We gratefully acknowledge the contributions of Alyssa Manz, Ph.D. and Quinn Civik for their work on the data analysis which supports this publication.

Each rare disease (RD) only impacts a relatively small population, and given the clinical breadth of these conditions, new RD product development may feel like forging a completely new path towards a relatively limited commercial value. But while a given rare disease is of course individually rare, “rare disease” as a therapeutic area is surprisingly large. There are ~7,000 different rare diseases, collectively impacting as much as 10% of the total population1,2. Some are true “orphans”, with completely unique molecular underpinnings and clinical characteristics, but the majority have at least some common features ranging from shared genetic alterations to similar patterns of symptoms and progression.

Regardless of disease target, RD products themselves may also have similarities when they are based on a shared platform or modality. So, there are ample opportunities to develop and apply knowledge across RD development generally and also to maximize the value of each individual RD product specifically. For example, this may be achieved across additional similar indications, or more indirectly through deeper understanding of clinical characteristics that inform future RD product development (e.g., new targets, meaningful endpoints). Until relatively recently, few RD developers were taking advantage of these opportunities.

A Focused Mindset vs. a Broader Perspective

This hesitation for RD developers to go broad early in product planning is perhaps expected. Often, RD drug development has taken a narrow approach, with a laser-focused path towards a highly-tailored product within a single disease, or a fortuitous repurposing of an already existing therapeutic from a more common disease space.

However, this differs from some other therapeutic areas in which drug development increasingly expands beyond the primary or lead indication and includes strategies across other indications that share biological or clinical similarities. For example in oncology, this includes development plans across various cancer types with a shared mutational background and can extend as far as the “pan tumor” NTRK-fusion targeted drugs that were successfully developed and approved for any tumor that has the relevant molecular alteration.

In either situation, it has been an open question as to what extent, and under what conditions, rare disease drug development can incorporate label expansion strategies earlier into product planning. In parallel, for those rare disease therapeutics which are platform-based (e.g., gene therapies), a related question is to what extent can successes (and informative failures) from lead indication development be leveraged for the same platform to deliver a new target in a new disease.

The RD Drug Development “Universe”: From 1:1 to the Constellation Approach

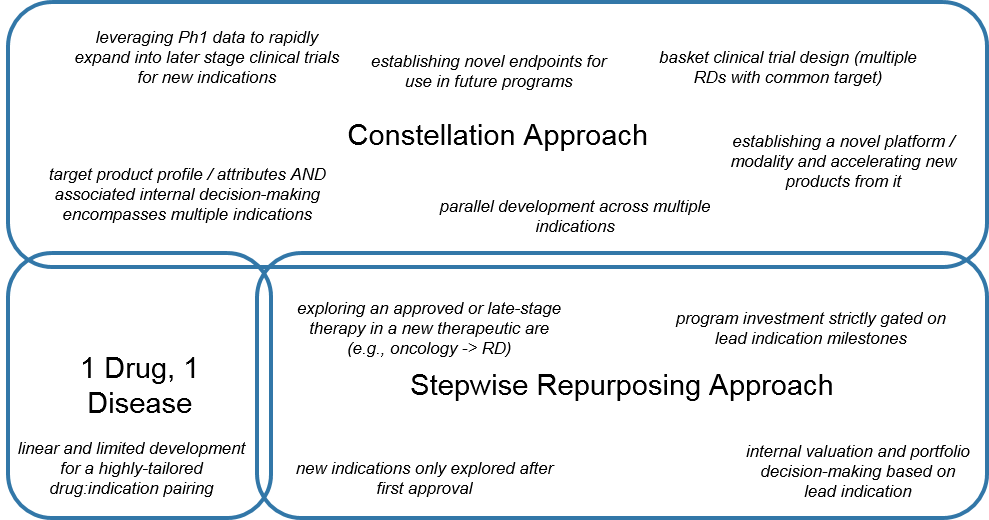

From the RD manufacturer perspective, we can therefore consider a spectrum for maximizing the value for an emerging RD product: the focused “1 Drug, 1 Disease Approach”, the linear “Stepwise Repurposing Approach”, and the broad and parallel “Constellation Approach”.

