Introduction

GLP-1 agonists have long been used in Type 2 Diabetes Mellitus (T2DM) and obesity, with decades of clinical data and real world experience demonstrating significant benefits, including reductions in HbA1c levels, body weight, and cardiovascular risk markers. So, why in 2023 were these products in such high demand that stock-outs occurred, and some pharmacies even resorted to unauthorized compounding?

Of course, a growing base of clinical evidence and positive treatment experiences have led to increased uptake over time, but perhaps more significantly, these products have become culturally relevant. GLP-1 agonists and other incretin mimetics have been generating a consistent flow of headlines in traditional media, occupying an increasing share of voice in social media, and spreading through word of mouth like wildfire across certain affluent social circles.

This situation feels different from other drug classes because it is: diabetes and obesity are massive markets, and beyond the FDA approved indicated populations, there’s a swath of people interested in getting their hands on GLP-1 agonists off-label to help them lose a few extra pounds. For diabetic patients this creates challenges, as individuals who really benefit from these therapies are having a tough time obtaining the treatment they need. For manufacturers, this presents a dilemma. On one hand, their core customers are having a suboptimal experience accessing medication. On the other hand, product uptake is through the roof. Novo Nordisk’s Ozempic brought in ~$1.7B in 2019 sales; fast forward to 2022 and that number quintupled to ~$8.5B.

Incretin mimetics have established a massive market in diabetes and obesity, and have yet to reach their peak potential in these therapeutic areas. Additionally, incretin mimetics hold potential promise in many other indications (e.g., non-alcoholic steatohepatitis [NASH], short bowel syndrome) that are currently being studied or are yet to be clinically explored. Moving forward, manufacturers are faced with a choice regarding where to invest: should they aim to capture share in established indications or pursue novel disease areas? Companies who get this right have an opportunity to realize the benefits of what may become the largest market the biopharmaceutical industry has ever seen, with analysts projecting class sales to be in the $70-100 billion range by 2030. However, there are many hurdles along the road to success, and a complex set of interdependent factors will determine who will win across existing and new indications.

To understand how this evolving market might play out, this paper will address the following questions:

- What is the current state of the incretin mimetic market in diabetes and obesity, and how did we get here?

- What remaining unmet needs exist for incretin mimetics across diabetes and obesity, what strategies are being employed to address these needs, and what factors determine who will win?

- What other potential therapeutic areas could GLP-1s address, where is the white space, and how should companies evaluate where to play?

