This is the first in a series of resources from Blue Matter analyzing the potential impact of Most Favored Nation (MFN) pricing for pharmaceuticals being enacted in the U.S.

What was announced with President Trump’s recent MFN Executive Order and what remains unknown?

The MFN Executive Order1 of May 12, 2025 represents the potential for a fundamental shift in U.S. and global drug commercialization. Over the past week, you’ve probably read numerous articles and opinion pieces about this topic, most containing analyses of the meager available facts and rife with speculation about the impacts it may have.

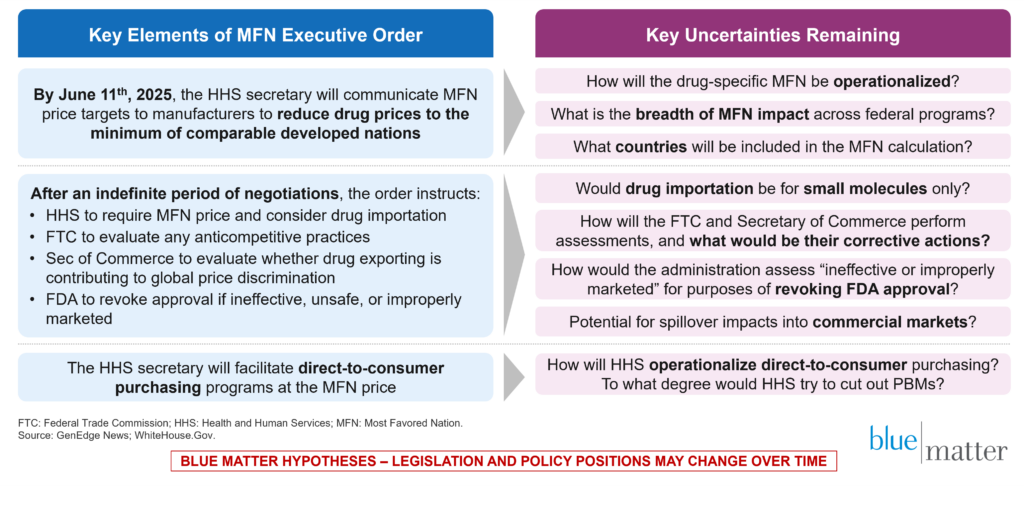

We have created this short article for those who have been left hungry for a somewhat deeper discussion that begins to consider the potential secondary—and often inadvertent—consequences for biopharma companies and other key players in the commercialization pathway (corporate partners, customers, competitors, and others). The first Trump administration attempted to implement MFN pricing related to biopharma, but that attempt ultimately failed in the US court system. Now, we enter the world of “MFN v2.0.” Figure 1 provides a brief summary of the key facts and uncertainties below.

Figure 1: Short-Term MFN Timeline and Related Uncertainties for Forecasting and Market Stability

To further our understanding, it would be helpful to contextualize MFN v2.0. It does not exist in a vacuum and fits within a broader environment of policy activity.

How does MFN fit within the flurry of other recent policy activity?

Over the past few months, the Trump administration has announced several major shifts in policy that are relevant to the pharmaceutical industry. While the MFN Executive Order has generated the most buzz, we must keep a holistic view of impending changes and consider other policy initiatives that are ongoing:

- Pharmaceutical Tariffs: Tariffs are expected be announced following a Section 232 investigation which will likely declare pharmaceuticals to be a matter of national security, thereby enhancing the administration’s authority to act.2

- 340B Reform: Procedural steps have been initiated (drug price survey) to likely reduce the 340B reimbursement rate to ASP – 22.5%.3

- PBM Reform: PBMs are being investigated by several government bodies for their middleman role and have recently been required to disclose fees that they pay brokers to direct employers to utilize their services.3

- Canada Drug Importation: The FDA has been instructed to streamline and improve the process for importing drugs in an effort to lower prices.3

- IRA Adjustments: HHS will partner with Congress to remove the “pill penalty” that small molecules currently experience for years of granted exclusivity.3

Our initial analyses reveal a common thread across all these policy initiatives: each has a precise target and is intended to be used like a scalpel to cause specific effects in a particular area. In contrast, we view the MFN order as a different policy initiative archetype, one that seems more like a sledgehammer, with the potential to cause fundamental disruption in the US healthcare system. The sledgehammer analogy is applicable for two main reasons:

- Acts with Force: In addition to noting that MFN prices will be imposed on drugmakers, those who do not comply with negotiations have been threatened with investigations from the FTC and the Secretary of Commerce, as well as the potential pull-back of FDA approvals.

