2020 was a memorable year for some less-than-positive reasons, but even in the shadow of the COVID-19 pandemic there were numerous oncology advancements well worth celebrating. In addition to the specific research and clinical developments described below, there was also the recent announcement by the American Cancer Society that cancer death rates have continued to drop year over year. This was particularly true in lung cancer, where the improvement is no doubt driven by recent advances in targeted agents and immunotherapies in that indication. It is immensely validating to see the broad real-world impact of so many efforts towards improving cancer treatment outcomes.

In 2021, we expect further clinical breakthroughs and competitive intensification within both established and emerging spaces. In addition to the regulatory decisions and data releases we explore below, there are also several overarching clinical development trends that were sparked in 2020 and that we expect to continue in 2021.

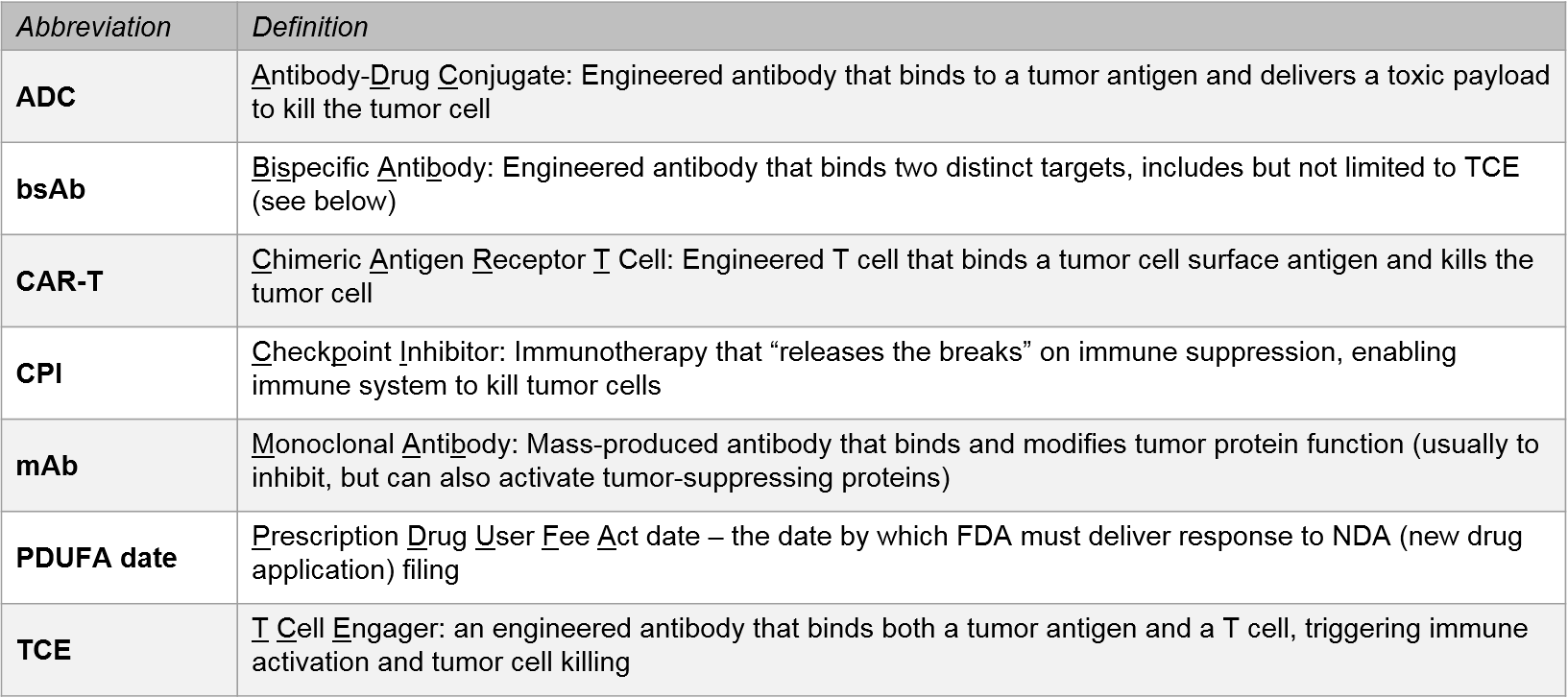

For this discussion, we organize key 2020 updates and anticipated 2021 milestones across 6 major trends:

Across all these categories, we also acknowledge the global impact of the COVID-19 pandemic, which caused clinical trial and regulatory delays. However, it also accelerated trends towards flexible and remote customer engagement, as well as increased decentralization.

