Current Scenario: Challenges, Opportunities, and Critical Success Factors

The current situation regarding COVID-19 is alarming. At the time of publication, infection and death rates are continuing to rise rapidly in the United States, Spain, Switzerland, and many other European countries. In other countries like China, Italy, and Germany the situation appears to be resolving, but significant numbers of patients are still impacted. Beyond the direct impact of the disease, the indirect effects of government mitigation strategies (e.g., school closures and “stay at home” policies) are severe.

In the US, unemployment claims are now higher than at the peak of the 2008 economic crisis. Worldwide, those workers who remain employed are adjusting to new ways of working (e.g., remote working, no travel) and nearly all children are home full-time due to school closures. Parents with school-age children must now balance some degree of home education along with their existing work and family responsibilities.

Within the healthcare landscape, the pressure of COVID-19 infection is already intense at hotspot locations, and more broadly the entire system is bracing for a significant impact of unknown magnitude. “Non-essential” procedures and treatments are being cancelled or postponed, yet the lack of a codified criteria for what is “essential” have left healthcare providers (HCPs) and patients navigating a grey area of uncertainty on what type of care should be sought, especially in the context of risking COVID-19 exposure by going to the doctor’s office, hospital, etc.

In addition to the broader pressures on their workforces from shifting to a Work From Home (WFH) model for an uncertain duration, pharma companies are experiencing specific challenges related to R&D and commercialization. Workers cannot access the labs, clinical trials are paused, and both HCPs and patients navigate the uncertainties associated with COVID-19.

Fortunately, the news is not all dire. We are already seeing incredible amounts of innovation and community support as individuals and corporations collaborate to accelerate COVID-19 treatments as well as ensure continuity of care for non-COVID-19 conditions.

In addition, the challenges we see exposed now within the drug development and healthcare system are also opportunities for improvement where biopharma companies can solidify their leadership positions. These include direct fixes as well as exploration of new models like remote engagement with customers, telemedicine, increased reliance on real-world data for both clinical development and regulatory decision-making, and direct delivery of medications leading to better access and compliance for patients.

We are hopeful that the challenges exposed within healthcare will also lead to improved models for HCPs – better training, better recruitment and retention strategies, and compensation commensurate with their value not just for MDs but nurses, home health aides, etc. And more generally, there may be an increased focus on preventative care and wellness at the individual level which will not only curtail the spread of COVID-19 but increase overall health and benefit patients over the longer-term.

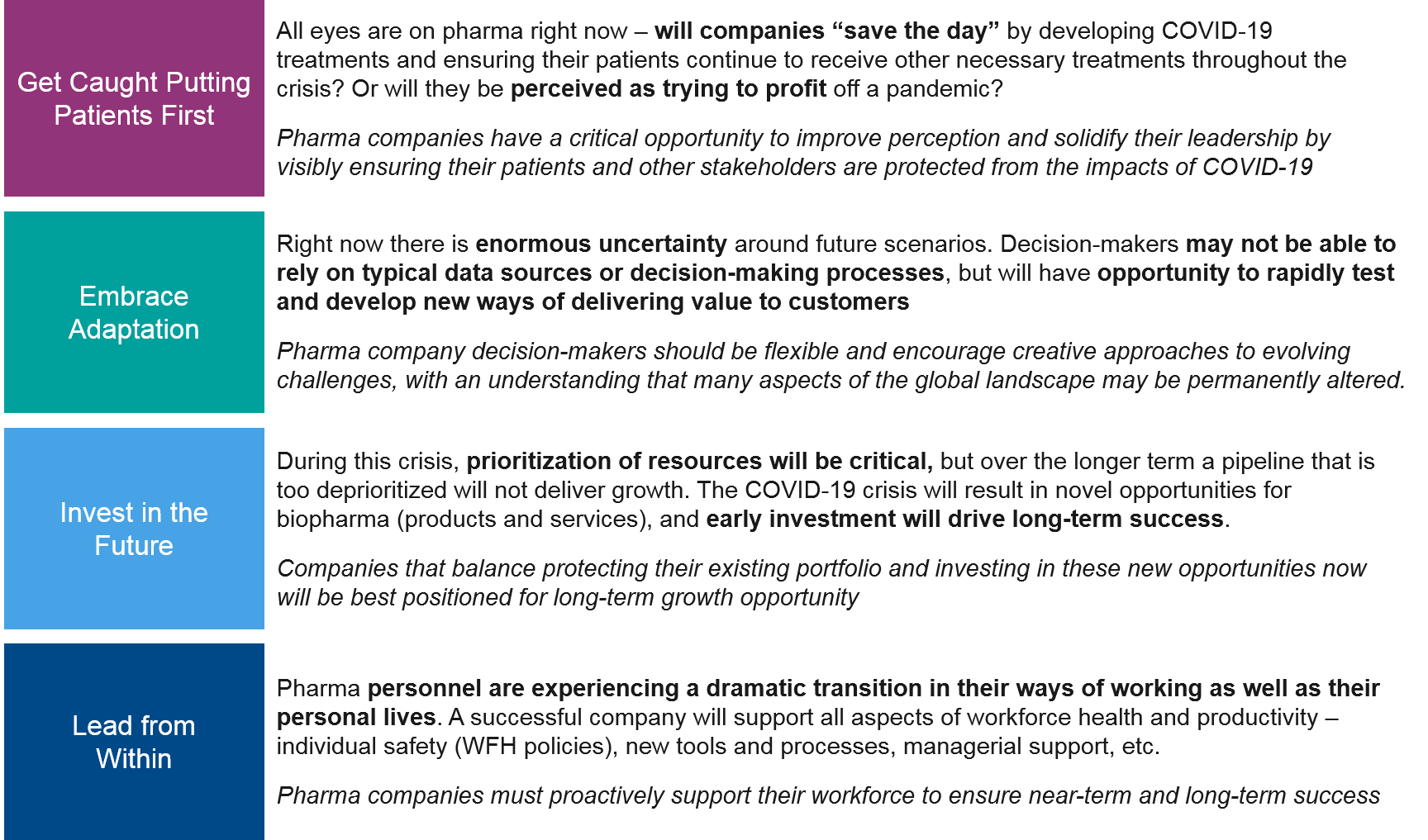

For pharma companies, we recommend several critical success factors to weather this storm and emerge with long-term growth opportunities.

Key Uncertainties and Pharma Stakeholders Impacted

To prepare for the near-term and more extended future impact on the pharma business, we must consider the key uncertainties that define future scenarios:

- Immediate disease impact: What will be the near-term trajectory and magnitude of the COVID-19 impact? For example, will we successfully “flatten the curve” or will healthcare systems be overwhelmed with increased mortality rates as a result?

