Introduction

The Market Access environment in Europe is continually evolving and remains a perpetual challenge for manufacturers as payers look to obtain the best value, especially when it comes to high cost and high impact technologies.

To capture the latest HTA outcomes, policy changes, and interesting insights, the Blue Matter EU Access team will be providing a monthly review with key implications for manufacturers seeking pricing and reimbursement within Europe.

EU HTA in July

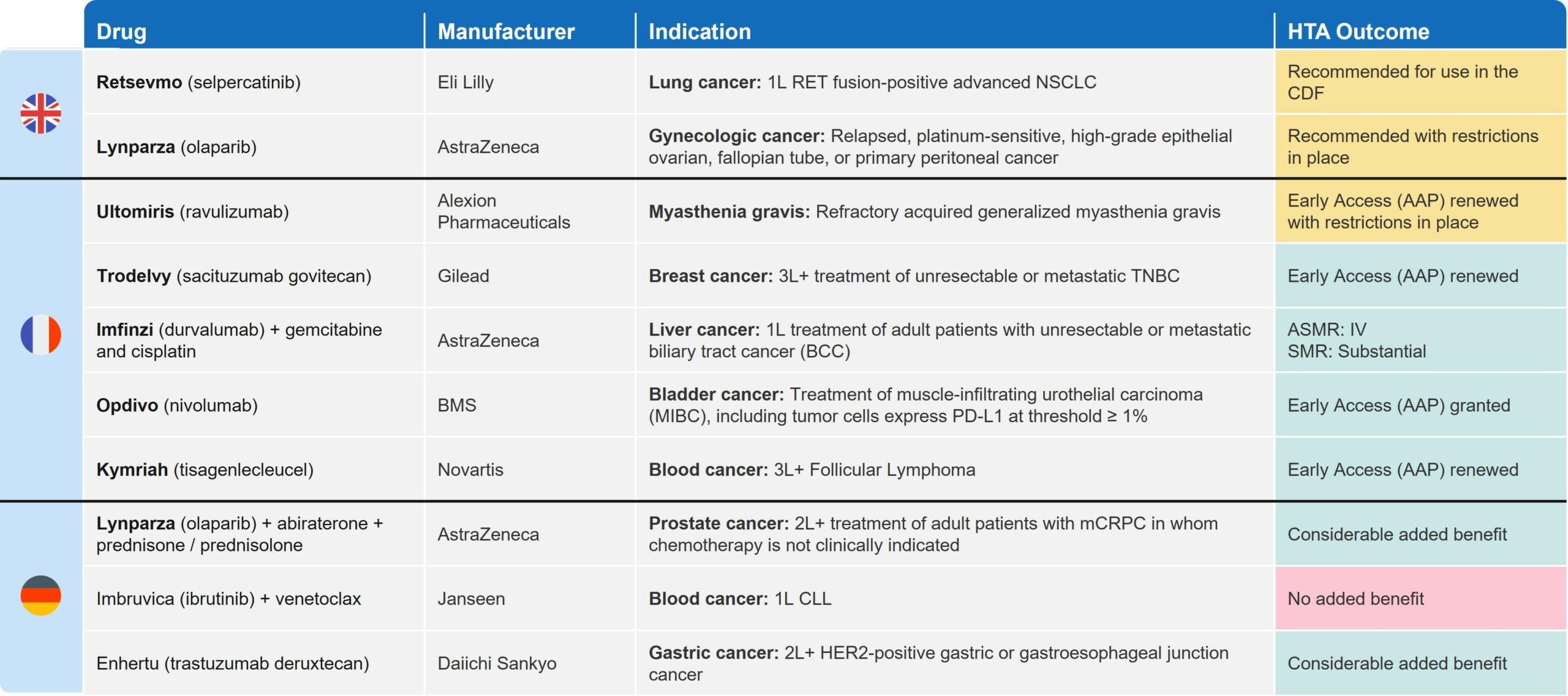

July was a busy month in Europe, with 27 pricing and reimbursement (P&R) decisions made in the UK (5), France (14), and Germany (8). Many of these decisions were related to oncology (Table 1) and offer insights for biopharma companies approaching asset commercialization.

In this installment, we primarily focus on the case of Eli Lily’s Retsevmo™ (selpercatinib) (Retevmo™ in the US) for non-small cell lung cancer (NSCLC). Recent decisions related to Retsevmo offer some insights into the UK’s Cancer Drugs Fund (CDF) and its potential viability as a pathway into the UK market.