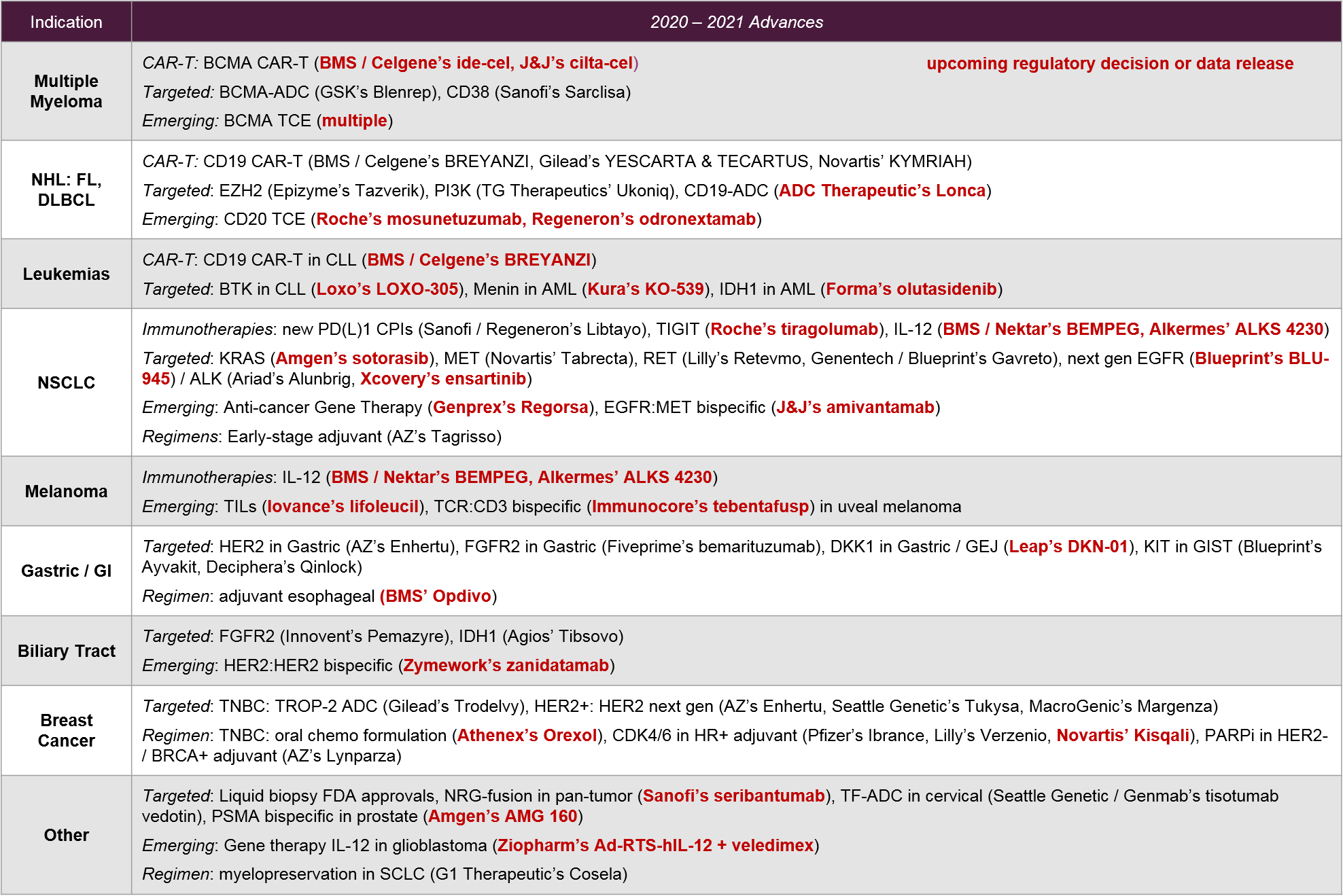

Trend 1: Select indications see continued intense activity

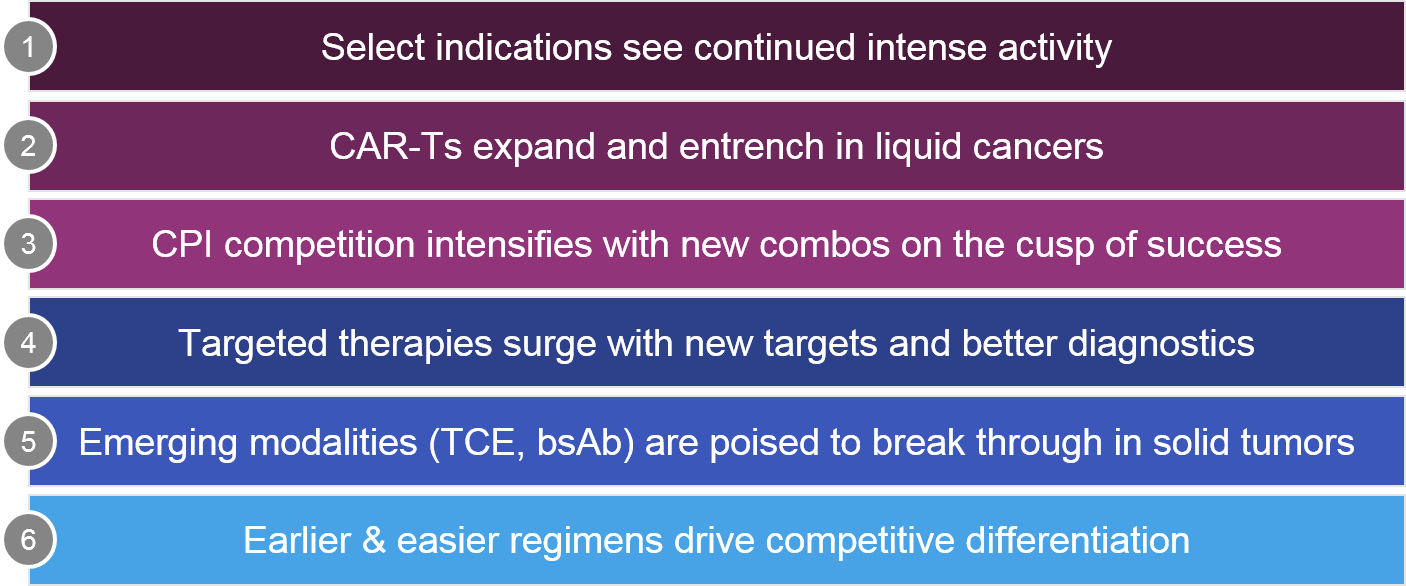

To take a broad look at the overall oncology landscape, we consider activity within key indications as well as the overarching categories described above, which encompass modalities / classes of therapy as well as development approaches (e.g., diagnostic integration, regimen selection).

2021 will be a milestone year for several oncology indications, in particular for multiple myeloma where we expect the market entrance of one or more BCMA CAR-T therapies. This will set the stage for competitive positioning between the BCMA CAR-T, the BCMA-ADC, BCMA mAbs, and the emerging BCMA T Cell Engagers. It remains to be seen how the BCMA therapies will position themselves relative to the established CD38 therapies in multiple myeloma. In the leukemias, we will see additional CD19 competition, not just between CAR-Ts but in the context of emerging targets like Menin, IDH1, EZH2, PI3K, and CD20 T Cell Engagers.

In NSCLC, the recent entrance of therapies for novel targets (e.g., RET, METexon14), along with the anticipated 2021 approval of the first KRAS G12C targeted therapy, offers new hope for previously untreated mutations. These developments also add complexity to this biomarker-driven market.

Aside from targeted therapies, NSCLC will continue to be a competitive arena for established and emerging CPIs, as well as possible new CPI combo entrants (e.g., IL-12, TIGIT). NSCLC also has novel emerging modalities, including bispecifics and gene therapy. Given the breadth and competitive intensity of NSCLC therapies, we also expect increased activity in regimens that maximize market potential, such as earlier lines and stages (e.g., Tagrisso in early stage lung).

Melanoma will be a particularly interesting arena in 2021 for emerging cell therapies and other novel modalities. The first solid tumor cell therapy (Iovance’s lifileucil) may be approved with a March PDUFA date. In addition, we await anticipated data for a TCR:CD3 bispecific antibody (Immunocore’s tebentafusp) as well as multiple IL-12 therapies.

In other solid tumor types like gastric, biliary tract, and breast cancers, we see continued focus on targeted therapies and regimen plays led by both new targets (e.g., KIT, DKK1) and new designs or regimens with established targets (e.g., HER2 bispecifics, CDK4/6, PD1 CPIs in earlier lines).