Overview of the Current Incretin Mimetic Landscape

Brief History

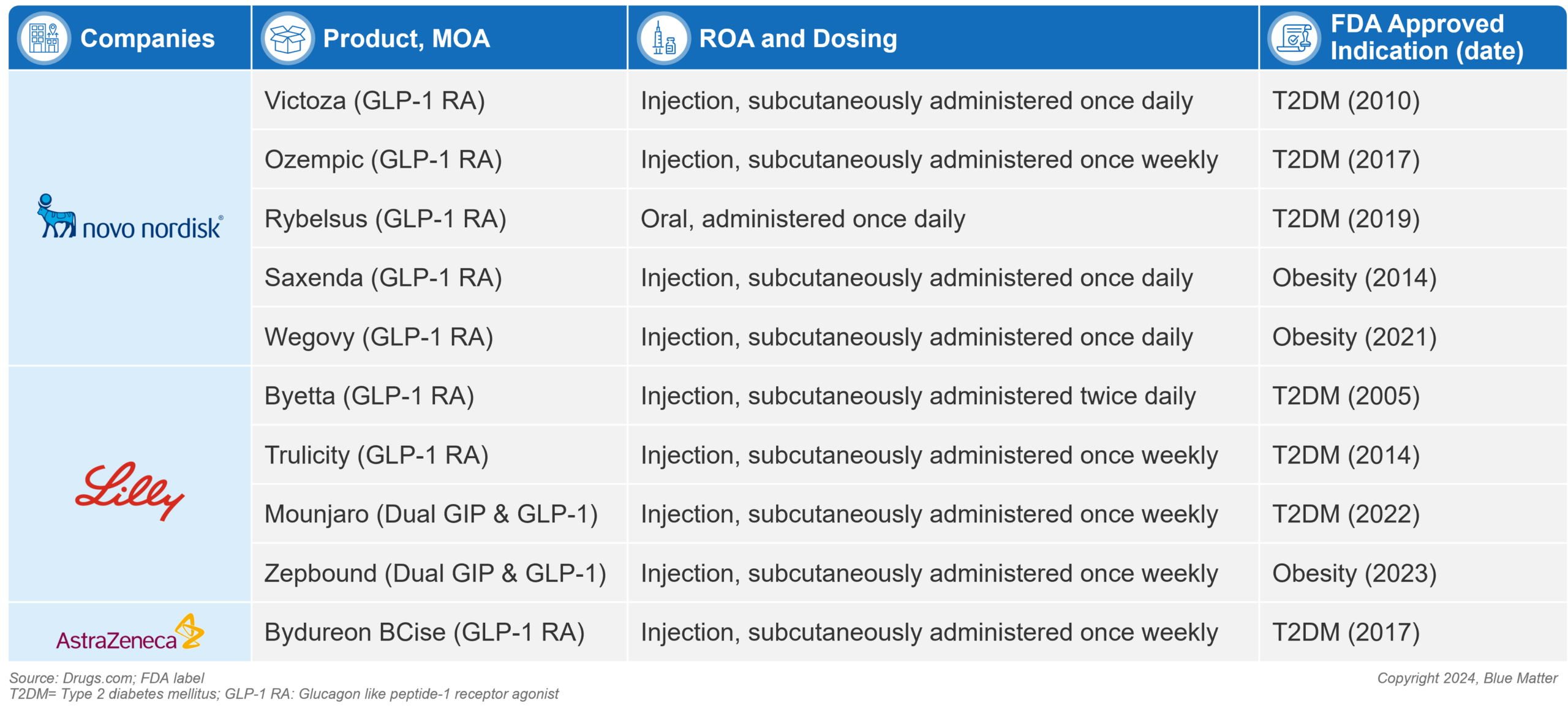

The first GLP-1 agonists were famously inspired by the venom of the Gila monster (a desert dwelling lizard). Scientists developed synthetic versions of a hormone found in the lizard’s saliva as a novel approach to regulating blood sugar in type 2 diabetic patients. The resulting 1st generation GLP-1 agonists were introduced with the approval of Amylin’s Byetta (exenatide) in 2005 and Novo’s Victoza (liraglutide) in 2010 in adults with type 2 diabetes. The weight loss promoting effects of GLP-1 agonists led to clinical development expanding beyond diabetes into obesity. In 2014, Novo’s Saxenda (liraglutide) became the first GLP-1 agonist approved for obesity. This first wave of GLP-1s were commercially successful (Victoza saw peak sales of ~$3.8B in 2018), but results were modest relative to today’s market.

A wave of 2nd generation GLP-1 agonists came to market between 2014-2021, improving clinical outcomes and providing more convenient dosing and administration options. This pack is headlined by several type 2 diabetes treatments: Novo’s Ozempic (semaglutide injection) and Rybelsus (semaglutide oral), and Lilly’s Trulicity (dulaglutide injection). Ozempic has matured into the diabetes market leader in this class, with Trulicity close behind – 2022 Ozempic sales were $8.5B vs. $7.4B for Trulicity. In obesity, Novo’s Wegovy (semaglutide injection) was approved in 2021, however uptake has been hindered by access limitations, with no Medicare coverage and limited coverage among commercial plans.

Recent Developments and Current Landscape

The latest development is the introduction of dual GLP-1/GIP agonists, which aim to build on the success of GLP-1 agonists by leveraging the complementary effects of two gut hormones. While consensus does not exist regarding the exact synergistic mechanisms by which dual-agonists work, the addition of GIP agonism is posited to improve the HbA1c control and weight loss offered by GLP-1 agonists alone by enhancing insulin secretion, decreasing energy consumption, and stimulating satiety in the hypothalamus.