- Immediate mitigation strategy impact: What will be the degree and duration of mitigation strategies that severely impact the pharma workforce, patients, and other stakeholders? Examples include school closures, “stay at home” or quarantine policies, closures of “nonessential” businesses, and so on.

- Ongoing disease / mitigation strategy impact: After the first wave of disease calms, will future outbreaks occur? Will mitigation strategies need to be long-term or staggered in order to manage ongoing outbreaks?

- Vaccine / treatment development: When will successful vaccines and / or treatments be developed? When will they be scalable enough to release the population from mitigation strategies?

At this relatively early stage in the pandemic and societal response to it, it is difficult to quantify the likelihood of specific scenarios. Instead, we will discuss the range of likely impacts and implications for key stakeholders and standard processes within the pharma landscape, including recommendations for pharma companies that will help prepare for this broad range of possible outcomes.

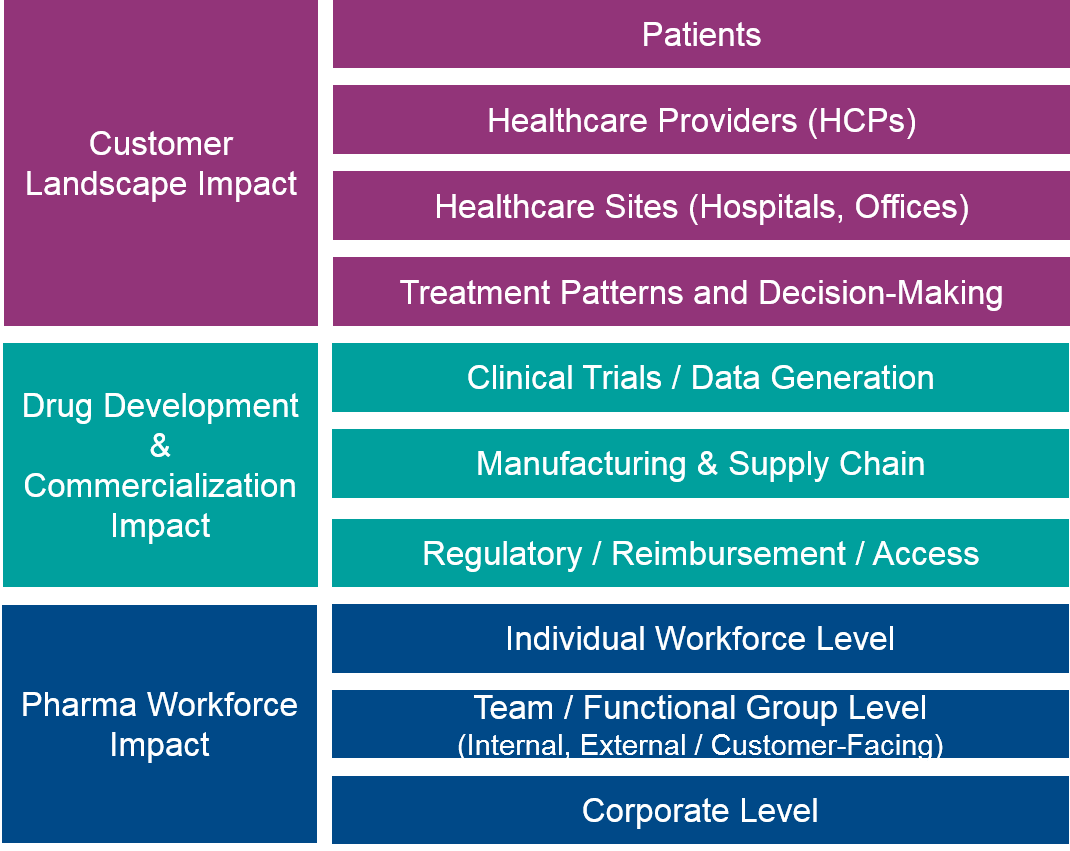

Customer Landscape Impact: Patients, Healthcare Providers, Healthcare Sites, Treatment Patterns

Patients

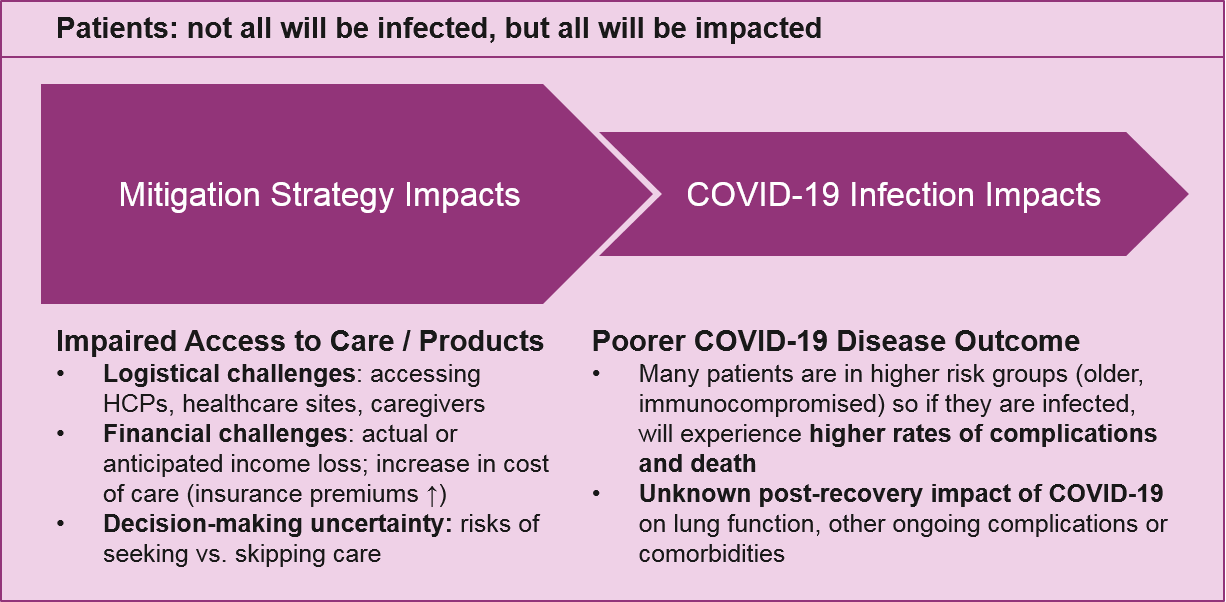

During this pandemic, we are all potential COVID-19 patients. But even during this acute crisis, individuals who were already managing both chronic and acute conditions will still require healthcare. We will use the term “patients” for these pharma customers throughout the rest of this discussion.