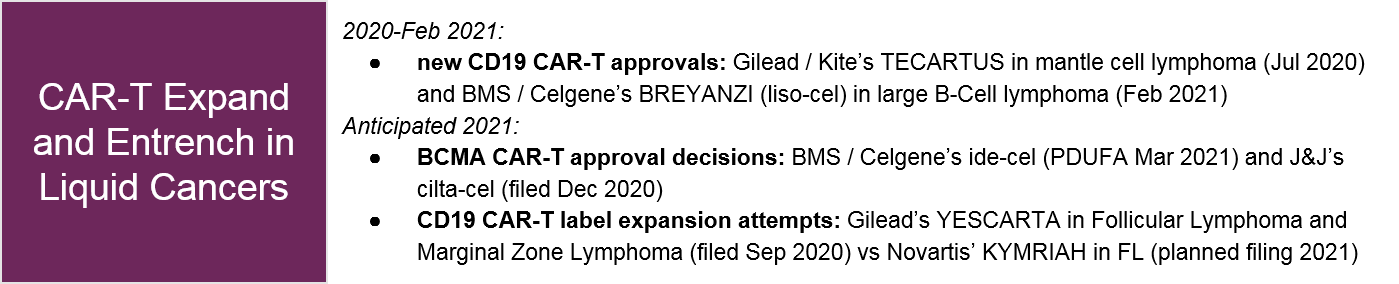

Trend 2: CAR-Ts expand and entrench in liquid cancers

In this section, we focus on CAR-T cell therapies. Other emerging cell-based therapies like TCR-T, TILs, and DC vaccines are discussed below as “Emerging Modalities”.

In 2020, the cell therapy stage was set for major 2021 clinical, regulatory, and commercial action for both the CD19 CAR-Ts as well as the BCMA CAR-Ts, which would be the second CAR-T target ever approved. BMS / Celgene’s CD19 CAR-T, Breyanzi (liso-cel) was finally approved in Feb 2021 after FDA delays postponed its anticipated 2020 approval decision. With a Complete Response (CR) rate of 54% in DLBCL, Breyanzi will likely be competitive with approved CAR-Ts (Novartis’ KYMRIAH and Gilead’s YESCARTA). Meanwhile, in 2021 both KYMRIAH and YESCARTA will be attempting approval in Follicular Lymphoma (FL), another NHL subtype.

Beyond the competitive intensification in the CD19 CAR-T space, we expect the next real breakthrough in CAR-T to be the entry of a novel target, BCMA. Both BMS / Celgene’s ide-cel and J&J’s cilta-cel have already filed for approval, so we anticipate not just a first BCMA CAR-T entry, but direct competition in this space. Most likely, ide-cel will enter first. But, based on recent ASH data, cilta-cel may be able to differentiate on efficacy.

For a deeper dive on recent clinical developments and the 2021 outlook across the entire cell therapy landscape, please refer to our recent publication.

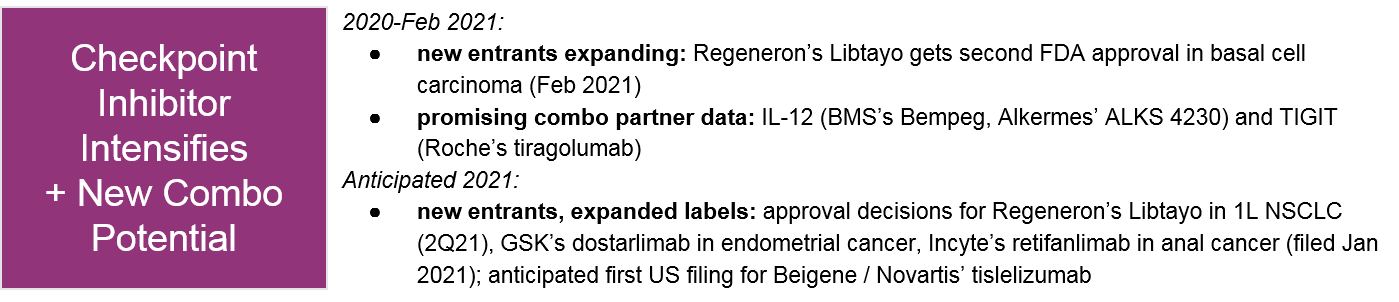

Trend 3: CPI competition intensifies with new combos on the cusp of success

For the immunotherapies, a key question has long been whether any combination therapy could unlock expanded efficacy for the PD1/PDL1 checkpoint inhibitors, other than the well-established CTLA4 therapies. Over the past 5 years or so there have been numerous other immunotherapy targets explored with early hints of efficacy, only to disappoint in later clinical studies, e.g., IDO, OX40. In 2020, we saw evidence for at least two emerging immunotherapy combo partners with potential to be confirmed in 2021, namely IL-12 (BMS / Nektar’s Bempeg, Alkermes’ ALKS 4230) and TIGIT (Roche’s tiragolumab). A validated clinical success here would be the first novel immunotherapy target to break through since PD(L)1.

In parallel, the PD1/PDL1 checkpoint inhibitor competition will continue in NSCLC, with the possible new entrant Sanofi / Regeneron’s Libtayo in 1L NSCLC.