Classically, RD manufacturers have preferred either:

- The very tailored 1 Drug, 1 Disease towards a unique targetable alteration in a RD, or

- The Stepwise Repurposing Approach with a product that is already validated in one or more (usually non-RD, e.g., oncology) indications and fortuitously may be effective in an RD as well.

A gated and sequenced approach minimizes investment risk but may also leave value on the table due to:

- Longer timelines

- Reduced priority within the portfolio given the lower expected commercial return

- Potentially limited breadth of indications before the patents expire

That said, manufacturers can be strategic about introducing orphan drug designations (ODD) to extend patent life, getting a boost from including an RD in the overall product lifecycle plan. In addition, the longer timeframe can also enable developers to generate a more robust dataset to inform decision-making, and also provides opportunities to engage academic partners via investigator sponsored trials (IST/IITs).

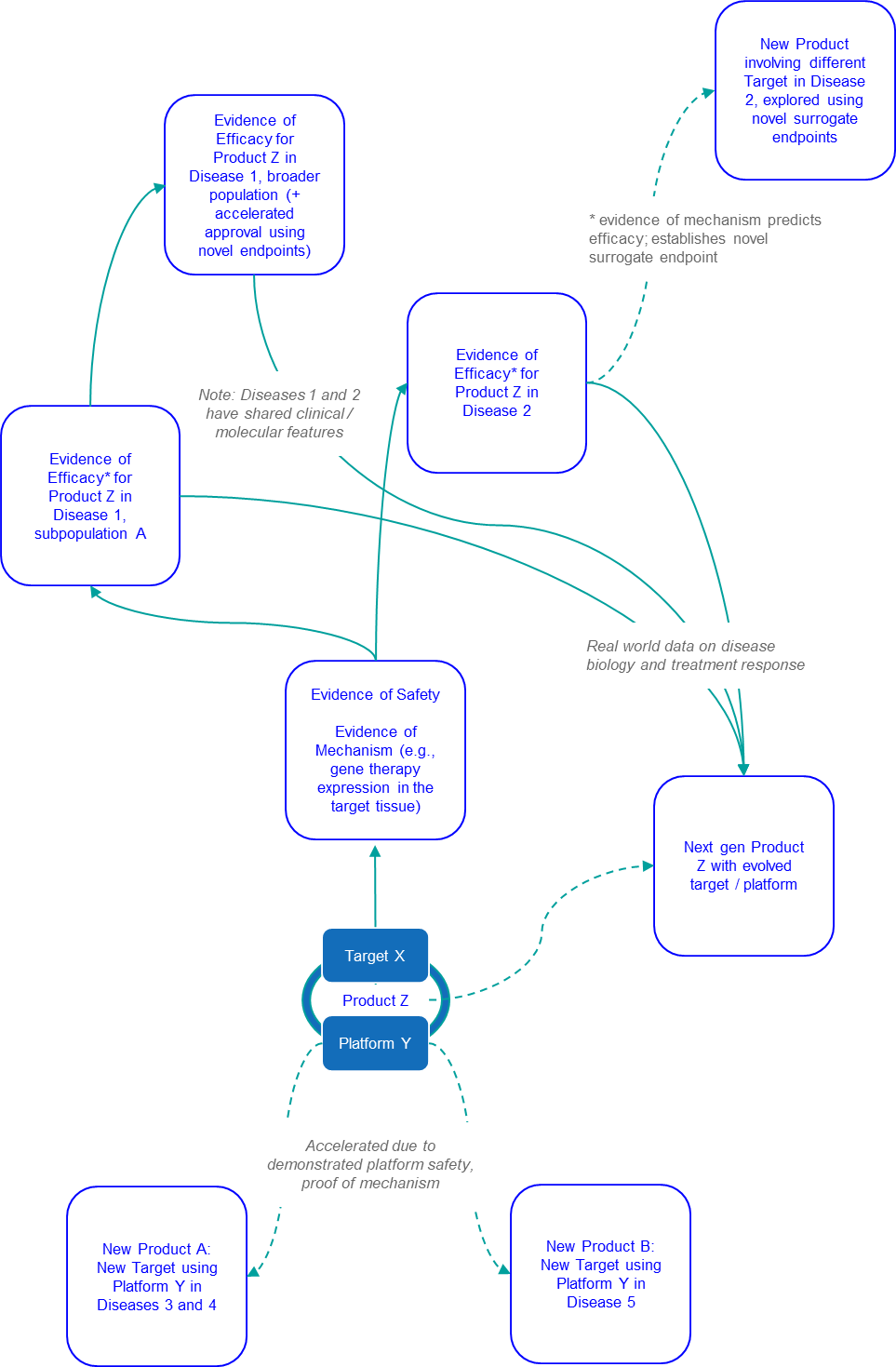

Alternatively, some manufacturers are leveraging a Constellation Approach for RD development. This is not a single path, but rather an approach that from the earliest stages of product planning accounts for multiple indications where the RD product or platform may work, as well as future development strategies within the various diseases of interest (e.g., surrogate endpoints, pathways for combination strategies).

