In Part 1 of this series, we said that a “quiet revolution” has been taking place in central nervous system (CNS) therapies. While much attention has been focused on the dramatic advancements in oncology, companies large and small have been focusing more resources on CNS research, and the pace of advancement is accelerating. In that article, we also described a series of trends that are motivating this change.

Here, in Part 2, we provide some quantitative information that shows this resurgence in CNS investment activity. To illustrate the situation more clearly, we feature a few key examples of key deals that companies have done in the space.

The CNS Investment Environment

The CNS market is very important, with a high degree of unmet need. In 2016, for example, neurological disorders were the world’s largest cause of disability-adjusted life years (DALYs), at 276 million. Furthermore, neurological disorders were the second leading cause of death, trailing only cardiovascular disease.[i]

Due to this need, the CNS market is growing rapidly. Sales of prescription medications for CNS-related diseases were $86 billion in 2019 and are projected to top $101 billion and $131 billion in 2022 and 2025, respectively.[ii]

However, the development pathway for CNS therapies has been more challenging than for those in many other therapeutic areas. For the years 1999-2013, approvals for CNS medications took, on average, 12.8 months longer than those for non-CNS medications. Their average clinical success rate has also been lower than that of non-CNS drugs. For those CNS therapies that were first tested in human subjects from 1995-2007 (and followed through 2013), the success rate was only 6.2%. This was less than half the average rate for non-CNS drugs.[iii],[iv]

These challenges have created some interesting dynamics in the CNS investment environment. In particular, it has driven larger pharmaceutical companies to reduce their development risks by partnering with innovative biotech firms and academic institutions, often relying on them to lead the initial discovery and development work, moving in later once therapies have been sufficiently de-risked. As a result, business activity in the CNS space is heavily dependent on venture capital investment and mergers and acquisitions.

Overview of Investment Activity

Deal activity in CNS has been rising for at least five years and shows no signs of abating. The trend is upward not just in an absolute sense, but also relative to other therapeutic areas.

Looking back, deal volume (as measured by the total number of deals) during the 5 years from 2013 to 2017 was 60% greater than it was in the 5 years prior. Pain and Alzheimer’s therapies were among the top drivers.[v]

The number of dollars being invested also grew. During the five years from 2012-2016, the amount of capital invested in CNS grew by $1 billion, or 42%, over the previous 5-year period. This was 33% faster than the overall rate of venture funding growth during the same time period.[vi]