Lily’s Mounjaro (tirzepatide) is the first dual agonist to market with its 2022 approval. In a head-to-head study (SURPASS-2), Mounjaro topped Ozempic (1 mg semaglutide), showing it was more effective in helping patients keep their blood sugar levels in check and lose weight. At 40 weeks, mean HbA1c levels for Mounjaro patients at doses of 5 mg, 10 mg, and 15 mg were reduced by 2.01%, 2.24%, and 2.30%, respectively, compared to a reduction of 1.86% with Ozempic 1 mg. Additionally, mean body weight was reduced by 17, 21 and 25 pounds, respectively, compared to 13 pounds with Ozempic 1 mg.

While Mounjaro’s clinical results are promising, differentiation versus Ozempic is not clean cut, as clinical results appear to be dose dependent, and Ozempic may have a slight advantage in terms of gastrointestinal (GI) tolerability and dropout rates (discontinuation rates due to adverse events in tirzepatide arms were 5.1% – 7.9% compared to 3.8% in semaglutide cohort).

In its first year on the market in T2DM (2022), Mounjaro brought in $483 million in global sales. Those numbers were quickly topped with $2.95 billion in sales in Q1-Q3 2023 alone. Analysts are projecting those numbers to grow significantly in the coming years, with Mounjaro having potential to compete for diabetes market leadership.

Lilly is aiming to build on Mounjaro’s diabetes success with their obesity formulation of tirzepatide – Zepbound – having received FDA approval in November of 2023. Patients taking the highest dose of Zepbound (15mg) in phase 3 clinical trials lost 48 pounds on average at 72 weeks, representing a ~20% body weight reduction. This represents an improvement over the ~15% weight loss seen over a similar time period in Wegovy clinical trials, though cross trial comparisons are unreliable.

Figure 1: FDA Approved Incretin Mimetic (GLP-1 and dual agonist) Diabetes and Obesity Products (as of December 2023)