Development then runs at least somewhat in parallel, as the RD product is advanced not just in the “lead” indication but in multiple, sometimes staggered indications. Development may also expand beyond the specific product into next gen versions, as well as novel products leveraging the newly-established platform.

This approach is increasingly common in oncology, especially for any therapeutic that has a target expressed in numerous cancer types. However, we also see opportunities for these strategies in RD where:

- Targets are the same across indications, or where overlapping molecular pathways and patterns of symptoms are shared

- Therapeutic modalities / platforms can be used to launch various targeted therapies

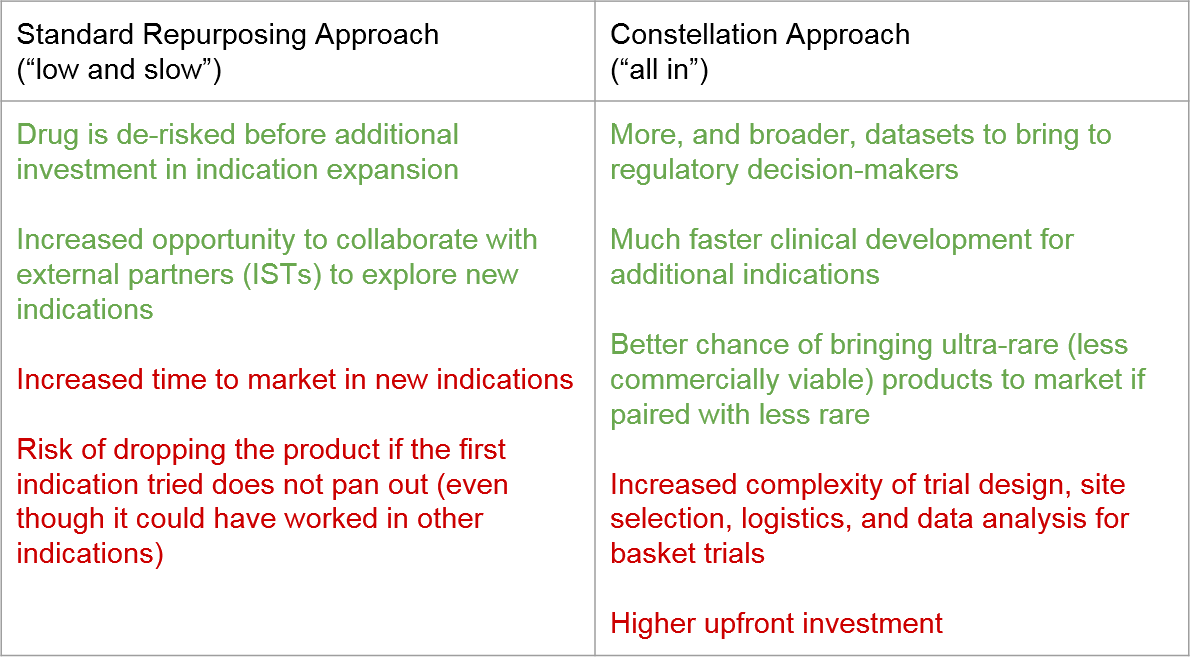

Both approaches have their benefits and challenges. The Stepwise Approach minimizes risk during development by gating broader investment on demonstrated success (but at the expense of time to market). The Constellation Approach seeks to move quickly and spreads out development risk across multiple indications in parallel, with the associated risk of none of them panning out and the upfront investment being lost.