The broadest impact of COVID-19 on patients will be from mitigation strategies, which will potentially affect not just patients but everyone (HCPs, the pharma workforce, and others, as discussed later). As local governments announce school closures, non-essential business closures, and “stay at home” decrees for weeks and possibly longer, patients will immediately face a series of challenges:

- Decision-making uncertainty: Is my planned treatment / procedure “essential” or should I cancel it? What is my personal risk of contracting COVID-19 if I venture out to access it, or my community risk of potentially spreading it? If I can’t access or afford my medication, should I stop it, or cut the dose in order to make it last longer? If I can’t talk to my doctor, how do I decide?

- Logistics: How do I access my planned treatment or procedure if the office is closed, or if my care provider is unavailable? What if every time I go to the pharmacy it’s too crowded or my prescription is sold out? What if I need urgent care but the hospital is overwhelmed with COVID-19 cases?

- Financial: If I have lost my income or expect to lose it soon, can I afford my treatment? With limited income, which treatments are most important? It’s important to note that this impact varies significantly by country depending on government support and healthcare structure. In the US, the burden on patients will be extremely high.

Decision-making uncertainty will be a major stressor on patients, because they will likely have reduced access to their main doctor and will therefore either delay the decision or turn to other sources, including telemedicine, their own networks, and disease advocacy groups.

“Stay at home” or quarantine requirements will also dramatically impact patients who rely on caregivers for support – not just physical but emotional. It will be particularly hard for patients who have impaired mobility and / or live alone who cannot see their caregiver due to risk of infection. In the US, a specific subset of patients may also have close relationships with pharma company teams who help them navigate their treatment. They may be unable to engage in the same way they are accustomed to, given travel and social distancing requirements and evolving responsibilities.

It is very likely that telemedicine and other communication technology tools will emerge as the key trend in addressing these issues. The challenges for telemedicine will be that it is not yet easily accessible to all patients and over time, as HCPs get pulled into COVID-19 care, there may be fewer doctors available for telemedicine. The US is already relaxing rules on HCPs practicing across state lines in order to boost access to telemedicine. Disease advocacy groups will also no doubt rise to the occasion to provide comfort and guidance to patients, and pharma will have an opportunity to support information quality in this setting.

In addition to these challenges, some proportion of patients will also get infected with COVID-19. Many of them will already be in higher-risk groups (older adults, the immunocompromised, etc.) and therefore face a higher risk of complications and death. Depending on the eventual number of COVID-19 infections, we may see a significant impact on future market size for indications that include these higher risk populations. It is also unclear to what extent the long-term impact of COVID-19 infection will be in those who do recover, e.g., impaired lung function, which may predispose or exacerbate other underlying conditions.

Implications for Pharma: Unless they are developing COVID-19 treatments, pharma companies have limited opportunity to address the direct impact of COVID-19 infection on patients. But all pharma companies have an opportunity to assist patients through the mitigation phase and therefore support future market success by:

- Proactively providing appropriate information and guidance regarding product use

- Smoothing logistical challenges towards product access

- Offering financial assistance to ensure patient access in the US and elsewhere as needed

Healthcare Providers (HCPs)

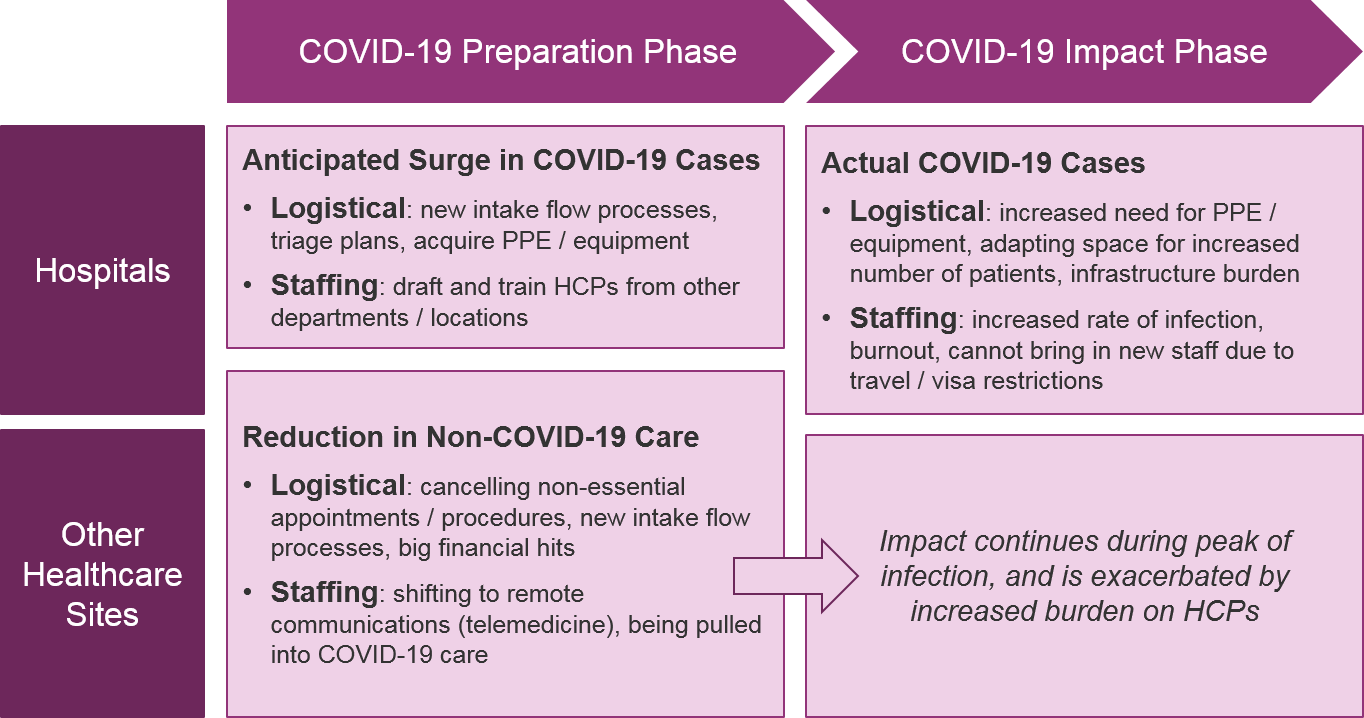

While timelines will vary by geography, all HCPs will face first a preparatory phase and eventually a direct impact phase from COVID-19. For those geographies not already experiencing high rates of COVID-19 infection, HCPs are preparing by:

- Handling “non-essential” or elective procedures / treatments – expediting to get them done ASAP or postponing / canceling them

- If not already working on the “front lines” of hospital ICUs, preparing to leave their current practice / specialty and be pulled into hospital-based COVID-19 care

- Participating in institutional preparation for COVID-19 – defining triage procedures, acquiring supplies, preparing training for inexperienced HCPs

- Shifting in-person interactions to virtual – both for patients but also discussions with other doctors, e.g., tumor boards

Many geographies are already experiencing the direct impact phase. This includes significant personal impact on HCPs as they focus on providing care for COVID-19 patients, deal with immense amounts of stress and fear regarding their own health and that of their families, and ultimately become sick themselves due to lack of sufficient personal protective equipment (PPE).