The Future of Incretin Mimetics in Diabetes and Obesity

Looking Forward – GLP-1 Clinical Development Pipeline

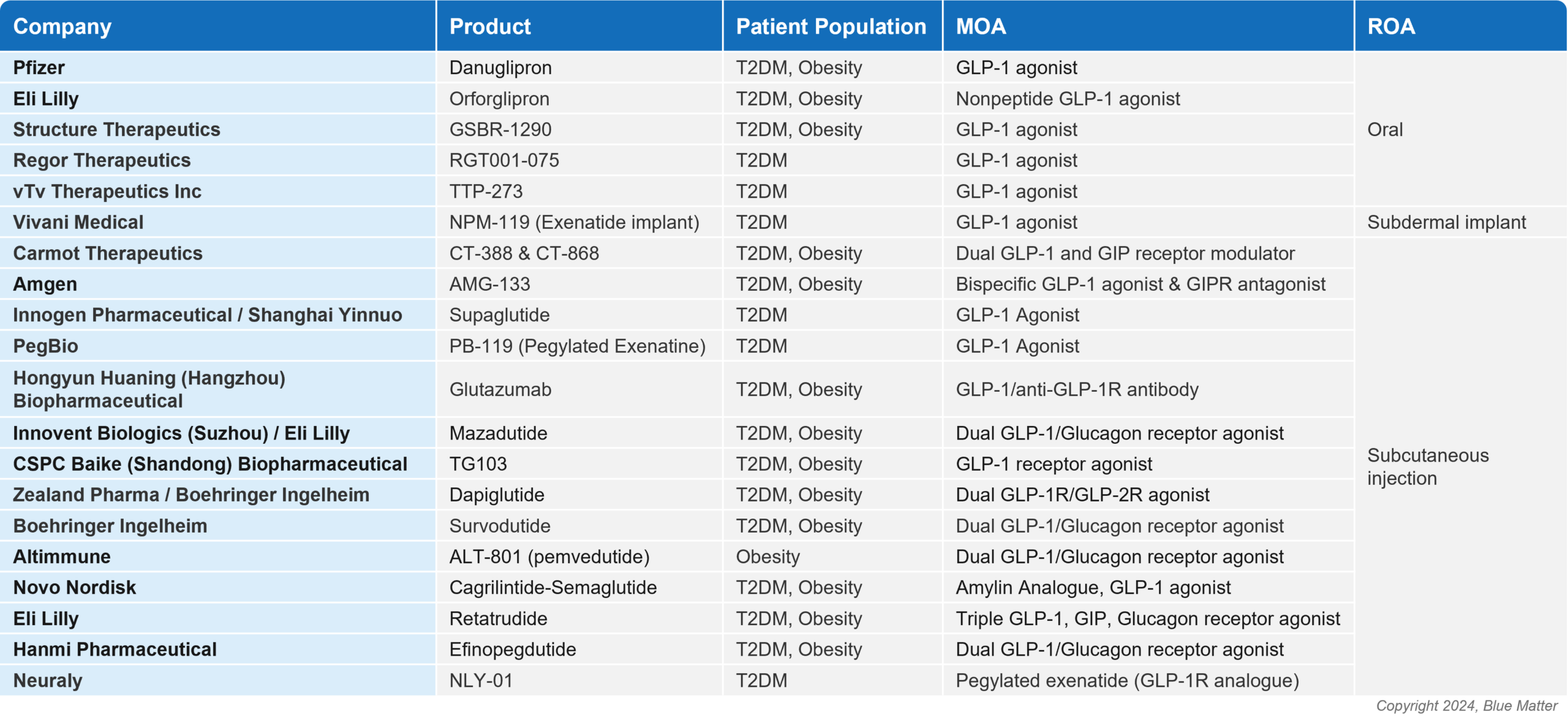

While Novo Nordisk and Eli Lilly dominate today’s market, the success of incretin mimetics has attracted greater interest and investment, with a slew of potential new players aiming to enter and carve out their own space. Across diabetes and obesity, there are ~20 novel GLP-1 agonists and multi-agonists in Phase 2/3 development (see image 2), with a host more in earlier stages. These agents are being studied across both first and second line, with subcutaneous, oral, and novel routes of administration (ROAs).

Heavyweights including Amgen and Pfizer are on the list of aspiring players, as well as smaller companies including Carmot Therapeutics, Structure Therapeutics, Zealand Pharma, Altimmune, Regor Therapeutics, and Vivani Medical. These players will face a steep challenge, especially as the market evolves, new bars for clinical outcomes are set, and unmet needs shift.

Figure 2: Novel Incretin Mimetic Assets for T2DM and Obesity in Phase 2/3 of Development