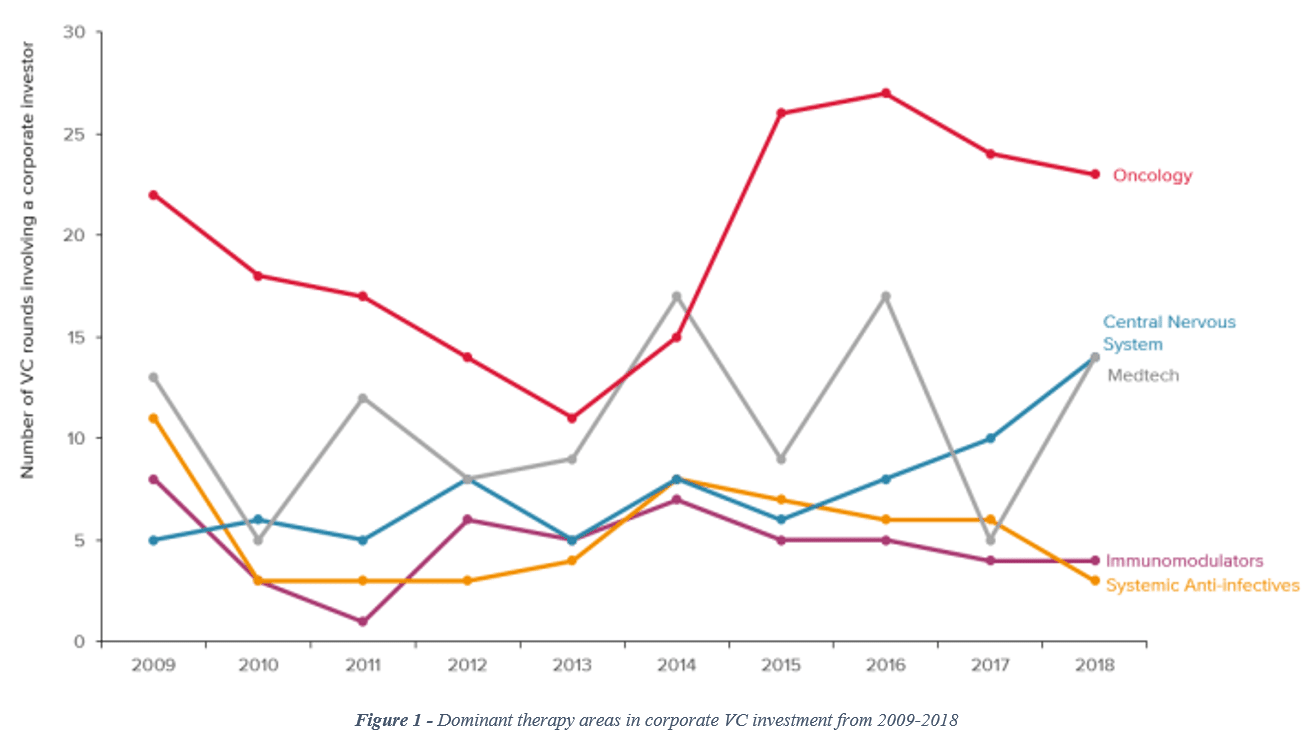

When considering the number of venture capital rounds involving a corporate investor, CNS has been tracking upward since 2016, bringing CNS to parity with medical technology and moving it closer to the leader (oncology) by the end of 2018 (see Figure 1).[vii]

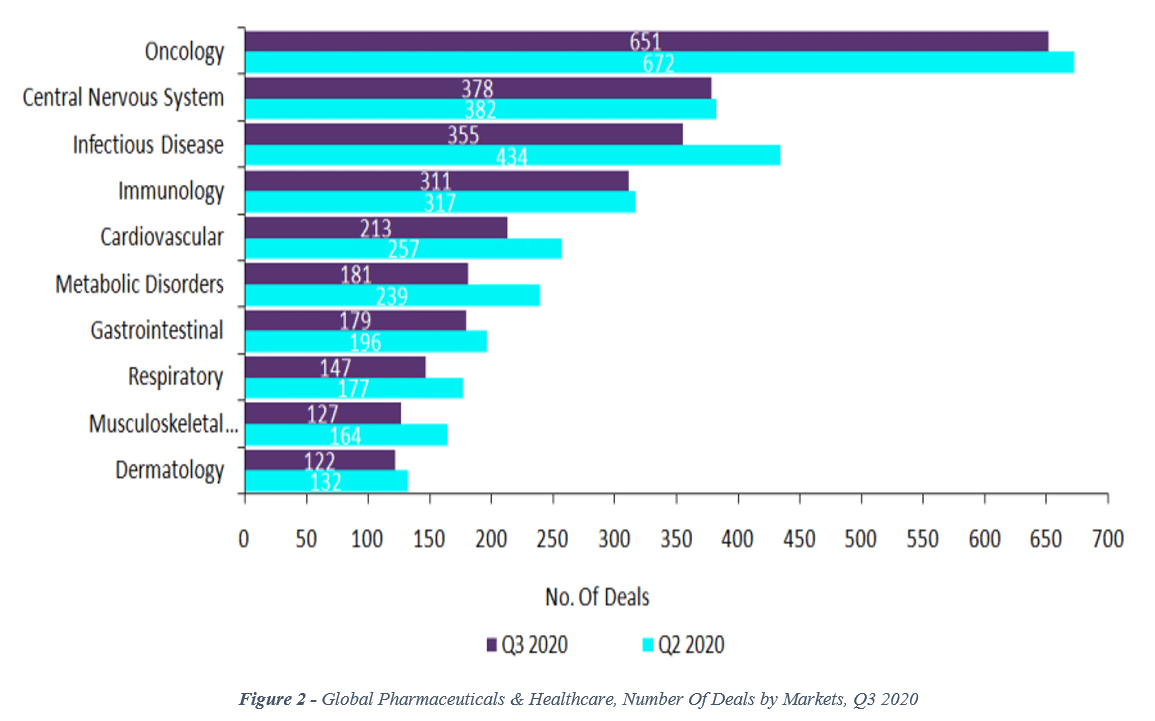

Since 2018, that trend has continued. More recently, data from the 2nd and 3rd quarters of 2020 show that CNS deal volume (number of deals) is now in 2nd place, behind oncology with 378 deals in the 3rd quarter (vs. 651 for oncology; see Figure 2).[viii]

Key Examples

Below, we describe a few deals that illustrate the broader trends we’ve highlighted. We’ve selected them because they fit nicely with some of the market dynamics described earlier.