When institutional guidance is not yet in place, HCPs will also have to make individual decisions about how to prioritize time and equipment (e.g., use masks with an immunocompromised patient now, or reserve for anticipated COVID cases later). This will contribute to stress and burnout.

Implications for Pharma: During the acute phase of this crisis, HCPs will likely not welcome direct contact from pharma companies on any topic, with the possible exception of informing them what support pharma is providing to their patients. Existing models for sales force engagement, Ad Boards, market research, and clinical trial sponsorship will need to evolve accordingly.

Healthcare Sites (Hospitals, Clinics, Offices)

Healthcare sites will experience the same two phases of preparation followed by actual COVID-19 impact. And like patients, mitigation strategies occurring during both phases will strongly impact them, logistically and potentially financially.

The definition of “essential” vs “non-essential” procedures continues to evolve, but criteria will typically include the urgency of the procedure, the health of the patient, and possibly the resource requirements of in-hospital stays. Cancer care poses a particular dilemma for defining essential vs non-essential. This is because many types of cancer treatments lead to immunosuppression, which is a risk factor for COVID-19. We are already seeing HCPs and patients consider delaying certain cancer treatments (or switching to less immunosuppressive ones, like targeted therapies) due to perceived risk of COVID-19.

Hospitals and other healthcare sites must adapt their intake and triage processes to be safer in case of COVID-19 presentation, e.g., patients phone the office from their parked car and wait to be called in, intake checklist for COVID-19 symptoms, increased cleaning of common areas, etc. In the US, where financial impact can translate into staff reduction, the burden will be escalated as fewer personnel are available to manage these new workflows.

Hospitals will also have an increased requirement for PPE and specialized equipment for COVID-19, all of which are already experiencing shortages. As COVID-19 cases increase, healthcare sites must be prepared to triage and prioritize how equipment is used, both for staff protection as well as patient necessity. The limits on PPE and equipment will negatively affect quality of care for all patients, as well as endanger HCPs.

As the COVID-19 infection rates increase, the hospitals will need more HCPs, and will likely start pulling from other departments of the hospital and potentially offsite specialists. This will require investment in training and will have the secondary impact of delaying care for non-COVID-19 patients. It will unfortunately be difficult to bring in HCPs from more distant locations (even if they are willing) given travel and visa restrictions.

Finally, in the US and other geographies where healthcare sites derive revenue from care, the dual impact of loss of revenue from other procedures as well as net loss from costly COVID-19 treatments will negatively impact their business. This will impact other healthcare sites (outpatient clinics, doctors’ offices, etc.), as well where “non-essential” appointments will decrease significantly.

Implications for Pharma: Pharma can support healthcare sites indirectly by supporting patients and HCPs who are managing the transition away from their usual care. This can include patient outreach and education and supporting access to medications both logistically and financially.

Treatment Decision-Making and Practice Patterns

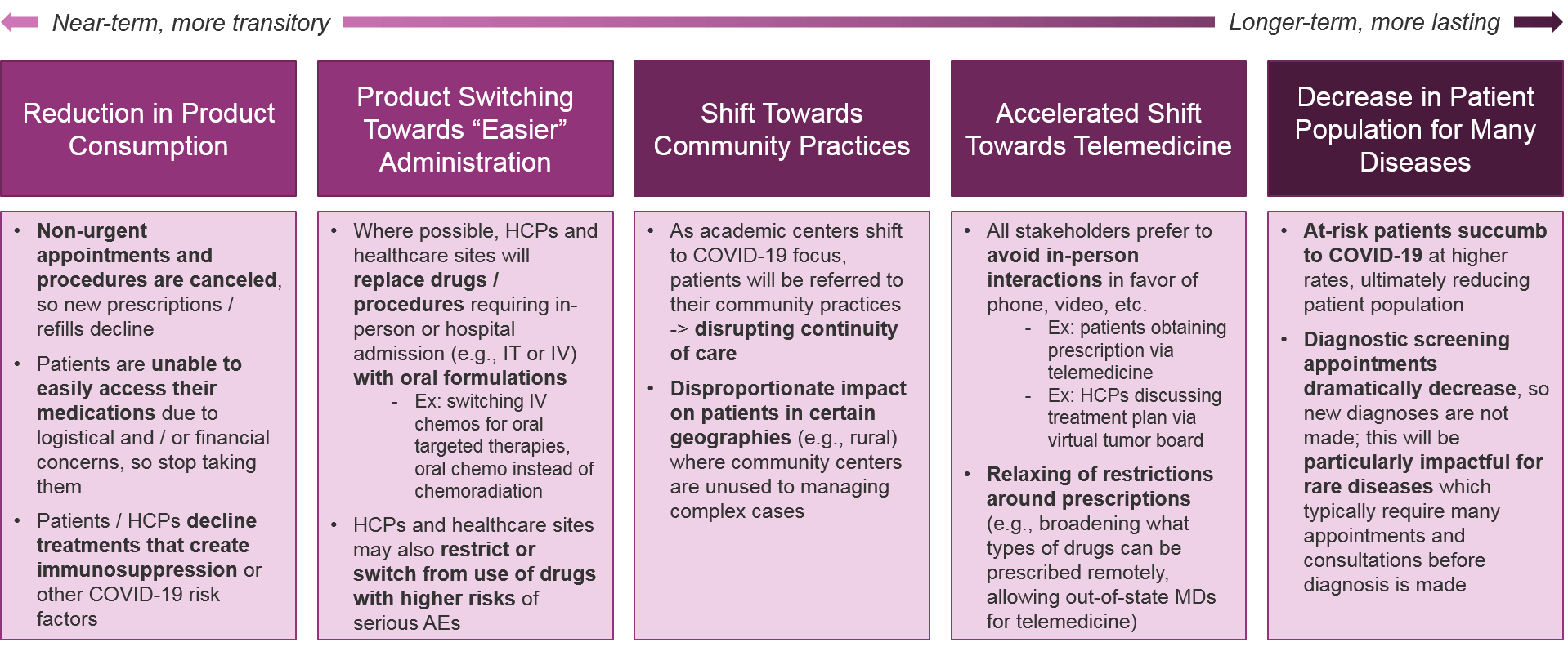

Taken together, the COVID-19 impact on patients, HCPs, and healthcare sites will have enormous effects on overall treatment patterns. We anticipate the following key trends:

Implications for Pharma: Pharma will be challenged by the overall reduction in product consumption, as well as potentially challenged by product switching (or alternatively, may benefit depending on the drug). However, telemedicine and other remote communication tools will ultimately streamline diagnoses and prescriptions for both academic and community practices, so pharma companies should support and enable these tools as possible. Pharma companies should also consider how recovered COVID-19 patients may require adjustments or new treatments (e.g., due to reduced lung function).