Remaining Unmet Needs

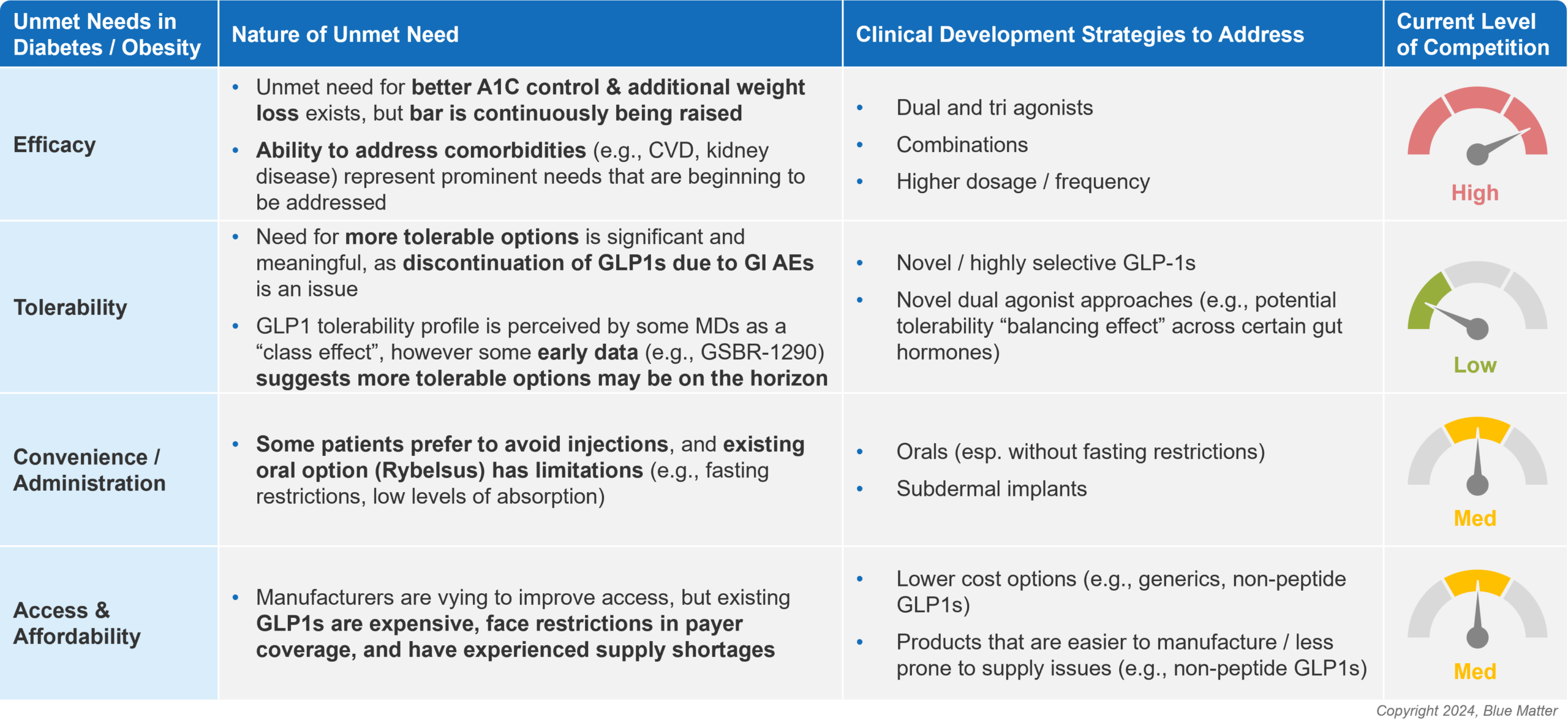

Though the value proposition of on-market GLP-1 and dual-agonists is strong, several key unmet needs still exist for incretin mimetics across diabetes and obesity, namely: (1) improved efficacy, (2) better tolerability, (3) more convenient options / alternative ROAs, and (4) improved access and affordability. Figure 3 (below) provides an overview of the nature of these unmet needs, as well as strategies and the level of competition to address them (based on current clinical development pipelines).

Figure 3: How to Win in Diabetes and Obesity: Address Remaining Unmet Needs

It’s unlikely that any single therapy will be able to satisfy all unmet needs. As a result, manufacturers must be targeted in their strategies regarding what specific need(s) they aim to address. Recent data and clinical updates provide a glimpse into manufacturer approaches:

Efficacy:

Currently approved incretin mimetics are viewed as highly efficacious across diabetes and obesity. Unmet needs for better A1C control and additional weight loss still exist, but the bar is continuously being raised. Manufacturers are seeking to improve efficacy by developing new dual- and tri-agonists, studying combinations, and offering more potent doses. The dual- and tri-agonist approach is attracting attention due to Mounjaro’s success, and recent data for one of Lilly’s pipeline products – retarutide – are promising.

Retarutide is a subcutaneously injected tri-agonist (GLP-1/GIP/glucagon receptor) that demonstrated unprecedented levels of weight loss in a relatively short period of time. In a phase 2 obesity trial, the highest dose led to participants losing an average of 24.2% of their body weight over 48 weeks (a secondary endpoint). For reference, currently approved products offer around ~15–20% weight loss over a similar time period. A number of other manufacturers are developing dual- and tri-agonists (e.g., Amgen, Carmot, Zealand), setting the stage for a competitive market.

Beyond improvements in weight loss, increasing evidence is mounting of cardiovascular benefits of GLP-1s. Liraglutide, semaglutide and dulaglutide have demonstrated cardiovascular benefits, and Wegovy recently added to this evidence base: in the SELECT trial, patients on Wegovy had a 20% lower incidence of heart attack, stroke or death from heart disease compared to those on a placebo.

