Gene therapy has made significant advances over the past few years. However, those therapeutic advances have not been accompanied by spectacular commercial successes, at least not yet. This raises a simple question: When will gene therapy fully realize its commercial potential?

We explored that question with a distinguished panel on November 7, 2018 at the World Orphan Drug Congress (WODC) Europe in Barcelona. The panel was entitled The Disruptive Potential of Gene Therapy and it highlighted the fact that even though our core question was a simple one, the answer is far from simple. This article provides a summary of that discussion. The panelists were:

- Nicolas Koebel, Head of Program & Portfolio Management, Orchard Therapeutics

- Daan Kranenburg, VP Commercial Operations Europe, bluebird bio

- Sam Rasty, Chief Operating Officer, Homology Medicines

- Marcio Souza, Chief Operating Officer, PTC Therapeutics

The discussion was hosted by Blue Matter Consulting and moderated by Dirk Moritz, Principal, Rare Diseases. In addition to key insights and points from the panel, we also add insights from other discussions that took place at the WODC and provide some of our own perspectives.

The Commercial Potential of Gene Therapy

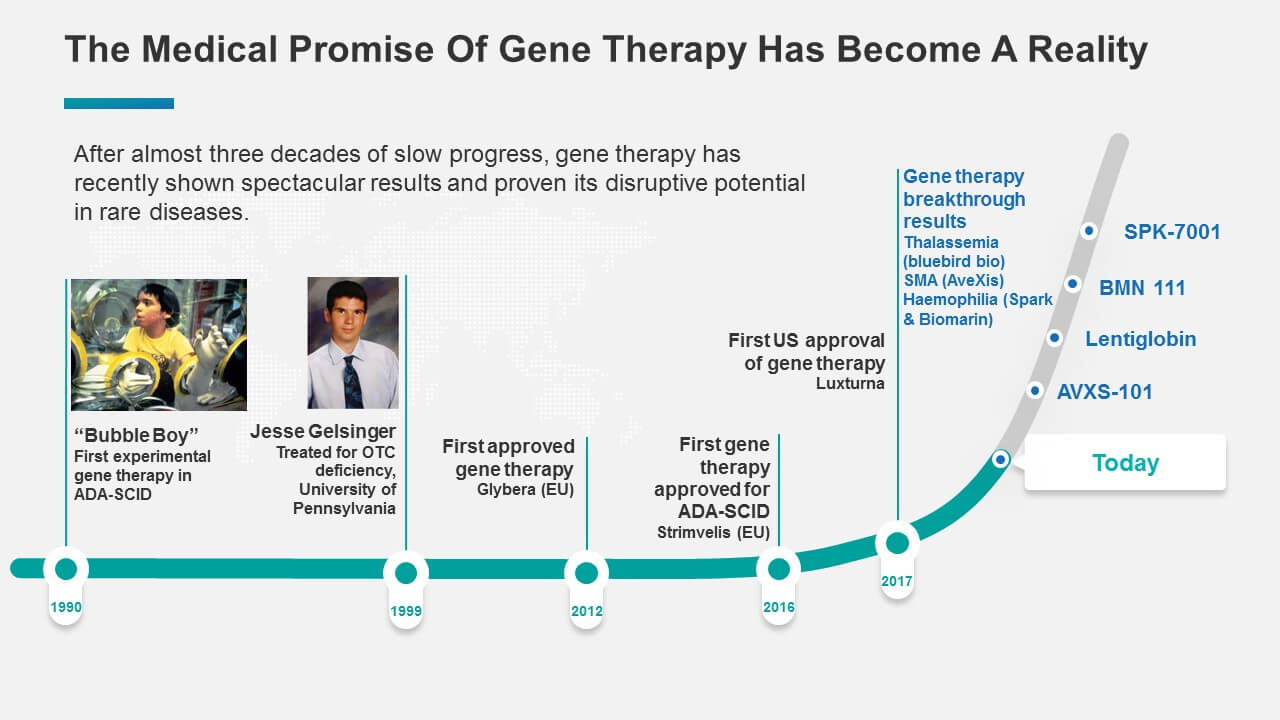

After more than three decades of slow progress and a major setback in 1999 (when 18-year-old Jesse Gelsinger died as a direct consequence of his participation in a gene therapy study, effectively delaying other clinical studies for many years and leading to a new process for gene therapy trials in the US), gene therapy has recently shown some spectacular results. In 2017, a number of breakthrough therapies underlined the disruptive potential of gene therapy in rare diseases (Figure 1).