Drug Development & Commercialization Landscape Impact: Clinical Trials, Manufacturing & Supply Chain, Regulatory / Reimbursement / Access

Clinical Trials

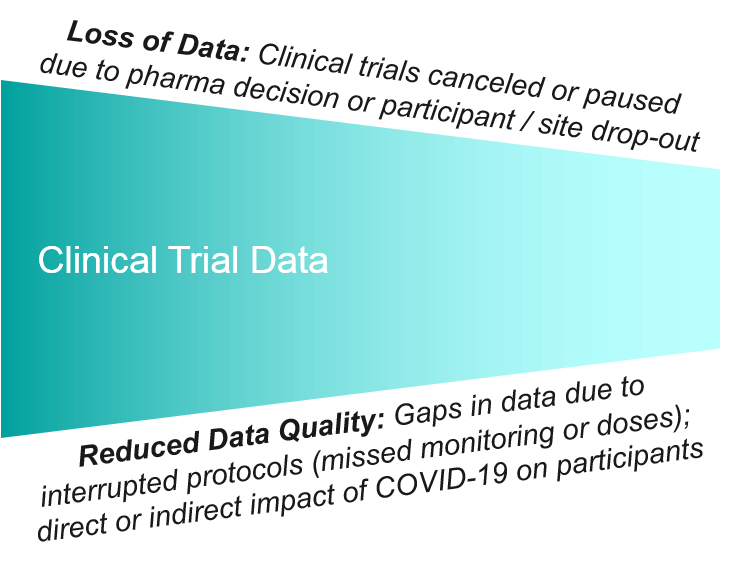

The FDA and other regulatory bodies have released guidance that clinical trials must guarantee participant safety and must halt enrollment / participation if those conditions are not met. We are already seeing pharma companies making the pre-emptive decision to hold, sponsors restricting access in order to preserve healthcare sites for COVID-19, and patient participants who no longer want to risk exposing themselves to COVID-19 in order to access an experimental medication. In the US, clinical trial participation can also be costly depending on an individual’s travel requirements and existing insurance coverage, so the financial impact of job loss due to COVID-19 will also impact participation over the longer term.

Pharma companies are already exploring mechanisms to adapt trials in ways that increase participant safety while still maintaining sufficient data quality. This can include switching to remote monitoring strategies (e.g., wearable devices) and switching to remote delivery of the product when it is safe and feasible to do so (e.g., having an experimental oral medication sent by mail rather than received at the trial site). These strategies will help keep some trials open, but they are not possible for all interventions. For example, some trials designs require in-person monitoring, and some drugs are not safe or feasible to provide remotely.

The impact on data amount and quality will be significant. There will major gaps in data from participant / site drop-out, and the data that is collected will have the unforeseen variable of the ongoing COVID-19 crisis. It may be that some trial datasets are not salvageable and will have to be restarted after the acute phase of the crisis passes. This will be costly not just financially but in terms of patient and sponsor confidence in the pharma company’s ability to execute.

Beyond clinical trials, post-approval or real-world data studies will be impacted as well, both generally by the effects of COVID-19 on the participant population, and more directly by the same limitations on data gathering as clinical trials.

Implications for Pharma: Pharma companies should proactively adapt their clinical trials as possible to ensure they can safely remain open. If not, they must determine if / how the existing data can be used, and whether the trial can be reopened or must be scrapped and restarted. Pharma companies should also explore alternative methods of data collection such as wearable devices, apps for self-reported outcomes, and secondary sources such as chart pulls and EHR.

Manufacturing / Supply Chain

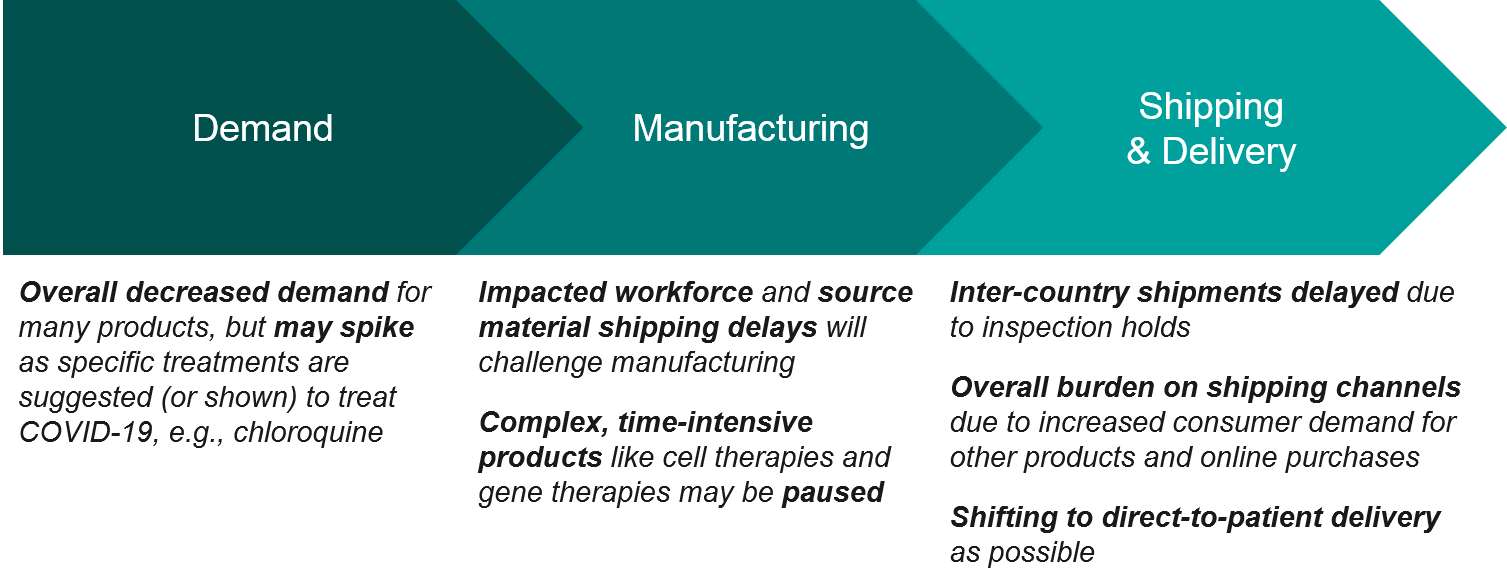

Getting products made and delivered to healthcare consumers is a crucial part of the commercialization model and pharma companies have varying degrees of control over different aspects of the supply chain.