PD1 CPIs are also seeking to break into the market in other indications or geographies, including:

- Libtayo’s recent FDA approval in basal cell carcinoma

- Incyte’s recent FDA filing for retifanlimab in anal cancer

- GSK’s upcoming PDUFA data for dostarlimab in endometrial cancer

- Beigene’s tislelizumab, which has been approved in China in both HL and bladder cancer, and is now in-licensed to Novartis with a first ex-China regulatory filing planned for 2021

2021 will be a critical year for these potential new entrants to achieve a market foothold and position themselves for indication expansion.

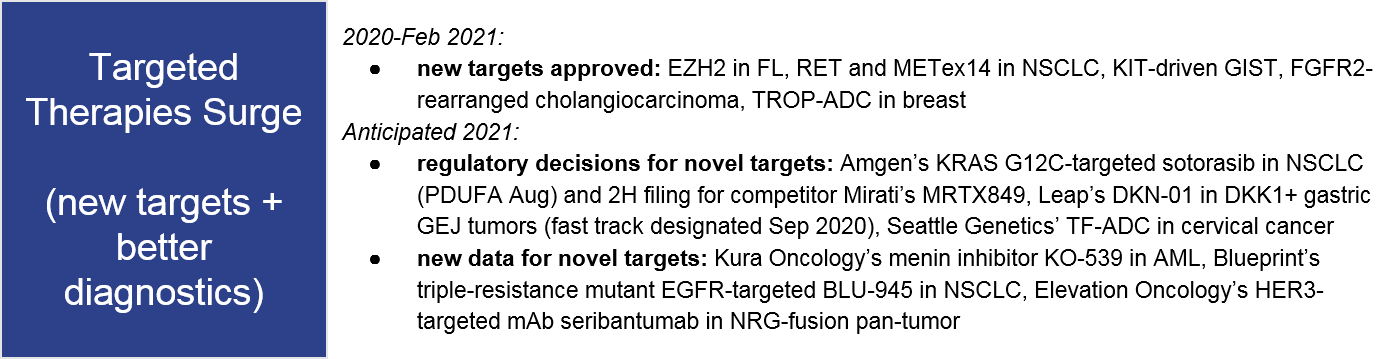

Trend 4: Targeted therapies surge with new targets and better diagnostics

Over the past few years, major advances for checkpoint inhibitors and other immunotherapy approaches have been somewhat limited, with no novel targets since the PD1/PDL1 CPIs and a limited breadth of efficacy for CAR-Ts. However, we have in parallel seen a striking resurgence in targeted therapies. For this discussion, we consider targeted therapies to include small molecule inhibitors as well as antibody-based therapies including monoclonal antibodies (mABs) and antibody-drug conjugates (ADCs). Another antibody-based modality, the bispecific antibodies—which include T Cell Engagers (TCEs)—will be discussed below as Emerging Modalities.

Over the past few years, numerous new targets, indications, and modalities were approved, and 2021 will be no exception. Certain tumor types will be particularly active for targeted therapies, resulting in market fragmentation and potentially some confusion as practice guidelines and individual physicians adapt to these new options. For example, within the last year Follicular Lymphoma (FL) has seen FDA approvals for Epizyme’s EZH2 inhibitor Tazverik (approved July 2020) and TG Therapeutic’s PI3K inhibitor Ukoniq (approved Feb 2021). Keeping in mind the CD19 CAR-T activity in this same space, treatment decision-makers will have to put complex information into context as they consider which treatments to choose and how to sequence.

The target CD19 is another interesting example in DLBCL. While the CD19 CAR-Ts are clearly dominant in this space, we did see a new CD19 targeted therapy approved in 2020 (MorphoSys / Incyte’s Monjuvi). Plus, we will potentially see the first CD19-ADC (ADC’s Lonca) with a May 2021 PDUFA date. Here, we will be able to compare product attributes across different modalities for the same target and indication.

In AML, there are two new targets in play. One is IDH1, where Forma has filed their IDH1-targeted, olutasidenib. If approved, it would compete with Agios’ Tibsovo. The other new target is menin, where we anticipate 2021 data for Kura Oncology’s KO-539 to potentially confirm its early efficacy in AML.

In solid tumors, we expect continued intense targeted therapy activity in NSCLC. In 2020, two novel targets entered the market:

- Lilly’s Retevmo and Genentech / Blueprint’s Gavreto (RET-driven NSCLC)

- Novartis’ Tabrecta (METex14 NSCLC).