- Creates an Uncertain Outcome: Predicting outcomes with absolute certainty is not feasible given the likelihood of legal challenges, potential voluntary participation in negotiations, and the potential rise of direct-to-consumer purchasing (i.e., bypassing PBMs).

Now that we’ve aligned on what MFN v2.0 is intended to do and how, let’s pivot. For leaders in biopharma companies, what are the burning questions that might be swirling in their minds?

What are the burning questions for biopharma leaders?

Throughout this past week, Blue Matter leaders have been speaking with biopharma executives across functional and therapeutic areas, discussing numerous aspects of their imminent launches and investments in the ongoing development of their innovations.

Of course, not every biopharma company—or leader—is in the same situation. Companies are at different stages of maturity and they face a range of different circumstances. The questions facing a biopharma leader will vary somewhat based on those factors. In a short article, we certainly can’t cover all potential situations, but we can zero in on a few.

If you are a biopharma decision maker, then perhaps one of the situations below is similar to your own:

Have you just completed a U.S. launch and are deep in the middle of your ex-U.S. launch?

For a company that has launched a key asset in the US and is now engaged in an ex-US launch, some key questions might be:

- With our US launch already completed, how does this change or impact our global pricing strategy, if at all?

- Given the new implications of European prices on the U.S. market post-MFN v2.0, what is the “new optimal” global pricing strategy? What is the resulting impact on the decision to launch in select markets? What is the impact on patient access and ultimately the overall commercial potential for our novel therapy?

- Is there any impact on our global launch sequence that was developed pre-MFN 2.0?

- Should we “wait and see” and delay our ex-U.S. launch until more details are available? How should we model the impact of delays on our forecast vs launching as planned and dealing with the “costs” of navigating any resulting impact on the U.S. business?

Do you have on-market products in all global markets?

If so, you might ask:

- How voluntary is participation in MFN negotiations? What are the implications of choosing to negotiate for the business, for patient access, and for our customers?

- What are the implications of forced participation in MFN? Would the expected pricing outcomes be similar or worse than voluntary participation? What would be the impact on our business, on patient access, and on our customers?

Are you considering a deal (e.g., M&A, in- or out-licensing an asset) or seeking to determine the optimal go-to-market strategy?

In the situation above, some key questions might be:

- How does the MFN v2.0 uncertainty impact asset value? How should we approach scenario planning around pricing assumptions? How will risks around pricing affect the revenue opportunity and final valuation?

- How can the buy-side limit risk on any near-term deals? How should current evaluations and strategies shift to account for the elevated risk of making a large investment?

- What is the optimal time to pursue a deal on the sell-side? Will return be maximized in the near-term or after the market has further clarity?

- On the sell-side, does MFN v2.0 change our perspective on our go-to-market strategy? Should we build specific internal capabilities, outsource, or partner to de-risk the launch?

Looking Forward

If you’re a commercial or market access leader who is seeking MFN analysis, please follow our LinkedIn page for updates and for additional resources in this series. In addition, don’t hesitate to contact us if you’d like to schedule a call to discuss how these changes may impact your company and portfolio specifically. Our team will continue to monitor the MFN situation (and the broader policy landscape) to provide insights regarding the potential implications for our clients.

References

- May 12 Executive Order: Delivering Most Favored Nation Prescription Drug Pricing to American Patients

- The Times May 6th: “Trump to Announce Pharmaceutical Tariffs ‘In Next Two Weeks’”

- April 15 Executive Order: Lowering Drug Prices by Once Again Putting Americans First

Editor’s Note: In an earlier version of this article, Figure 1 referred to a 180-day period of negotiations following HHS’ communication of target prices to biopharma manufacturers during which they would need to make significant progress toward MFN pricing. The final executive order did not specify a 180-day period, so Figure 1 has been updated to reflect an indefinite period.