Beginning at the demand side, we expect a relatively steady decline in demand for “non-essential” products, but also drops and surges in demand as existing or repurposed drugs are highlighted as contraindicated or potential treatments for COVID-19. We have already seen this with ibuprofen being temporarily recommended against for COVID-19, and with the chloroquine-based drugs showing some initial promise for treatment. This led to a run on prescriptions and now lupus and rheumatoid arthritis patients are no longer able to access their treatments. Obviously, a manufacturer cannot predict or necessarily control these swings in demand, but they must adapt in order to ensure continuity of care for existing patients. And should one of these repurposed drugs eventually succeed as COVID-19 treatment, manufacturers must be prepared to massively scale up operations.

From the supply end, we are already seeing impact on manufacturing as workers face logistical challenges in getting to work. For example, in India the recent national lockdown has led to an anticipated drug shortage as public transportation shutdowns means workers cannot get to manufacturing sites. Particularly for time-intensive and complex products like cell therapies and gene therapies (that are also manufactured at a relatively small scale), it may eventually become necessary to pause manufacturing through the acute phase of this crisis, and these products may be paused. That said, we are already seeing China manufacturing plants come back online, so we are hopeful that direct manufacturing impact will be relatively short term and staggered as different geographies experience COVID-19 peaks at different times.

Once the product is manufactured it must be shipped, and for those products that are being sent between countries they are subject to delays due to inspections and shipping restrictions. In the US most manufacturing is in-country so this less of an issue, but still the overall burden on shipping to prioritize COVID-19 supplies and other essentials means that other pharma shipments may be deprioritized and delayed. The overall shipping and distribution system is also under an unusually high burden as the general population is buying large amounts of certain goods and also preferring direct delivery to store pick-up.

A final challenge will be getting product to the patient recipient, as product administration models will be shifting (away from hospital-based to other healthcare sites, for example), and from pharmacy pick-up to direct-to-consumer (mail-based) as possible. We may also see rerouting for some products via specialty pharmacies.

Implications for Pharma: Pharma companies must be adaptive and creative with solutions to manufacturing and supply chain challenges, including flexibility with distribution strategies to shift access requirements away from overburdened healthcare sites to more direct to consumer models (e.g., pharmacies, mail-based).

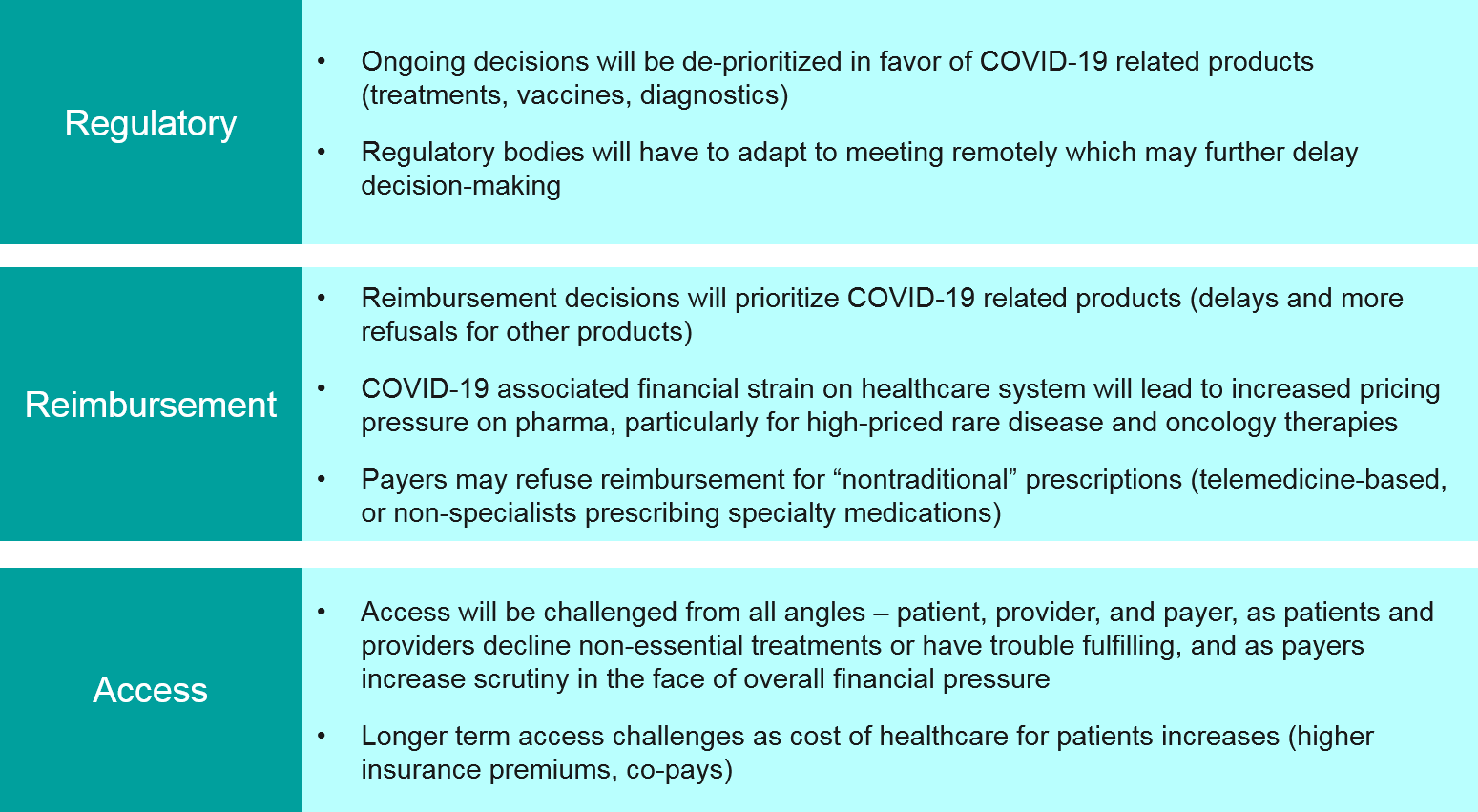

Regulatory, Reimbursement, Access

Simply put, regulatory decisions for non-COVID-19 treatments will almost certainly be significantly delayed as review bodies can no longer meet in-person and must use their limited capacity to focus on COVID-19. Over the longer-term, regulatory bodies must also consider how to assess clinical trial and real-world datasets impacted by COVID-19, and to what extent they will accept modified protocols and certain types of gaps in data.

For already approved products, payer reimbursement decisions will be similarly delayed and COVID-19-focused. As the overall financial pressure on the healthcare system increases due to COVID-19 cases, there could be much greater scrutiny on high cost treatments in oncology and rare diseases, and possibly refusals. Pharma companies may need to reframe their value arguments to ensure access.

