Posted by Naval Shanware, Ph.D. on March 7th, 2023.

It’s that time again: the time when we look down the road and make a few predictions about what the rest of the year is likely to hold for the oncology market. It’s hard to believe that the first quarter of 2023 is nearly gone, so we’ve put “pen to paper” to document our thoughts before too much more of the year slips past.

Incidentally, in our previous article, we revisited our old predictions for 2022 to see how well we did. Interested readers can find that article here.

The oncology market remains a very exciting place. We are fortunate to be in the midst of an ongoing period of rapid—and potentially transformative—innovation and change. As we peer into the near-term future, we have identified five key trends to watch for in 2023:

- Cancer vaccines will come into focus

- Radiopharmaceuticals will further mature

- The commercial success of bi-specifics will significantly dampen enthusiasm for allogeneic CAR-T approaches

- Antibody drug conjugates (ADCs) will continue to see clinical and commercial success

- Measurable-residual disease measurement and other diagnostics will start to significantly impact patient management

Now, let’s go a bit deeper into each of these trends to explore the details and see how things are likely to progress in the coming months.

Cancer vaccines will come into focus

Cancer vaccines are not a new idea. Over the years, though, data regarding them has been mostly disappointing. However, there has been a resurgence of interest in the concept, particularly demonstrated by the mRNA COVID vaccine makers.

First, an mRNA cancer vaccine being jointly developed by Moderna and Merck has shown positive data in a phase 2 trial. When combined with Merck’s Keytruda®, the vaccine reduced the risk of cancer recurrence or death by 44% compared to Keytruda alone over a one-year period. It’s a personalized vaccine, made with an mRNA coding for neoantigens selected based on the genetic mutation profile of each patient’s tumor.

The vaccine was tested in people with stage 3/4 melanoma who had their tumors removed but had a higher chance of the cancer returning due to features of their melanoma.[1] It’s unclear whether such a strong benefit would be seen in other solid tumor types. A phase 3 study in melanoma is planned for this year. The vaccine candidate recently received a breakthrough therapy designation from the US FDA.[2]

BioNTech shared its own promising early data for an individualized mRNA cancer vaccine. In a phase 1 trial presented at the ASCO annual meeting, its vaccine—in combination with Genetech’s Tecentriq® and chemotherapy—showed that half of the treated patients demonstrated a noticeable immune response, correlating with longer recurrence-free survival.[3]

In addition, BioNTech is entering into a multi-year agreement with the UK government to provide 10,000 patients with personalized mRNA cancer therapies by 2030. The agreement will accelerate clinical trials for personalized mRNA immunotherapies and provide patients with early access to treatment. As part of the partnership, BioNTech will build an R&D hub in Cambridge.[4]

We predict that there will be an increase in partnering activities in 2023; particularly regarding neoantigen vaccines. Despite our expectation of an increase in partnering and competitive activity, we (like others)[5] remain very guarded in our enthusiasm for cancer vaccines in general. Time will tell.

Radiopharmaceuticals will further mature

As readers of our previous paper will recall, we had been bullish about 2022 for radiopharmaceuticals. In fact, 2022 was a big year with the approval and initial commercial success of Pluvicto™. Despite some hiccups, it is truly on its way to becoming a blockbuster.[6]

Late last year, Novartis shared that Pluvicto had met its primary endpoint in a pivotal trial for expanding on its approved indication.[7] The data will be shared in an upcoming medical conference. Another key readout that we are tracking is the Phase 3 study of PNT2003, which was part of a deal that Point Therapeutics made with Lantheus late last year.[8] In general, we expect positive results, though commercially it is unclear how PNT2003 will do in the market against Pluvicto. The competition should be interesting to watch.

Simultaneously, we expect the market to mature with more radiation oncologists embracing the opportunity to expand their practices by involving themselves in theranostics for oncology. Similar to CAR-T therapies, radiopharmaceuticals will require a “village” to successfully deliver at scale for patients, and we will watch with interest as projects move forward in the clinic and as the infrastructure develops to meet upcoming commercial demand. Like CAR-Ts, the market footprint of these products will be limited by the infrastructure required to produce and deliver them (for a while). A British Nuclear Medicine Society report published late last year indicated that many centers had undertaken some preparation for Pluvicto, but only four of the 45 centers surveyed stated that they were “ready to start.” Of those that were ready, two had no experience with Lu-177-based agents. Doubtless, the lagging infrastructure will limit the initial uptake of radioligand therapy into clinical practice.[9]

Another sign of a maturing market space is the emergence of academic / industry partnerships. Late last year, the University of Texas MD Anderson Cancer Center and Radiopharm Theranostics announced a joint venture to develop novel radiopharmaceutical therapeutics in cancer.[10] We expect to see more partnerships like that one in the coming year as additional companies seek to enter the space.