Figure 1: Gene Therapy: The Promise Becomes Reality

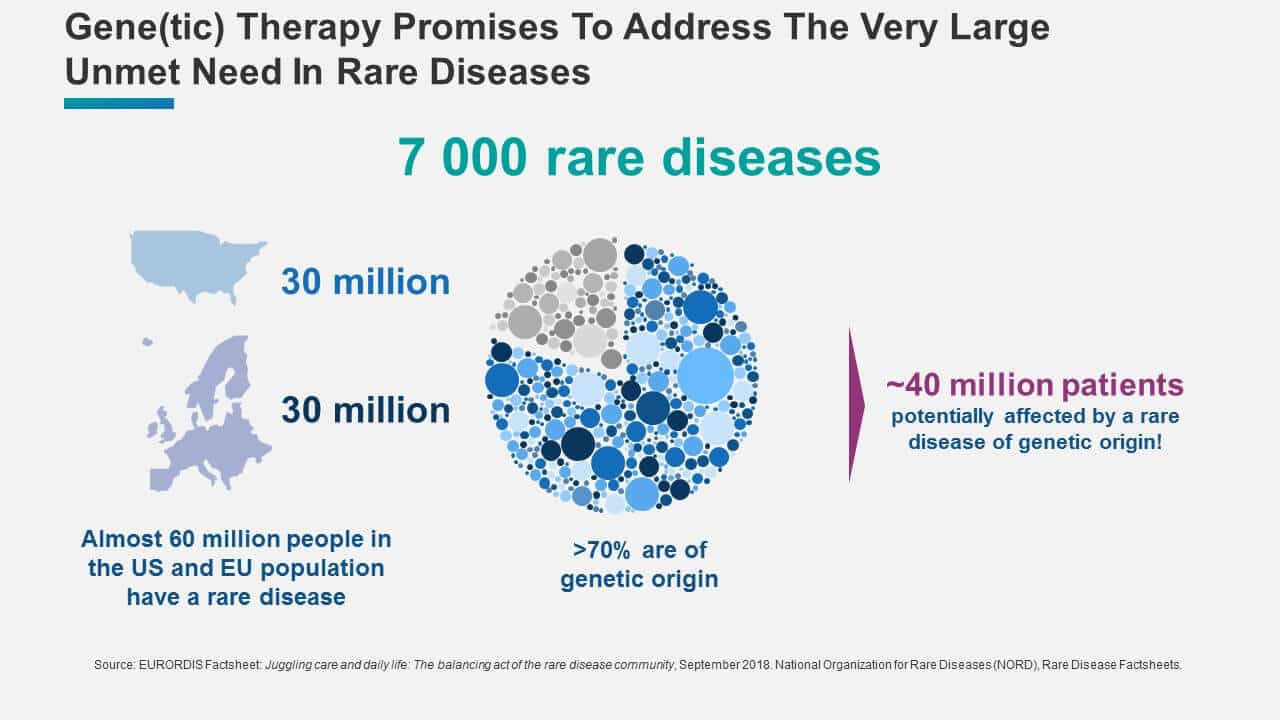

In general, genetic therapies have the potential to address the very large unmet need in rare diseases. A high-level analysis shows that the commercial potential for these products could be immense. There are about 7 000 rare diseases affecting about 60 million people in the US and in Europe. About 80 % of these diseases are of genetic origin and an estimated 70 %, are monogenic and potentially addressable by gene or genetic therapy. Therefore, there are about 40 million rare disease sufferers in the US and Europe that might benefit from some form of gene therapy (Figure 2).

