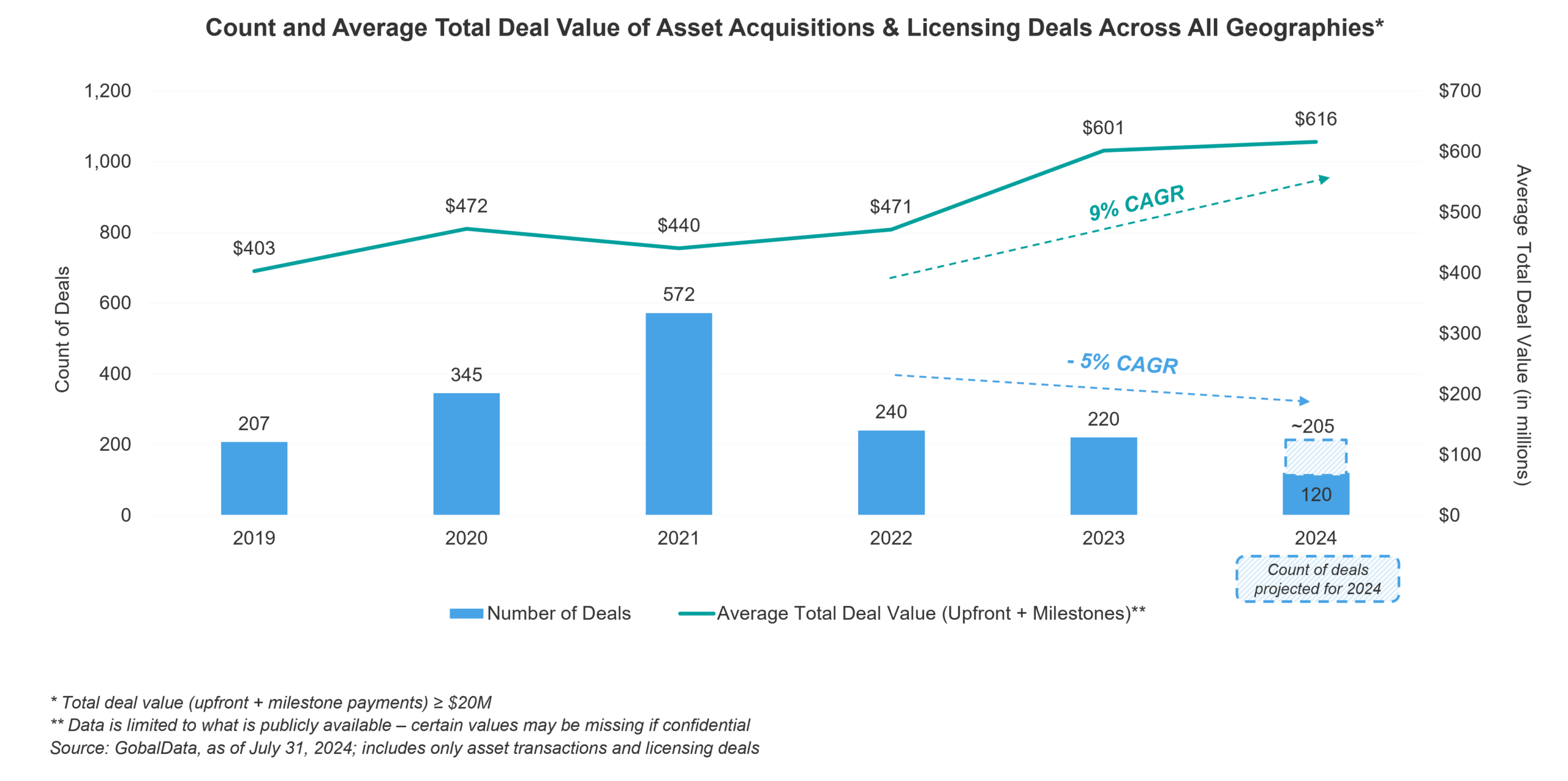

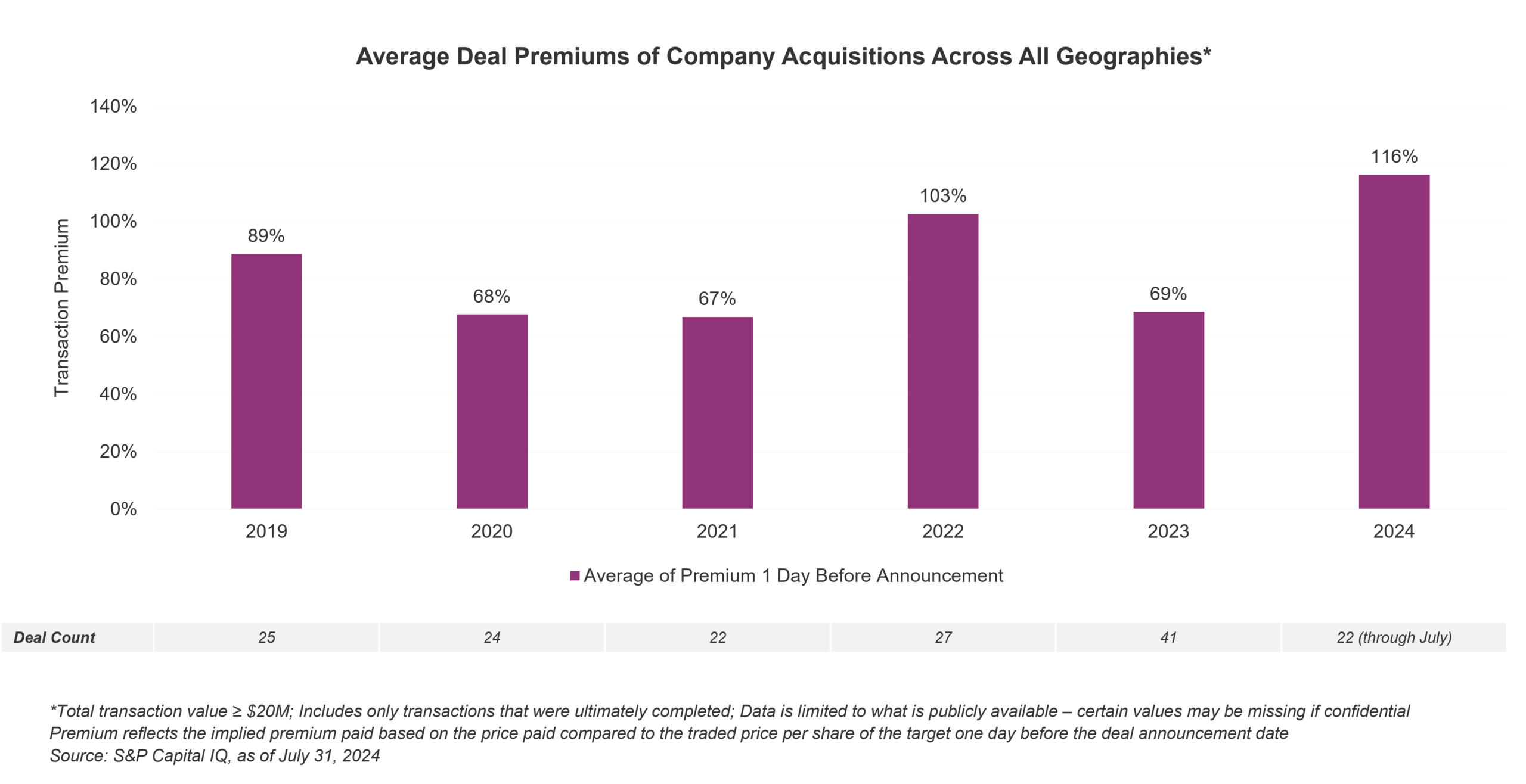

Activity in business development and licensing continues to heat up, as many asset buyers are flush with cash and increasingly motivated to drive growth inorganically. The decreasing total number of asset acquisition and licensing deals alongside increasing average total value across the globe provides ongoing evidence of this. Figure 1 provides a quick look at the total number of asset-level deals and the average value of those deals over the last 5+ years, highlighting that the average total deal value has been increasing recently. From a company acquisition perspective, Figure 2 illustrates that average deal premiums for pharma/biotech deals have been very attractive, ranging from 70% to 100%+ over the past five years with 2024 YTD average deal premiums of ~110%.

Fig.1

Fig.2

In addition, asset buyers are becoming increasingly specific regarding the assets they’re seeking, such as de-risked assets and innovative therapies and delivery platforms. In such a busy, competitive, and increasingly high-stakes environment, companies must be extremely adept at evaluating assets for potential acquisition, thereby supporting well-informed decision-making.

However, in fast-paced and competitive environments, resource constraints and aggressive deal timelines can often result in important factors receiving less attention than they deserve during asset evaluation. This may undermine a potential acquirer’s understanding of both an asset’s potential value and what it will take to unlock that value. To minimize risks and provide the firmest possible foundation for success, a biopharma company must use a clear, repeatable framework for asset evaluation that “covers all the bases” and provides a well-rounded, holistic view of the asset in question.

In this article, we describe such a framework. Our hope is that decision makers who are seeking to bolster their pipelines through inorganic growth with promising new therapies will find it useful to their own asset evaluation efforts.