Finally, Novartis isn’t resting on Pluvicto. It has identified radioligand therapy as one of the key focus areas in their new corporate strategy.[11] It is being prioritized for continued investment into new R&D capabilities and manufacturing at scale. We look forward to new developments in this space.

Bi-specifics will dampen enthusiasm for allogeneic CAR-T approaches

Bi-specific antibody therapies generated a lot of excitement last year, and we expect them to continue doing the same during 2023. Two potential blockbusters have their PDUFA dates in 2023: Genmab / Abbvie’s epcoritamab and Roche / Genentech’s glofitamab.

Of the two, the first likely approval will be for epcoritamab, which has a May PDUFA date and a concurrent filing in the EU. Epcoritamab’s top-line pivotal data, released last April, suggest it may have the edge over its rivals. It achieved a 63.1% overall response rate (ORR) in 157 DLBCL patients who had received two prior lines of therapy at a median follow-up of 10.7 months. It was also associated with a 12-month duration of response (DOR), although nearly half of participants in the pivotal trial experienced cytokine release syndrome (CRS).[12] Jefferies analysts project peak epcoritamab sales of around $2.75 billion.

Roche / Genentech’s glofitamab, also being developed for relapsed or refractory large B-cell lymphoma (R/R LBCL), will likely be the second one approved, with a decision expected in July. Early this year, glofitamab was granted priority review and fast-track designation by the FDA.[13]

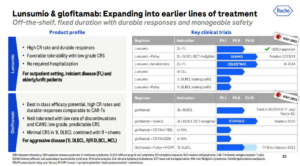

If approved, glofitamab will be the first fixed-duration treatment available to R/R LBCL patients who have not responded to prior therapy. Interestingly, if successful this will be the second approval for Roche / Genentech, coming after the 2022 approval of Lunsumio™. Roche is co-positioning these two assets in an interesting manner, with Lunsumio being focused on the out-patient setting for patients with indolent disease, and elderly unfit patients, while glofitamab is being reserved for patients with aggressive disease.

Both programs are moving forward with a number of combinations and two pivotal trials, one for each, that are expected to read out in 2023. This will further drive market evolution towards combinations.

Figure 1: Expansion of Lunsumio™ and glofitamab into earlier lines of treatment (source: Roche)

Pfizer is also getting in on the action. Very recently, the company announced the filing of its very own BCMA bi-specific antibody, elranatamab.[14] In addition, it has been granted a priority review by the FDA.[15]

As the bi-specifics advance, we think the market will further sour on the comparatively lackluster allogeneic CAR-Ts. The appeal of allogeneic therapies and bi-specifics has always been the potential efficacy of autologous CAR-Ts without the complexity and cost. With the allogeneic therapies’ durability challenges and the relative strength of the bi-specifics, we predict that current allogeneic approaches will fall further to the wayside, unless specific platforms are able to address the current challenges.

Antibody drug conjugates (ADCs) will continue to see success

ADCs are another class that saw showed strength in 2022 and should continue to do the same this year. The first development that we anxiously await is the result from the TROPION-Lung01 trial (phase 3) for datopotamab deruxtecan, a TROP2-targeted ADC.[16]

If successful, this would be the second asset to come from the already successful deal between AstraZeneca and Daiichi Sankyo. Enhertu® was the first drug to emerge from that partnership, and it has already become a key standard of care in breast cancer. Analysts expect it to generate north of $5 billion in revenues.