Table 1: Key Oncology and HTA Decisions in UK, FR and DE in July 2023

Access Challenges in Oncology

Oncology continues to be an area of great innovation with a high number of new drug launches and indication expansions. However, securing wide patient access for therapies—ideally to the fullest extent their regulatory labels allow—has become increasingly challenging due to evermore stringent payer requirements coupled with constrained healthcare budgets.

NSCLC is one of the largest global markets within oncology, with high unmet need particularly in the metastatic setting. This has led to significant development investment and a very competitive landscape. To differentiate novel therapies and demonstrate the most value to payers, manufacturers have focused on developing personalised therapies defined, where possible, by unique biomarker status.

Retsevmo’s NICE appraisal illustrates how payers often mitigate uncertainty around the clinical and economic evidence while providing access to patients through the CDF. Below, we offer our perspective on what it tells us about the CDF and considerations for new therapies entering NSCLC in the UK market.

[TA911] NICE Recommends Retsevmo for use in 1L RET fusion-positive NSCLC within the CDF1

Retsevmo was recommended by NICE, in line with its EMA label, as an option for adult patients with untreated (1L) RET fusion-positive advanced NSCLC, though only through the CDF. Retsevmo is now the only treatment recommended by NICE for this patient population since Garveto (pralsetinib) was rejected in 2022 [TA812]2.

Retsevmo is currently also available for use via the CDF (since 2022) for 2L+ RET fusion-positive NSCLC patients who have already been on an immunotherapy, a platinum-based therapy, or both. Similar to 2L+, Retsevmo’s entry into the CDF for its indication expansion into 1L RET fusion-positive NSCLC is dependent on a managed access agreement (MAA). The MAA includes additional data collection requirements and a commercial arrangement with NHS England, which typically takes the form of an additional confidential discount.

NICE recognised the potential clinical benefit of Retsevmo demonstrated in the clinical study (LIBRETTO-001: open-label Phase 1/2 study). However, the high clinical and cost-effectiveness uncertainty meant that NICE could not recommend it for routine commissioning. The Committee highlighted the key drivers of clinical and economic uncertainty as being associated with the

- Short trial follow-up duration

- Absence of direct comparison against the standard of care (SOC: pemetrexed + carboplatin [NG122] and pembrolizumab + pemetrexed platinum chemotherapy [TA683], aligned with pralsetinib assessment)

An indirect treatment comparison (ITC) using a network meta-analysis (NMA) was conducted to support the objective response rate (ORR: 63.8%) and median progression-free survival (mPFS: 16.5mos) benefit for Retsevmo, but the Evidence Review Group (ERG) noted the trials used in the ITC were unlikely to contain an adequate number of patients with RET fusion-positive NSCLC due to the rare nature of the mutation. The ERG also stated that in general the data were immature and the short follow-up times impact the strength of any conclusions regarding a survival benefit.

Uncertainty on clinical, and importantly, survival benefit due to data immaturity also affected the cost-effectiveness range. Even considering the condition’s severity and impact on quality and length of life, the wide range of possible ICERs (company provided and ERG estimates) proved unfavourable. The base case ICER presented by the company was £55,119 per QALY gained vs. docetaxel and £48,800 per QALY gained for docetaxel + nintedanib. The ERG, however, questioned these estimates and provided ICER estimates of over £70,000 per QALY gained.

Interestingly, NICE’s recommendation for Retsevmo in 2L+ NSCLC (within the CDF) was for the same reason that impacted 1L; high uncertainty due to insufficient trial duration and lack of direct comparison vs. SOC3. Retsevmo in 2L+ NSCLC is due for re-appraisal in 2024.

Across France and Germany, the opinions followed a similar trend. In France, Retsevmo received an unfavourable opinion in 1L NSCLC (SMR: insufficient) and is currently reimbursed in 2L+ only (ASMR V; SMR: low). The negative reimbursement decision by HAS in 1L was due to inadequate trial design, including immature data, lack of comparative data vs. SOC and inappropriateness of primary endpoint selection (ORR)4. In Germany, the G-BA split the eligible 1L patient population for Retsevmo by PD-L1 expression (≥ 50% or <50%, given routine use of PD-1/PD-L1 inhibitors). However, no additional benefit was proven in either of the two sub-populations due to lack of “assessable” data vs. the appropriate comparative therapies (ACT)5.