2014 – Biogen and Eisai Partnership

This first example is relevant because it illustrates how companies are working together to spread out the risk and cost of developing CNS medications, specifically in Alzheimer’s disease.

In March of 2014, Biogen and Eisai entered into a partnership to co-develop treatments for Alzheimer’s disease. Initially, the agreement focused on two experimental therapies owned by Eisai with the option to commercialize two of Biogen’s drug candidates. The financial terms of the deal were not disclosed but it included an upfront payment from Biogen to Eisai, plus a fixed amount of development, approval, and commercial milestone payments.

In October of 2017, Eisai selected aducanumab as a product they would like to co-develop with Biogen. Currently seeking approval with the FDA, aducanumab has the potential to be the first disease modifying therapy in Alzheimer’s, as it is purported to reduce the accumulation of amyloid plaque, a potential cause of the disease. Both Biogen and Eisai will share the costs of developing aducanumab while also sharing profits with percentage splits dependent on the region of the world.[ix]

Although the FDA itself has been positive on aducanumab, an FDA advisory committee convened in November of 2020 was negative after reviewing data from phase 3 clinical trials. This puts into question the possibility of approval.[x]

2018 – Novartis Acquisition of AveXis

In a good example of a “Big Pharma” company purchasing a smaller firm leading to success, Novartis acquired AveXis in 2018 for $8.7 billion.[xi] Novartis made the acquisition primarily for AVXS-101, the first one-time gene replacement therapy for spinal muscular atrophy (SMA). It was approved in May of 2019 for patients less than 2 years old.

2019 – Alnylam and Regeneron Partnership

In April of 2019, Alnylam and Regeneron entered into a partnership to explore CNS and eye therapies focusing on several targets expressed in the liver using RNA interference (RNAi).[xii]

Regeneron is paying $1 billion total, including $400 million in up-front payments, $400 million in equity, and up to $200 million in near-term milestones during early clinical development for the CNS and eye programs. As we mentioned in Part 1, RNAi is a key technology whose application in CNS is driving a significant amount of innovation.

2020 – Roche and Dyno Therapeutics Partnership

This past October, Roche agreed to pay Dyno Therapeutics up to $1.8 billion for CNS and liver-directed therapies for licensing and collaboration using Dyno’s CapsidMap platform.[xiii] The platform can identify novel adeno-associated virus (AAV) capsids.

Dyno will design the novel AAV capsids while Roche (and Spark Therapeutics) will use them for preclinical trials (with the ultimate goal of commercialization). The use of AAVs is another technology that has been helping to drive the “quiet revolution” in CNS.

2020 – Eli Lilly and Precision Bio Partnership

In November, Eli Lilly partnered with Precision Biosciences to develop gene therapies using the ARCUS platform. The focus will be on Duchenne muscular dystrophy and two other undisclosed targets.

Eli Lilly will pay Precision $100 million up-front and make a $35 million equity investment. $420 million in future milestone payments per product, with 6 products all in all bringing the total deal potential to $2.655 billion.[xiv]

2020 – UCB Acquisition of Handl Therapeutics

This deal is a good example how a large pharma company can use an acquisition to help grow its own CNS arm. In November of this year, UCB acquired Handl Therapeutics, a company focused on AAV gene therapies for neurodegenerative diseases.[xv]

2020 – ATAI Life Sciences

Also this year, Peter Thiel (of Facebook and PayPal fame) has joined a syndicate that’s putting $125 million into a company with a portfolio of psychedelic drugs in the clinic for mental health.[xvi]

The company, ATAI Life Sciences, is studying psychedelic and non-psychedelic approaches for depression, anxiety, and addiction. This investment into ATAI resulted in a valuation of greater than $1 billion. This firm embodies one trend we highlighted in Part 1: The willingness to study “taboo” drugs for therapeutic uses.