While it is true that some RD products are only suitable for a single RD (due to the specificity of the target), many if not most do have targets with potential across additional indications. The question then becomes when and how to use the Constellation Approach vs Stepwise Repurposing. In addition to the considerations described above, we can also look to the real-life behavior of RD drug developers across this spectrum, namely trial timing and the number of successful approvals across both RD and non-RD for Orphan Drug Designated (ODD) products.

RD Development Landscape Analysis: What Approaches Are Developers Actually Using?

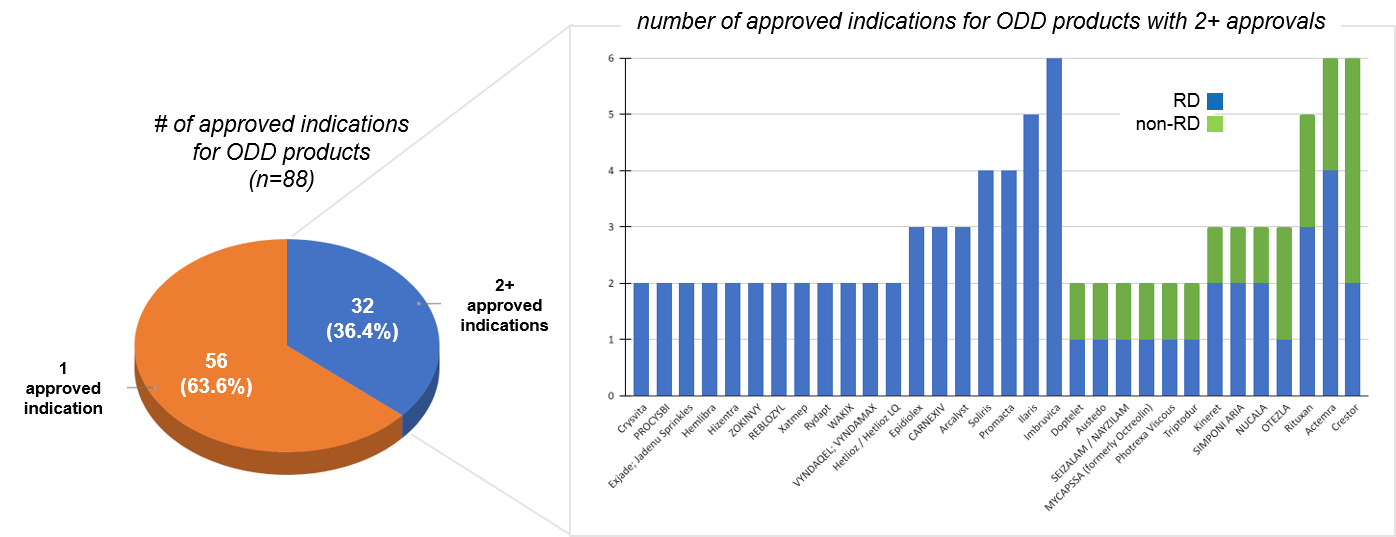

For this analysis, we reviewed the FDA approval history and trial timelines across RD products which have received an ODD designation across a 5 year period (2016-2020). We excluded products which had exclusively oncology indications from our analysis, in order to more closely focus on RD products. However, products which had both non-oncology RD indications and oncology indications (rare or non-rare) were retained in the analysis.