Retsevmo’s efforts to expand into 1L NSCLC is one of the numerous examples in oncology of how innovative therapies initially launch in later-line indications to establish patient and physician familiarity, and quickly move earlier in the treatment paradigm. Penetrating into highly competitive markets, such as 1L metastatic NSCLC, can be quite challenging. This has led manufacturers to carve out niche- and biomarker-defined patient populations, and then demonstrate robust efficacy data within them.

However, as we can see with Retsevmo, even positive evidence in a strictly defined population may not be sufficient to secure reimbursement across all markets. Nevertheless, the CDF is a positive mechanism that facilitates earlier access to the UK market. It supports physician familiarity and data collection, and makes the UK an attractive market for therapies with a certain degree of uncertainty.

Manufacturer Considerations for the CDF

The CDF represents an opportunity for many of the recently authorised innovative treatments in oncology, especially those with conditional approvals based on immature data. By ensuring patient access to new therapies and reducing uncertainties over time, the CDF is beneficial not only for the healthcare system, but also for manufacturers to access funding while additional data is collected to resolve UK-specific uncertainties raised by NICE. We have outlined below some key considerations for manufacturer’s looking to explore the CDF route.

First, products need to meet several criteria to be considered eligible for inclusion on the CDF. In addition to offering a confidential discount to meet NICE’s cost-effectiveness threshold, innovative therapies need to have:

- A clearly defined patient population

- A robust cost-effectiveness model

- Plausible potential to be cost-effective

- Potential to reduce uncertainty through ongoing studies

A managed access agreement through the CDF has two key components:

- Data collection agreement

- Commercial access agreement

Manufacturers drive the engagement and work closely with NICE and other stakeholders to align on how uncertainties will be addressed: via ongoing confirmatory trials, additional evidence generation protocols, or UK-specific utilisation data. When collecting additional data, the agreement clearly outlines the approach, roles and responsibilities of all stakeholders, patient population eligible for treatment, types of clinical assessments and types of data to be collected in the analyses. The data collection period should be as short as possible and must not exceed five years, with the majority of products spending in the fund prior to re-assessment. The commercial access agreement lays out the commercial terms on which the NHS will fund the therapy while in the CDF, including the level of discount to list price6.

However, manufacturers should only apply to the CDF if there is strong enough confidence of a positive eventual outcome. Upon completion of the data collection period, products undergo an accelerated re-assessment. If the therapy is not recommended, the manufacturer will be required to absorb the cost of therapy for patients who are still on treatment over the remaining duration of the therapy course. In addition, once the annual budget for the CDF is exceeded, manufacturers are obliged to pay back a proportional rebate based on the funding amount they have received through the CDF.