Figure 2: The Unmet Need in Rare Diseases

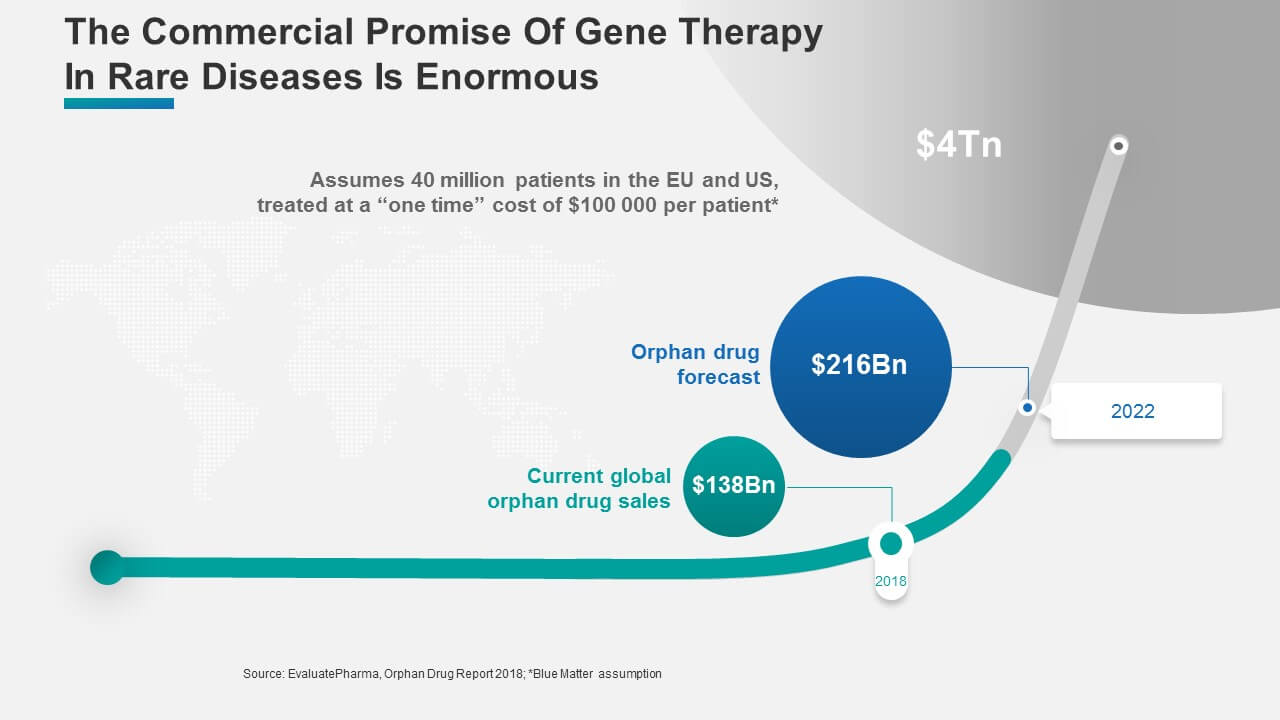

Given an assumed one-time cost of about $100 000 per patient (a conservative figure, considering the currently discussed price levels at $4-5 million for some gene therapies)1, the size of the commercial opportunity can approach $4 trillion! Figure 3 shows how this “mind-blowing” market potential compares to the current realized market and the projected market size for 2022.

Figure 3: The Commercial Potential in Rare Diseases

Critical Success Factors for Realizing Gene Therapy’s Commercial Potential

While the commercial potential is enormous, recent gene therapy launches have not yet translated into significant commercial success, though there was a common belief among the WODC panel members that gene therapy will be commercially successful in the future. The panel identified several critical success factors that must be achieved before gene therapy’s full potential can be realized. These factors are described below.

Patient Centricity and Aligning Investments with Unmet Need

Today, key gene therapy players focus on relatively few “hot-spot” indications. R&D investments levels aren’t necessarily well-aligned with the unmet needs in rare diseases. To illustrate this phenomenon, consider well-served indications such as hemophilia A (AskBio, Biomarin, CRISPR Therapeutics, Sangamo, Spark, uniQure), Duchenne muscular dystrophy (DMD) (AskBio, Bamboo/Pfizer, CRISPR Therapeutics, Editas, Genethon, Sarepta, Solid Biosciences), and beta-thalassemia (bluebird bio, CRISPR Therapeutics, Editas, Intellia Therapeutics, Sangamo). After the first phase of approvals, followed by a phase of consolidation, the “low-hanging fruit” will be gone, hopefully leading companies to target a much broader set of the more than 7 000 rare disease indications that are currently largely unserved.

Leveraging Innovative Research & Development Approaches

On the R&D front, innovative approaches are urgently needed to overcome the challenging nature of gene therapy trials. Typically, patient populations are very small, making recruitment difficult. As a result, study samples are also small, making it hard to generate statistically significant data. In rapidly progressing and severe diseases such as spinal muscular atrophy (SMA), gene therapy studies are often open-label and single-arm (i.e. uncontrolled studies), making it difficult to establish the magnitude of the therapeutic benefits. In addition, it’s particularly important to establish the long-term therapeutic impact, which requires different approaches than those used in traditional clinical trials.

Overcoming these challenges will require novel clinical approaches. Innovative techniques for patient finding and recruitment will be very important. AveXis, for example, is using newborn screening to identify pre-symptomatic SMA patients as early as possible. Other approaches, such as adaptive design, will also have their place. Collaboration between biopharmaceutical companies and non-industry partners, such as the Telethon Foundation, will also be important to overcoming barriers to success.