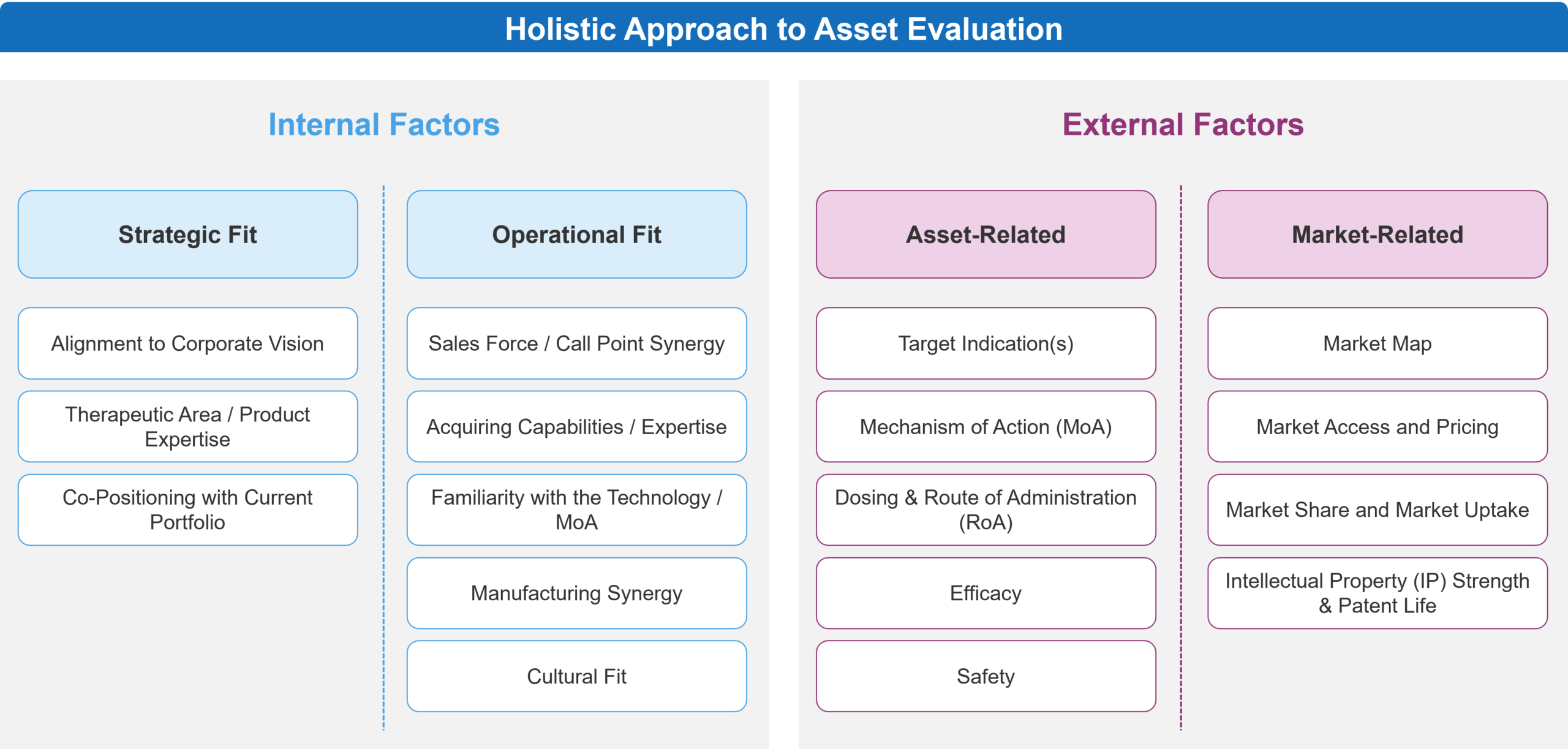

Internal and External Factors

A good holistic evaluation framework must consider a range of factors regarding any given asset. Two of those factors can be considered “internal” to the company: Strategic Fit considers how well an asset fits with the company’s own strategic objectives while Operational Fit considers the degree to which it’s compatible with the company’s operational capabilities. This can become very important with complex cell and gene therapy assets, some rare-disease therapies that require a high degree of patient and/or caregiver support, and assets with complex manufacturing or supply chain requirements.

The “external” factors relate to the science surrounding the asset, as well as a range of market-related factors that can significantly impact its value.

Fig.3

Let’s take a deeper dive into some of the details.

Internal Factors

Strategic Fit

Before diving into a comprehensive assessment of a potential new therapeutic asset, decision-makers should first ensure that it will be a good strategic fit for the company. The company should have articulated a clear strategic vision that guides its efforts, enabling it to build focused expertise and establish a meaningful and differentiated position in its chosen space(s).

A company can choose to focus its corporate vision on a particular disease area or set of related areas, specific patient population(s), a core market segment or related segments, a particular technology, etc. However the company defines its focus, that definition should help it meaningfully build a competitive advantage. No company can be “all things to all people.”

As decision-makers evaluate an asset’s strategic fit, they should determine the degree to which it aligns with the corporate vision and whether it is complementary to the existing portfolio. For example:

- Could the asset drive the strategy to be a leader in a particular disease area?

- Could the asset be co-positioned with other portfolio assets in different lines of therapy within a similar indication?

- Does the asset compete with other therapies in the portfolio, which would likely be a negative? Or does it enable the company to reach more patients within its therapeutic area(s) of focus, perhaps via a different indication?

- Would the asset leverage some sort of expertise or familiarity that the company already has? This could involve, for example, a similar mechanism of action (MoA) to current assets or it could involve a novel MoA in a familiar disease area that could help position the company on the cutting edge.

Operational Fit

When a company and an asset are highly compatible from an operational standpoint, the company should be much better positioned to realize optimum value from the asset. Conversely, a poor operational fit will most likely hamper the company’s ability to generate value while driving up costs and slowing down the commercialization process.