As HCPs explore new models to safely engage with patients, e.g., prescribing medications based on telemedicine, or non-specialists prescribing specialty medications, we may also see pushback from payers on reimbursement for certain products.

Finally, in the US we will almost certainly see big increases in insurance premiums and co-pays as payers pass the increased cost of care back towards individuals. This will impact access as patients may lose their insurance or decline medication due to cost.

Implications for Pharma: Pharma companies must focus more than ever on the value propositions of their products, and proactively communicate with regulatory bodies and payers about concerns and how best to address them. Pharma companies must also consider strategies to make up for lost time in data analysis, filing, etc.

Pharma Impact: Individual Workforce, Team / Functional Group, Corporate

Individual Workforce Level

The impacts of COVID-19 mitigation strategies and actual disease impact will be very similar to those discussed in the “Patient” section. These individual challenges will impact the overall business:

- General stress and burden due to increased community and family responsibilities (e.g., “sheltering in place”, kids home from school) leading to decreased work output

- Decision-making challenges and delays due to learning curve on remote communication tools and strategies

- Remote communication strategies may contribute to interpersonal challenges as face-to-face discussions are no longer possible

- Severe impact on work output for all personnel who rely on in-person interaction (e.g., sales teams) who therefore cannot engage in their core work function

- Additional stress on those personnel who are in “essential” functions and must still come in to work, e.g., perceived risk of COVID-19 exposure through the workplace, inability to help out at home

- Increased individual workload as personnel become sick with COVID-19 and remaining workforce must fill in

Most pharma personnel are quite reliant on in-person interactions to do their jobs, including staff meetings and conferences but also externally with HCPs, Ad Boards, etc. Therefore, the WFH / travel restrictions will have a particularly large burden.

Implications for Pharma: Pharma companies have an opportunity (and responsibility) to support individual personnel through the COVID-19 crisis by putting processes and tools in place to keep them safe and productive. This will include flexibility in transitioning to WFH models where possible, setting reasonable expectations and communicating them to managers and individual contributors, and providing not just technology tools but also guidance in how to work effectively in remote teams. Pharma companies focused on long-term success will not punish individuals for temporary lapses in productivity due to the COVID-19 crisis but instead focus on supporting them towards eventual success in this new work environment.

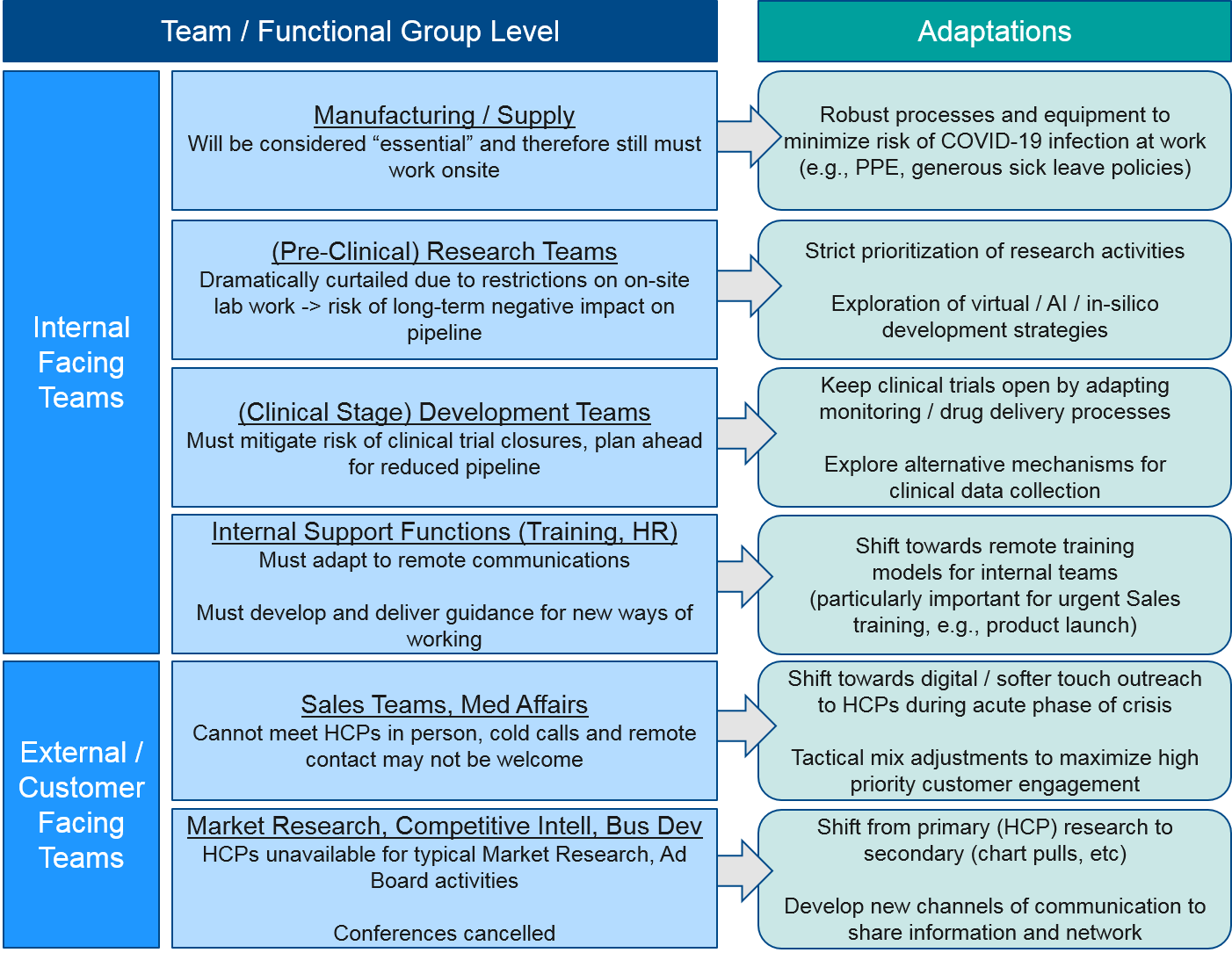

Team / Functional Group Level

Before and during the peak of the COVID-19 crisis, pharma companies will need to adapt at the team or functional group level in order to meet customer needs. Both internal and external-facing functions will be particularly impacted by the restrictions on in-person meetings. The customer-facing functions will need to adapt to entirely new ways of customer engagement in order to succeed in this new environment.

Both internal-facing functions and external / customer-facing functions will be severely impacted by the new ways of working under COVID-19 mitigation strategies. During the near-term acute phase, nearly all personnel will be working from home, with no work travel. For those personnel that are “essential” (e.g., manufacturing, certain research functions), new processes must be put in place to protect them from COVID-19 exposure. For those who are switched to WFH, over time these restrictions will relax, but it seems unlikely that any large or international meetings will occur within the next few months and possibly for much longer.