In 2021, we expect a much-anticipated regulatory decision for Amgen’s KRAS G12C-targeted sotorasib (PDUFA date in August). We also expect a possible 2H filing for their nearest competitor: Mirati’s MRTX849.

Looking further ahead, we will see whether Blueprint’s triple-mutant EGFR-targeted BLU-945 delivers in the clinic. The drug is designed to target the classic activating L858R or exon19 mutations plus known resistance mutation T790M, as well as the secondary resistance mutation C797S.

In the ALK inhibitor space, we also see new competition with Takeda’s ALK/EGFR-targeted Alunbrig 2020 approval in ALK+ NSCLC, and data releases for Xcovery’s ensartinib. 2021 will therefore be a key year for the new target KRAS, as well as novel resistance targeting for the more established EGFR and ALK spaces.

The gastrointestinal cancer space is another active arena for targeted therapy, with the recent approvals of

- Blueprint’s Ayvakit and Deciphera’s Qinlock in KIT-driven GIST

- AZ / Daichii Sankyo’s HER2-ADC Enhertu in HER2+ gastric and gastro-esophageal junction (GEJ) cancer.

Leap’s DKN-01 in DKK1+ gastric GEJ tumors has a fast-track designation. DKN-01 would be a first-in-target approval. Finally, Five Prime Therapeutic’s FGFR2b-targeted bemarituzumab will have a 1L gastric readout in 2021, with a potential Ph3 trial start.

In biliary tract cancer / cholangiocarcinoma, the 2020 approval of Incyte/Innovent’s Pemazyre in FGFR2-rearranged cholangiocarcinoma was the first targeted approval in this indication. Agios plans to file their IDH1-targeted Tibsovo in IDH1-mutated cholangiocarcinoma in 1Q2021, despite missing their secondary OS endpoint.

In breast cancer, 2020 saw new entries for a novel target (TROP) with Gilead’s TROP-ADC Trodelvy, as well as a new modality for HER2 with Seattle Genetics’ small molecule inhibitor Tukysa. Macrogenics’ HER2 mAb Margenza, while not a novel target or modality, did beat Roche’s Herceptin in a head-to-head trial, so no doubt will become a key competitor.

Another new target is TF. Seattle Genetics filed in February of 2021 for FDA approval of TF-ADC tisotumab vedotin in cervical cancer. If approved it would be first-in-target.

Finally, we see Elevation Oncology’s HER3-targeted mAb seribantumab as one to watch. Despite earlier failures in breast cancer, the drug is showing pan-tumor potential in NRG-fusion solid tumors. In 2021 we expect to see further data confirming whether they might reasonably pursue a pan-tumor label.

Both new and established targets are only expressed in a subset of tumors, so in parallel with these novel therapies and expanding indications we see an increasing need for diagnostics that identify appropriate therapies for each individual tumor. In some tumor types where there is a small set of relatively frequent targetable alterations. For example, in breast or melanoma, a limited diagnostic test is usually sufficient (i.e., ER, PR, HER2 IHC or BRAF V600E and PDL1 IHC, respectively). In other tumor types like NSCLC there are numerous targetable alterations (PDL1, EGFR, ALK, RET, MET, KRAS), so it makes more sense to use a broad panel test that will detect any and all alterations that are present. These broad panel tests can also be used for other indications where alterations are rare, but still targetable if found.

Over the last few years we have seen increasing reimbursement and regulatory approval for broad panel tests, and in 2020 the FDA approved two broad liquid biopsy tests – Guardant’s 360 CDx and FoundationOne’s Liquid Dx. Biopsy sample access was a major limitation of other tests, particularly in the case of recurrences or progressions where an additional biopsy was not considered necessary to confirm disease. Now, with the availability of these blood-based tests, we expect to see increased use of these tests to inform treatment decision-making not just upon initial diagnosis, but throughout the course of disease. In addition, as the overall reimbursement landscape becomes more favorable to panel-based diagnostic tests, we expect additional market uptake of both solid and liquid biopsy-based diagnostics, which in turn will drive use of pan-tumor or expanded application of targeted therapies.