There are several elements to consider when it comes to operational fit, outlined in the table below.

| Sales Force/Call Point Synergy | If a potential new asset is a good fit for the company’s current sales force and target prescriber base, then it will be easier to realize value from it. Otherwise, the company would face additional costs to engage with new and potentially unfamiliar target segment(s), acquire additional field force resources, and get “up to speed” in a new market space. |

| Acquiring Capabilities/Expertise | Decision makers must consider the long-term impact of the capabilities that are being acquired, particularly when evaluating a corporate acquisition. If the new capabilities, such as R&D expertise that provide synergies that can be leveraged across an entire portfolio of assets, then the long-term impact can be very positive, significantly boosting value for the whole enterprise. |

| Familiarity with the Technology/MoA | If the acquiring company is already familiar with the potential new therapy’s technology or MoA, then it will be in a much better position to evaluate it from a technical standpoint. In addition, once it acquires the asset, the company should be able to more efficiently complete development and realize commercial value from it. |

| Manufacturing Synergy | A potential new asset should fit nicely into the company’s current manufacturing capabilities, avoiding the need to develop and master new processes or manufacturing infrastructure that will cost time and resources. Ideally, a new asset will offer manufacturing synergies with other products in the portfolio, helping the company with manufacturing efficiency, productivity, and economies of scale. |

| Cultural Fit | This can become very important when evaluating a corporate acquisition. A good cultural fit is essential if a company intends to absorb an acquisition, realize efficiencies, and retain valuable team members. |

External Factors

Asset-Related

Asset-related factors deal with the potential therapy itself. Collectively, they determine whether the asset has the attributes that it needs to deliver value in the market.

There are several elements to consider when it comes to the asset, outlined in the table below.

| Target Indication(s) | To accurately assess the potential of an asset, decision makers must have a detailed understanding of what the most realistic indication(s) might look like. This may be informed by the following:

|

| Mechanism of Action (MoA) | In many cases, the mechanism of action may drive healthcare decision maker perception of the therapy. While evaluating the asset, you should ask yourself:

|

| Dosing & Route of Administration (RoA) | Without diving too far into market-related considerations, asset-related evaluation should incorporate the feasibility of the dosing regimen and RoA for patients and doctors. Convenience and site-of-care considerations may very well be the key driver or barrier for an asset at the end of the day. |

| Efficacy | In most cases, the efficacy and safety profile of an asset are the most critical of asset-related considerations. Strong asset evaluation necessitates understanding of:

|

| Safety |

|

Armed with a baseline understanding of the asset itself, decision-makers can then begin assessing the market environment. The goal then becomes to determine how the therapy would best fit within the market, what that’s likely to mean for its overall value, and how quickly the company could realize that value.

Market-Related

Market-related factors deal with the size of the patient population, the prescriber base, the therapeutic alternatives available, unmet need(s), and more. Collectively, these factors help determine the size of the market and nature of the market opportunity for the asset. Decision makers will need a thorough understanding of all those factors to accurately determine an asset’s potential value. The table below provides a useful framework for building this understanding.

| Market Map | A well-constructed market map addresses a range of components that directly relate to a market’s overall size and the things that could affect it moving forward. These include:

|

| Market Access and Pricing | Market access is a critical area, as payer perspectives can have a major impact on asset value. Key areas of analysis include:

|

| Market Share and Uptake | Given a certain estimated market size, key trends, and market access dynamics, decision makers must estimate what share of that market the asset could be expected to capture. They must also understand how long it will take to capture that share and reach peak revenues. This requires a solid assessment of:

|

| Intellectual Property (IP) Strength & Patent Life | Consideration of a “patent cliff” is becoming more complex and less certain, given the complexity of biologics today. The acquiring company should make sure that it understands the asset’s IP situation and considers a proactive approach to life cycle management and IP protection. |

Why This Matters

A thorough assessment of the internal and external factors can really help decision makers understand the value drivers, risks, and value proposition associated with the asset. Further, such a holistic assessment of the asset can then better inform the key assumptions used to develop a robust revenue and expense forecast and valuation of the asset, better inform on the go / no-go decision on the deal, drive the deal pricing and structuring strategy, and increase the likelihood of executing a value-enhancing deal.