Datopotamab deruxtecan has shown some early promise in lung cancer, however success in its phase 3 trial could lead it to become a key standard of care in 2L+ non-small cell lung cancer (NSCLC), where there is a significant unmet need in patients who have stopped responding to immunotherapy-based regimens.[17]

We expect to see more activity from ADCs in NSCLC in 2023. Last year, the FDA granted breakthrough designation to two other ADCs: patritumab deruxtecan and telisotuzumab vedotin[18]

Another big trial that’s on our radar is for mirvetuximab. It received an accelerated approved last year as Elahere™ for adult patients with folate receptor alpha (FRα) positive, platinum-resistant epithelial ovarian, fallopian tube, or primary peritoneal cancer.[19] Initial results for the confirmatory phase 3 MIRASOL trial are expected in early 2023 and will help solidify Elahere in gynecologic cancer, where it is currently the second ADC approved so far, after tisotumab vedotin (September 2021, for patients with recurrent previously treated cervical cancer).

Measurable-residual disease (MRD) measurement and other diagnostics will start to significantly impact patient management

MRD Measurement

MRD, which refers to the presence of leukemic cells below the threshold of traditional detection methods, is a key cause of cancer recurrence. A range of new techniques for measuring the presence of MRD are in existence and will begin to make a difference. There is increasing evidence that next-generation sequencing-based MRD assessment can aid in risk stratification and can inform treatment decisions. We believe 2023 will be an important year in moving the needle on the more routine adoption of MRD-assessment into clinical practice.

A steady drumbeat of publications has contributed to our increased enthusiasm. For example, a recent article showed that the presence of detectable MRD led to a higher likelihood of relapse in adult patients with acute lymphoblastic leukemia (ALL) who underwent hematopoietic cell transplant (HCT) compared with those who had undetectable MRD pre- and post-transplant. The data, which came from a retrospective study that was presented at the 2023 Transplantation & Cellular Therapy Meetings, show that MRD do have prognostic value in that disease.[20]

In another example, a recent trial showed that MRD could guide treatment discontinuation in some settings such as maintenance, where patients currently may be treated until progression, or unacceptable toxicities.[21] This year, we expect to see the readout of two phase 3 studies with a primary endpoint of MRD negativity: AURIGA and CEPHEUS with daratumumab. If successful, these trials could support the first approval using MRD as a primary endpoint and herald a new wave of activity in this space.

| Study | Aim | Endpoints |

|---|---|---|

| AURIGA (Phase 3, NCT03901963) | Evaluate the conversion rate of MRD-negativity after maintenance treatment with DARZALEX FASPRO plus lenalidomide (D-R) vs lenalidomide alone in patients with NDMM who are MRD-positive after ASCT | Primary Endpoint – Percentage of Participants with MRD Negative Status as determined by NGS |

| CEPHEUS (Phase 3, NCT03652064) | To determine if the addition of daratumumab to bortezomib + lenalidomide + dexamethasone (VRd) will improve overall minimal residual disease (MRD) negativity rate compared with VRd alone | Primary Endpoint – Percentage of Participants with Negative MRD Status; Secondary Endpoint - MRD Negative Rate; durable MRD Negative Rate |

Developments have also occurred on the reimbursement front, where several commercially available MRD tests are receiving CMS reimbursements. The latest news was from Natera’s Signatera™ test, which received coverage from CMS for its use in breast cancer.[22] The test is already covered by Medicare for colorectal cancer, muscle-invasive bladder cancer, and pan-cancer immunotherapy monitoring.

Guardant health also received Medicare coverage for MRD liquid biopsy in Stage II and III colon cancer late last year.[23] For 2023, we expect increased uptake of MRD utilization based on the volume of data generated; coupled with a more permissive reimbursement situation.

Multi-Cancer Early Detection (MCED) Tests

Currently, only five useful traditional cancer screening tests are available, each for one cancer type: breast, colorectal, cervical, high-risk lung, and prostate.[24] Several companies are developing blood-based (liquid biopsy) MCED tests.

Galleri® by GRAIL is currently offered as a laboratory developed test,[25] and has a Breakthrough Device designation with the FDA. In the company’s IPO filing, GRAIL had indicated that it would file for approval in 2023. However, we do not expect approval in 2023, as several of the trials that will likely form part of the filing are still underway. However, that will likely not stop GRAIL from pushing forward with one-off deals or partnerships with payers and health systems.

Exact Sciences has its own MCED in development, and the company expects to begin recruiting patients for the FDA registrational Study Of All comeRs (SOAR) trial in MCED during 2023. Similar to MRD, we don’t expect 2023 to radically shape the MCED landscape, but we do expect the volume of data to increase enthusiasm—and hopefully utilization by patients—which will provide us with real-world data from these tests.