Combination approaches are also gaining traction in clinical development as a potential means to improve efficacy and address risk factors / comorbidities. For example, in November 2023 Novo announced a head-to-head phase obesity 3 trial (REDEFINE 4) evaluating CagriSema (fixed-dose combination of Wegovy and cagrilintide) against Lilly’s dual-agonist Zepbound. Novo is not alone in investing in combination approaches: in AstraZeneca’s 2023 announcement of its acquisition of Eccogene’s GLP-1 program, the manufacturer noted that they intend to combine the GLP-1 asset with other products in their portfolio (e.g., Farxiga, baxdrostat) in an effort to address obesity comorbidities (e.g., heart disease, kidney disease, metabolic syndrome).

Tolerability:

While the side effect profile of incretin mimetics is relatively mild (low rates of severe AEs; most common AEs include nausea, vomiting, and diarrhea), room for improvement exists in improving GI tolerability and patient discontinuation due to AEs. For example, rates of nausea in incretin mimetic trials typically range from ~15% to 22% and discontinuation due to AEs range from ~3% to 8%. Opportunity exists for therapies with better tolerability profiles, though it may be difficult for an agent to achieve both enhanced efficacy and tolerability. Approaches to improvements in efficacy primarily target additional gut hormones via dual- and tri-agonists, and if Mounjaro provides any indication, dual- and tri-agonists may not be likely to enhance tolerability. That being said, different mechanisms may offer different side effect profiles, and it’s possible that future multi-agonists could yield improved tolerability profiles. Additionally, some novel GLP-1s hold promise for improved tolerability, as evidenced by Structure Therapeutics’ phase 2 data for GSBR-1290, which demonstrated encouraging results in terms of AEs and discontinuation rates.

Convenience / Administration:

Oral therapies offer some promise as a more convenient option than the leading injectables. Oral GLP-1 agonists haven’t quite caught on yet, primarily due to (1) issues with absorption, which necessitates higher dosing than injectables and may impact efficacy, and (2) fasting restrictions (must be taken on an empty stomach). If manufacturers are able to develop orals that rival the clinical profile of injectables, the market could be flipped on its head. Companies including Pfizer, Eli Lilly, and Structure Therapeutics are leading the charge in developing novel orals.

Access and Affordability:

Access and affordability challenges are a key factor preventing the GLP-1 market from reaching its peak potential, particularly in obesity where payer coverage is limited. Improvements in access will take time, and require generation of compelling data (e.g., pharmacoeconomics, impact on comorbidities) and savvy commercial strategy. In addition, some manufacturers are employing development strategies that may help address access issues. For example, Lilly is studying orforglipron, a daily oral non-peptide GLP-1 agonist which is easier and less costly to manufacture vs. traditional GLP-1 agonists. This has potential to alleviate supply shortages currently plaguing the class, and may provide an opportunity for Lilly to bring a lower-cost option to market, though Lilly’s pricing strategy for orforglipron is unknown and likely to be dependent upon clinical results.

Another key development that may support access and affordability is the impending availability of generic liraglutide, which is expected to hit the market in the next 1-2 years. Generic liraglutide adoption may be aided by a lower price and potentially broader market access, but will be hindered by the need for daily injections.

How to Win in Diabetes and Obesity

The high volume of new entrants is likely to fragment the market moving forward. The massive size and heterogeneity of the diabetes and obesity patient populations offer ample opportunity for a range of products to simultaneously succeed. Manufacturers seeking to win in this space should consider how to address the following success factors:

Determine whether to go broad or target a niche:

Going broad has been an effective strategy to date, but this may change as the market fractures. To successfully employ an all-comers strategy moving forward, manufacturers need to ensure products have strong clinical and/or non-clinical differentiation, a robust data package that addresses a range of patient types and comorbidities, and well-funded physician and patient facing marketing campaigns.