For research teams who work in the labs, their work will be dramatically restricted to analysis of existing data and any in-silico or modeling work they can do remotely. While “essential” research work is still permitted, there will still be potentially significant longer-term effects on pipelines. For clinical-stage development teams, the major risk to their work is the closing of clinical trials, so their challenge will be to mitigate that risk by adapting protocols and procedures to protect patients and HCPs involved in the trials.

Other internal-facing teams like Training, HR, and various analytic functions must adapt to remote working but also develop new strategies and tactics to work with other teams who rely on their functions.

For external-facing teams (Market Research, Sales, Medical Affairs), that rely on customer interaction, the impact will be significant. HCPs will no longer be available for in-person or even remote interactions, so Market Research activities must adapt to more secondary strategies, and Sales / Med Affairs teams must also develop new ways of customer engagement that respect the enormous burden HCPs are under during the COVID-19 crisis.

Similarly, other external-facing teams (Competitive Intelligence, Business Development) will be hampered by conference cancellations which are typically the major channel for information flow and networking. These teams will have to develop new ways of working with and outside their company.

Implications for Pharma: In addition to supporting functional groups through the initial acute phase of the COVID-19 crisis, pharma companies must consider longer-term organizational design adjustments to meet the new external landscape. Much is still in flux, but it quite likely that remote and virtual engagement models will persist, and that customer-facing tactical mix must be adapted accordingly.

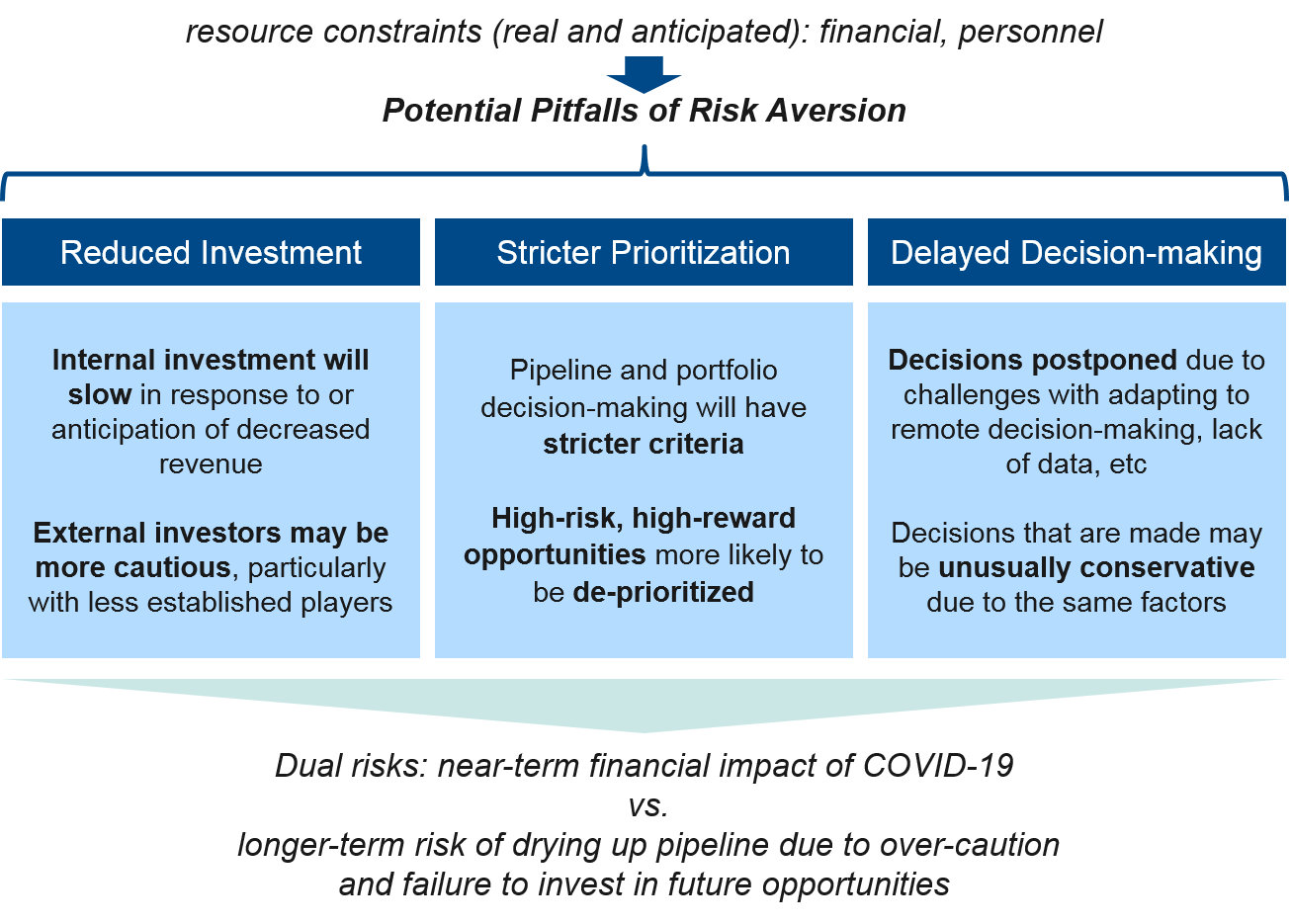

Corporate Level

At the corporate level, pharma companies will be significantly impacted by the internal challenges to individual workforce and functional teams described above, as well as by pressures from the external landscape. Corporate decision-making must carefully balance the dual priorities of protecting the business in the near-term as well as ensuring future success by appropriately investing in new opportunities. Given the uncertainties of the COVID-19 crisis, it may be tempting to operate with risk mitigation as the primary criteria (e.g., focus on cutting costs, pruning the pipeline), but there is also an opportunity to take advantage of the overall pause in the system (e.g., delayed trials, regulatory reviews, etc.) to prepare for the eventual recovery by prioritizing and investing to accelerate the most promising programs.

Taken together, it is likely that smaller pharma companies will be particularly challenged as their pipelines are smaller (more at risk of drying up as R&D activities are impaired) and investors prioritize larger companies as “safer bets”. All pharma companies will take a financial hit to some degree, so strict internal prioritization and maximizing revenue from existing products (as possible) will be key to weathering this crisis. In parallel, pharma companies must also take advantage of emerging opportunities and invest appropriately to set the stage for longer-term success.

Implications for Pharma: Pharma companies should seek a balance of decision-making that protects their business but is not so risk averse that it dries up the future pipeline. Innovative therapy designs and rare diseases / other small indication products will likely be hardest-hit by strict prioritization, leaving opportunity for players who do retain a focus here to succeed in a less-crowded competitive space.