Of the 88 ODD products in this analysis, more than one-third (32; 36.4%) have more than one approved indication, indicating that many RD products do have potential beyond “1 Drug, 1 Disease”. Because this analysis is focused on products approved in a recent timeframe, it is also likely that a proportion of the 56 products that do only have 1 approval will go on to expand in the future.

Within the subset of RD products that do have more than one approval, it is important to note that of these, almost half (14 of 32) have more than 2 approvals, confirming broad potential for at least some RD products. Another question is to what extent RD products are restricted to RDs. While many of the multi-approval RD products are only within various RDs, we do see that 13 of the 32 (40%) have at least one non-RD indication.

That said, for the majority of these 13, the lead indication was non-RD, suggesting that typically the RD indication is adding incremental value rather than leading the product development. However, the 2 of 13 that launched first in RD and went on to achieve a non-RD indication are particularly interesting as a constellation type approach that can start small and then expand into a much larger market potential.

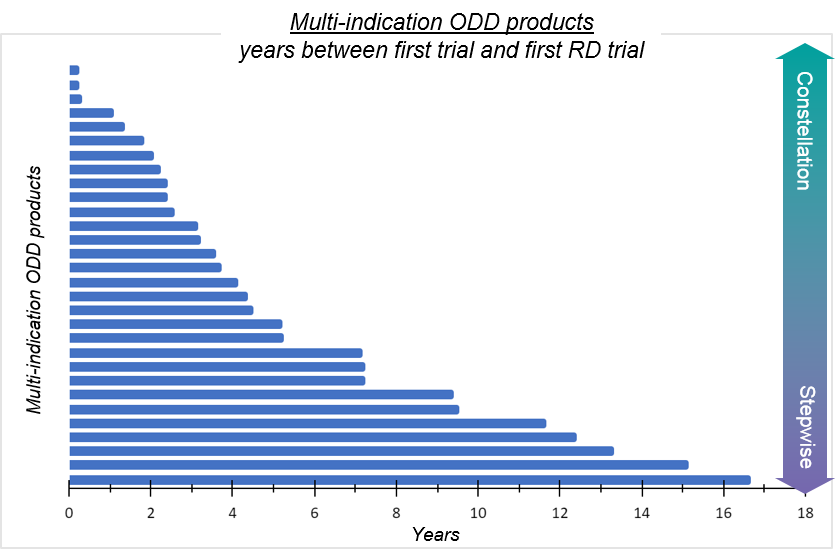

By examining trial start dates for recent ODD approvals (over the last 5 years), we can also get a sense of the prevalence of each model – keeping in mind that a 1 drug: 1 disease product may eventually be further developed.

Most ODD products (57/88 or ~65%) are “1 drug, 1 disease” in the sense that no additional rare disease trials have been initiated outside of the first indication. For the ~35% of ODD products that have had rare disease trials initiated outside of the first indication, there is a broad distribution of start dates extending from less than 1 year (“constellation-like”) to more than 15 years (“stepwise-like”). Notably, many of these products (18/31; 58%) had a next RD trial started within 5 years of first trial date, and only two of these products had the first new indication trial start after the first approval, suggesting some degree of parallel development indicative of the constellation approach.

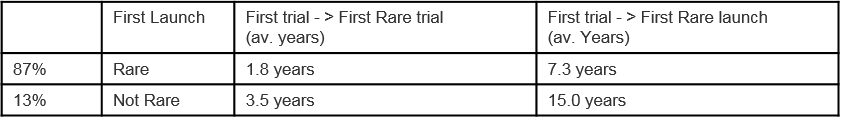

We may also wonder to what extent ODD developers are “committing” to RD, namely pushing rapid development of products across multiple RDs, vs more opportunistically developing a non-rare product in a rare indication. One way to assess this intentionality is to look at average times to RD trial start for products that initially launched in another RD vs a non-RD indication.

Here, we see that products in which the first launch was rare tend to move more rapidly through RD clinical development, with a much shorter timeframe between clinical development initiation, first rare trial, and first rare launch. It’s important to note that for 65% of products where the first launch is in RD, the first trial is also in an RD population. For products where the initial launch (and thus presumably the initial focus) is Not Rare, RD development progresses much more slowly, on average.