Creating niches to occupy will become increasingly important, especially for new players. This requires carefully designed clinical trials that account for commercial dynamics, as well as pre-launch disease education to prime market understanding regarding where new therapies fit in the treatment paradigm. For example, niches may be created by addressing specific unmet needs in certain patient types (e.g., patients who prefer not to inject, or who failed prior lines of GLP-1s), or by addressing specific access issues (e.g., developing a lower-cost option, securing broader payer coverage).

Generate data that addresses unmet needs in diabetes and obesity:

Generating compelling data on comorbidities of diabetes and obesity, including cardiovascular and kidney outcomes, is critical to effectively competing with incumbents. Additionally, developing products with unique benefits that differentiate from the pack and address stakeholder needs may provide a path to success: for example, novel routes of administration, simplified titration schedules, or improved GI tolerability profiles.

Manufacturers relying solely on efficacy improvements to differentiate should be aware that in TD2M, current therapies are perceived to be efficacious enough to address the needs of many patients. Therapies that offer better efficacy could be saved for sicker diabetic patients. Therapies with improved efficacy would ideally not come at the cost of compromised tolerability, especially considering that patient discontinuation due to AEs is an important factor in physician decision making in this space.

Deeply understand physician and payer dynamics, and build strategy accordingly:

Understanding the differences between primary care provider versus endocrinologist perceptions and prescribing behaviors (e.g., class preferences, route of administration preferences, etc.) is foundational to developing strategies that account for stakeholder-specific nuances. Likewise, understanding payer dynamics and patient affordability, and building strategies that remove access obstacles for target customers (e.g., co-pay and cash pay assistance programs that enable affordability to more patients) are important to support the realization of the full potential of this market, especially considering the economic demographics of diabetes and obesity patients.

