® or Mounjaro® (for further information, part two of this series will provide a detailed examination of the individual asset archetypes). While it is certainly easier to cultivate a strong engagement with high-potential brands, fostering a leadership mindset requires ongoing effort and reinforcement at all organizational levels. It is even more challenging to achieve the same level of engagement and establish the necessary mindset for brands demonstrating incremental innovation in highly competitive markets, such as oncology (in our analysis, the therapy area with the lowest proportion of peak performers) and, in the future, obesity.

Coming Next

While the concepts above are critical to driving peak performance, the ways in which they should be applied can vary. The product, therapy area, and any number of other factors can drive shifts in the recipe. In part 2, we will outline why a “one size fits all” approach is, in general, a bad idea. In particular, we will take a deep dive into five distinct and asset-specific archetypes. We’ll also explore how and why the framework’s application varies based on those archetypes…and the resulting impacts on performance.

End Notes:

[1] Consensus forecasts as of November 2024

[2] Veeva Pulse Field data, July 2023 – September 2024

[3] Digital Health Coalition, 2023

[4] The state of customer experience in the global pharmaceutical industry, 2024. HCP interactions (DT Consulting).

[5] Blue Matter analysis of Evaluate data on SG&A. Growth products defined as assets in the market for up to 5 years. Ratio between SG&A and revenues from new and growth products went from 163% in 2016 to 80% in 2022, with a rebound to 123% in 2023 (primarily due to a limited pool of companies exhibiting a sharp decrease of revenues in growth assets).