Stepwise Approach Considerations and Case Studies

The Stepwise approach has been favored in the past because it is maximally de-risked: before the manufacturer invests any additional financial or other resources into clinical development, they wait to see if the new product can succeed (or at least demonstrate safety and proof of mechanism) in its lead indication. In addition, Stepwise Repurposing also enables thoughtful consideration of existing clinical data and ongoing engagement with academic partners (IST/IITs) to explore additional indications before committing significant resources.

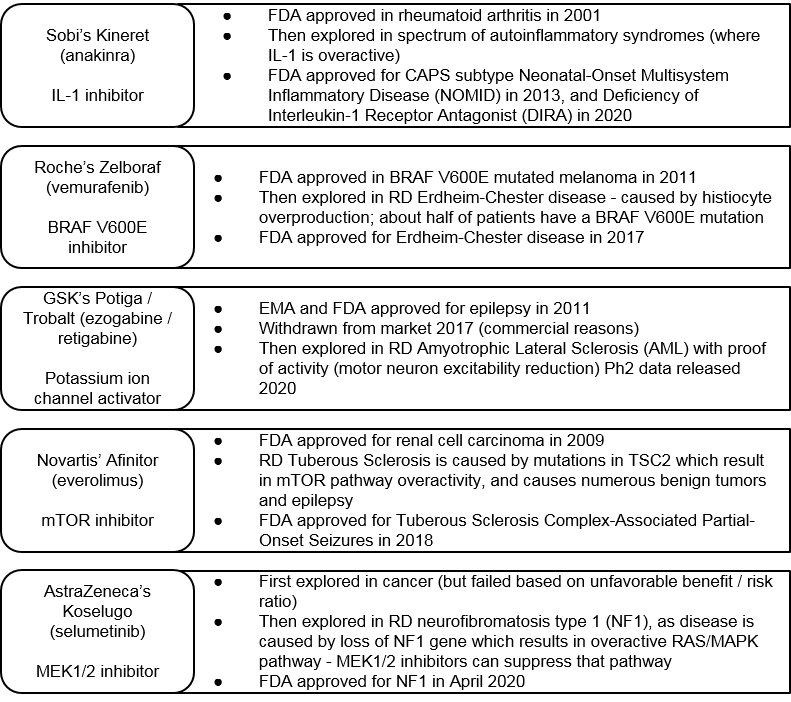

We see multiple examples of Stepwise Repurposing where established therapeutics are then explored in RD. For example, Sobi’s Kineret was first approved in 2001 for rheumatoid arthritis, then stepwise explored and approved in two RDs, both associated with IL-1 overactivity: NOMID in 2013 and DIRA in 2020.

Similarly, Roche’s BRAF V600E inhibitor Zelboraf was FDA approved in 2011, then subsequently explored and FDA approved for an RD (Erdheim-Chester disease) where the same mutation is present. More indirectly, we see pathway approaches where a targeted cancer therapy is explored in an RD where the target itself is not mutated, but the associated molecular pathway is mis-regulated. An example is Novartis’ mTOR inhibitor, Afinitor. This therapy was recently approved in RD Tuberous Sclerosis, which is caused by mutations in another gene that make the mTOR pathway overactive.

AstraZeneca’s MEK 1/2 inhibitor Koselugo is another interesting example. This drug failed across various cancer indications and was never approved in oncology, but then succeeded in RD NF1 (which is characterized by an overactive MEK pathway). Outside of cancer, GSK’s potassium ion channel activator, Potiga was launched (but then subsequently withdrawn for commercial reasons) in epilepsy, and is now in mid-stage clinical trials for ALS. Notably, the time between initial approval and the RD “follow-on” ranges from 6 to 12 years.

One key consideration for the stepwise approach is the time it takes. As each new indication is explored for an already approved RD product, the patent clock is already ticking, and competitive pressure is intensifying. In addition, there are “all or none” risks associated with a lead indication selection advancing with no parallel paths in progress. If an RD product fails in that first trial or is otherwise deprioritized within a pipeline due to low perceived market value, then all future indication opportunities are often lost as well (even if some may have been successful and valuable). Along similar lines, as an RD product launches in its first approval, another risk is locking in a price that may not be maximized for future indications.