Avoiding the Revenue Cliff

Given the curative nature of gene therapy, the revenue curves won’t look like the ones the industry is used to seeing in chronic diseases. Instead, a given product will likely see a relatively immediate uptake, a sharp peak as existing patients are treated, and then a steep drop-off. After going over the “revenue cliff,” sales levels would likely stabilize for a while. This dynamic would be similar to that seen in the HPV (human papillomavirus) market with HPV drugs such as Gilead’s Sovaldi and its follow-on treatment Harvoni.2 One way to overcome the cliff is to use gene therapy as a platform technology to continuously develop new products in novel indications. Obviously, this is easier said than done.

Evolving the Payer Model

In its ideal form, a gene therapy is a one-time treatment that will provide substantial long-term benefits. Traditional models are characterized by regular payments over time in line with sustained benefits derived from chronic treatment regimes. How can payments be phased over time in gene therapy?

Today, payers think in terms of the current pharma business model and in short-term, one to three-year cycles. Current payment models are not set up to deal with the large up-front costs that are typical of gene therapies.

Clearly, established reimbursement systems need to evolve. This will likely happen over time as payers face pressure and as precedence with innovative treatments is being established. Novel annuity-based models, regular installments, and pay-for-performance schemes are potential solutions. While companies such as Novartis indicate to work with payers on novel and innovative payment plans3, some of the answers to the patient and access challenges may well come from other industries outside the biopharmaceutical or healthcare sectors.

As an example, the panel discussed risk securitization, a financial model aimed at pooling contractual debts such as commercial mortgages and credit card debt obligations. In this model, cash flows related to the payment of treatment costs could be sold as securities to larger investors, thereby reducing the risk for individual investors / payers.

Establishing Long-Term Value

As we’ve established, gene therapies are expensive. Current and suggested future price levels are being hotly debated. However, the full value of once-and-done potentially curative gene therapies remains to be established. When compared to a chronic high-price treatment, a price level of $1 million might not actually be too high.

For example, treatments with Elaprase for Hunter Syndrome cost typically around $375 000 per year, which would result in more than $10 million over the course of 30 years. Similarly, Sarepta Therapeutics’ Exondys 51 for the treatment of DMD has a yearly price tag of about $300 000 and would accumulate to a 10-year treatment cost of about $3 million. Given these long-term price levels, an effective gene therapy would compare very favorably. Of course, this requires that the long-term benefits be firmly established.

Reducing Costs

Even though payer models will catch-up and biopharma companies will become more adept at establishing long-term value, there remains an ongoing need to reduce costs. One component of the cost equation involves production. Usually, the manufacturing processes for gene therapies are extremely complex and expensive.

Chemical, manufacturing, and control (CMC) aspects need to be optimized to bring down costs. Contract Manufacturing Organizations (CMOs) and biopharma companies are working to address the issue, but they are still in the early phases. Most of the effort to date has been focused on scaling up production volumes, rather than streamlining processes and reducing costs.

Documenting Treatment Durability

To support any value argument, it’s critical to properly document the long-term effectiveness of a gene therapy. This helps to establish whether the therapy really is curative (or at least capable of providing a long-term benefit and value to patients and health systems). Registries, which are critical to generating real-world evidence, would require longer follow-up periods. Usually, a minimum of 5 years would be needed, but potentially much longer.

Conducting studies and/or maintaining registries over such long periods of time can be challenging. When patients see significant improvements under a therapy, it might be very difficult to get them back for follow-up visits years later. This point has been nicely illustrated by the experience with LUXTURNA, an eye treatment recently approved by the FDA. For Spark Therapeutics, the maker of LUXTURNA, it has been difficult to bring back patients throughout the 36-month follow-up period. As patients’ eye-sight progressively improved, they saw no need to see a doctor and often did not participate in follow-up appointments. The 3-year mark is important, as this is the typical time (in the US) for patients to change to new insurers and important for continued reimbursement.

Enhancing Delivery & the Supply Chain

For a number of gene therapies, significant challenges exist with the complex supply chains and drug delivery mechanisms. Usually, e.g. in an allogeneic setting, the supply chain is a linear process (it starts with extracting cells from a donor that will be modified and eventually be administered to a patient). The process is different in an autologous gene therapy where the cells are extracted from a patient, genetically modified, and then re-administered into the same patient. This circular process is far more complex than a linear process. It’s more expensive, carries higher stakes for the patient, and must have much stricter controls. They key point is: biopharma companies will need to continue working with a range of stakeholders to make these complex processes simpler and less expensive without compromising patient safety or efficacy.