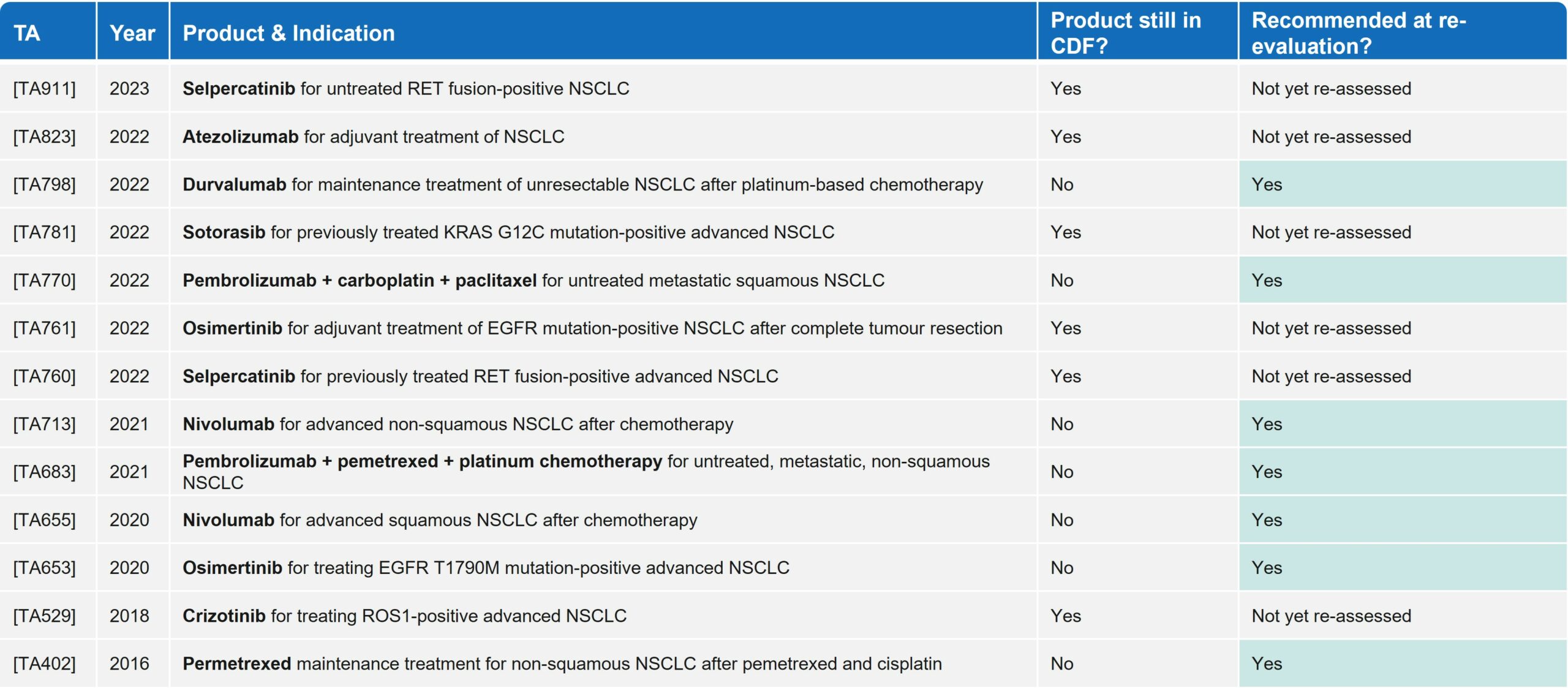

Since 2016, in the NSCLC space alone, there have been 13 technology appraisals (TAs) by NICE that led to entry in the CDF, including blockbuster PD-(L)1s such as Keytruda (pembrolizumab) and Opdivo (nivolumab). All seven products that have been re-appraised have achieved routine commissioning, showing the clear benefit of the CDF in granting early access to innovative therapies where they may have been rejected by NICE without this mechanism. Of note, within NSCLC there have been no negative HTA outcomes for drugs re-assessed by NICE post-CDF (Table 2).

Table 2: Reimbursement outcomes for products in NSCLC that have entered the CDF since 2016

Conclusion

As seen with Retsevmo’s expansion in 1L in the largest European markets (FR, DE, UK), the drug achieved the most favourable outcome in the UK thanks to the temporary reimbursement via the CDF. Moreover, there have been no examples in NSCLC of a negative NICE decision post-CDF, which illustrates the potential benefits of this route to access in the UK in this crowded, but high unmet need area. For Retsevmo, it is well-positioned to become the first-in-class, SOC for 1L RET fusion-positive NSCLC.

There is no doubt that the CDF offers both opportunities and risks. Overall, it allows manufacturers to gain physician and patient use—and be reimbursed—while generating the evidence needed to mitigate uncertaintly around clinical and cost-effectiveness.

Looking beyond oncology, the Innovative Medicines Fund (IMF)7 was started just over 12 months ago (June 2022) to offer a similar mechanism to non-oncology drugs. As yet, no drugs have been listed with the IMF, but this will be an interesting space to watch.

References:

- NICE (2023). Selpercatinib for untreated RET fusion-positive advanced non-small-cell lung cancer [TA911] https://www.nice.org.uk/guidance/TA911

- NICE (2022). Pralsetinib for treating RET fusion-positive advanced non-small cell lung cancer [TA812] https://www.nice.org.uk/guidance/ta812

- NICE (2022). Selpercatinib for previously treated RET fusion-positive advanced non-small-cell lung cancer [TA760] https://www.nice.org.uk/guidance/ta760/

- Haute Autorité de Santé (2023). Retsevmo (selpercatinib) – Non-small cell lung cancer (NSCLC). https://www.has-sante.fr/upload/docs/application/pdf/2023-07/retsevmo_01022023_summary_ct19920_en.pdf

- Federal Joint Committee (G-BA, 2022). Selpercatinib Resolution Document. (New therapeutic indication: first-line RET fusion-positive non-small cell lung cancer) https://www.g-ba.de/downloads/91-1455-846/2022-12-15_Resolution_Selpercatinib_D-832_EN.pdf

- NICE (2023). Managed Access. https://www.nice.org.uk/about/what-we-do/our-programmes/managed-access

- Innovative Medicines Fund. https://www.england.nhs.uk/medicines-2/innovative-medicines-fund/