Constellation Approach Considerations and Case Studies

The Constellation Approach mitigates the risks mentioned above by seeking to maximize value throughout the development path based on multiple (potentially staggered or gated) opportunities. The benefits of this approach include early generation of a breadth of data that can improve decision-making. This includes internal decision-making (e.g. indication prioritization and sequencing), but also supports regulatory perspectives, as there may be opportunity to bolster a safety package and validate new endpoints. Another key benefit is much faster time to market as multiple indications are being explored in parallel. And finally, a clear plan towards multiple indications can improve the overall viability of drug price. The Constellation Approach also offers a stronger foundation for a path to market for ultra-rare indications that can be “paired” to less rare indications.

One challenge of the Constellation Approach is right-sizing the investment over time. In a world with unlimited resources, it might make sense to fully explore every potential indication for each RD product from the very beginning of clinical development. But in the real world, there is a real risk of spreading out investment across too many indications in parallel. Alternative options, such as a basket design or other broad clinical trial, have associated logistical complexities around identifying patients as well as appropriate trial sites. It can also make it more difficult to communicate evidence to regulatory authorities. Even with the best planning and design, it is also true that the product itself may not be viable due to lack of efficacy or unacceptable toxicity, in which case all this upfront investment is lost.

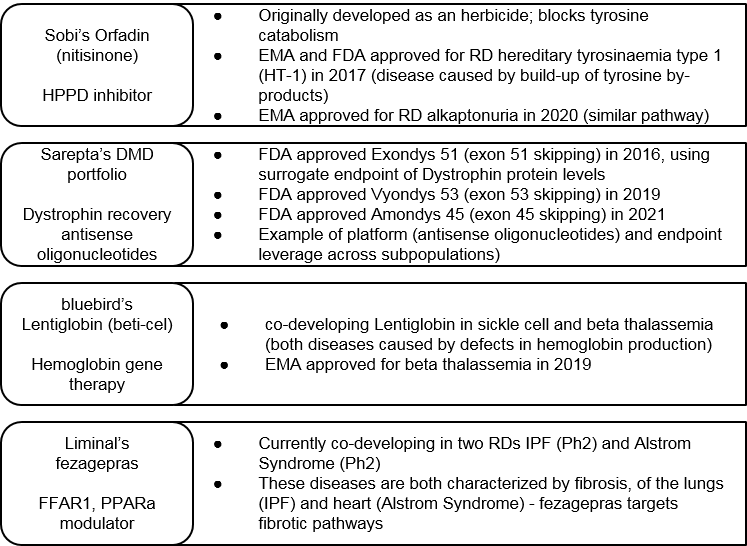

That said, the Constellation Approach can certainly deliver when successful. One recent example is Sobi’s Orfadin, which was successfully approved in two RDs with a similar molecular pathway defect. These approvals came only 3 years apart due to parallel development.

Sarepta is another example where a platform approach has led to three successful approvals for three unique products in various subpopulations of Duchenne’s Muscular Dystrophy (DMD) within just five years. Here we see success in both a specific novel platform (the antisense oligonucleotides) as well as gaining regulatory approval based on a set of novel surrogate endpoints.

More recently, we also see interest in this approach from a government-funded research perspective. Namely, the US National Institutes of Health (NIH) has made a request for proposals specifically for small companies to run basket trials for rare diseases3.

So, is there a “best of both worlds” approach? There can be, but it depends on the situation, including the manufacturer’s size and capabilities, as well as the external environment.