Parting Thought

Clearly, there are a lot of interesting—and promising—trends to follow in 2023. Progress is being made on multiple fronts, from vaccines to therapeutics to diagnostics, all of which have the potential to change the face of cancer treatment for a long time to come. We’ll be sure to keep an eye on these, as well as any other developments that arise, as the year progresses.

End Notes

[1] Vitale, Gina, Moderna/Merck cancer vaccine shows promise in trials, Chemical & Engineering News, Dec. 20, 2022, https://cen.acs.org/pharmaceuticals/vaccines/ModernaMerck-cancer-vaccine-shows-promise/100/web/2022/12

[2] Moderna press release, MODERNA AND MERCK ANNOUNCE MRNA-4157/V940, AN INVESTIGATIONAL PERSONALIZED MRNA CANCER VACCINE, IN COMBINATION WITH KEYTRUDA(R) (PEMBROLIZUMAB), WAS GRANTED BREAKTHROUGH THERAPY DESIGNATION BY THE FDA FOR ADJUVANT TREATMENT OF PATIENTS WITH HIGH-RISK MELANOMA FOLLOWING COMPLETE RESECTIONFeb. 22, 2023, https://investors.modernatx.com/news/news-details/2023/Moderna-and-Merck-Announce-mRNA-4157V940-an-Investigational-Personalized-mRNA-Cancer-Vaccine-in-Combination-With-KEYTRUDAR-pembrolizumab-was-Granted-Breakthrough-Therapy-Designation-by-the-FDA-for-Adjuvant-Treatment-of-Patients-With-High-Risk-Melanom/default.aspx

[3] Bayer, Max, ASCO: BioNTech’s Roche-partnered cancer vaccine combo hints at survival benefit in pancreatic cancer, Fierce Biotech, June 5, 2022, https://www.fiercebiotech.com/clinical-data/biontech-touts-early-data-roche-partnered-cancer-combo-hinting-it-could-dent-prostate

[4] Arthur, Rachel, BioPharmaReporter, Jan. 6, 2023, https://www.biopharma-reporter.com/Article/2023/01/06/biontech-and-uk-partner-on-personalized-mrna-cancer-immunotherapies

[5] Liu, Angus, Bristol Myers CMO, others still skeptical about cancer vaccines as BioNTech, Moderna march ahead with I-O partners, Fierce Biotech, Jan. 25, 2023, https://www.fiercebiotech.com/biotech/bristol-myers-cmo-still-skeptical-about-cancer-vaccine-biontech-moderna-march-ahead-i-o

[6] Liu, Angus, Novartis CEO: Leqvio, Pluvicto off to solid starts, but blockbuster sales will take time, Fierce Pharma, April 26, 2022, https://www.fiercepharma.com/marketing/novartis-ceo-leqvio-pluvicto-good-us-launch-blockbuster-sales-long-term-effort

[7] Novartis Press Release, Novartis Pluvicto™ shows statistically significant and clinically meaningful radiographic progression-free survival benefit in patients with PSMA–positive metastatic castration-resistant prostate cancer, Dec. 5, 2022, https://www.novartis.com/news/media-releases/novartis-pluvictotm-shows-statistically-significant-and-clinically-meaningful-radiographic-progression-free-survival-benefit-patients-psma-positive-metastatic-castration-resistant-prostate-cancer

[8] Plieth, Jacob, Lantheus gets to the Point in therapeutics, Evaluate Vantage, Nov. 15, 2022, https://www.evaluate.com/vantage/articles/news/deals/lantheus-gets-point-therapeutics

[9] PLUVICTO’s approval mounts pressure on POINT Biopharma’s PSMA [Lu-177]-PNT2002, Clinical Trials Arena, March 29, 2022, https://www.clinicaltrialsarena.com/comment/pluvicto-approval-point-biopharma-psma/

[10] MD Andersen Cancer Center press release, MD Anderson and Radiopharm Theranostics launch joint venture to develop novel radiopharmaceuticals, Sept. 13, 2022, https://www.mdanderson.org/newsroom/joint-venture-focused-novel-radiopharmaceuticals-launched-md-anderson-radiopharm-theranostics.h00-159542901.html

[11] Novartis investor presentation, Sept. 22, 2022, https://www.novartis.com/sites/novartis_com/files/2022-09-meet-novartis-management-event-presentation.pdf