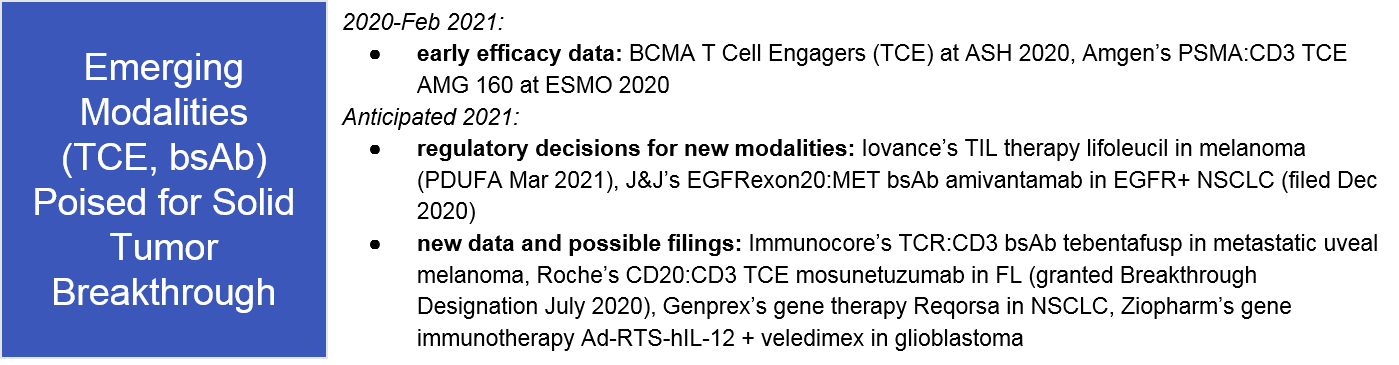

Trend 5: Emerging modalities (TCEs, bsAb) are poised to break through in solid tumors

For this discussion, we define emerging modalities as those which either have no approved therapeutics or only in one target or indication. For example, despite the approval of the CD19:CD3 bispecific T Cell Engager (TCE) blinatumomab in 2014, there have been no subsequent approvals and limited market uptake. So, we consider bispecific antibodies (bsAb) to still be an emerging modality. Other examples of emerging modalities discussed here are non-CAR-T cell therapies (TILs, TCR-T) and gene therapies.

We discuss the 2021 outlook for cell therapies in more depth here, but a key milestone will be the regulatory approval decision for Iovance’s TIL therapy lifileucil in melanoma, which would be the first TILs approval as well as the first solid tumor cell therapy.

The TCE category of bispecific antibodies is certainly the most active emerging modality space for 2021, with additional data and possible filings for Immunocore’s TCR:CD3 bispecific tebentafusp in metastatic uveal melanoma, as well as Roche’s CD20:CD3 TCE mosunetuzumab in FL (granted Breakthrough Designation July 2020). Several BCMA:CD3 TCEs also showed early efficacy at ASH 2020. We will keep an eye on this space in 2021 to see which emerge as potential competitors to the BCMA CAR-Ts. Amgen’s PSMA:CD3 TCE, AMG 160 also showed early positive data in prostate cancer at ESMO 2020.

Another emerging type of bispecific antibody (bsAb) is not intended to recruit T cells but rather to enhance or broaden targeted therapies, e.g., dual targeting. For example, in 2021 we will see an FDA decision for J&J’s EGFRexon20:MET bsAb amivantamab in EGFR+ NSCLC, and a data release for Zymework’s HER2:HER2 zanidatamab in HER2-amplified biliary tract cancer.

Gene therapies, which have been initially established in rare diseases with several launched therapies, is still a very emerging modality in oncology, where we are seeing it used as a method to activate or express anti-tumor genes. For example, Genprex’s gene therapy-based Reqorsa uses a lipid nanoparticle to deliver the growth-inhibiting gene TUSC2 into cancer cells. It is currently in a clinical trial where it is combined with Tarceva in EGFR+ NSCLC. In glioblastoma, there is another promising gene therapy-based approach – Ziopharm’s Ad-RTS-hIL-12 + veledimex, which enables a targeted on-switch for immune booster IL-12 via an adenovirus vector within the tumor.

Finally, in 2021 we will continue watching for cancer vaccine data releases – namely Moderna’s mRNA cancer vaccine mRNA-4157, which showed preliminary promising data in solid tumors.