Opportunities Outside of Diabetes and Obesity

Additional Indications for Exploration

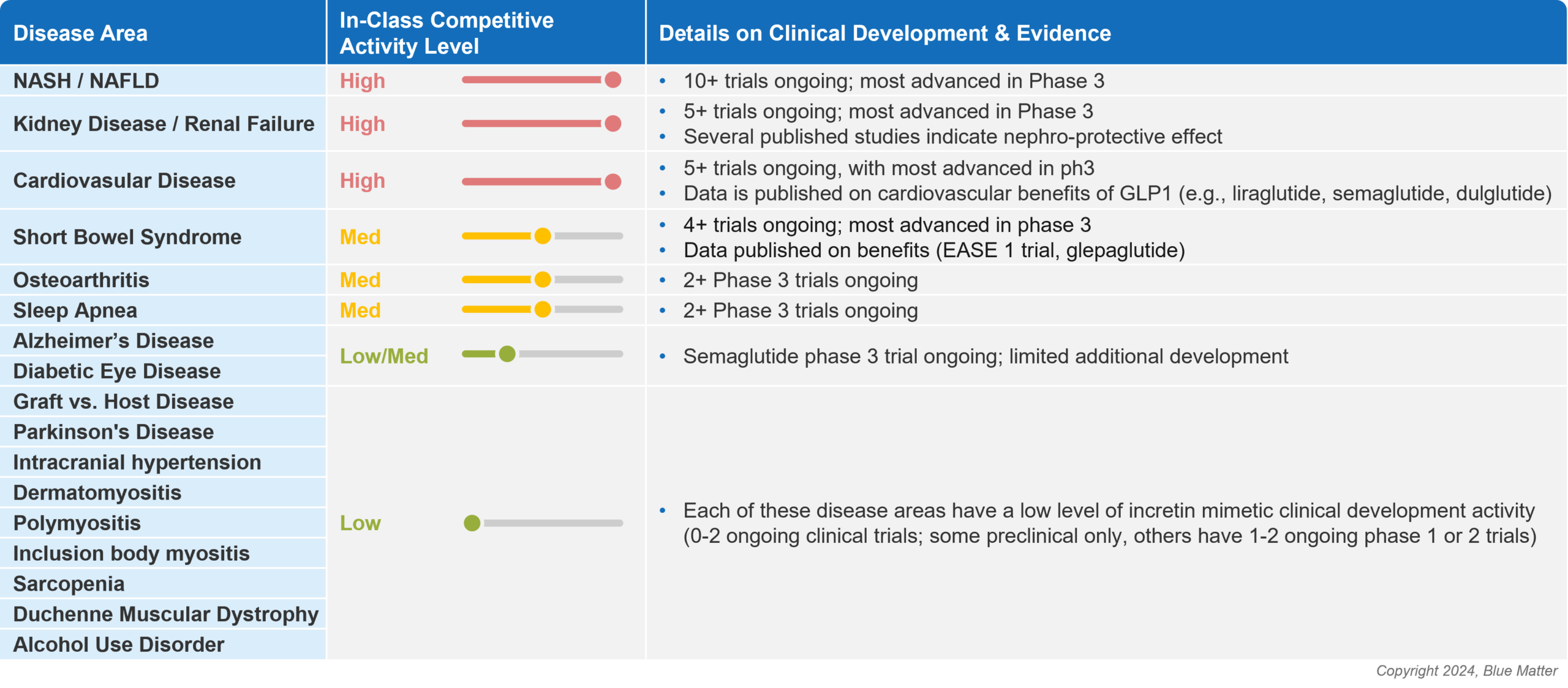

As new companies look to enter the incretin mimetic space, and existing players seek to expand their portfolios, it’s increasingly important to look beyond diabetes and obesity. The diabetes and obesity markets are massive, but are also intensely competitive and rapidly evolving. Opportunities exist in alternative therapeutic areas where there may be more white space for the incretin mimetic class, and these opportunities are garnering the attention of manufacturers (see image 4 below).

Figure 4: Opportunities Outside of Diabetes and Obesity for Incretin Mimetics

As mentioned earlier, NASH is an area that has attracted a high level of manufacturer attention, as the liver disease is associated with metabolic syndrome and represents an area of large commercial opportunity with significant unmet medical need. Other therapeutic areas that are being heavily studied include kidney disease and cardiovascular disease, which are often comorbid with obesity and/or type 2 diabetes.

The potential versatility of incretin mimetics will be tested in coming years, with a long list of additional diseases being studied including short bowel syndrome, including Alzheimer’s disease, Parkinson’s disease, and diabetic eye disease, just to name a few. These less crowded indications may offer high risk, high reward pathways for manufacturers who are looking to enter the GLP-1 arena without needing to fight for space in the competitive diabetes or obesity markets.

Yet to be explored disease areas that may soon attract interest include alcohol use disorder, other addictive disorders, and even oncology. Studies in rodents and primates have signaled that GLP-1 agonists may drive a reduction in intake of alcohol and drugs of abuse, and clinical trials have been initiated to investigate whether preclinical findings can be translated to humans. There’s some scientific rationale supporting this possibility, as it has been hypothesized that GLP‐1 agonists may decrease rewarding/reinforcing effects of alcohol and other drugs of abuse.

As companies consider whether to enter new therapeutic areas, they must carefully evaluate each to understand whether the risk / reward equation nets out positively. The opportunities in these indications can be assessed by deploying effective new product planning / opportunity assessment methodologies, including evaluating the following for each potential indication:

- Level of in-class / competitive activity

- Likelihood of technical and regulatory success (i.e., based on scientific rationale and regulatory precedent)

- Level and nature of unmet needs for new therapies in the disease area of interest

- Potential for GLP1-s to address these unmet needs

- Commercial attractiveness of market

- Potential speed to market

- Alignment with individual manufacturer portfolio / strategy / capabilities

Conclusion

Incretin mimetics have had an immense and growing impact on patient outcomes. This trend shows little signs of slowing. While the market is highly attractive to manufacturers, companies who aim to successfully commercialize therapies face a steep task: shifting sands necessitate carefully constructed development programs and product strategies.

To be successful, manufacturers should incorporate commercial considerations into early stage clinical development decision making and be quick to revise program and portfolio strategies as new data and products emerge. Smart manufacturers will implement iterative mechanisms to gather insights, aim to understand how new data and products impact customer perceptions and behaviors, and develop products and strategies that deliver on clearly defined unmet needs.