[12] McConaghie, Andrew, Genmab Confident It Has Edge Over Roche In Bispecific Battle, Scrip, June 17, 2022, https://scrip.pharmaintelligence.informa.com/SC146572/Genmab-Confident-It-Has-Edge-Over-Roche-In-Bispecific-Battle

[13] Genentech press release, FDA Grants Priority Review to Genentech’s Bispecific Antibody Glofitamab for People With Relapsed or Refractory Large B-Cell Lymphoma, Jan. 6, 2023, https://ca.news.yahoo.com/fda-grants-priority-review-genentech-060000605.html

[14] Pfizer press release, Pfizer’s Elranatamab Receives FDA and EMA Filing Acceptance, Feb. 22, 2023, https://www.pfizer.com/news/press-release/press-release-detail/pfizers-elranatamab-receives-fda-and-ema-filing-acceptance?fbclid=IwAR1gguUXQrW_QgmogNPltA68Cf2EgEUCOwGy5vXlTo-7l98JDahau6RWmf0&mibextid=Zxz2cZ

[15] Fischer, Lindsay, Elranatamab Application Granted Priority Review For Relapsed/Refractory Multiple Myeloma, Oncology Nursing News, Feb. 24, 2023, https://www.oncnursingnews.com/view/elranatamab-application-granted-priority-review-for-relapsed-refractory-multiple-myeloma

[16] ClinicalTrials.gov, accessedMarch 6, 2023, https://clinicaltrials.gov/ct2/show/NCT04656652

[17] Fidler, Ben, Fresh off Enhertu success, AstraZeneca and Daiichi claim progress for next cancer drug, BioPharma Dive, Aug. 9, 2022, https://www.biopharmadive.com/news/astrazeneca-daiichi-trop2-lung-cancer-results/629169/

[18] Virgil, Hayley, FDA Grants Breakthrough Therapy Status to Patritumab Deruxtecan for EGFR+ Metastatic NSCLC, Cancer Network, Jan. 4, 2022, https://www.cancernetwork.com/view/fda-grants-breakthrough-therapy-status-to-patritumab-deruxtecan-for-egfr-metastatic-nsclc

[19] US FDA, FDA grants accelerated approval to mirvetuximab soravtansine-gynx for FRα positive, platinum-resistant epithelial ovarian, fallopian tube, or peritoneal cancer, Nov. 14, 2022, https://www.fda.gov/drugs/resources-information-approved-drugs/fda-grants-accelerated-approval-mirvetuximab-soravtansine-gynx-fra-positive-platinum-resistant

[20] Feldman, Jonah, MRD Detection Provides Prognostic Value in Patients With ALL Undergoing HCT, OncLive, Feb. 16, 2023, https://www.onclive.com/view/mrd-detection-provides-prognostic-value-in-patients-with-all-undergoing-hct

[21] Derman, Ben, Higher MRD Threshold Could Guide Discontinuation of Myeloma Maintenance, Targeted Oncology, Feb. 10, 2023, https://www.targetedonc.com/view/higher-mrd-threshold-could-guide-discontinuation-of-myeloma-maintenance

[22] Natera Press Release, Medicare Extends Coverage of Natera’s Signatera™ MRD Test to Breast Cancer, Feb. 16, 2023, https://www.natera.com/company/news/medicare-extends-coverage-of-nateras-signatera-mrd-test-to-breast-cancer/

[23] Guardant Health Receives Medicare Coverage for MRD Liquid Biopsy in Stage II and III Colon Cancer, GenomeWeb, Aug, 2, 2022, https://www.genomeweb.com/cancer/guardant-health-receives-medicare-coverage-mrd-liquid-biopsy-stage-ii-and-iii-colon-cancer#.ZAYPg3bMJD9

[24] Regenauer, Achim, Will Multi-cancer Early Detection Tests Soon be a Reality?, PartnerRE, March 14, 2022, https://www.partnerre.com/opinions_research/will-multi-cancer-early-detection-tests-soon-be-a-reality/

[25] Beasley, Deena, Illumina’s Grail expands use of cancer detection test with life insurer deal, Reuters, Sept. 20, 2022, https://www.reuters.com/business/healthcare-pharmaceuticals/illuminas-grail-expands-use-cancer-detection-test-with-life-insurer-deal-2022-09-20/