Looking Ahead

The CNS space is growing at a rapid pace, as evidenced by the increase in deal volume and the rising average value of those deals. Investments, partnerships, and merger deals form a core part of the business as large pharmaceutical companies rely heavily on academic organizations and smaller, more nimble biotech firms for innovative new therapy candidates. Recent deal activity demonstrates this reality, as these investments help advance AAV, RNAi, gene therapy, and other technologies in CNS applications.

To this point, we’ve spent a fair amount of time looking backward to understand how the CNS environment has been evolving in recent years. In our third and final installment, we’ll take a look ahead, making some predictions for 2021 and perhaps beyond.

References

[i] Feigin, V.L. (2016) Global, regional, and national burden of neurological disorders, 1990–2016: a systematic analysis for the Global Burden of Disease Study. The Lancet Neurology

[ii] “A view into the central nervous system disorders market.” Biopharma Dealmakers. Sept. 1, 2020, https://www.nature.com/articles/d43747-020-01119-8

[iii] Gribkoff V.K., Kaczmarek L.K. (2017) The need for new approaches in CNS drug discovery: Why drugs have failed, and what can be done to improve outcomes. Neuropharmacology. July 1, 2017

[iv] Kaitlin KI (editor). (2014) CNS drugs take longer to develop, have lower success rates, than other drugs. Tufts CSDD Impact Reports. Vol. 16., pp. 1-4. Tufts University, Tufts Center for the Study of Drug Development

[v] Munro J, Dowden H. (2018) Trends in neuroscience dealmaking. Biopharma Dealmakers. Nov. 12, 2018

[vi] Booth B. (2017) Investors venture boldly into neuroscience. Forbes. Sept. 21, 2017, https://www.forbes.com/sites/brucebooth/2017/09/21/venturing-boldly-into-neuroscience/?sh=7201746a3c0e

[vii] Gardner J. (2019) Like the rest of biopharma investors, corporate VCs love oncology. Evaluate Vantage. Feb. 21, 2019

[viii] GlobalData, Pharma Intelligence Center, Deals Database, 3rd quarter, 2020

[ix] La Motta L, Eisai shows confidence in Biogen’s Alzheimer’s drug, Biopharma Dive, Oct. 23, 2017, https://www.biopharmadive.com/news/eisai-shows-confidence-in-biogens-alzheimers-drug/507899/

[x] Park A. (2020) The most promising alzheimer’s drug in years took a thrashing from an FDA advisory committee. Time. Nov. 10, 2020

[xi] Novartis enters agreement to acquire AveXis Inc. for USD 8.7 bn to transform care in SMA and expand position as a gene therapy and neuroscience leader. Novartis Company Press Release, Apr. 9, 2018, https://www.novartis.com/news/media-releases/novartis-enters-agreement-acquire-avexis-inc-usd-87-bn-transform-care-sma-and-expand-position-gene-therapy-and-neuroscience-leader

[xii] Terry M., Regeneron and Alnylam Ink $1 Billion Eye and Central Nervous System R&D Deal, BioSpace, Apr. 8, 2019, https://www.biospace.com/article/regeneron-and-alnylam-ink-1-billion-eye-and-central-nervous-system-r-and-d-deal/

[xiii] Keown A., Dyno Therapeutics Strikes AAV Deal with Roche worth up to $1.8 Billion. BioSpace, Oct. 14, 2020, https://www.biospace.com/article/dyno-therapeutics-forges-gene-therapy-collaboration-with-roche-worth-up-to-1-8-billion/

[xiv] Gelman M. In an apparent R&D about-face, Eli Lilly partners with Precision Biosciences on genome editing in a deal worth up to nearly $2.7B. Endpoints News, Nov. 20, 2020, https://endpts.com/in-an-apparent-rd-about-face-eli-lilly-partners-with-precision-biosciences-on-genome-editing-in-a-deal-worth-up-to-nearly-2-7b/

[xv] Taylor N,P. UCB inks Handl buyout to boost nascent gene therapy unit. Fierce Biotech, Nov. 12, 2020, https://www.fiercebiotech.com/biotech/ucb-inks-handl-buyout-to-boost-nascent-gene-therapy-unit

[xvi] Carroll J. Tech Billionaire Peter Thiel backs a leading psychedelic drug developer. EndPoints News, Nov 23, 2020, https://endpts.com/tech-billionaire-peter-thiel-backs-a-leading-psychedelic-drug-developer/