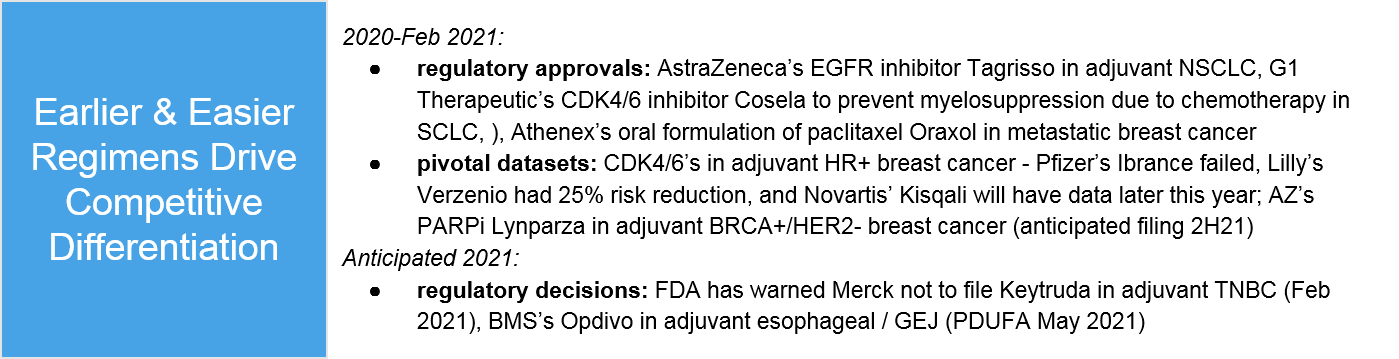

Trend 6: Earlier & easier regimens drive competitive differentiation

Across all these indications and modalities, we see another general theme in approach: differentiation of more established therapies by seeking earlier disease stages or lines of therapies as well as improving administration options. Seeking earlier stages or lines of therapy in order to leapfrog the competition makes a lot of sense for crowded markets, and we see several examples of this in 2020-2021, some successful and some not.

In 2020, AstraZeneca’s next-gen EGFR inhibitor, Tagrisso was FDA approved in the adjuvant setting for early stage EGFR+ NSCLC. In early 2021 AstraZeneca published additional data confirming that Tagrisso provides a benefit both with and without chemotherapy. They are now testing Tagrisso in the neo-adjuvant setting (before surgery), with an estimated data readout and potential filing in 2022.

In 2020, Pfizer’s CDK4/6 inhibitor, Ibrance failed in the adjuvant setting (adding the drug to hormone therapy did not improve disease free survival after surgery for HR+/HER2- breast cancer). However, Lilly’s CDK4/6 inhibitor, Verzenio did deliver in this setting, showing a 25% reduction in risk of recurrence or progression. Novartis has an ongoing trial for their CDK4/6 inhibitor, Kisqali in this setting. That trial is expected to conclude in 2022 but may offer interim data sooner. An open question will be to what extent adjuvant uptake cannibalizes the mBC market.

In 2021, Merck is attempting to launch their checkpoint inhibitor Keytruda in the early stage adjuvant setting for TNBC. However, in February of 2021 the FDA discouraged them from filing, stating that the proposed 15% improvement in complete pathologic response threshold may not be adequate to predict long-term outcomes. The drug also failed the co-primary endpoint of event free survival. It remains to be seen if Merck ultimately withdraws their filing, and if not, what the FDA will decide.

The news for checkpoint inhibitors in the adjuvant setting is more promising for BMS’ Opdivo in esophageal / GEJ cancer, where the FDA has granted priority review based on positive phase 3 data. The decision date is May 20, 2021.

Beyond aiming earlier, some manufacturers are addressing other customer needs. Examples include offering better supportive therapies and dosing options.

In February 2021, the FDA approved G1 Therapeutic’s CDK4/6 inhibitor, Cosela (trilaciclib) for use in SCLC to prevent chemotherapy-induced myelosuppression. G1 is also testing Cosela in colorectal cancer and TNBC and plans to launch a bladder study in 2021, suggesting a potentially broad pan-tumor utility for this type of approach.

Athenex is making a formulation play, with their lead program Oraxol (a combination of oral paclitaxel and encequidar, which enables oral administration) in metastatic breast cancer. An FDA decision is expected in February. If approved, this strategy could open the door for many indications where intravenous chemotherapy could be supplanted by an easier oral dosing.

Conclusions and Longer-term Outlook

Despite the ongoing impact of the COVID-19 pandemic, we expect 2021 will have significant clinical and regulatory activity across oncology. Particular hot-spots of activity will be associated with:

- CAR-Ts in NHL and multiple myeloma

- NSCLC where we see both immunotherapy and targeted therapy activities

- The emerging bispecific antibodies where we expect to see both regulatory approval decisions as well as new data to confirm their potential across various indications

Beyond the specifics of data releases and regulatory decisions, we also expect that COVID-19 and its associated trends (e.g., increased use of telehealth, restrictions on in-person interactions) will continue to impact customer engagement, and that manufacturers will evolve their commercial models to adapt to this new environment. It is also possible we will begin to see some of the longer-term predicted impacts of COVID-19 on R&D, including not just clinical trial delays but pipeline impacts where resources are limited.

Beyond 2021, we hope that the COVID-19 pandemic will be over or at least successfully contained and managed. That would result in a less restrictive environment that should help further accelerate R&D and continue to improve patient outcomes.