Blended Approaches: Taking a Stepwise Constellation Path with a “Known Quantity”

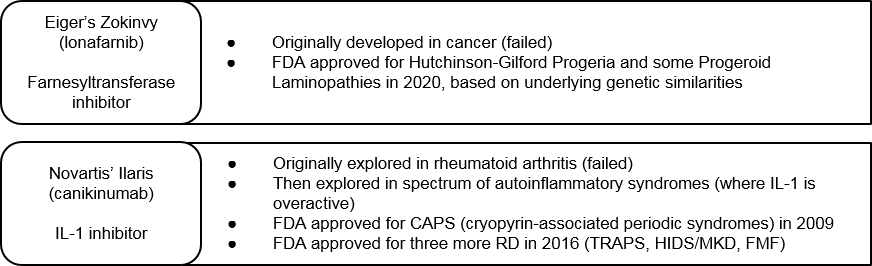

One de-risked variation on the Constellation approach is to take a broad development approach starting with an already clinically characterized product. Eiger’s Zokinvy and Novartis’ Ilaris are two examples of this. Both products failed in their original lead indications (cancer and rheumatoid arthritis, respectively) due to lack of sufficient efficacy. Eiger then pivoted Zokinvy to a suite of premature aging diseases with underlying genetic commonalities. They then successfully launched Zokinvy in multiple Progeroid diseases under the same label. Novartis’ Ilaris is an IL-1 inhibitor, so Novartis explored the drug in parallel across multiple RDs with overactive IL-1 pathways. It has launched in four separate RDs to date.

This blended approach makes good sense, but how does a drug developer recognize which “known quantity” drugs have the best RD constellation potential? Fully characterizing the eventual potential of a RD constellation requires a broad and deep landscape assessment, which can be challenging across the breadth of RD opportunities. To get there, RD developers can work through some or all of the following interrelated analyses:

- First Principles Approach: Choose either a target pathway or drug of interest. Then, endeavor to map possible molecular pathway interactions across the known universe of RDs. Where do we see shared unmet needs that can be addressed across different RDs? It is not always feasible to do this manually. However, increasing availability of broad basic research databases and tools to data mine them (e.g., computational platforms like the Schrodinger platform used by Agios during identification of IDH inhibitors ivosedinib and enasidenib) can make these evaluations more feasible.

- Landscape Opportunity Evaluation: For the suite of related RDs identified for a particular drug, or alternatively the set of RD suites identified (without a target drug yet), set up a valuation that accounts for patient population as well as competitive intensity and other landscape trends. This work can also feed into pricing strategy as the development program matures.

- Prioritization and Selection: Based on these opportunities, narrow the suite of RDs for the given drug, or select the RD suite to then go out and find or develop a targeted drug.

Conclusions and Application Beyond RD

The RD Constellation Approach may be based on broad approaches used in select other disease areas, but it is also expanding into new and exciting directions. For example, we see two recent examples of a Constellation approach that starts with an RD and then rapidly targets broader indications. One is Epizyme’s EZH2 inhibitor, Tazverik, which was first launched in a rare cancer indication (epitheloid sarcoma) and then subsequently in the much larger follicular lymphoma indication. Even more recently, Sanofi has announced that their first late-stage clinical readout for their BTK inhibitor rilzabrutinib in the RD pemphigus vulgaris, will be followed by development in blockbuster indications like asthma and atopic dermatitis.

Outside of RD entirely, we can also see interesting parallels with the recent success of the mRNA-based COVID-19 vaccines. This platform can now be rapidly used not just to develop annual boosters and / or variant-targeted versions of this vaccine, it is also delivering early promising data for an HIV vaccine as well as in cancer (i.e., cancer vaccines).

Given evolving technologies and improving understanding of underlying RD biology, we anticipate increasing use of Constellation approaches in the near future. We look forward to seeing how the knowledge and insights gained from these efforts become integrated into the drug development ecosystem, resulting in faster, more efficient development of new therapies.

References

- https://rarediseases.info.nih.gov/diseases/pages/31/faqs-about-rare-diseases

- Drug Repurposing for Rare Diseases. Roessler H, Knoers N, van Han Haelst M, van Haaften G. Trends Pharmacol Sci. 2021 Apr;42(4):255-267. doi: 10.1016/j.tips.2021.01.003

- https://grants.nih.gov/grants/guide/rfa-files/RFA-TR-21-010.html