Managing Future Expectations

Biopharma companies will have to convince patients, caregivers, physicians, and investors that these products will be viable long-term, given the substantial clinical benefits. Solid long-term data and sound communications strategies will be central to doing this.

Companies must effectively balance two competing dynamics: The need to communicate the fantastic potential of these therapies (without over-hyping) while simultaneously tempering expectations regarding the speed with which these therapies will prove themselves and “take over” the market.

The Potential for Long-Term Market Disruption

In addition to discussing the critical success factors for gene therapy, the panelists also offered insights regarding the disruptive nature of gene therapy. Some of those insights are summarized below.

Threat to Conventional Therapies & Players

Gene therapies definitely present a threat to existing treatments and conventional actors. Many companies are taking some steps to mitigate the risks by investing in this space. As far as “Big Pharma” players go, Pfizer and Novartis have been especially proactive.

Other players are cautiously monitoring the environment. It is quite likely that Big Pharma players who don’t get into this field will fall behind. However, a system that allows for both disruptive and incremental innovation models would be desirable and will leave room for different company strategies.

Tremendous Potential

Gene therapy has huge disruptive potential, particularly for monogenic diseases. In the mid-term—over the next three to seven years—old treatment paradigms are likely to change completely. Metabolic conditions such as Gaucher disease, Hunter syndrome, Fabry disease, and others are currently treated with enzyme replacement therapy. They are ideal targets for gene therapy, and many companies are involved in transforming this field.

There are clear parallels in oncology with immuno-oncology and CAR-T therapies. The older treatment models are getting replaced, and those companies who invest in new technologies will be the most successful in the long run.

Gene Therapy Will Become Standard

Gene therapy has the potential to become part of the standard armamentarium to treat a range of conditions, along with other more established treatment options. In any given case, the focus will be on identifying the best option for optimizing the patient’s care. For future success, it will be critical to establish sustainable pricing and payer models. This would avoid repeating the story of antibiotics, when the pricing model became so unattractive that companies no longer invested in them, with negative consequences for public health.

Gene Therapy Itself Will Likely Be Disrupted

Other new technologies might—in the future—disrupt gene therapy. While the practical applicability still needs to be proven, gene editing (modifying and editing the human genome) could eventually disrupt gene therapy. Like any new technology, gene therapy has a window of time in which to blossom, but it will eventually get displaced.

Looking to the Future

Overall, the panelists were cautiously optimistic for the commercial future of gene therapy, even if they weren’t willing to predict a specific time frame. While tremendous progress has been made over past 30 years, gene therapies have not had significant commercial successes yet. However, gene therapy is a technology with disruptive potential and the size of the commercial opportunities and unmet needs are enormous.

There is certainly a lot of activity in the space, with more than 1 200 studies of gene and cell therapies currently underway. More than 140 studies are in a late phase4.

The panelists predict that over time, more innovative products will launch, and commercial successes will begin to mount. Uptake will initially be slow until more and more confidence and positive patient experience accumulate, generating positive momentum.

The current ecosystem is not quite ready to support all this and needs to evolve. However, challenges involving administration and supply chain, payer models, production costs, and others will be sorted in fits and starts. Gene therapy will require compromise on both the payers’ and manufacturers’ parts. Given the magnitude of the need, that compromise will happen.

In addition, collaboration across multiple stakeholders—including patients—will be critical to overcoming the key challenges and evolving the market environment. While early innovation will be driven by a mix of larger and smaller players, “Big Pharma” will eventually drive consolidation of this crowded space.

Overall, the outlook is positive for gene therapy. As is always the case, the revolutionary potential of a new technology is talked about for many years before it is realized. When it does happen, it’s almost never a clean and linear process. But it does happen, and it will with gene therapy.

Notes

- Sagonowsky, Eric. “Novartis plots ‘innovative’ payment models for pricey Luxturna’s EU ” Fierce Pharma, 26 Nov. 2018, accessed 28 Nov. 2018 at https://www.fiercepharma.com/pharma/novartis-scores-eu-nod-for-gene-therapy-luxturna-plans-innovative-payment-models

- Gatlin, Allison. “How Gilead is Paying the Price for Actually Curing a Disease.” Investor’s Business Daily, 10 Mar. 2017, accessed 28 Nov. 2018 at https://www.investors.com/news/technology/can-gilead-withstand-hep-c-boom-and-bust-or-will-merck-abbvie-win/

- Sagonowsky, https://www.fiercepharma.com/pharma/novartis-scores-eu-nod-for-gene-therapy-luxturna-plans-innovative-payment-models

- gov, as of Nov. 2018